Lithium Miners News For The Month Of August 2023

Summary

- Lithium chemical spot prices and spodumene prices were significantly lower the past month.

- Lithium market news - BloombergNEF: EV battery sizes increasing may lead to battery supply chain shortages. BMI: 401 gigafactories planned to be in operation by 2030.

- Lithium company news - Albemarle invests C$109m Strategic Investment and MOU into Patriot Battery Metals. Pilbara Minerals announces 109Mt Mineral Resource increase to 414Mt.

- Sigma Lithium jumps following reported M&A speculation. Lithium Americas shareholders approve the plan to separate into two leading lithium companies.

- I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

John Moore

Welcome to the August 2023 edition of the lithium miner news.

The past month saw lithium prices fall significantly and lots of good news and activity from the lithium producers.

Lithium price news

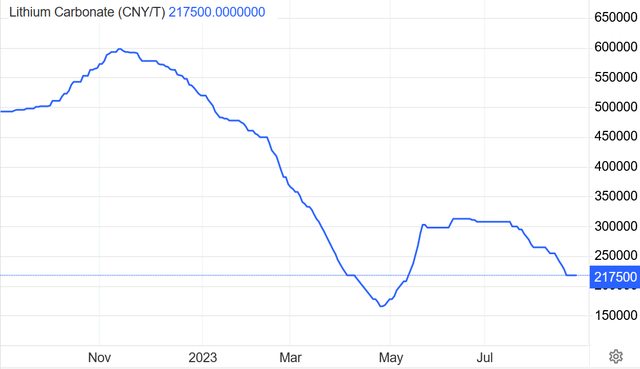

Asian Metal reported during the past 30 days, the 99.5% China delivered lithium carbonate (99% min.) spot price was down 15.86% and the China lithium hydroxide (56.5% min.) price was down 14.93%. The Lithium Iron Phosphate (3.9% min) price was down 7.98%. The Spodumene (6% min) price was down 10.77% over the past 30 days.

Metal.com reported lithium spodumene concentrate (6%, CIF China) average price of USD 3,265/t, as of Aug. 25, 2023.

China lithium carbonate spot price 5 year chart - CNY 217,500 (~USD 29,844) (source)

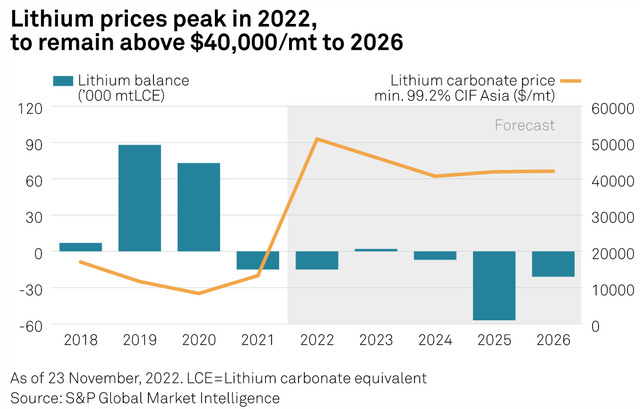

S&PGlobal lithium price forecast as of Nov. 2022 (source)

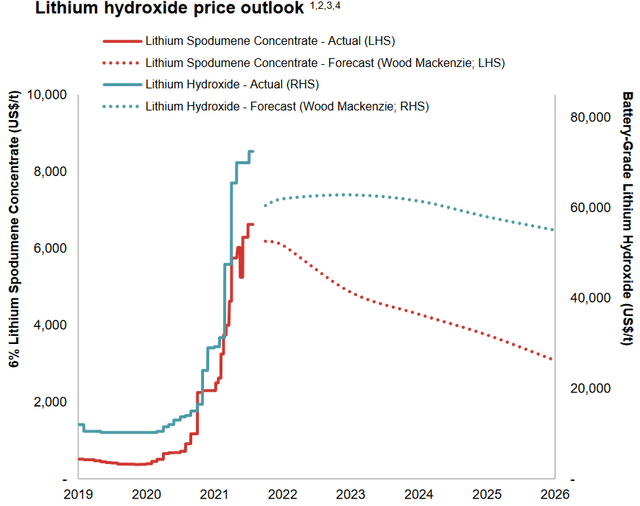

Wood Mackenzie's lithium price forecast - July 2022 (Source)

