BigCommerce: Decelerating ARR Is A Red Flag

Summary

- BigCommerce, an e-commerce software platform, is struggling to regain traction, and losses are expected to continue.

- The company's subscription growth rate slowed down to just 10% y/y in Q2, while rival Shopify showed triple that growth rate despite its much larger scale.

- Enterprise ARR is slowing as well, as BigCommerce notes that sales cycles are lengthening.

- Though cheap at 2.4x forward revenue, BigCommerce is a value trap.

ArtistGNDphotography

Now more than ever, investors have to be incredibly choosy when picking stocks. Don't just buy a market index: in my view, the market averages will continue to be flat through year-end as investors digest the latest rate policies and weigh how much to allocate toward risk-free bonds.

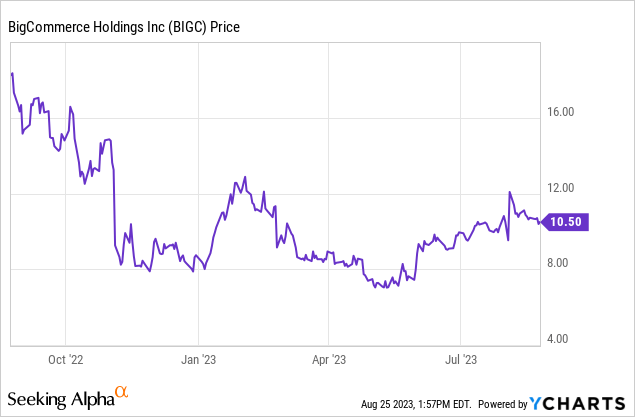

And in particular, be careful with stocks whose fundamentals have soured. One example here is BigCommerce (NASDAQ:BIGC), an e-commerce solutions software platform that competes against its much bigger and better-known rival, Shopify (SHOP). Year to date, shares of BigCommerce have still outpaced the broader S&P 500 with roughly 25% gains, though the stock has tapered off in August in sympathy with other tech names. Q2 results, released in early August, came in ahead of expectations and provided an initial surge in the stock (which has since been wiped out), but still offer a picture of a company that is struggling to regain traction amid softer consumer spending.

In analyzing the company's latest results and weighing them against BigCommerce's latest valuation, I am retaining my bearish call on BigCommerce, and I believe losses are set to continue.

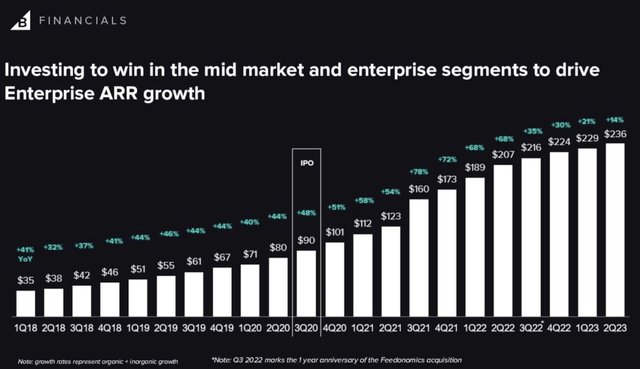

In particular, I am concerned about the company's slowdown in enterprise ARR growth. Recall that a mix shift toward the enterprise business and its steady stream of recurring revenue was a core portion of the BigCommerce bullish thesis: but amid softer macro conditions and poor results from retail/e-commerce companies this quarter, this business has seen a large slowdown.

It's worth noting as well that despite operating on a much larger scale, competitor Shopify is growing more than twice as quickly as BigCommerce. I have long worried about the fact that even though BigCommerce cites a large $28 billion TAM in which it is only 1% penetrated, its poor revenue growth showcases a lack of ability to execute and poor branding relative to its much larger peers.

Then there's the profitability concern, on top of BigCommerce's debt pile. Now, to its credit, BigCommerce has been making progress on expenses (as we'll review in the earnings recap in the next section) ever since the company decided to lay off 13% of its staff, which is helping adjusted EBITDA margins to expand (though not all the way yet toward full profitability). But amid this volatile market and risk-averse environment, we really do have to ask this question: is it worth investing in a company with slowing growth and burning losses like BigCommerce, when risk-free treasuries are yielding 5% or more?

From a valuation perspective, there's no doubt that BigCommerce is cheap and risks are factored into the share prices. At current share prices just north of $10, BigCommerce trades at a market cap of $788.9 million. After we net off the $297.4 million of cash and investments on BigCommerce's most recent balance sheet against its $339.4 million of debt, the company's resulting enterprise value is $830.9 million.

Meanwhile, for next year FY24, Wall Street analysts are expecting BigCommerce to generate $347.6 million in revenue, representing reaccelerating to 13% y/y growth (which presupposes that this year FY23 is abnormally plagued by retail weakness that will create an easy comp in FY24). If we take this estimate at face value, the stock trades at just 2.4x EV/FY24 revenue.

Cheap, but in my view, BigCommerce is a value trap. In order for me to regain confidence in this stock, I need to see either a re-acceleration in ARR/revenue growth rates, or a sharp boost in profitability stemming from more aggressive cost cuts (or ideally, both). Without either of these drivers, I don't see a way forward for BigCommerce and am perfectly content to remain on the sidelines.

