Vera Bradley: Stock Price Rise Likely To Continue On Earnings Release (Rating Upgrade)

Summary

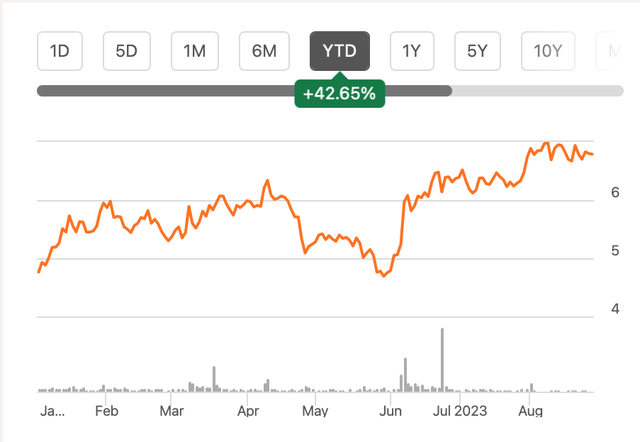

- Vera Bradley's stock has run up by over 42% YTD, likely on an improved profit outlook for FY24.

- Even though the company's Q1 FY24 figures were lacklustre, the revised expectation of a 158% YoY EPS increase is very encouraging.

- Despite its price uptick, VRA's market multiples look attractive, indicating some upside to the stock for now.

Cooper Neill/Getty Images Entertainment

When I checked on the bag maker Vera Bradley (NASDAQ:VRA) the last time, in May, its prospects looked vastly improved even since late 2022. This led me to a rating upgrade in the stock to Hold from the Sell earlier. But its first quarter (Q1 FY24) numbers that followed soon after received a big thumbs up from investors, leading to a now significant 27% since the time I wrote and an even bigger rise year to date (see chart below).

With its Q2 FY24 numbers due for release late next week, here I look at what’s making Vera Bradley tick and if the stock can continue on its upward journey.

The story so far

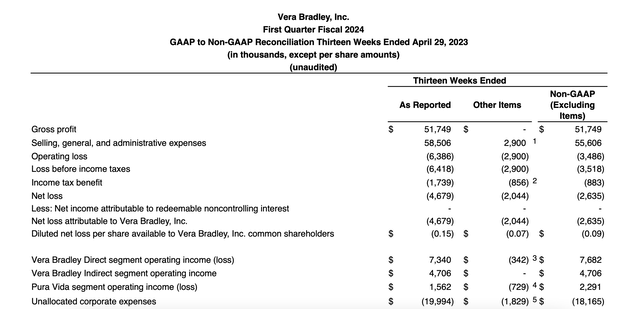

First, a quick look at the financial developments since the last I wrote on it. The company’s Q1 FY24, ending April 29, 2023, continued to show weakness on “challenging traffic trends in March and April”, as the company puts it. This resulted in a 4.2% year-on-year (YoY) decline in net revenues, a reported operating loss of USD 6.4 million and a diluted reported loss per share of USD 0.15.

Still, there are silver linings to these numbers:

- The contraction in net revenue is particularly disappointing considering that it’s expanded from the 1.7% decline in Q4 FY23. However, it’s still an improvement over the 7.5% fall seen in FY23 as a whole.

- It's worth noting also that the company has closed 19 full-line stores and two factory outlets (though it opened five more) in the past 12 months. Also, encouragingly, bracelet maker Pura Vida, whose acquisition was completed in January this year, has seen a small revenue increase, the first such in five quarters.

- The gross profit margin at 54.8% looks healthy on its own and is also significantly better than that seen in Q4 FY23 (40.8%) and in Q1 FY23 (53.3%) on a shrinking in cost of sales.

- The loss per share is similarly smaller than what we saw in Q1 FY23 (USD 0.21).

In total, it looks like Vera Bradley’s numbers are showing some signs of recovery, in continuation with the story from the last time when it was still struggling to come up for air. Clearly, though, these numbers indicate little reason for bullishness on the stock.

Positive outlook

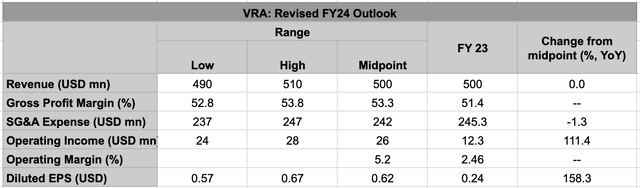

Besides its share buybacks, I believe the real positive impetus is its profit outlook, even as it maintains its revenue guidance for FY24 at USD 490-510 million. Assuming that it lands at the midpoint means that revenues will be flat from FY23.

- Gross Profit Margin

But we’ve already seen a drop in cost of revenues in Q1 FY24 by 7.25% YoY, in continuation with the trend seen in the corresponding period of the previous year. This is likely to continue into the rest of the year too, going by the flat revenues and upwardly revised gross profit margin.