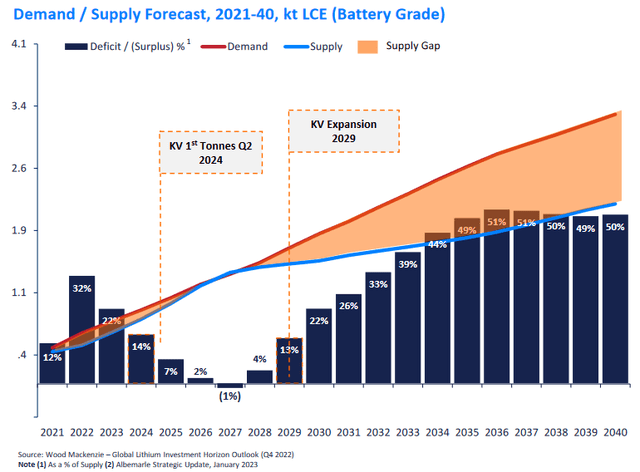

Lithium demand versus supply outlook

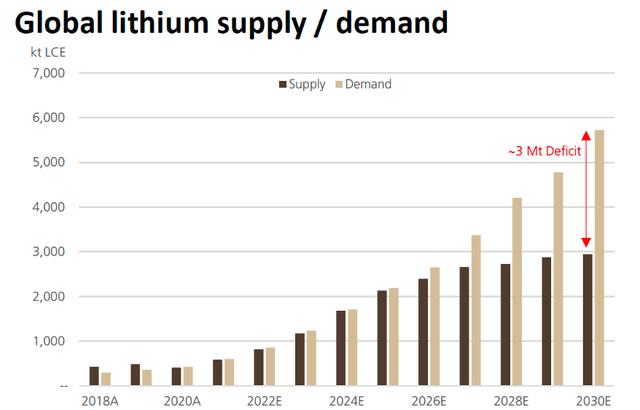

2022 - UBS lithium demand v supply forecast to 2030

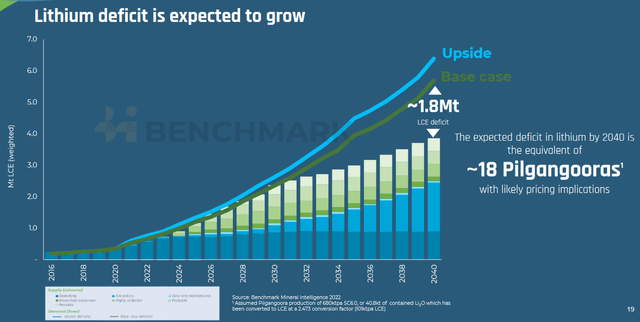

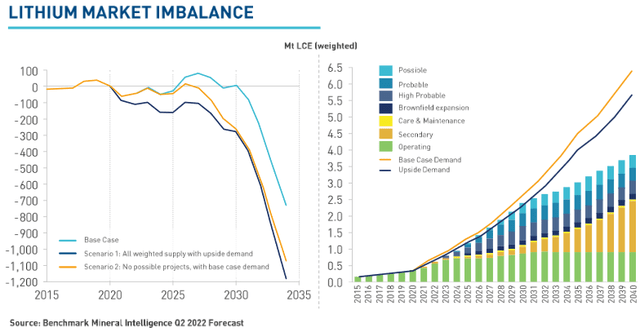

Lithium demand v supply forecast by Benchmark Mineral Intelligence (mid 2022 forecast)

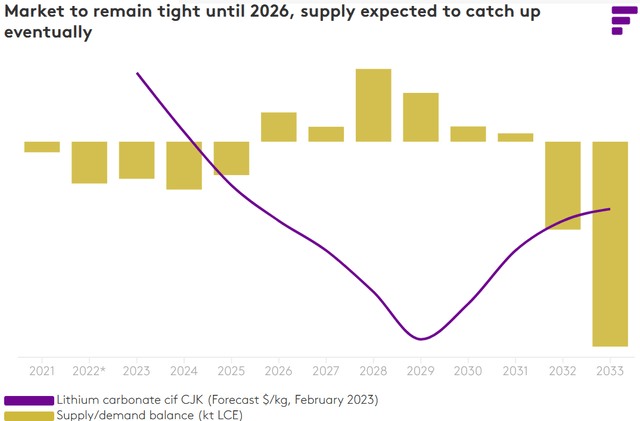

Fastmarkets forecasting mostly lithium deficits ahead to 2025 (as of March 2023) (Source)

BMI (Q2, 2022 forecast) - Lithium demand to exceed supply mostly this decade

Lithium demand v supply chart (kt LCE battery grade) (deficits forecast every year with only a slight surplus in 2027) (source)

Liontown courtesy of Wood Maclenzie & Albemarle

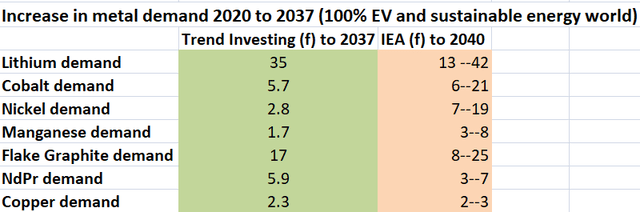

Trend Investing v IEA demand forecast for EV metals (Trend Investing) (IEA)

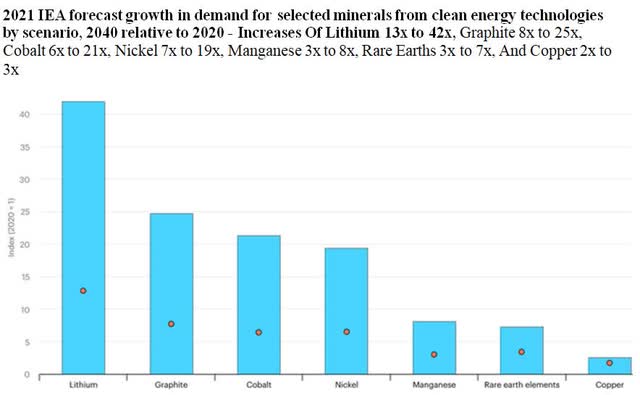

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 - Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

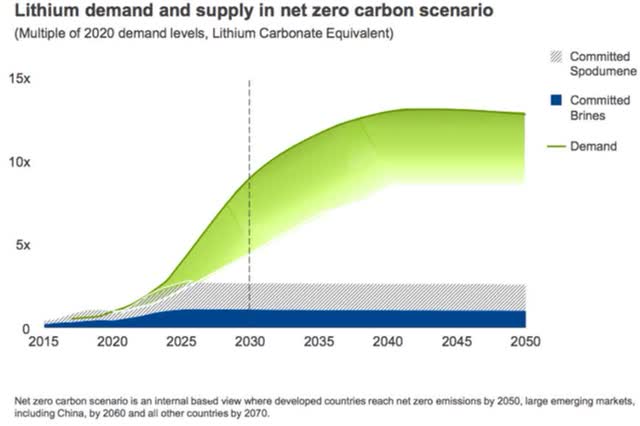

Rio Tinto forecasts lithium emerging supply gap (October 2021) - 60 new mines the size of Jadar will be needed

BMI demand growth 2022-2035 (in mtpa) for critical metals. Number of new mines required by 2035 - 78 new lithium mines needed

Lithium market and battery news

On July 25 Bloomberg reported:

Top battery-maker CATL’s profit soars 63% amid EV sales boom. Net income, revenue both jump more than 50% to beat estimates. Strong growth in battery EV cells, energy storage business.....

On July 31 Bloomberg reported:

Exxon in talks With Tesla, Ford, VW on supplying Lithium. Oil giant is exploring production from underground saltwater......The talks with potential customers are still early stage, and the company has yet to lay out its plans for potential lithium operations......Chevron Corp., Occidental Petroleum Corp. and SLB, the world’s biggest oil-services provider, have all said they’re considering or actively exploring opportunities in the metal.....Exxon, which has set a goal of extracting 100,000 tons of lithium per year, is exploring a 10-acre site in Arkansas and recently began drilling wells there......Albemarle Corp. is among the lithium producers Exxon is talks with, the people said......

On August 1 Bloomberg reported:

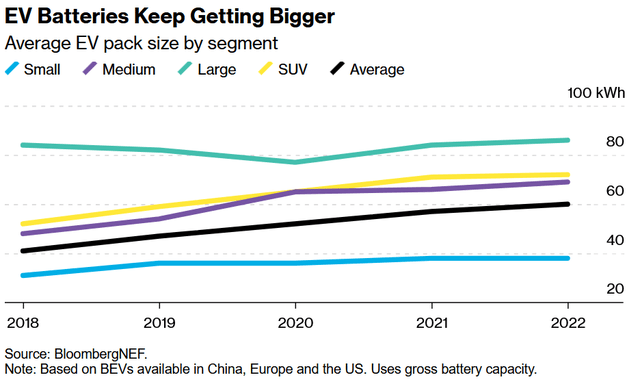

Battery bloat could backfire on electric vehicle manufacturers.......average lithium-ion battery pack sizes increased 10% annually over the same period, going from 40 kilowatt hours to 60 kWh. This rise shows no real signs of letting up. The wave of electric pickups that started with the Ford F-150 Lightning and will continue with the Chevy Silverado EV, the RAM 1500 REV and Tesla’s Cybertruck will keep inflating the US average in the years ahead. In these bigger vehicles, 100 kWh-plus battery packs are quickly becoming the norm. The increase makes sense from an automaker’s perspective — consumers in most segments say they want more range. But if left unchecked, this relentless rise in range and accompanying battery-pack sizes will eventually make it very difficult for the battery supply chain to keep pace.

