Valero: Renewables And Sustainable Fuel Will Contribute To Upside

Summary

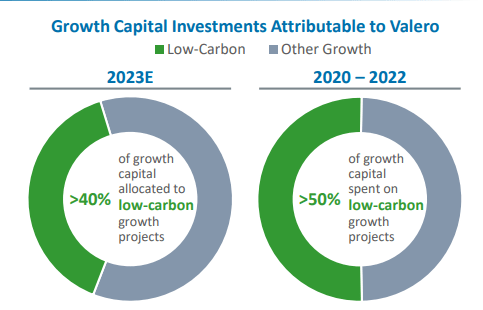

- Valero has invested 40% of their growth capital into low carbon growth projects to capture rising demand.

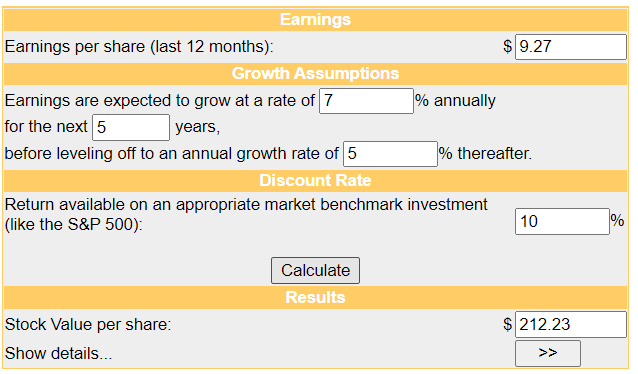

- Analysts predict an EPS of $9.27 for 2027. Using this estimate alongside the expected growth rate of 7%, VLO's fair value per share comes out to over $200/share.

- Valero has a conservative payout ratio of 13% and a 5-year average dividend growth rate of 5.4%.

Brandon Bell/Getty Images News

Valero (NYSE:VLO) is a refining company that conducts operations in the United States, Canada, and the United Kingdom. With a presence across these regions, VLO manages 15 refineries that undertake the processing of diverse types of crude oil, along with various feedstocks. These processes result in the creation of a range of end products, notably including transportation fuels, low-sulfur fuel oil, and heating oil.

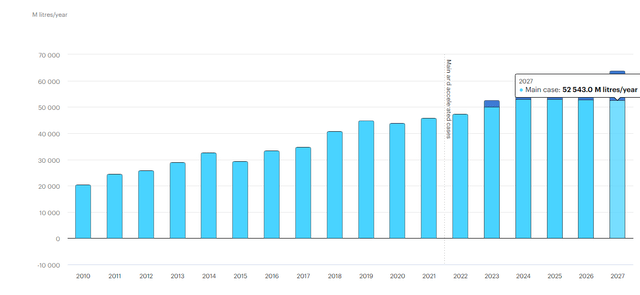

An important statistic from the most recent IEA report (International Energy Agency), states that the demand for biofuel is estimated to increase 20% by 2027. Ethanol is projected to consume the majority of this increased demand and Valero is set to benefit as they have approximately 1,080 million gallons of ethanol production per year. As demand rises despite rising costs, Valero is strategically investing capital in these parts of their business to profit from this market demand. With this in mind, I believe that VLO is currently undervalued and has big upside potential. The double-digit upside potential alongside the strong dividend coverage makes this a solid investment for dividend growth investors.

Strategic Advantage

Valero's Investor Presentation

Valero holds ownership of midstream assets that play a vital role in facilitating the transportation of both crude oil and refined products. These assets encompass crude oil pipelines, product pipelines, terminals, storage tanks, and marine docks. While the majority of its refined products are distributed through unbranded channels, VLO has also established a network of independent dealers and distributors that operate under its proprietary branding.

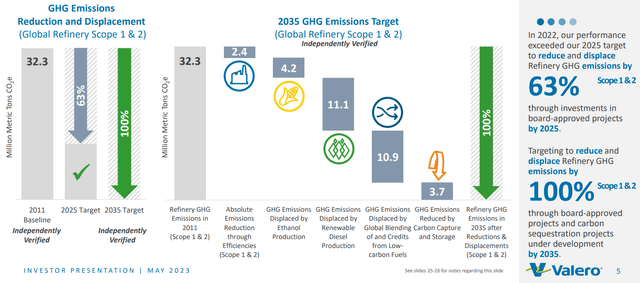

They operate a network of 15 refineries designed to handle 3.2 million barrels per day of oil, showcasing significant operational efficiency. This refinery network stands as the cornerstone of the company's asset portfolio, with its intricate operations providing notable value enhancement. Concurrently, the company is actively engaged in sizeable low-carbon initiatives that are being developed. We can see an aggressive target to have GHG emissions reduction of 100% by 2035.

As the world embraces cleaner sources of fuel, we can appreciate the fact that Valero is adapting rather than fighting it. In fact, we can see that 40% of VLO's growth capital is being allocated to low-carbon growth projects.