In its initial guidance, the company mentioned only “reduced inbound freight expense” as having a favourable impact on the margin. This has now been extended to “lower year-on-year freight expense, cost reduction initiatives, and the sell-through of previously-reserved inventory..”. As a result, Vera Bradley has upped its gross profit margin slightly to 52.8-53.8% from the earlier expectation of 52.6-53.6%.

Source: Vera Bradley, Author's Estimates

- Operating profits

But that’s not all as far as either costs or profits go. It has also reduced forecasts for non-GAAP selling, general and administrative expenses (SG&A expenses) or operating costs. They are now expected to come in in the range of USD 237-247 million, a 1.3% YoY decline assuming that the actuals come in at the midpoint of the range. Its initial guidance was USD 241-251 million, which would have meant essentially unchanged numbers.

The impact on operating profits, though, with expectations for operating income to range between USD 24-28 million compared to the USD 17.3-21.7 million range earlier. At the midpoint of the latest guidance range, this is a whole 111.4% increase over the FY23 number.

The operating margin is commensurately expected to more than double to 5.4% this year from FY23. It’s also an appreciable rise from the 3.9% expected as per the initial guidance. It’s still lower than the company’s pre-pandemic margins, but this is still an improvement over the past year when Vera Bradley reported an operating loss.

I would like to add here that the company underperformed on its operating income target last year, which is a risk factor. In Q1 FY23, it expected operating income to come in in the range of USD 18.8-25 million, instead, it ended the year with a non-GAAP operating income of USD 12.3 million.

The gap might be less so in FY24 considering that last year it went through significant restructuring and streamlined costs, but I'm not negating any spillover impacts into this year. Especially since we haven't seen an operating profit in the past quarter.

- EPS

This betterment in profits right from the gross profits, is expected to flow into the non-GAAP diluted EPS as well, with a huge 158% YoY increase expected in FY24. The guidance range for the consolidated diluted EPS is at USD 0.57-0.67, which is also a notable rise of 37.8% from the initial guidance.

The turnaround in EPS is expected to start in Q2 FY24 itself, with analysts’ expectations of a figure of USD 0.12 on average. However, for the same reasons as the operating income, I would be cautious about the EPS figure too.

Competitive market multiples

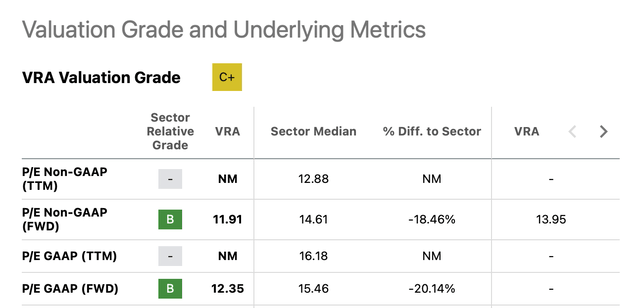

Interestingly, Vera Bradley’s market multiples look competitive despite its recent stock price rally. Its non-GAAP forward price-to-earnings (P/E) ratio is at 11.9x, which isn’t just lower than the corresponding figure of 14.6x for the consumer discretionary sector, it's also lower than the stock’s own five-year average figure of 13.95x. The GAAP forward P/E is similarly smaller than that for the sector (see table below).

While these figures indicate that there's an upside to it of at least 20% right now, I'm cautious going by the fact that it underperformed compared to its outlook last year. Still considering that analysts' forward estimates are at the lower end of the company's guidance range, there may well be an upside to it. Maybe not 20%, but its tangible book value per share at USD 7.5 alone indicates a 10% upside.

What next?

Vera Bradley expects slow but sure improvements to lead to significant growth in earnings by the end of its FY24. However, the turnaround is expected to have begun in the Q2 FY24 quarter itself, going by analysts' estimates.

At the same time, it's essential to remember that the company underperformed on its own outlook last year. While it's true that significant restructuring was underway at the time, an operating loss in the latest quarter isn't encouraging either. Still, there's something to be said for its market multiples, which are trading below its past averages and those for the consumer discretionary sector.

However, for now, I expect only a 10% share price rise. Once it touches that mark, any further increase will depend on how the company performs in Q2 FY24 and beyond. I'm upgrading VRA to Buy.

--

This article was written by

Manika is an investment researcher and writer as well as a macroeconomist, with a focus on converting big-picture trends into actionable investment ideas. She has worked in investment management, stock broking and investment banking. As an entrepreneur, running her own research firm, she received the Goldman Sachs 10,000 Women scholarship for certification in business. She is also a public speaker, having shared her views at multiple international forums and has been quoted in leading international media.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in VRA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.