EV battery sizes increasing may lead to battery supply chain shortages - In 2022 the average BEV battery size is now 60kWh (source)

On August 4 Benchmark Mineral Intelligence reported:

Lithium industry needs over $116 billion to meet automaker and policy targets by 2030.....This is more than double the $54 billion investment needed to meet Benchmark’s base case lithium demand scenario......

On August 8 Mining.com reported:

Mali adopts new mining code that boosts state interests......The new code now allows the government to take a 10% stake in mining projects and the option to buy an additional 20% within the first two years of commercial production, mining commission chairman Assane Sidibe told reporters. A further 5% stake could be ceded to locals, taking state and private Malian interests in new projects to 35%, from up to 20% today. Meanwhile certain tax exemptions have been abolished.

On August 9 Fastmarkets reported:

Major lithium producers eye price recovery as buyers expected to restock soon. US-headquartered lithium producers Albemarle and Livent are expecting lithium spot prices to recover from the weakness seen in recent months, because they foresee a brighter demand picture for the remainder of the year.

On August 17 Car Sales reported:

New CATL electric car batteries to add 400km range in 10min. Shenxing EV batteries set for 2024 introduction to feature cheaper LFP chemistry ......Announcing that mass production would begin late this year ahead of first deliveries in the first quarter of 2024, CATL said the secret behind the Shenxing batteries’ capabilities is a new graphite anode, revised electrolyte formulation and thinner and safer separator, with enhanced ion transport......CATL says its next-generation powerpack can be charged to 80 per cent in temperatures as low as minus-10 degrees Celsius.

On August 17 Electrek reported:

Ford and SK announce new massive battery cathode factory in Quebec’s battery valley. Ford and SK, a Korean battery manufacturer, have announced a plan to build a new $1.2 billion battery cathode factory in Becancour, known as Quebec’s battery valley...... On top of the battery cell production, the companies have been looking to build the entire battery supply chain in North America.....SK On, EcoProBM and Ford today are announcing an investment of C$1.2 billion to build a cathode manufacturing facility that will provide materials that ultimately supply batteries for Ford’s future electric vehicles. They are planning to start production in the first half of 2026 and ramp up production to up to 45,000 tonnes of CAM per year.

On August 18 Stockhead reported:

Is your lithium stock having a rough week? China may have something to do with it.....After stabilising through the middle of the year lithium prices have been falling for over three weeks in China. Experts say the market is well supplied and EV growth rates are below expectations. But Australian spodumene producers are still pulling in high prices as margin shifts to the mine......

On August 18 Benchmark Mineral Intelligence reported:

Over 400 gigafactories in 2030 pipeline, but overcapacity fears loom. There are now 401 gigafactories planned to be in operation by 2030, representing almost nine terawatt hours of annual production capacity, according to Benchmark. The 400th gigafactory to be added to the pipeline is Tata Group’s £4 billion ($5.2 billion), 40 gigawatt-hour UK-based facility due to begin production in 2026.......

Note: Trend Investing forecasts global lithium-ion battery demand by end 2029 to be 4.8 TWh and end 2030 to be 6.0 TWh.

Lithium miner news

Albemarle (NYSE:ALB)

On July 31, Patriot Battery Metals announced:

C$109 Million Strategic Investment and Memorandum of Understanding with Albemarle Corporation.......Albemarle will subscribe for an aggregate of 7,128,341 common shares of the Company......At the closing of the Strategic Investment, Patriot will enter into a non-binding memorandum of understanding (the “MOU”) with Albemarle to assess partnership opportunities to study the viability of a downstream lithium hydroxide plant integrated with the Property and located in Canada or the United States, including options in the Province of Quebec.

On August 2, Albemarle announced: "Albemarle reports net sales increase of 60% for second quarter 2023." Highlights include:

- "Net sales of $2.4 billion, an increase of 60%.

- Net income of $650.0 million, or $5.52 per diluted share, an increase of 60%.

- Adjusted diluted EPS of $7.33, an increase of 112%.

- Adjusted EBITDA of $1.0 billion, an increase of 69%.

- Established strategic agreement with Ford Motor Company to supply over 100,000 metric tons of lithium hydroxide from 2026 to 2030.

- Agreed to amend the terms of the transaction signed earlier this year with Mineral Resources Ltd. ("MinRes") to significantly simplify operations and retain full control of downstream conversion assets.....

- Named to Fortune 500 rankings and TIME100 Most Influential Companies list.

- Improved 2023 Energy Storage guidance reflecting recent lithium market prices; Albemarle's 2023 net sales are now expected to increase approximately 40% to 55% year-over-year and 2023 adjusted EBITDA is expected to increase 10% to 25% year-over-year."

On August 3, Benchmark Mineral Intelligence reported: "Albemarle looks to acquire more lithium resources to secure post-2030 supply."

Sociedad Quimica y Minera S.A. (NYSE:SQM), Wesfarmers [ASX:WES] (OTCPK:WFAFY), Covalent Lithium (SQM/WES JV

On August 15, Sociedad Quimica y Minera S.A. announced: "SQM comments on Azure Minerals Transaction....."

On August 16, Sociedad Quimica y Minera S.A. announced: "SQM reports earnings for the six months ended June 30, 2023." Highlights include:

- "SQM reported net income(1) for the six months ended June 30, 2023 of US$1,330.1 million compared to US$1,655.4 million for the same period last year. Earnings per share totaled US$4.66 for the six months ended June 30, 2023.

- Revenues for the six months ended June 30, 2023, reached US$4,315.6 million compared to US$4,618.6 million reported for the same period last year.

- SQM signed long-term lithium supply agreements with Ford Motor Company and LG Energy Solution.

- Total contribution to the Chilean treasury amounted to approximately US$1.7 billion for the six months ended June 30, 2023."

Upcoming catalysts:

Q4, 2023 - Mt Holland spodumene production to begin (SQM/Wesfarmers JV).

