Manufactured Housing: The Sun Will Rise Again

Summary

- Following nine straight years of outperformance over the REIT Index, Manufactured Housing REITs have uncharacteristically stumbled over the past year, pressured in the direct and secondary effects of higher interest rates.

- Interest rate-related risks have been compounded by concerns over "climate risk" exposure and the effects of a post-COVID demand normalization in the recreational vehicle and marina business segments.

- Domestically, fundamentals within these REITs' core manufactured housing segment are as strong as ever. Propelled by COLA effects, rent growth has accelerated this year even as broader residential rents have moderated.

- For Sun, an ill-timed international expansion into the UK last year has proven to be a rare strategic blunder for one of the best-managed REITs of the prior decade. While only representing about 10% of its NOI, Sun whiffed badly on its forecasts for UK profitability.

- Sun receives little credit for its outperforming marina business, which is twice as large as its UK segment. Sun trades with a Price-to-FFO multiple that is 40% below its five-year average - among the widest in the REIT sector - a discount that is far deeper than fundamentally warranted.

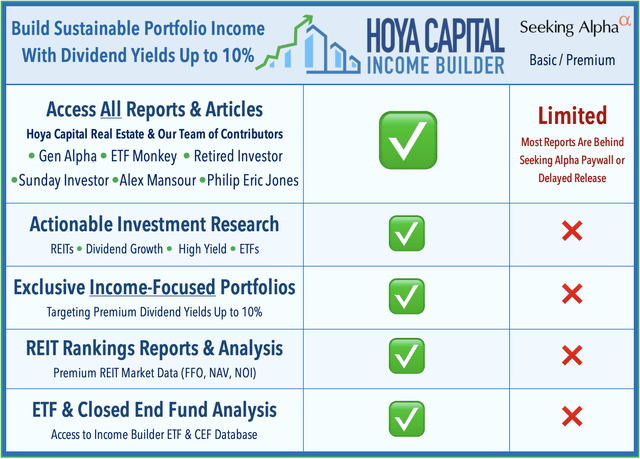

- Hoya Capital Income Builder members get exclusive access to our real-world portfolio. See all our investments here »

JamesBrey

REIT Rankings: Manufactured Housing

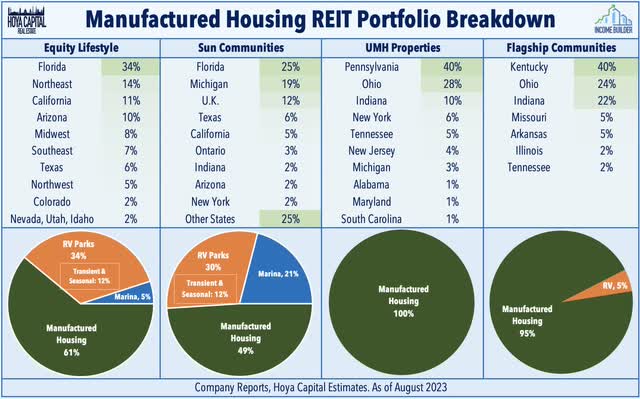

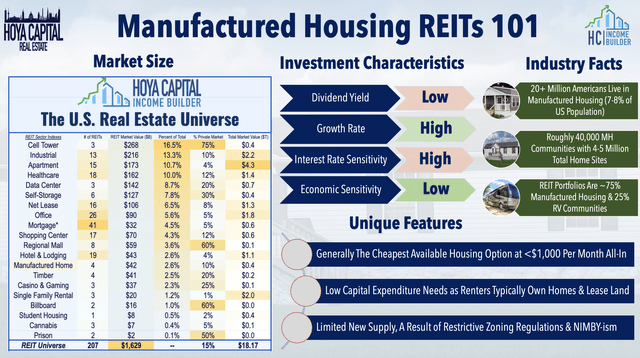

Manufactured Housing REITs ("MH REITs") have emerged over the past decade from relative obscurity into several of the largest and most well-run REITs, but have uncharacteristically struggled since mid-2022 despite the impressive performance within the core MH business, as the effects of surging interest rates have created direct and secondary headwinds across these REITs' ancillary business segments. Within the Hoya Capital Manufactured Housing Index, we track the three U.S.-listed MH REITs, which own nearly 400k MH and RV sites and account for roughly $30B in market value: Equity LifeStyle (ELS), Sun Communities (NYSE:SUI), and UMH Properties (UMH). We also track small-cap Flagship Communities, which trades on the Toronto Stock exchange and owns MH communities in the U.S. Midwest.

