Wells Fargo: Dividend Increase And Buyback Do Go Far

Summary

- Wells Fargo has increased its dividend by nearly 17% and announced a $30 billion buyback program following a successful stress test.

- Wells Fargo's dividend coverage and related metrics mostly compare favorably against its peers.

- Wells Fargo's leadership in the middle-market is attractive.

- Bank stocks may have been beaten down too far, as indicated by Wells Fargo's technicals.

Michael M. Santiago

In my previous coverage on Wells Fargo & Company (NYSE:WFC), I predicted that the company will announce a dividend increase after the then-upcoming stress test. And boy did the company deliver. Not only did Wells Fargo increase the dividend by nearly 17% but also announced a massive $30 billion buyback program, as Seeking Alpha has reported here.

I recently covered JPMorgan Chase & Co.'s (JPM) dividend increase. To help readers compare the two big banks, I am reviewing Wells Fargo's dividend increase using the same format. Let us get into the details.

New Dividend and Yield

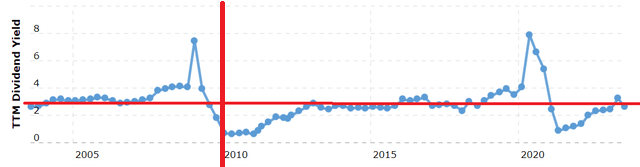

The new annual dividend of $1.40 per share ($.35/quarter) gives Wells Fargo investors a current yield well above 3%. This is higher than JPMorgan's yield by 66 basis points and is in line with Bank of America Corporation's yield (BAC). Wells Fargo has not yielded above 3% (indicated by the red horizontal line) too many times since the financial crisis (indicated by the red vertical line), with the notable exception being the COVID sell-off. The current yield is also 25 basis points above the 5-year average yield.

WFC Yield (Macrotrends.net)

Payout Ratio (Based on Earnings Per Share)

Based on Wells Fargo's forward earnings estimate of about $4.84, the stock has a forward payout ratio of 29%. This is in line with Bank of America and JPMorgan's payout ratios as both are in the mid-to-high 20s as well.

Payout Ratio (Based on Free Cash Flow)

Generally speaking, I've been using Free Cash Flow ("FCF") as my primary metric to evaluate dividend coverage due to the flakiness that can be attributed to EPS. However, let's bear in mind Free Cash Flow is not the best metric to evaluate a bank, which primarily exists to help fund liquidity by lending its cash out. However:

- Total shares outstanding: 3.66 billion

- New annual dividend/share: $1.40/share.

- Annual FCF required to cover dividends: $5.124 billion.

- Wells Fargo's FCF in 2022: $27.052 billion.

- Payout ratio using 2022's FCF: 18.90% (that is, $5.124 billion divided by $27.052 billion). Just like JPMorgan's 11%, Wells Fargo too has a very comfortable payout ratio in this regard.

- Looking at the average quarterly FCF over the last 5 years, Wells Fargo has brought in $2.63 billion/quarter. The average quarterly FCF required to cover the new dividend is $1.28 billion. The payout ratio works out to 48.60% using this metric.

Overall, Wells Fargo's current payout ratio based on FCF is quite strong.

Dividend Growth Rate [DGR]

This is the area where Wells Fargo falls way behind JPMorgan and Bank of America, as the latter two companies have a dividend growth streak close to 10 years at this point. Wells Fargo is now starting this streak from scratch as the company had to cut its dividend by 80% as a result of weak earnings during the pandemic.

Buyback

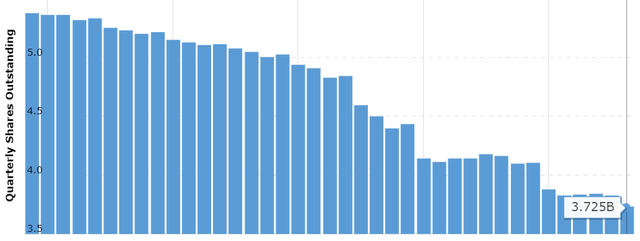

While Wells Fargo is lagging on dividend growth streak, it is not lagging behind on buybacks, as proven by the new $30 billion buyback announcement. Let's see how Wells Fargo compares with JPMorgan in share count reduction over the last few years:

- 11% reduction in the last 3 years (compared to JPM's 8%)

- 22% reduction in the last 5 years (compared to JPM's 16%)

- 30% reduction since 2014 (compared to JPM's 22%)

As I've stated before, meaningful reduction in shares count has double benefit for shareholders of companies that pay dividends. Not only do buybacks enhance EPS, but also save money every single quarter as the retired shares do not demand/expect their quarterly dividend.