Q2 download

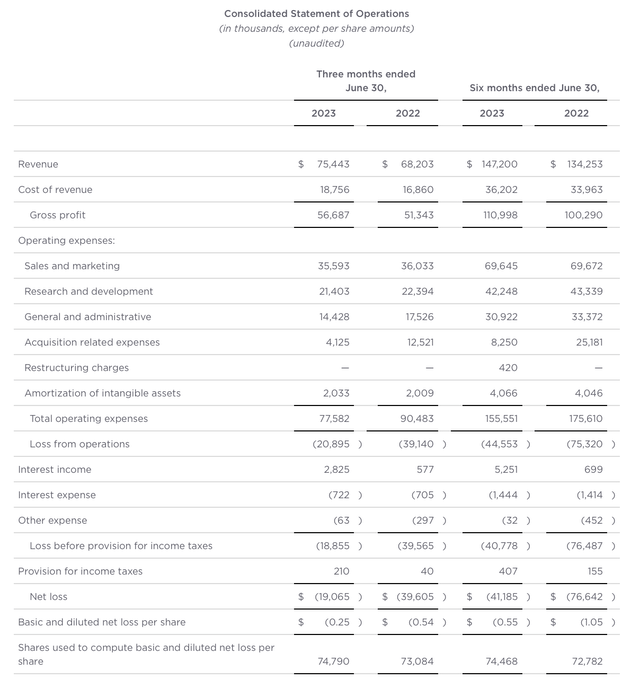

Let's now go through BigCommerce's latest quarterly results in greater detail. The Q2 earnings summary is shown below:

BigCommerce Q2 results (BigCommerce Q2 earnings deck)

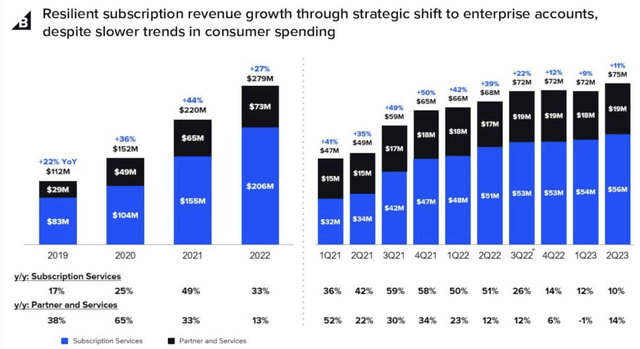

BigCommerce's revenue grew 11% y/y to $75.4 million, which did beat Wall Street's expectations of $73.4 million (+8% y/y) by a three-point margin. However, looking underneath the hood, we can see that revenue mix has shifted quite unfavorably. While services revenue grew 14% y/y in Q2, underlying subscription revenue decelerated to just 10% y/y growth, down two points from Q1 and four points from Q4. During the pandemic era, as shown below, subscription growth had hovered closer to the ~50% y/y range.

BigCommerce revenue trends (BigCommerce Q2 earnings deck)

We can also see a trend of slowing ARR (annual recurring revenue) builds in the chart below. Landing enterprise and mid-market clients for their stable base of recurring revenue and large end-customer pools has long been a core tenet of BigCommerce's expansion strategy; but as shown below, net-new ARR in the quarter was just $7 million, while ARR growth slowed to just 14% y/y (from 21% y/y in Q1).

BigCommerce enterprise ARR (BigCommerce Q2 earnings deck)

2020-2021 saw a massive spike to 50-70% y/y growth rates in ARR, and this was also when BigCommerce stock reached its zenith - but now as we see growth decelerating to the low/mid-teens, it seems more like the pandemic era was a pull-forward of demand that isn't being sustained.

The company notes that while it is performing better among smaller non-enterprise clients (a segment that has returned to growth, after expectations of a high single-digit decline), enterprise customers have started to enter into a period of lengthier and more complex sales cycles driven by the current macro environment. This is similar commentary to what other enterprise software companies are reporting. Per CEO Brent Bellm's remarks on the Q2 earnings call:

While total ARR results are close to our mid-year targets, the mix between enterprise and non-enterprise accounts has differed from our expectations. Going into the year, we expected non-enterprise accounts to contract by mid to high single-digits. Improvements to cohort retention and pricing adjustments returned this portion of the business to growth in Q2, providing encouraging signs of momentum going into the back-half of the year.

Merchants using our enterprise plans, which we refer to as "Enterprise accounts," come from two parts of the market: mid-market merchants and traditional large enterprise. We define mid-market as merchants doing $1-50 million per year in Gross Merchandise Value or GMV. This part of the market has a large and growing TAM and is underserved by many legacy ecommerce providers. Our share and momentum in this part of the market is strong, and we have seen strong results from the mid-market relative to our 2023 plans.

Large enterprise merchants, those with GMV of at least $50 million annually including those up to $1 billion or more are experiencing"

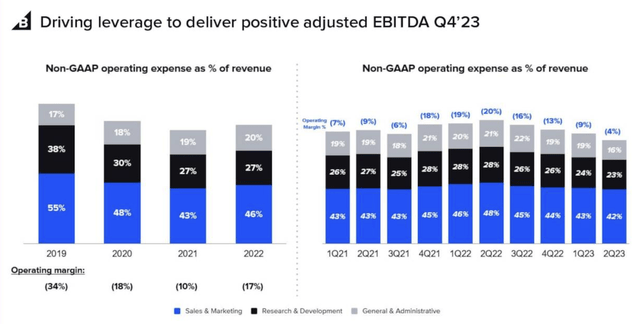

Where the company did make incremental progress was on profitability. Overall pro forma operating margins improved to -4% in Q2, a five-point sequential improvement and a sixteen-point y/y improvement.

BigCommerce opex trends (BigCommerce Q2 earnings deck)

The company also notes that it hit adjusted EBITDA and free cash flow profitability for the discrete month of June. Again, however, I'd argue that a breakeven adjusted EBITDA stacked up against a subscription revenue growth profile that has slowed to just 10% y/y is hardly substantial to justify any excitement in the stock.

Key takeaways

Shopify, despite having more than $1.5 billion in quarterly revenue, reported >30% y/y growth over the same time period. It's clear that despite macro challenges that are putting pressure across the software industry, BigCommerce is still getting outmatched by its peers. Steer clear here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.