Manufactured housing REITs have historically been viewed as one of the most "recession-resistant" property sectors given the countercyclical demand trends of manufactured housing demand, which is generally the cheapest housing option available in the United States. SUI and ELS have both made a push into more pro-cyclical analogous asset classes – RVs and marinas – that have offset some of these effects perhaps at the expense of higher risk related to major storm events, but all of these sub-sectors benefit from a similar fundamental backdrop of limited supply and relatively high barriers to entry. RV parks now comprise roughly a third of assets for ELS and SUI, while marinas comprise 5% and 20%, respectively. UMH and MHC focus almost exclusively on traditional manufactured housing communities.

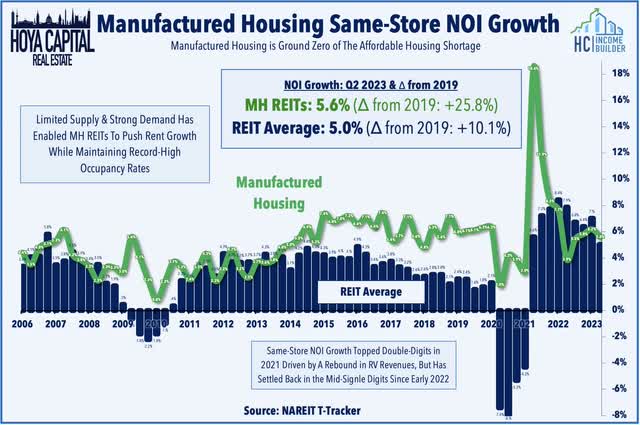

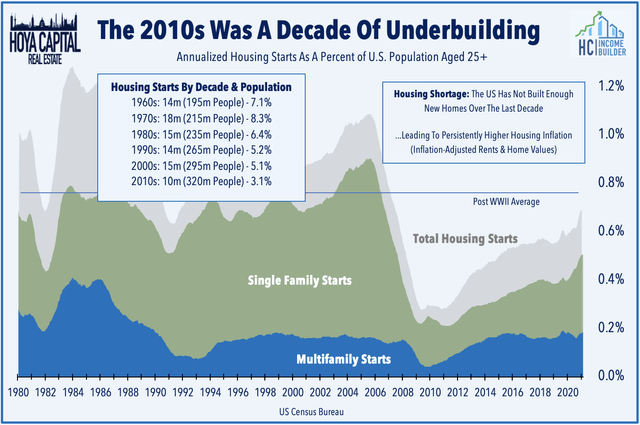

Beneficiaries of the intensifying affordable housing shortage across the United States resulting from a decade of underbuilding, manufactured housing REITs were the single-best performing REIT sector during the 2010s, delivering a record-setting streak of nine-straight years of outperformance over the Equity REIT Index from 2013 through 2021. MH REITs had been the "canary in the coal mine" of the intensifying housing shortage for the past decade, producing the strongest - and most consistent - cumulative same-store NOI growth since 2015. Despite this enviable growth profile, we've long discussed how MH REITs are among the most interest-rate-sensitive REIT sectors - an interest rate correlation that we believe isn't entirely warranted, but one that has nevertheless resulted in sluggish stock price performance since the Federal Reserve began their historically-aggressive rate hiking cycle in mid-2022.

