China's New Accounting Rules Will Have A Big Impact On Alibaba And Other U.S. Traded Chinese Companies

Summary

- China's updated accounting regulations will classify data resources as intangible assets or inventories, boosting the country's digital economy.

- The inclusion of data assets on balance sheets offers potential benefits, but will also lead to increased scrutiny from investors.

- Alibaba's financial assets may increase significantly overnight, depending on a number of factors.

- Chinese companies listed in the US will need to reconcile the new regulations with GAAP standards, potentially leading to challenges and regulatory interventions.

DNY59

China's push to advance its digital economy is set to receive a significant boost through updated accounting regulations; the Chinese Ministry of Finance on August 21, 2023, released the Interim Provisions on Accounting Treatment of Enterprise Data Resources, which will come into effect on January 1st, 2024. These rules offer a framework for classifying data resources (that is, personal and business data collected online or otherwise for enterprise purposes) and will allow companies to designate them as intangible assets if they meet relevant accounting standards or as inventories when held for sale in business activities.

The new accounting rules stem from the 20th National Congress of the Communist Party of China, that proposed to accelerate the construction of "digital China", the development of the digital economy and to standardize the accounting treatment related to enterprise data resources.

China's strategy to enhance its digital economy includes the establishment of a National Data Bureau, that will coordinate and facilitate data infrastructure development, integration, sharing, and utilization across the nation's economy and society.

It is not clear what type of data will be eligible for inclusion; under the new regulations, when compiling a balance sheet, enterprises will be required to include data resources as part of their inventory, intangible assets and capital expenditures. It is likely that data such as personal and business information, maps, internet behaviors, real time GPS location, spending patterns, financial details, browser cookies, etc. will be recognized as a strategic economic asset and will be reflected in the financial statements of companies.

Pros and Cons

The implications of these new regulations are expected to be huge, in particular for sectors such as computing and telecommunications, cloud services providers, internet retail, streaming services, fintech and social networks.

Recognizing data assets on the balance sheet could present several benefits. It allows companies to demonstrate the value they derive from collecting and analyzing data, offering investors a more comprehensive view of their operations and growth potential and also promote transparency and accountability in data management practices, pushing organizations to adopt better data governance and security measures. Companies will also be able to leverage their data resources to create new revenue streams or even record them as goodwill to increase book value.

However, challenges accompany these potential advantages. Determining the precise value of data assets is intricate, as data's worth often depends on its context, quality and usability. Moreover, the inclusion of personal and sensitive information raises ethical considerations, demanding stringent privacy and security measures to safeguard user data. The recognition of data assets may lead to increased scrutiny from investors, regulators and stakeholders regarding data management practices, usage and compliance with data protection laws. Companies will need to ensure that they maintain data quality and accuracy, as inaccurate or misused data could negatively impact their reputation and financial performance.

How much is data worth?

It is predicted that by 2025 the digital universe of data will grow to 175 Zettabytes (yes, that's a huge number).

The primary motivation behind data collection lies in the intricate interplay between platforms and companies, aimed at optimizing the effectiveness of their advertising endeavors, product development and marketing strategies. This dynamic field encompasses two key applications of personal data:

Direct Advertising: Personal information, ranging from age and preferences to familial dynamics, collected for example by social networks and online retailers, finds its way into the hands of advertisers. This enables companies to precisely target their messages to specific individuals, rather than employing a broad and costly approach. For instance, a first-time mother in her mid-twenties would engage differently with an advertisement directed at expectant women compared to a mother of three in her mid-thirties. Similarly, a young Asian man keen on sneakers and K-pop holds greater value to a streetwear brand than an older European man with interests in mid-century furniture and classical music. By utilizing personal data, advertising is streamlined, reducing waste and heightening both user satisfaction and the effectiveness of advertising campaigns.

Predictive Analytics: A more contemporary approach involves the utilization of extensive personal data sets to identify emerging trends, evaluate market readiness, and fine-tune product messaging. By gathering substantial personal data across numerous individuals within the same demographic, companies can uncover novel market opportunities and interests that might have otherwise gone unnoticed. This affords brands the opportunity to adapt their messages to align with prevailing cultural contexts and to delay product launches until market conditions are more favorable. For instance, a solar panel manufacturer could significantly benefit from comprehending which age groups respond positively to renewable energy-focused messaging versus those that lean toward cost-saving messages.

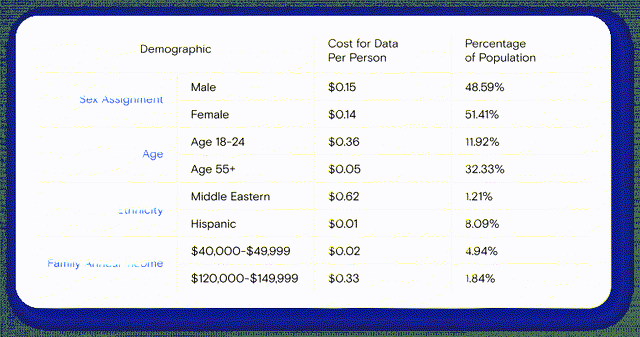

The value of personal data behaves akin to any market, undergoing fluctuations mainly influenced by the principles of supply and demand. Notably, due to a larger number of females globally, male data is typically priced at a slightly elevated level. Similarly, diverse markets and demographics are assessed with distinct valuations. A study conducted in 2020 by data analytics firms MacKeeper and YouGov unveiled that personal data of individuals aged 18–24 commands a notably higher value compared to other age groups. Additionally, businesses exhibit a willingness to allocate substantial resources for personal data from Black and Middle Eastern audiences.