Q4, 2024 - 50ktpa Lithium hydroxide [LiOH] refinery (SQM/Wesfarmers JV).

Investors can read SQM's latest presentation here or the latest Trend Investing article on SQM here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772] (OTCPK:GNENF) (OTCPK:GNENY)

On July 28 aastocks reported: "GANFENG LITHIUM to acquire 70% stake in Mengjin Mining from Chair for over RMB1.4B."

Investors can read the Trend Investing article on Ganfeng Lithium here.

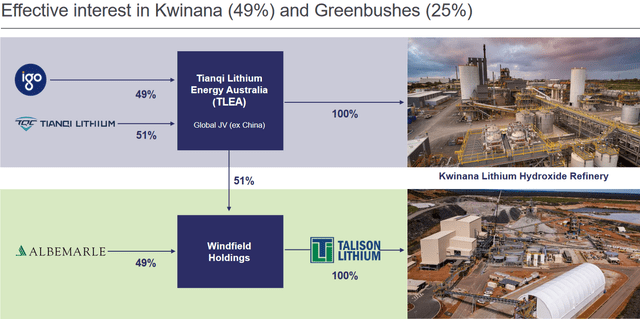

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466], Tianqi Lithium Energy Australia (TLEA) is a JV with Tianqi Lithium (51%) and IGO Limited (49%). TLEA owns the Kwinana lithium hydroxide facility in WA

No significant news for the month.

IGO Limited's ownership % for Kwinana & Greenbushes (source)

Pilbara Minerals [ASX:PLS] (OTCPK:PILBF)

On July 25 Bloomberg reported:

Pilbara Minerals hunts for deals after record lithium output.....The company had “started to run the ruler” over potential acquisitions and was “in pretty good stead” to fund deals both from its balance sheet and through capital raising, Managing Director Dale Henderson said in an interview Tuesday......The Perth-based company’s preference was for hard-rock rather than brine projects in stable jurisdictions like Australia, he said, adding Pilbara Minerals hadn’t itself been the subject of any takeover offers.

On August 2, Pilbara Minerals announced: "Final investment decision for mid-stream demonstration plant." Highlights include:

- "Final Investment Decision [FID] has been made to progress the construction and operation of a Mid-Stream Demonstration Plant (the Project) at the Pilgangoora Operation in joint venture (JV) between Pilbara Minerals Limited and Calix Limited.......

- Estimated construction costs of $104.9M will be partially funded with a $20M Australian Government grant3 with Pilbara Minerals now funding $67.4M of the remaining budgeted construction expenditure.

- Pilbara Minerals as manager of the JV will manage both the construction and operational phases of the Project.

- Successful demonstration of the Project may lead to future commercialisation of the technology......

On August 7, Pilbara Minerals announced:

Substantial 109Mt Mineral Resource increase to 414Mt - further extends Pilgangoora's position as a world class lithium project.

On August 25 Pilbara Minerals announced:

FY23 Financial Results. RECORD PRODUCTION AND SALES DRIVE 326% INCREASE IN NET PROFIT TO $2.4B.......Final dividend of 14 cents per share determined, fully franked.

You can view the latest company presentation here.

Upcoming catalysts:

- Late 2023 - P680 Expansion Project set to begin production.

- Late 2023 - Plan to commission production of POSCO/Pilbara Minerals (18%, option to increase to 30%) JV LiOH facility in Korea.

- Q3, 2025 - P1000 Expansion Project set to begin production.

Mineral Resources [ASX:MIN] (OTCPK:MALRF)

Mineral Resources lithium assets include Mt Marion Mine (50% MIN: 50% Ganfeng). Wodgina Lithium Mine (50% ALB: 50% MIN).

On July 26, Mineral Resources announced: "Quarterly exploration and mining activities report April to June 2023 (Q4 FY23)." Highlights include:

- "Quarterly Mt Marion SC6 equivalent spodumene shipments were 39k dmt (attributable), bringing FY23 shipments to 149k dmt, in line with revised guidance of 145-150k dmt. The FY23 SC6 equivalent FOB cost is expected to be within guidance of $1,200-$1,250/dmt. The average quarterly realised spodumene price was US$2,589 per dmt.

- The expansion of the Mt Marion processing plant was completed in June 2023.

- MinRes announced encouraging exploration results at Mt Marion which confirm significant opportunity for open pit extensions and underground potential.

- The cooperation agreement to convert Mt Marion spodumene concentrate into lithium battery chemicals with Ganfeng Lithium Co. Ltd (Ganfeng) was mutually terminated.

- Quarterly Wodgina SC6 equivalent spodumene shipments were 34k dmt (attributable), resulting in FY23 shipments of 143k dmt, marginally below the revised guidance of 150k dmt. The FY23 SC6 equivalent FOB cost is expected to be within guidance of $925-$975/dmt.

- Wodgina lithium battery chemical production in the quarter was 4.2kt and 11.5kt for FY23, in line with production guidance of 11.5-12.5kt. Lithium battery chemical sales in the quarter was 3.5kt and 7.3kt for FY23, in line with sales guidance of 7.0-7.5kt. The average realised lithium battery chemical revenue in the quarter was US$40,484/t.

- MinRes has amended the terms of the transactions signed with Albemarle Corporation (Albemarle), previously announced on 23 February 2023. MinRes will no longer invest in any Chinese conversion assets and Albemarle will take full ownership of the Kemerton lithium hydroxide plant. Albemarle will pay MinRes an estimated US$380-$400 million on completion. Completion is expected in the December quarter.

- MinRes announced a significant natural gas discovery at North Erregulla Deep-1. The Company also completed the acquisition of Norwest Energy NL on 29 April 2023."

On August 7, Mineral Resources announced:

MinRes invests in game-changing lithium extraction technology. Mineral Resources (MinRes) has entered into a joint development agreement with Lithium Australia to further develop technology that has the potential to be a game-changer in lithium extraction. MinRes will invest up to $4.5 million to fund the development and operation of a pilot plant and an engineering study for a demonstration plant, as well as supply the raw materials.....

Investors can read the latest Trend Investing article on Mineral Resources here.

Livent Corp. (LTHM)[GR:8LV] (NB: Alkem and Livent plan to merge towards the end of 2023)

On July 31, Livent Corp announced: "Livent publishes 2022 Sustainability Report."

On August 3, Livent Corp announced: "Livent releases second quarter 2023 result." Highlights include:

- "Reports strong Q2 financial performance and reaffirms 2023 full year guidance range.

- Publishes 2022 Sustainability Report.

- Highlights Nemaska Lithium development progress, including long-term supply agreement with Ford.

