Brookline Bancorp: The Positives Outweigh The Negatives

Summary

- Brookline Bancorp has experienced a significant decline in its stock performance, down 28% YTD and 31% over the past year.

- The stock has shown a lack of significant growth over the past decade, with its price ending at a similar level to where it started 10 years ago.

- However, there was a positive rebound in Brookline's stock leading up to the start of 2022, following a low point in late 2020/early 2021.

- The stock appears poised to see a similar type of rebound and maintains a strong dividend yielding over 5%.

DenisTangneyJr/E+ via Getty Images

Overview

Brookline Bancorp (NASDAQ:BRKL) is a bank holding company for Brookline Bank, which provides commercial, business, and retail banking services to corporate, municipal, and retail customers in the United States. Its deposits include checking, NOW, money market, and savings accounts. The company was founded in 1871 and is headquartered in Boston, Massachusetts.

I believe that Brookline in its current state is well-positioned to reward long-term investors with significant returns moving forward. Brookline has not performed well at all recently and is down 28% YTD and 31% over the past year. I believe the stock has been oversold compared to its actual performance and overall financial state.

Looking at the chart below, you can see that the stock is down even more over the past five years.

Looking back even further, you can see that the past decade has seen multiple ups and downs for Brookline's stock with its price ending at roughly the same place it started 10 years ago.

At near its lowest point in the past decade, I believe that Brookline is more likely to see a rebound moving forward than it is to see a significant further drop in price. When you add in its attractive dividend that yields over 5% Brookline is a stock worth considering for long-term investors.

PCSB Financial Acquisition

Looking at the price charts above, you can see that Brookline's stock was actually doing pretty well going into the start of 2022, having rebounded nicely from low points in late 2020/early 2021. In May 2022, it was announced that Brookline entered into an agreement to acquire PCSB Financial for $313M in cash and stock. Since that announcement, the stock is down 33%. The acquisition isn't the reason for the stock's slump as the downslide had already begun prior to this announcement, but it didn't help matters any.

The acquisition seems to be a solid long-term growth provider allowing Brookline to be one of the few Northeast regional banks operating in all three of the Boston, Providence, and New York markets. However, the acquisition has definitely had some short-term negative impacts on the company's financials and stock performance. Those negative impacts appear to be decreasing significantly and should have more of a negligible impact moving forward. An example of this can be seen in Brookline's 2nd quarter earnings results. Non-interest expense declined by $7M with $5.4M being driven by a decrease in associated merger and acquisition expense.

Financials

When looking at banks, I don't look at the usual metrics I look at for investments (EPS, revenue growth, etc.). Instead, I look at other factors such as their non-performing assets is one of the biggest factors in determining the likelihood of future positive returns. Reviewing Brookline, non-performing assets have ticked up but remain very low overall. Brookline's 10-Q statement shows that nonperforming loans and leases as a percentage of total loans and leases are just 0.50% while nonperforming assets as a percentage of total assets are just 0.42%. Brookline's provision for loan and lease losses is more than double at 1.35% meaning that there should be plenty set aside to deal with those nonperforming assets.

Another item I like to review for banks is their net interest margin. This is the difference between the interest income that is produced by borrowers and the interest that is paid to depositors. This is an important profitability ratio for banks and it is very useful when comparing values between similar banks.

The following banks are all regional banks like Brookline with similar market caps: Dime Community Bancshares, Inc. (DCOM), PacWest Bancorp (PACW), Capitol Federal Financial, Inc. (CFFN), Bank First Corporation (BFC), and Lakeland Bancorp (LBAI).

This is the ranking of the net interest margin for each bank based on their latest 10-Q statements:

