Destination XL Group: Pressure On Margins Continues

Summary

- The company's revenue decreased by 3.2% YoY, while operating margin reached 13.9% in Q2.

- The decrease in the average ticket due to macro headwinds continues to have a negative impact on revenue growth.

- I believe that operating margin will continue to be under pressure due to increased marketing spending and investment in prices.

FG Trade/E+ via Getty Images

Introduction

Shares of Destination XL Group (NASDAQ:DXLG) have fallen 35% YTD. Since my last article, where I talked about how it is still not the best time to buy shares of the company, quotes have decreased by 13%, while the S&P 500 index has shown growth of 1.6%. In my article, I would like to update my opinion about the company's shares.

Investment thesis

Despite the fact that in my previous article I said that I was ready to change my recommendation to buy if the company continues to show strong financial results, for now I would like to maintain my opinion. Firstly, the average check in the chain's stores is still under pressure due to macro headwinds. Also, I do not expect a quick recovery in consumer clothing spending in the second half of 2023 if inflation slows as consumers continue to face higher daily spending. Secondly, I expect profit margins to continue to be under pressure due to increased marketing spending and no plans to raise prices for the company's products. Thirdly, at the moment I do not see a fundamental potential for the growth of prices in accordance with my assessment.

Company overview

Destination XL Group specializes in clothing for large and tall men. The main sales channel is the retail segment. According to the results of the 2nd quarter of 2023, the company operates 281 stores. The company operates in the US market.

2Q 2023 Earnings Review

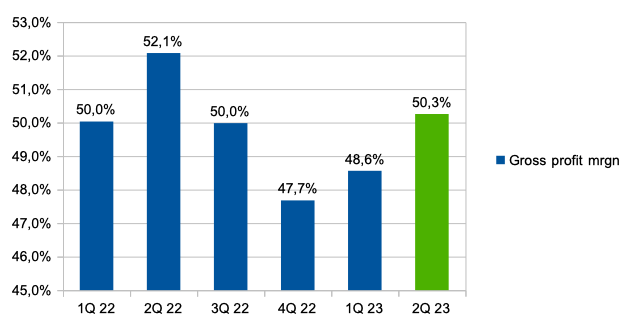

The company reported results better than investors expected. The company's revenue decreased by 3.2% YoY due to a decrease in comparable sales by 1.4% YoY, where the main negative factor is the decrease in the average ticket. Gross profit margin decreased from 52.1% in Q2 2022 to 50.3% in Q2 2023 due to investment in prices, higher rental costs and higher shipping costs.

Gross profit margin (Company's information)

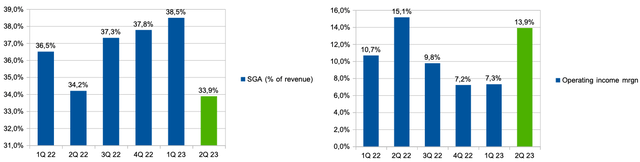

SGA spending (% of revenue) decreased from 34.2% in Q2 2022 to 33.9% in Q2 2023 due to lower marketing spend. Thus, operating margin decreased from 15.1% in Q2 2022 to 13.9% in Q2 2023.

Op. expenses (% of revenue) & op. margin (Company's information)

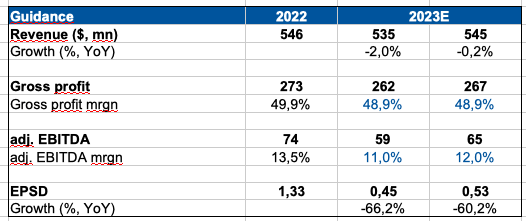

In addition, the company provided guidance for the rest of 2023. Thus, management expects the company's revenue to be $535 - $545 million, which implies a decrease in revenue by 2-0.2% compared to 2022. However, if we look at expectations from the second half of 2023, we can see that management expects revenue growth in the range of -1.5% to +2.2%, which, in my personal opinion, looks positive. You can see the details in the chart below.

Guidance 2023 (Company's information)

My expectations

On the one hand, I like the company's plans to increase revenue growth, increase market share (opening new stores, increasing advertising activity and launch of sales of new brands such as Faherty and Hugo Boss) and normalizing inventory. As I wrote in the previous section of my article, based on the guidance of the company, we can conclude that the company can return to positive revenue growth in the second half of 2023.

However, on the other hand, as an investor, I would like to draw attention to the fact that an increase in growth rates will be associated with increased marketing costs in the following periods, which may have a negative impact on the operating profitability of the business.

Our plan is to increase our advertising-to-sales ratio over the next few years. We expect over the next few years to invest more in brand building and top-of-funnel marketing to grow our customer file.

In addition, the company still does not plan to pass on the increased inflation rate to the end consumer in order to maintain traffic in the chain's stores. While this approach allows you to maintain positive traffic trends and consumer loyalty, I believe that this factor can have an additional negative impact on the profitability of the business. Thus, I expect that despite a possible recovery in growth rates, we may see a decrease in net income in the following quarters.

We believe that over the next three to five years, we can scale and grow the top line in low double digits and take market share profitably, but it is unlikely to be at the greater than 10% adjusted EBITDA margins that we have enjoyed over the past two years.

Valuation

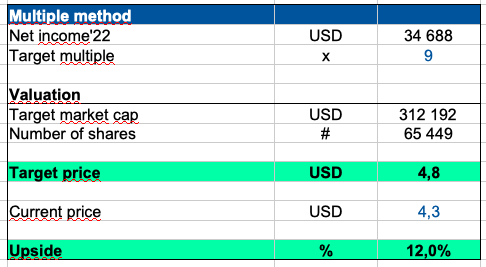

I prefer to value a company using a multiple because valuation using the DCF model is too sensitive to input data. For example, I use a P/E multiple of 9x for valuation, which implies a discount of about 40% to the sector median due to weak revenue growth and business size. The net income forecast is based on the company's guidance. So, according to my estimate, the fair share price is about $4.8 with an upside potential of 12%. At the moment, I believe that the current upside does not match the risks that come with investing in the company's shares.

Valuation (Personal calculations)

Risks

Revenue: decreasing consumer spending on clothing, an ineffective marketing campaign, declining in-store traffic and increased competition could lead to lower revenue growth for the business.

Margin: investing in pricing, additional investment in marketing, and reduced economies of scale can put pressure on a business's operating margins.

Conclusion

I believe that investors should wait for the results for the next quarters before making a purchase decision. Despite the first signs of a normalization in revenue growth, I expect operating margins to continue to be under pressure, which could put pressure on the company's quotes. Thus, I would like to maintain my hold recommendation on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.