- Proposed merger with Allkem progresses towards targeted year end close."

Allkem [ASX:AKE] [AKE] (OTCPK:OROCF) (NB: Alkem and Livent plan to merge towards the end of 2023)

On July 27, Allkem announced: "June 2023 quarterly activities report." Highlights include:

Operations

- "The Olaroz Lithium Facility2 achieved record annual production of 16,703 tonnes of lithium carbonate with a record 5,059 tonnes produced in the quarter, up 47% on the previous corresponding period (“PCP”).

- Lithium carbonate sales were 3,430 tonnes, generating Olaroz quarterly revenue of ~US$132 million with a gross cash margin of 85% or US$32,172/tonne.

- Excluding shipments to Naraha, third party lithium carbonate sales for the quarter averaged US$38,062/tonne FOB.

- Mt Cattlin achieved annual production of 130,984 tonnes of spodumene concentrate, exceeding previous guidance with 58,059 dmt at 5.3% Li 2O grade produced during the quarter, a ~50% increase quarter on quarter (“QoQ”).

- Mt Cattlin recovery of 67% demonstrates significant improvement in grade and favourable mineralisation as the main ore body is mined.

- Spodumene sales of 46,787 dmt generated revenue of ~US$201 million with a gross cash margin of 80% based on an average sales price of US$4,297 /dmt CIF for SC 5.3%, which corresponds to approximately US$4,800 /dmt on a SC6 CIF basis."

Development Projects

- "Olaroz Stage 2 achieved first wet production in mid July with commissioning to continue and ramp up over the next 12-18 months.

- At Naraha, 464 tonnes of lithium hydroxide were sold and after completing work on product quality and operational improvements, battery grade qualification has commenced with customers in early July.

- Mt Cattlin’s Ore Reserve Update confirms an additional 4-5 year mine life to 2027-2028 via open pit methods.

- The liner installation has been completed on the first two strings of ponds at Sal de Vida Stage 1, engineering on string 3 is complete and earthworks have commenced.

- Engineering at James Bay has reached 72.5%. Permitting activities progressed but were interrupted as local communities were evacuated due to recent wildfires. Engagement with the communities remains very positive as local economic benefits are being finalised."

Financials and Corporate

- ".....Group revenue for the quarter was approximately US$334 million and group gross operating cash margin was approximately US$274 million (82%).

- At 30 June group net cash5 was US$648.4 million up US$70.5 million from 31 March 2023."

On August 1, Allkem announced: "Mt Cattlin Annual Ore Resource and Reserve update at 30 June, 2023."

On August 3, Allkem announced: "James Bay drilling update." Highlights include:

- "Assays continue to demonstrate thick intercepts of lithium mineralisation within spodumene-bearing pegmatites in the NW Sector.

- Intercepts include 114m @ 1.73 % Li 2O from 140.5m in JBL-23-050, and 94m @ 1.87 % Li 2O from 107m in JBL-23-085. The reader is cautioned that these thicknesses represent downhole thicknesses and not true thicknesses. True thicknesses are estimated to be between 60% and 80% of downhole thicknesses."

Upcoming catalysts include:

- 2023/24 - Olaroz Stage 2 ramp of production to 25ktpa. When combined with Stage 1 total capacity will be 42.5ktpa.

- Mid 2024 - Sal De Vida Stage 1 production targeted to begin and ramp to 15ktpa. SDV Stage 2&3 combined will begin about 2025 and ramp to an additional 30ktpa. Total combined when completed will be 45ktpa.

- ?2025/26 - James Bay production targeted to start.

You can read the latest investor presentation here. You can read the latest Trend Investing Allkem article here.

AMG Critical Materials N.V. [NA:AMG] [GR:ADG] (OTCPK:AMVMF) (Formerly AMG Advanced Metallurgical Group NV)

On July 26, AMG Critical Materials announced:

AMG’s lithium operations continue to drive record earnings with the fourth straight quarter exceeding $100 million of EBITDA.....driven largely by our Clean Energy Materials segment, specifically AMG Lithium’s Brazilian operation with an EBITDA contribution of $89 million. AMG’s liquidity as of June 30, 2023 was $586 million, with $391 million of unrestricted cash and $195 million of revolving credit availability. The Company will pay an interim 2023 dividend of €0.40 per ordinary share on or around August 9, 2023, to shareholders of record on August 1, 2023.....

On August 17, AMG Critical Materials announced:

AMG Brazil signs MOU for development of lithium concentrate production. AMG Critical Materials N.V. (“AMG”, EURONEXT AMSTERDAM: “AMG”) announces that AMG Brasil S.A. (“AMG Brazil”), has signed an exclusive memorandum of understanding (“MOU”) with Grupo Lagoa, which operates a pegmatite mine supplying the Portuguese ceramic and glass industry since 1984. The intention of the partnership is to concentrate the lithium minerals contained in the pegmatite to produce commercial grade Spodumene concentrate......

Upcoming catalysts:

- 2023/24 - Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin, bringing total production capacity to 130ktpa.

- Q4, 2023 - Lithium hydroxide facility in Bitterfeld-Wolfen Germany to be commissioned. First module to be 20,000tpa LiOH.

- 2025-2028 - German LiOH facility expansion plan with Modules 2-5 (100,00tpa LiOH).

You can view the latest company presentation here or the Trend Investing article here.

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

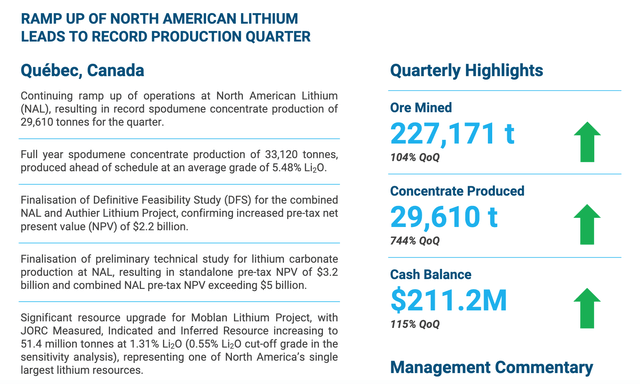

On July 31, Sayona Mining announced: "June 2023 quarterly activities report." Highlights include:

On August 2, Sayona Mining announced: "First shipment to launch NAL concentrate revenues." Highlights include:

- "First shipment delivered of approximately 20,500 tonnes spodumene (lithium) concentrate, sold into buoyant global spot market.

- Initial revenue secured for North American Lithium [NAL] operation following successful restart.

- Production ramp‐up at NAL on track amid continuing demand growth from accelerating EV and battery revolution."