Value of personal data (MacKeeper, YouGov)

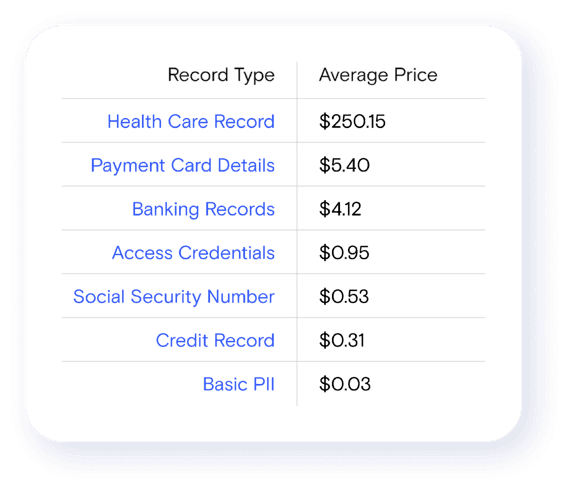

Evaluating the worth of distinct collections of personal and corporate data proves challenging, given the considerable variance in value due to factors like quality, quantity, and use cases. However, a potential estimation of the value of certain data sets can be derived by referencing the prices at which personal data is transacted on the Dark Web:

Dark web prices for personal data (MacKeeper, YouGov)

Using these prices as a gauge, it becomes clear that prominent internet corporations in China, leveraging on the data they hold on their servers or share with other enterprises, could potentially increase the recorded value of their assets by several hundred million dollars.

Alibaba

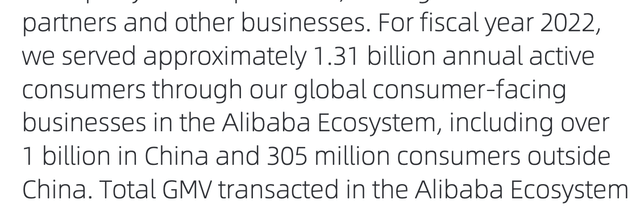

Taking for example Alibaba (BABA), in their 2022 annual report they stated they had served 1.31 billion customers:

Alibaba annual report 2022

Alibaba collects massive amounts of data on its e-commerce marketplaces, through mobile wallet Alipay, and from digital entertainment sites and social media properties operating within its ecosystem.

As a Morgan Stanley analyst noted, Alibaba has laid the foundation to transform itself into “a leading data commerce company that leverages big data and cloud computing to upgrade all of its businesses, ecosystem partners, and customers.”

Using Alibaba's artificial intelligence, real-time data sourced from Chinese consumers can undergo thorough analysis. This data serves a dual purpose: not only does it facilitate customer understanding, but it also enables their categorization, facilitating more pertinent and ongoing consumer interactions. With the China retail marketplaces boasting hundreds of millions of active buyers annually, Alibaba's dynamic data landscape has fundamentally reshaped the approach brands take to marketing.

In light of these applications, how much is Alibaba's data worth?

If we arbitrarily assign a price tag of 3 dollars to the collection of data of each customer (name, age, financial data, health records, browsing and spending habits etc.) that Alibaba retains, elaborates for marketing purposes and ultimately may share (or even sell?) to third parties, with over 1 billion customers we can easily arrive to a value of 3 billion dollars that Alibaba is allowed to record in its books on New Year's Eve 2024 by adopting the new Chinese accounting standards. Is $3 too much? Too little? Who knows, only time will tell.

Which ETFs and Chinese companies listed in the US will be affected?

The implementation of these accounting regulations, effective from January 1, 2024, is poised to exert a significant influence on Chinese equities listed in the United States. In light of this developments, these companies will be tasked with reconciling the newly recognized data assets with the rigorous standards required by GAAP (Generally Accepted Accounting Principles), which underscore the imperatives of financial transparency and uniformity in reporting practices.

A fund that may be broadly impacted by this new rule is the KraneShares CSI China Internet ETF (KWEB) that is comprised mostly of internet related companies; besides Alibaba, its largest holding, it also maintains shares in Tencent Holdings (OTCPK:TCEHY), PDD Holdings (PDD), Baidu (BIDU), NetEase (NTES) and Trip.com (TCOM).

Other companies traded in the US that may be affected are cloud and data services providers Kingsoft Cloud Holdings (KC), Chindata (CD) and GDS Holdings (GDS), social networks Weibo (WB) and Lizhi (LIZI), online music provider Tencent Music Entertainment (TME), online retailer JD.com (JD), fintech company Lufax (LU) and insurance provider Waterdrop (WDH).

Moreover, this new resolution may also impact other Chinese ETFs such as the iShares MSCI China (MCHI), iShares China Large-Cap (FXI) and the X-trackers Harvest CSI 300 China A-Shares (ASHR).

What investors should do?

The ongoing transition presents an opportunity to enrich investors' understanding of a company's assets driven by data and their inherent potential for appreciation. Nevertheless, the intricate task of precisely evaluating and categorizing data resources could present substantial hurdles. Issues might emerge related to data security, governance protocols and potential regulatory interventions by the SEC, which could eventually lead to the delisting of certain Chinese firms from U.S. markets.

Investors in these securities in our opinion should refrain from taking immediate action, opting instead to retain their holdings and remain vigilant of further developments, until there will be a better understanding of how this new accounting standard will be received by both the markets and the authorities.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.