- Bank First Corporation - 3.77%

- Brookline - 3.26%

- Lakeland Bancorp - 2.83%

- Dime Community - 2.50%

- PacWest Bancorp - 1.82%

- Capital Federal Financial - 1.50%

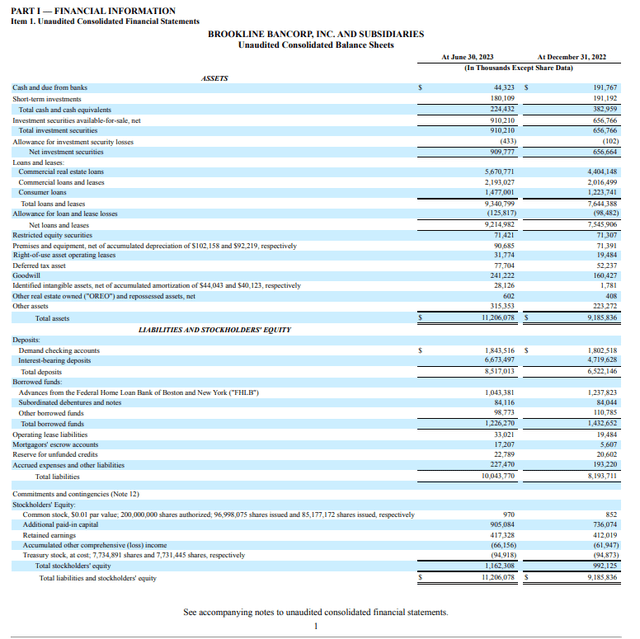

As you can see, Brookline compares favorably, ranking 2nd out of the group of six banks. Brookline also seems to be in good overall financial condition as it has seen growth in deposits, total assets, and stockholders' equity compared to the same time last year.

Valuation

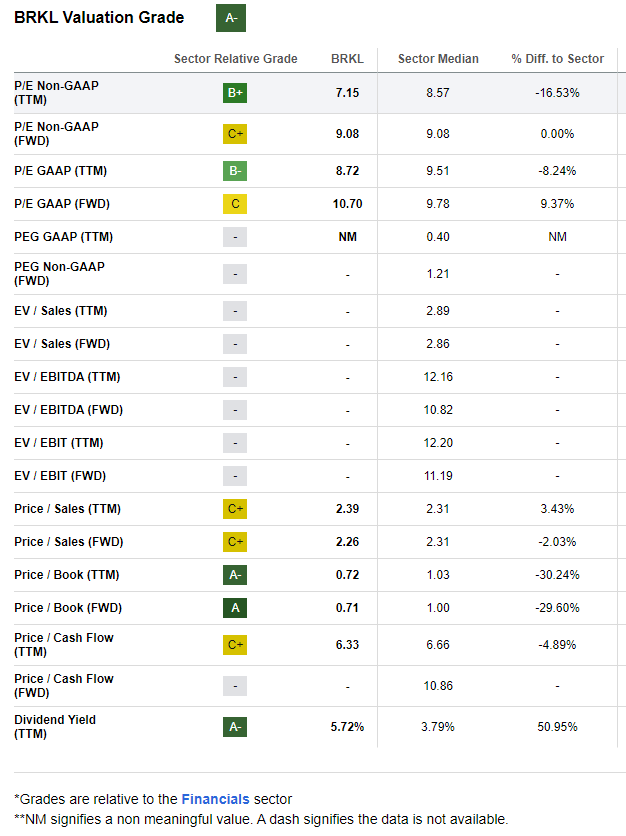

It's not too surprising that Brookline has a good grade when it comes to valuation considering the steep decline in price the stock has seen recently compared to its overall financial position.

Looking at the image below, you can see that Seeking Alpha's valuation grade is an A-.

Seeking Alpha

When comparing Brookline's PE ratio to some of its peers you can see that Brookline is right in the middle of the pack in terms of valuation.

Looking at the historical values of both Brookline's price-to-book value and PE ratio, you can see that both are near their ten-year lows.

As stated in my opening paragraph, I believe that Brookline has been oversold and is currently undervalued, presenting an attractive entry position for long-term investors. When you look at regional banks, the average PE ratio is 13.5x, so Brookline compares quite favorably. Brookline outperforms when looking at the average price-to-book value of regional banks as well with its 0.733x value compared to the average 0.92x value of the regional bank industry.

When determining whether a stock is overvalued, fairly valued, or undervalued, Brookline passes the first step of outperforming the industry sector averages. The next step is to look at the overall financial status of the related company to see if there are issues causing this valuation that outweigh the attractive pricing.

When I look at the balance sheet from Brookline's latest 10-Q, there is nothing that jumps out to me as a concern with regard to its current valuation.

Dividend

Brookline's dividend is another reason for long-term investors to take a look at the stock. The company is a Dividend Challenger with six years of consecutive dividend growth. Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

Brookline currently has a 5.66% dividend yield and looking at the chart below you can see that its dividend growth has been significant over these last six years.

Brookline maintains a 49.61% payout ratio which should not impact future dividends or add a burden to future dividend growth. For long-term dividend growth investors, the stability and growth of Brookline's dividend appears solid based on the company's current capital levels. This was demonstrated in the Q&A section of Brookline's earnings call transcript.