Upcoming catalysts include:

- 2023 - Spodumene production ramp up at NAL operations (owned SYA 75%: PLL 25%).

Piedmont Lithium (PLL) [PLL]

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of the North American Lithium [NAL] Project in Canada and 50% of the Ghana Lithium Project.

On July 27, Piedmont Lithium announced: "Piedmont Lithium’s Tennessee Project receives final permit required to advance to construction." Highlights include:

- "Piedmont now holds all the material permits required to commence project construction.

- Tennessee Lithium’s planned capacity of 30,000 tons per year would nearly triple current domestic production.

- Robust economics of recent DFS demonstrate positive impact of America’s pro-EV policies.

- Advisors retained to arrange strategic financing, customer offtake agreements, and project debt as the DOE grant process advances.

- Tennessee Lithium’s construction is targeted for 2024 with first production in 2026."

On July 28, Ghana Business News reported:

Ministry says Ghana government has not granted licenses to any company to exploit lithium.....there are various explorations of the mineral currently ongoing, and that the Ministry had submitted a policy proposal for the regulation, exploitation, and management of Ghana’s green minerals, including lithium, which is being scrutinised by Cabinet. The overarching goal of the policy is to ensure that the exploitation of these critical minerals inure to the benefit of the people of Ghana, the true owners of these resources, the statement said.

On August 2, Piedmont Lithium announced: "Piedmont Lithium announces first commercial shipments from North American Lithium." Highlights include:

Q3 customer deliveries to generate 2023 revenue and cash flow for Piedmont Lithium

- "Inaugural shipment of 20,500 metric tons of spodumene concentrate by North American Lithium departed the Port of Quebec City on August 1, 2023.

- Piedmont expects to ship approximately 56,500 metric tons in H2 2023 under its joint venture offtake agreement, including the first tons under the long-term supply agreement with LG Chem."

On August 17, Piedmont Lithium announced: "Piedmont Lithium plans development funding for Ewoyaa." Highlights include:

Company exercises option to acquire 22.5% stake in Atlantic Lithium’s flagship project.

- "Piedmont making staged investments to earn 50% of Atlantic Lithium’s Ghanaian portfolio.

- Support for Ewoyaa Lithium Project reflects Piedmont’s confidence in development of Ghana assets.

- Ewoyaa development furthers Piedmont’s strategy to secure feedstock for planned Tennessee conversion plant."

Upcoming catalysts include:

- Late 2024 - Ghana Project (50% PLL) targeted to begin. Some Ghana issues at present.

- 2026 - Tennessee Lithium hydroxide project targeted to begin.

- 2023-25 - Carolina Lithium (100%) - Permitting, off-take or project funding announcements.

You can view the company's latest presentation here, CEO interview here, or a Trend Investing article here.

Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

Core 100% owns the Finniss Lithium Project (Grants Resource) in Northern Territory Australia. Significantly they already have an off-take partner with China's Yahua (large market cap, large lithium producer), who has signed a supply deal with Tesla (TSLA). The Company states they have a "high potential for additional resources from 500km2 covering 100s of pegmatites."

On July 24 Core Lithium announced:

Quarterly Activities Report. Quarterly spodumene production of 14,685t (FY23: 18,274t) at a C1 unit cost of $902/t (FY23: $1,230/t). Spodumene concentrate between 5.35% and 5.6% (on specification). Lithia recoveries ~49% with work underway on improvement initiatives.

On August 3, Core Lithium Ltd. announced:

Early works update - BP33 Project. Australian lithium miner Core Lithium Ltd (ASX: CXO) has commenced the early works program and detailed feasibility study at the BP33 Underground Project – the second proposed mine at the Company’s 100% owned Finniss Lithium Operation in the Northern Territory.....“Commencing these $45-50 million of early site works to establish the box cut allows the Company to work at pace and stay on the critical path for developing the BP33 underground mine while updating the feasibility study in parallel. “This approach will allow the Company to be in the best position to move forward quickly should a final positive investment decision be received.”

On August 17, Core Lithium Ltd. announced:

Successful completion of A$100 million Institutional Placement. Australian lithium miner Core Lithium Ltd (ASX: CXO) (“Core”, “Core Lithium” or “the Company”) is pleased to announce the successful completion of its A$100m fully underwritten institutional placement (“Placement”) as announced on Wednesday, 16 August 2023. The Placement was supported by existing shareholders and new domestic and offshore institutional investors. 250 million New Shares are being issued under the Placement at a fixed price of A$0.40 per New Share.

On August 24, Core Lithium Ltd. announced: "Ready for export: first lithium concentrate cargo for offtake agreements and first lithium fines sale." Highlights include:

- "Third spodumene concentrate shipment of 10,000t and first into long-term offtake agreements ready for export.

- Initial parcel of lithium ‘fines’ product ready for shipment from Darwin Port."

Investors can read a company presentation here, or the Trend Investing article when Core Lithium was back at A$0.055 here.

Catalysts include:

- 2023 - Ramp up of spodumene production from Finniss.

Sigma Lithium Resources [TSXV:SGML] (SGMLF) (SGML)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo Project in Brazil.

On July 26, Sigma Lithium announced:

Sigma Lithium ships 30,000 tonnes of battery grade lithium and by-products; achieves net zero carbon, operating profitability and premium pricing.......Ramp-up of Phase 1 production continues to advance well, currently operating at approximately 75% of nameplate throughput capacity. Achieved maximum DMS recoveries of 60% and on track to reach design recovery of 65%......

On July 28, Seeking Alpha reported:

Sigma Lithium jumps following reported M&A speculation. Sigma Lithium (SGML) +5.8% in Friday's trading after Brazil's Valor Economico reported Bank of America has been conducting talks with funds and multinational firms interested in buying the mining company. Among those interested in the Brazilian company are China's Cnooc and Saudi Arabia's PIF sovereign wealth fund, according to the report. Tesla (TSLA) has approached Sigma (SGML) but is not currently in active negotiations, the report also said.

On August 11, Sigma Lithium announced:

Sigma Lithium to reach full annualized production Capacity of 270,000 tonnes of Triple Zero Green Lithium in third quarter.......Ramp-up of Phase 1 production continues to advance on schedule and the Company remains on track to achieve 2023 production guidance of 130,000 tonnes of Triple Zero Green Lithium with consistent annualized production of 270,000 tonnes of Triple Zero Green Lithium expected to be achieved by the end of Q3-2023...........

Upcoming catalysts:

- 2023 - Ramp up of spodumene production from Grota do Cirilo.

Investors can read the latest company presentation here or the Trend Investing article here back when Sigma was trading at C$5.00.