WFC Shares Outstanding (Macrotrends.net)

Extrapolation

I am not as comfortable projecting dividends with banks as I am with, say, consumer staples stocks. However, let's assume a paltry 5%/yr increase on average per year over the next 5 years. The yield on cost should go up respectably for someone buying here (~$41), breaching the 4% conservatively.

| Year | New Annual Div/Share | Yield on Cost |

| 2023 | $1.30 | 3.17% |

| 2024 | $1.37 | 3.33% |

| 2025 | $1.43 | 3.50% |

| 2026 | $1.50 | 3.67% |

| 2027 | $1.58 | 3.85% |

| 2028 | $1.66 | 4.05% |

Outlook & Conclusion

Despite the recent weakness in bank stocks, Wells Fargo's dividend increase is backed up by its financial strengths as shown above. Although this article is about WFC's dividend, let's take a quick look at the company and stock's outlook.

- Growth Initiatives: Wells Fargo has initiated many steps to further its business, including focused home lending aimed at minority communities and furthering its digital transformation. The company is already the leader in the middle-market (annual sales of $10 million to $500 million) and now has 130 middle-market banking offices in the U.S. These businesses are the lifeline of the American dream and the American economy as tomorrow's businesses take shape today, thanks to careful lending.

- Stress Test: Like most of the big banks, Wells Fargo did fairly well on the recent stress test as Seeking Alpha has covered here. The company's stress capital buffer is expected to be dropped to 2.90% from the previous 3.20%, showing confidence in the bank's liquidity.

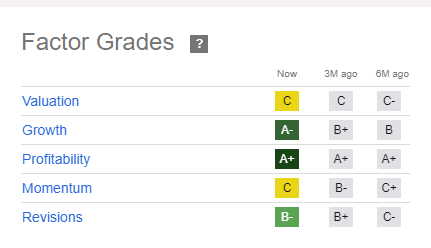

- Valuation: At a forward multiple of 8, WFC stock is trading around the same valuation as Bank of America but is cheaper than JPMorgan's stock. It is not a surprise that Seeking Alpha's quant ratings provides the same grade, C, for WFC and BAC's valuations while JPM gets a slightly lower D+. Finally, at ~$41, WFC stock is trading at less than its book value.

WFC Rating (Seekingalpha.com)

- Price Target: Analysts have a median price of $52, which is about 27% higher than the current price. Including the 3% yield, that would represent a satisfactory (to me) return of 30% from here. This is more than double JPMorgan's potential returns as mentioned in that article.

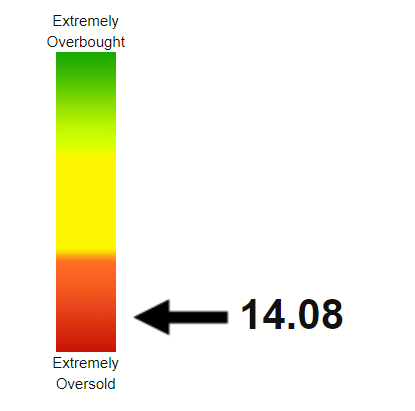

- Technical Strength: From a technical perspective, Wells Fargo's stock has a Relative Strength Index ("RSI") of 14, which is one of the lowest readings I recall seeing on a big-name company. I believe this is more reflective of the recent bearishness on bank stocks in general than anything specific to Wells Fargo.

WFC RSI (Stockrsi.com)

- Risks: The biggest risk for bank stocks in my opinion is Federal Reserve policies. Generally speaking, banks tend to do well when rates are higher as the impact of spread between what a bank pays as interest (say, savings account) and what it charges as interest (say, mortgage) is more pronounced. But the flip side is that not many individuals or businesses will be able to afford such high interest rates, affecting banks' overall ability to lend. In addition, I'd also be wary of the company's dividend cut history, as it happened in 2009 as well.

To conclude, I remain long Wells Fargo shares and will be looking forward to adding more should the stock break below the $40 level. But I acknowledge that this is not my typical dividend growth stock and dividend cuts may be part of the journey as banks generally bear the brunt of a recession while also enjoying a boom.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)