Manufactured Housing REIT Fundamentals

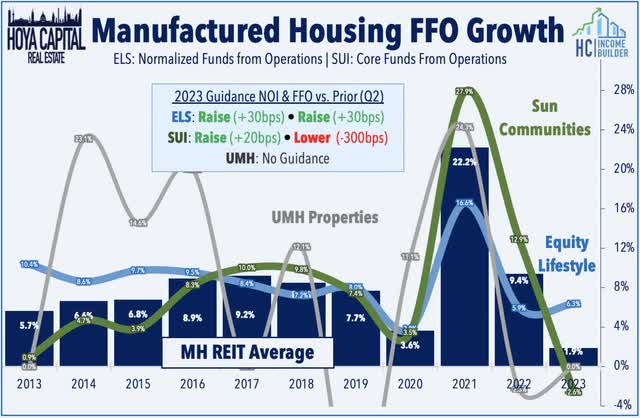

As discussed in our REIT Earnings Recap, MH REITs are pacing for a second-straight year of underperformance, but property-level fundamentals in the core manufactured housing segment are certainly not to blame. Sun Communities - the best-performing REITs in the 2010s - appears to have made an operational misstep with its push into the European market, a segment that has posted disappointing performance since its UK acquisition in mid-2022. SUI lowered its full-year FFO outlook as upward guidance boosts to its core manufactured housing and marina outlook were more than offset by a significant downward revision to its UK Home Sales NOI forecast. Following the downward revision, SUI now expects to report negative FFO growth this year for the first time in over a decade. Equity LifeStyle, however, raised its full-year FFO and NOI guidance, "driven by continued strength in annual revenue and reduced expenses throughout our portfolio." ELS was given an added boost by its inclusion in the S&P 400 Index, replacing Life Storage.

Expense pressures related to the immediate effects of recent weather events - along with the longer-term effects related to potential climate change - have also been a focus in recent quarters. Hurricane Ian - Florida's deadliest storm in nearly a century - resulted in a roughly 1% hit to revenues last year for ELS and SUI, but expense pressures from higher insurance premiums will remain a modest headwind in coming years. ELS had five properties that suffered significant flooding and wind-related damage which included three RV properties near Fort Myers - Gulf Air RV, Fort Myers Beach RV, and Pine Island RV - and two marinas in the area. SUI incurred more muted impacts, noting that three RV properties in the Fort Myers area, comprising approximately 2,500 sites sustained significant flooding and wind damage and one marina property suffered damage to the sea wall and docks. Both REITs reported that insurance has covered most or all storm-related charges, but each have seen annual insurance premiums rise by double-digit percentages this year.

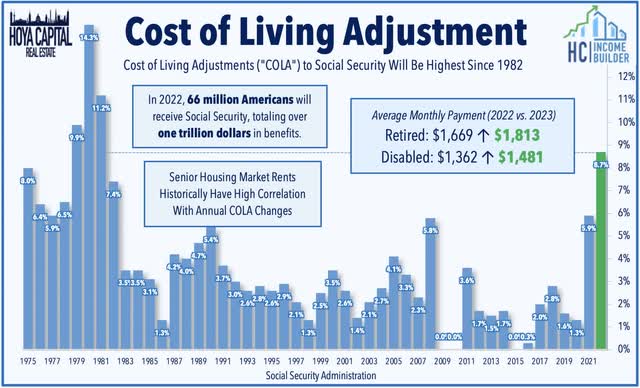

As expected, rent growth in these REITs' core manufactured housing segments has actually accelerated this year even as broader residential rents have moderated. We've theorized that these REITs' inflation-hedging potential is underappreciated by the market as MH rents are more closely linked with the CPI Index than any other residential sector. This CPI linkage comes in two forms – indirectly through the positive wage effects of the Social Security Cost of Living adjustments which affect a significant percentage of residents – and directly through the direct CPI linkage on MH site leases that are longer than the typical one-year term. While the majority of leases are determined by market rate adjustments on an annual basis, a direct CPI linkage affects approximately 10% of MH sites owned by ELS and SUI - primarily those in Florida and California due to state rent control statutes. The multi-decade highs on the CPI Index seen last year - and persistence in the headline CPI metric thus far in 2023 - effectively "unlock" embedded rent growth on below-market leases that were capped under the previous economic regime of low inflation and have begun to "catch-up" with market rents.