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Mine in Argentina, targeting a fast-track development strategy. Argosy initially plans to ramp to 2,000tpa lithium carbonate starting mid-2023.

On July 31, Argosy Minerals announced: "Quarterly activities report – June 2023." Highlights include:

- "2,000tpa operation works progressing, on path to achieving fully continuous production operations and leading to ramping up production operations during H2-CY2023.

- Positive progress with strategic partner process and EIA regulatory approval for 10ktpa expansion operation.

- Pre-development works advancing for 10,000tpa operation expansion.

- Resource expansion & production well drilling works progressing – targeting to materially expand current JORC Indicated Resource, increase project mine-life and future annual production capacity.

- Strong international lithium carbonate price outlook supporting positive lithium market sentiment, enabling potential to realise Argosy’s growing lithium production development strategy.

- Argosy becoming only the 2nd ASX-listed battery quality lithium carbonate producer.

- Strong financial position with cash reserves of ~$23.5 million at 30 June 2023.......

- The Company successfully completed 24-hour trials of continuous operations and produced ~20 tonnes of battery quality lithium carbonate product to date, attaining an average product quality of 99.79% (and up to 99.9%)........."

On August 3, Argosy Minerals announced: "Rincon test pumping results." Highlights include:

- "Pumping tests confirm that brine can be economically abstracted from the deep sand aquifer....."

Upcoming catalysts:

- 2023 - Rincon Lithium full ramp-up toward steady-state production targeted, 2,000tpa operation.

Investors can view the company's latest investor presentation here, and the latest Trend Investing Argosy Minerals article here.

Lithium Americas [TSX:LAC] (LAC) - Plan to split to form two companies - Lithium Americas and Lithium Argentina (source)

On July 31, Lithium Americas announced:

Lithium Americas shareholders approve plan to separate into two leading lithium companies.....

On August 9, Lithium Americas announced: "Lithium Americas reports second quarter 2023 results." Highlights include:

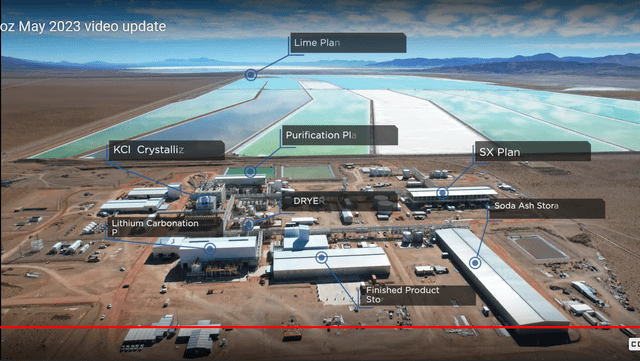

Caucharí-Olaroz

- "In June 2023, Caucharí-Olaroz achieved first lithium production as the project advances commissioning and ramp up to Stage 1 capacity of 40,000 tonnes per annum (“tpa”) of battery-quality lithium carbonate (”Li2CO3”), which is scheduled to be completed in mid-2024.

- Since startup, production quality has exceeded expectations with critical equipment required to achieve battery-quality lithium carbonate in the process of testing and commissioning.

- Caucharí-Olaroz is expected to produce approximately 5,000 tonnes of lithium carbonate in 2023.

- First lithium product from Caucharí-Olaroz has left the site and is being prepared for shipment at the port.

- As of June 30, 2023, $895 million of the $979 million total expected capex has been spent (on a 100% basis). As of June 30, 2023, the Company expects its remaining funding requirement to be less than $25 million for capital costs, value added taxes and working capital to reach positive cash flow.

- Preparation for Caucharí-Olaroz Stage 2 expansion targeting additional production capacity of at least 20,000 tpa is underway."

Pastos Grandes Basin

- "The Company continues to advance Pastos Grandes’ $30 million development plan, including engineering and evaluation work, which is expected to be completed by the end of the year.....

- On April 20, 2023, the Company completed its acquisition of Arena Minerals and its 65% ownership interest in the Sal de la Puna project, adjacent to the Pastos Grandes project in Salta, Argentina."

Thacker Pass

- "In mid-June 2023, major earthworks construction commenced at Thacker Pass to support the target of initial production in the second half of 2026.

- Deposits on long-lead items are expected to start in Q3 2023 and will continue through Q4 2024.

- The Company continues to work closely with the U.S. Department of Energy (“DOE”) Loans Program Office to advance confirmatory due diligence and term sheet negotiations for the Advanced Technology Vehicles Manufacturing Loan Program (“ATVM Loan Program”), following the receipt of a Letter of Substantial Completion on February 22, 2023.

- The Company expects the DOE ATVM Loan Program conditional approval process to be completed in 2023 and if approved, to fund up to 75% of capital costs for construction of Phase 1. Development costs incurred by the project may qualify as eligible costs under the ATVM Loan Program as of January 31, 2023.......

- On February 6, 2023, the US District Court, District of Nevada ruled favorably for the Company in the appeal filed against the Bureau of Land Management by declining to vacate the Record of Decision. The U.S. Court of Appeals for the Ninth Circuit affirmed the District Court’s decision on July 17, 2023."

Corporate

- "As at June 30, 2023, the Company had $502.0 million in cash and cash equivalents and short-term bank deposits, with an additional $75 million in available credit.

- On August 4, 2023, the Company obtained a final order from the Supreme Court of British Columbia approving the plan of arrangement to effect the Separation."

Upcoming catalysts:

- H2 2023 - Cauchari-Olaroz lithium production ramp to 40ktpa. From 2025 a Stage 2 20ktpa+ expansion is planned.

- 2023 - Thacker Pass construction to progress. Waiting on a potential DOE ATVM Loan.

- H2, 2026 - Phase 1 (40,000tpa LCE) lithium clay production from Thacker Pass Nevada (full ramp to 80,000tpa by ?2028).

NB: Ganfeng Lithium (51%) and Lithium Americas (49%) own the JV company Minera Exar S.A., which owns 91.5% interest and is entitled to 100% of the production from the Cauchari-Olaroz Project. The 8.5% interest is owned by Jujuy Energia y Mineria Sociedad del Estado (“JEMSE”) (a company owned by the Government of Jujuy province).

You can read a recent Trend Investing article discussing the Lithium Americas split here.