Valero Investor Presentation

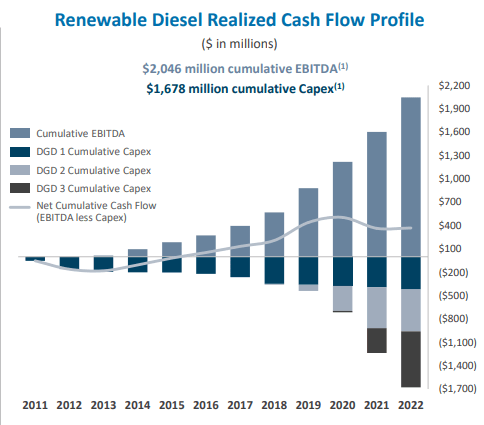

Within its operations, the company has achieved an annual production capacity of 1.2 billion gallons of renewable diesel, equivalent to approximately 100 thousand barrels per day of renewable diesel output. Simultaneously, the company is in the process of advancing new ethanol projects, thereby fostering a continuous enhancement in its overall renewable energy efficiency. The successful execution of these renewable fuel ventures holds the potential to fortify the company's durability over the long term.

Renewable Diesel segment operating income was $440 million for the second quarter of 2023 compared to $15 2 million for the second quarter of 2022. Renewable Diesel sales volumes averaged 4.4 million gallons per day in the second quarter of 2023, which was 2.2 million gallons per day higher than the second quarter of 2022. The higher sales volumes in the second quarter of 2023 were due to the impact of additional volumes from the start-up of the DGD Port Arthur plant in the fourth quarter of 2022. - Homer Bhullar, VP Investor Relations & Finance

Sustainable Aviation Fuel

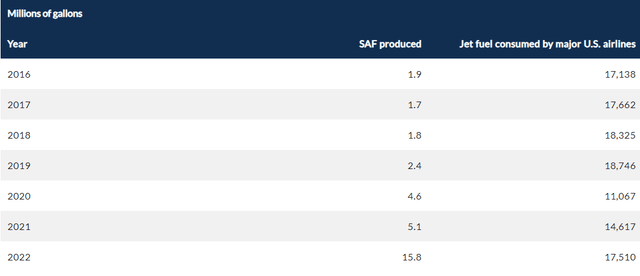

VLO is expanding their presence in sustainable fuel with their SAF initiative (Sustainable Aviation Fuel). SAF is fuel used for commercial aviation that has been proven to reduce CO2 emissions by up to 80%. As the world embraces more initiatives of using cleaner fuel and energy sources, we can expect that Valero will continue to pump more research and development into this part of their business.

Valero's SAF project is underway with an anticipated completion date in 2025. The facility will be equipped to convert up to 50% of its existing renewable diesel production capacity into SAF, equivalent to around 235 million gallons annually. I anticipate this creating increased revenue streams for VLO and will be a contributing factor to shareholders being handsomely rewarded.

Government Accountability Office

The Inflation Reduction Act (IRA) grants SAF a more lucrative clean fuel production credit value compared to renewable diesel, thereby generating higher margins from SAF production. Higher margins means higher profits which can translate to higher dividend raises.

Increased Renewable Diesel Consumption

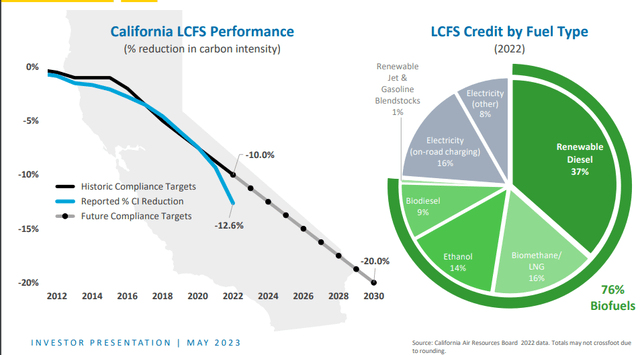

Following the implementation of California's Low Carbon Fuel Standard in 2011, there was a significant surge in the consumption of renewable diesel in the state. From 2011 to 2022, the consumption escalated from 42 million gallons to an impressive nearly 1.18 billion gallons per year. As Valero focuses their efforts on capturing this increased usage, we can see that profits will directly correlate. We can see that low carbon fuel standard's credit by fuel type consist primarily of biofuels at 76%. Valero is set to benefit from this increased usage as they continue to build their presence in the renewable and sustainable fuel market.

Valero Investor Presentation

As previously mentioned, the renewable diesel realized cash flow profile above shows an increasing cash flow from the sale of renewable fuel. I fully expect this to be the trend far into the future and Valero is positioning themselves to continue profiting here. Higher profits will lead to higher dividend distributions and I plan on accumulating here to capture this huge upside potential.