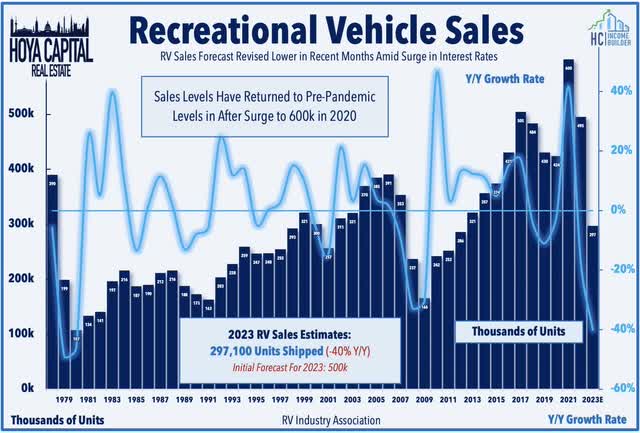

While COLA increases have helped to drive record-high rent growth across the MH portfolio, the RV segment has been a recent issue for both SUI and ELS after several years of stellar performance. The pandemic-era surge in transient RV usage has moderated over the past two years - a trend that's particularly visible in new RV sales which are now expected to be 50% below pandemic-era peaks this year per the RVIA - but showed signs of stabilization in Q2 as gas prices moderated. Both Sun and ELS have successfully transitioned the majority (>75%) of their RV business into annual membership, and thus RV revenues have remained "sticky" through short-term utilization cycles with mid-single-digit same-store growth. The transient & seasonal RV segment (~10% of total NOI) - which have been a key source of disappointment in recent quarters - will have easier comps beginning next quarter. Sun notes that transient RV site conversions to annual leases have historically increased revenue per site by 40-60% for the first full year after conversion.

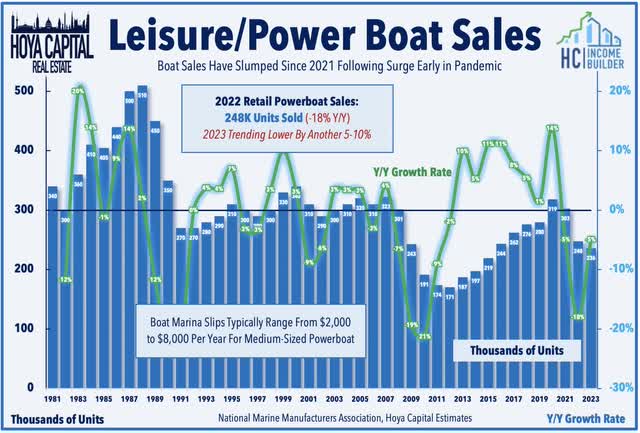

Recreational boat sales also accelerated significantly during the pandemic, but have similarly exhibited a post-pandemic moderation in recent years with sales expected to return to pre-pandemic levels this year. The recreational boating industry - which includes MarineMax (HZO), Malibu (MBUU), MasterCraft Boat (MCFT) and Brunswick Corporation (BC) delivered record sales volume and profitability in 2021 and into early 2022, but the combination of higher interest rates, higher fuel prices, and less time spent at home has put downward pressure on leisure boat usage and sales over the past eighteen months. With SUI's major investment in Safe Harbor Marinas, these MH REITs are now the two largest owners of marinas in the country. Institutional-quality marinas - of which there are roughly 500 across the U.S. - have substantial operating parallels to the company's RV business. Marinas now comprise about 20% of SUI's annual net operating income and comprise roughly 5% of ELS's annual NOI.