The Cauchari-Olaroz Project (Ganfeng/LAC JV) aerial view - Commissioning and 1st lithium produced in June 2023 (source)

Lithium miner ETFs

- Sprott Lithium Miners ETF (LITP) - A pure play lithium ETF

- Global X Lithium & Battery Tech ETF (LIT)

- ProShares S&P Global Core Battery Metals ETF (ION)

- The Amplify Lithium & Battery Technology ETF (BATT)

Global X Lithium & Battery Tech ETF (LIT) 10 year price chart (source)

Seeking Alpha

Trend Investing lithium demand v supply model forecasts

Our recently updated model forecast (due to surging stationary energy storage demand) is for lithium demand to increase 5.4x between end 2020 and end 2025 to ~1.9m tpa, and 12.9x this decade to reach ~4.6 m tpa by end 2029 (assumes electric car market share of 30% by end 2025 and 54% by end 2029, 60% by end 2030). These figures may be a bit lower if sodium-ion batteries take significant market share in stationary energy storage or low end vehicles.

Note: A Nov. 2020 UBS forecast is for "lithium demand to lift 11-fold from ~400kt in 2021 through to 2030."

- Trend Investing - Exclusive: Lithium Demand V Supply Update - April 2023

Conclusion

August saw lithium chemical spot prices and spodumene spot prices significantly lower.

Highlights for the month were:

- Top battery-maker CATL’s profit soars 63% amid EV sales boom.

- BloombergNEF - EV battery sizes increasing may lead to battery supply chain shortages.

- BMI - Lithium industry needs over $116 billion to meet automaker and policy targets by 2030.

- Mali adopts new mining code that boosts state interests.

- Albemarle and Livent are expecting lithium spot prices to recover from the weakness seen in recent months.

- New CATL electric car batteries to add 400km range in 10min.

- Ford and SK announce new massive battery cathode factory in Quebec’s Becancour battery valley.

- BMI - 401 gigafactories planned to be in operation by 2030, representing almost nine terawatt hours of annual production capacity.

- Albemarle invests C$109m Strategic Investment and MOU into Patriot Battery Metals. Albemarle reports Q2 net income of $650m, up 60% YoY.

- Ganfeng Lithium to acquire 70% stake in Mengjin Mining from Chair for over RMB1.4B.

- Pilbara Minerals hunts for deals after record lithium output. Announces 109Mt Mineral Resource increase to 414Mt. Record FY23 results with a 326% increase in net profit to $2.4B.

- Allkem Olaroz Lithium Facility achieved record annual production of 16,703 tonnes of lithium carbonate in FY23. James Bay drilling results include 114m @ 1.73 % Li2O from 140.5m.

- AMG Brazil signs MOU for with Grupo Lagoa to produce commercial grade Spodumene concentrate.

- Sayona Mining reported first spodumene shipment to launch NAL concentrate revenues.

- Piedmont Lithium’s Tennessee Project receives final permit required to advance to construction. Exercises option to acquire 22.5% stake in Atlantic Lithium’s flagship project.

- Core Lithium Quarterly Activities report - Lithia recoveries ~49% with work underway on improvement initiatives. Core commenced the early works program and detailed FS at the BP33 Underground Project. Raises A$100 million from an Institutional Placement.

- Sigma Lithium ships 30,000 tonnes of battery grade lithium and by-products. Sigma Lithium jumps following reported M&A speculation (Cnooc and Saudi Arabia's PIF sovereign wealth fund).

- Lithium Americas shareholders approve plan to separate into two leading lithium companies.....Lithium Americas (NewCo) and Lithium Argentina, set to potentially become effective by October, 2023.

As usual all comments are welcome.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Trend Investing

Trend Investing subscribers benefit from early access to articles and exclusive articles on investing ideas and the latest trends (especially in the EV and EV metals sector). Plus CEO interviews, chat room access with other professional investors. Read "The Trend Investing Difference", or sign up here.

Trend Investing articles:

This article was written by

The Trend Investing group includes qualified financial personnel with a Graduate Diploma in Applied Finance and Investment (similar to CFA) and well over 20 years of professional experience in financial markets. Trend Investing searches the globe for great investments with a focus on "trend investing" themes. Some focus trends include electric vehicles and the lithium/cobalt/graphite/nickel/copper/vanadium miners, battery and plastics recycling, the online data boom, 5G, IoTs, AI, cloud computing, renewable energy, energy storage etc. Trend Investing was recently selected as the leading expert consultancy for a U.S government project on the EV supply chain and to the Board of Directors of the Critical Minerals Institute.

Trend Investing hosts an Investing Group service called Trend Investing for professional and sophisticated investors. The service is information only and does not offer advice or recommendations - see Seeking Alpha's Terms of use .

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GLOBAL X LITHIUM ETF (LIT), AMPLIFY LITHIUM & BATTERY TECHNOLOGY ETF (BATT), ALB, JIANGXI GANFENG LITHIUM [SHE: 2460], ASX:AKE, ASX:PLS, ASX:MIN, LIVENT (LTHM), AMG CRITICAL MATERIALS N.V. [AMS:AMG], TSX:LAC, ARGOSY MINERALS [ASX:AGY], ASX:LTR, ASX:LLL, ASX:CXO, ASX:SYA, ASX:PLL, ASX:NMT, SIGMA LITHIUM [TSXV:SGMA], GALAN LITHIUM [ASX:GLN], SAVANNAH RESOURCES [LSE:SAV], LITHIUM SOUTH DEVELOPMENT CORP. [TSXV:LIS], CRITICAL ELEMENTS LITHIUM [TSXV:CRE], WINSOME RESOURCES [ASX:WR1], GLOBAL LITHIUM RESOURCES [ASX:GL1], EUROPEAN METAL HOLDINGS [ASX:EMH], FRONTIER LITHIUM [TSXV:FL], GREEN TECHNOLOGY METALS [ASX: GT1], SNOW LAKE LITHIUM (LITM), PATRIOT BATTERY METALS [TSXV:PMET] AND [ASX:PMT], OCEANA LITHIUM [ASX:OCN], MINREX RESOURCES [ASX:MRR], LOYAL LITHIUM [ASX:LLI], PATRIOT LITHIUM [ASX:PAT], ARGENTINA LITHIUM & ENERGY [TSXV:LIT], LITHIUM IONIC CORP. [TSXV:LTH], ATLAS LITHIUM (ATLX), LATIN RESOURCES [ASX:LRS], MIDLAND EXPLORATION [TSXV:MD], BRUNSWICK EXPLORATION [TSXV:BRW], AZIMUT EXPLORATION [TSXV:AZM], COSMOS EXPLORATION [ASX:C1X], MEGADO MINERALS [ASX:MEG], OMNIA METALS GROUP [ASX:OM1], ERAMET [FRA:ERA], FREY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is for ‘information purposes only’ and should not be considered as any type of advice or recommendation. Readers should "Do Your Own Research" ("DYOR") and all decisions are your own. See also Seeking Alpha Terms of Use of which all site users have agreed to follow. https://about.seekingalpha.com/terms

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.