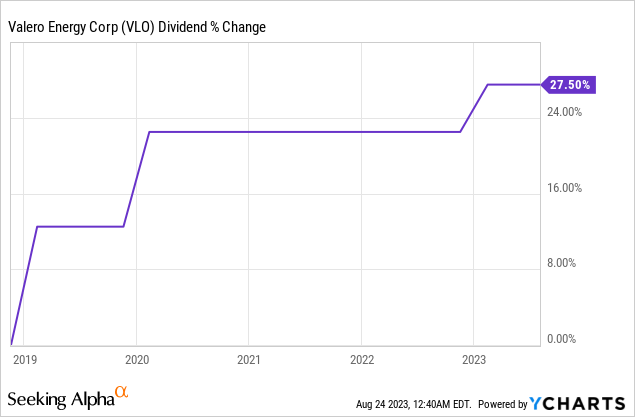

Dividend Strength

With an extremely conservative payout ratio of 13%, this 3% yielder will likely see plenty of dividend increases as there is a lot of room to grow. Over the last 5 year period, the average dividend growth rate has been 5.4% and as cash flow remains strong, I expect the average growth steadily get higher. The short term fluctuations in fuel prices don't concern me as even in the worst case scenario, it's important to realize that Valero is currently sitting on $5B in cash and earns $48B in net cash provided by operating activities. This is plenty to cover the $370 million that was paid out to shareholders in 2Q23.

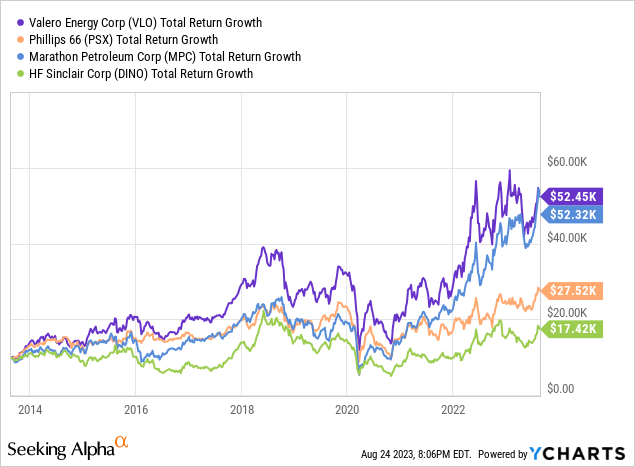

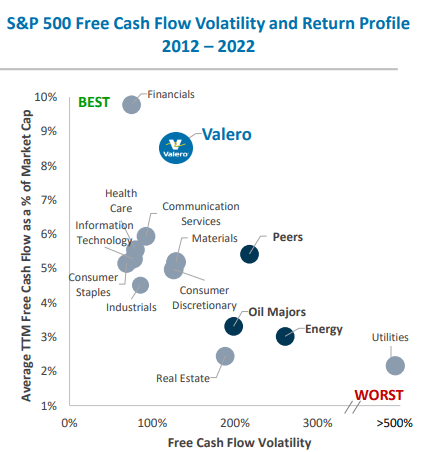

We can see that Valero has outperformed its peers on a total return level over a 10 year period. $10,000 invested would now be worth over $52,000. This further reinforces that Valero has a strong product and services mix to differentiate them from their peers and come out on top. Valero's free cash flow and historical return profile has proven it to be a top tier investment.

Valero Investor Presentation

Valuation - Undervalued

Recently reported Q2 earnings indicated a large YoY decrease in revenue of 33% but this isn't necessarily worrisome because revenue for companies like VLO are all dependent on the current price of fuel. VLO currently holds a valuation of 3.8 times its EV/EBITDA multiple, based on the consensus EBITDA for 2023.

Analysts predict an EPS of 9.27 for 2027. Using this estimate alongside the expected growth rate of 7%, we can see that VLO's fair value per share comes out to $212/share. This represents a huge upside gain of 63% from the recent price of $130/share. This makes VLO a strong buy contender for me as I would love to capture this upside. I started a position around $108/share and plan to buy on any major dips.

Money Chimp

Conclusion

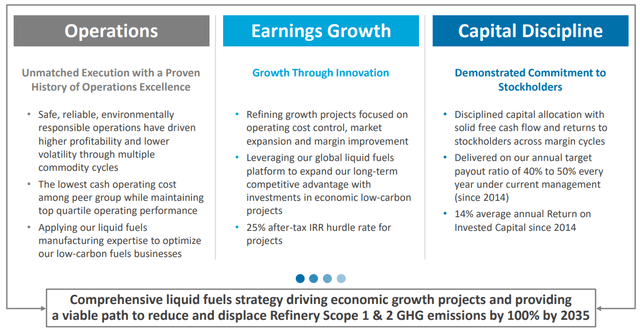

Valero stands as a formidable global refining player across the US, Canada, and the UK. The company's growth prospects shine in both core operations and renewable fuel ventures. VLO strategically leverages midstream assets for fluid product transportation. A commitment to renewable energy is evident through strong annual renewable diesel production and ongoing ethanol projects, aligning with shifting energy landscapes.

The SAF initiative positions VLO for revenue growth and improved margins, harmonizing environmental goals with shareholder benefits. Reinforced by strong financials, cash flows, and a prudent payout ratio, VLO's commitment to dividend growth is evident, even during volatile fuel markets.

VLO's consistent performance and innovation suggest undervaluation, amplified by earnings potential and growth projections. As it capitalizes on renewable trends and strengthens its portfolio, VLO offers a compelling proposition for investors seeking dividend stability and growth potential.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.