Christopher O'Connell

Okay. Great. And then on the capital side, I mean, you guys have had a pretty good capital levels now all around, picked up above 8% on TC. But it sounds like you have a relatively more robust growth outlook than a lot of the industry into the back half of the year. Are you guys considering at all any share repurchases at this time?

Carl Carlson

No. We continue to prioritize paying a very competitive dividend and funding our organic growth. Right now, we're not planning any share repurchase at this time.

Conclusion

I've painted a pretty bright picture of Brookline in terms of its valuation, dividend, and overall current financial standing. While I do believe Brookline is in good shape and will provide long-term returns for investors, there are definite risks associated with the stock. The biggest risk in my opinion is the recent performance of the stock and the possibility that this will continue into the short-term.

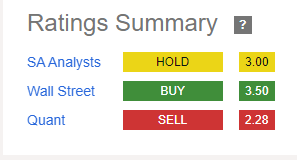

You can see the current ratings of Brookline below:

Seeking Alpha

While I agree with Wall Street's current rating of a buy, there are valid reasons that the stock is considered a Hold by SA Analysts and a Sell based on Quant rankings.

Besides the stock performance, another reason for the hold/sell ratings include the recent earnings reports of Brookline and its inability to meet estimates. In its last earnings report, even though revenue increased by 16% compared to the prior year, Brookline still missed estimates by nearly $1M and missed EPS by $0.03. There were even worse results with its Q1 earnings report in which EPS missed by $0.06 and revenue missed by over $4M.

I don't view this as a long-term trend though and believe that a lot of the negative impacts of the PCSB acquisition are winding down and the continued increase of core deposits along with a strong balance sheet will help Brookline's revenue/earnings performance moving forward.

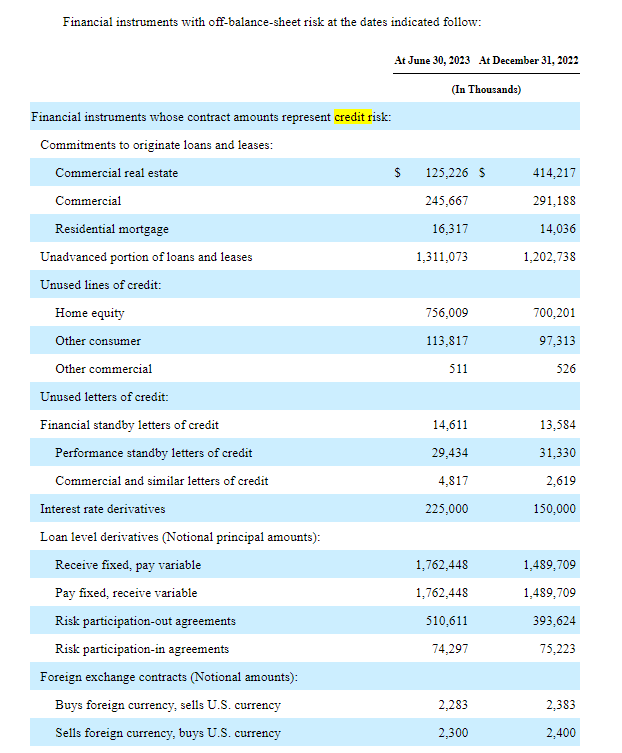

Credit risk is always a risk associated with banks and that is no different for Brookline but when looking at Brookline's financial instruments with amounts representing credit risk (based on the latest 10-Q), there is nothing to suggest Brookline's credit risk is increasing compared to its normal risk so I'm not too worried about this.

seeking alpha

The one additional risk that does concern me slightly is Brookline's dependence on commercial real estate loans, which accounts for 42.8% of its total loans and leases. This percentage is up from 39.9% six months ago. With empty offices across the areas that Brookline serves and as a result, declining property values, I would like to see this percentage not continue to creep up as the commercial real estate market will have a large impact on Brookline's earnings moving forward.

That being said, I do like Brookline's overall portfolio of loans which includes commercial real estate, equipment financing, residential mortgage, and home equity loans that can minimize associated risks with each market. I think that Brookline's growing deposits, strong capital position, and overall positive financial position outweigh these risks and when you add in its growing dividend with a yield over 5% I feel that Brookline will reward long-term investors with significant returns moving forward. As always, I suggest individual investors perform their own research before making any investment decisions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.