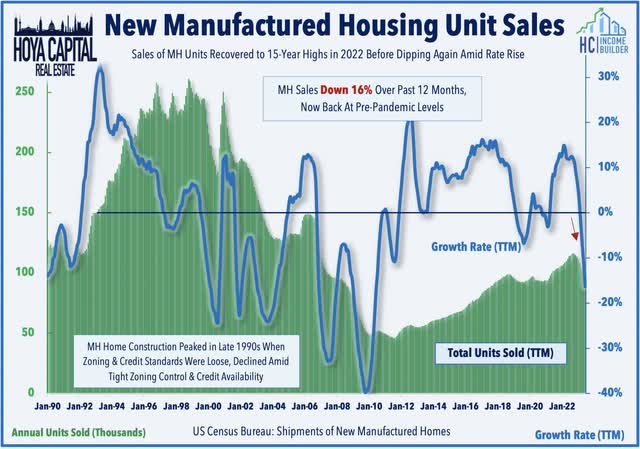

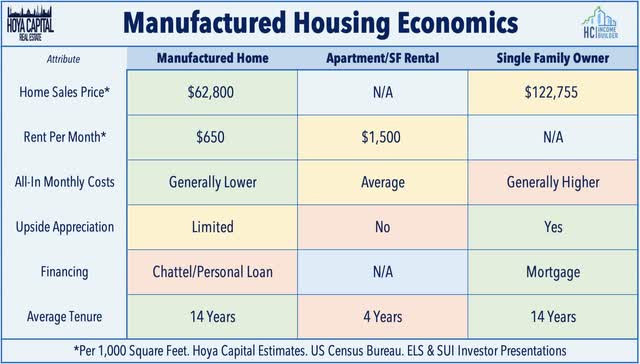

Sales of new manufactured housing units have also exhibited similar trends as RV and boat sales in recent years. New MH unit sales eclipsed 100k units in a twelve-month period for the first time in 14 years last year - driven largely by site expansions of existing MH REIT parks - but have dipped substantially over the past three quarters, returning to pre-pandemic levels. Interestingly, MH sales peaked in the late 1990s when zoning and credit standards were loose but declined sharply beginning in the early 2000s during the pre-GFC housing boom as demand shifted to site-built homes. Due to their relatively low construction costs and lack of land ownership, MH units are typically the most affordable non-subsidized housing option in most markets. The MH resident base tends to be incredibly "sticky", as the average MH owner stays in a community for 14 years, far higher than the roughly 4-6 year average for single-family rental homes and 2-4 year average for apartment homes.

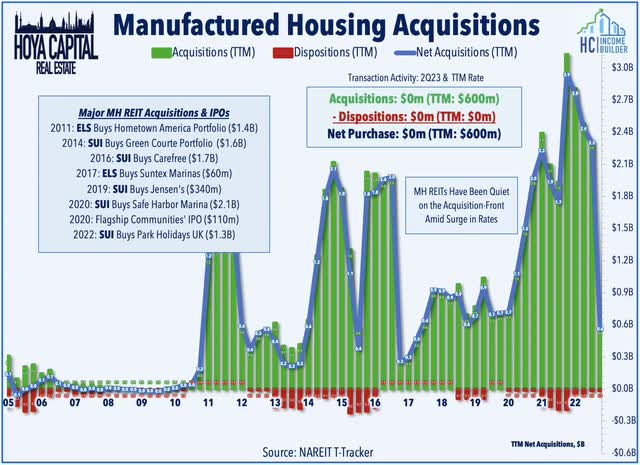

Higher interest rates have also temporarily neutralized another key driver of FFO growth fueling the incredible run of performance in the 2010s - external acquisitions. Per the latest NAREIT data, MH REITs recorded zero acquisitions in Q2 - the first time that all three REITs were "shutout" since 2011. ELS provided more color on the sluggish M&A environment, commenting: "Deal flow is down across the industry. We really haven't seen many deals of interest right now. The owners of MH and RV are not distressed sellers; they have the flexibility to take more time with a potential sale or take an asset off the market entirely. And that's kind of what we're seeing over the last few months. I think it takes a few more months for that acquisition activity to return."

MH REIT Stock Price Performance

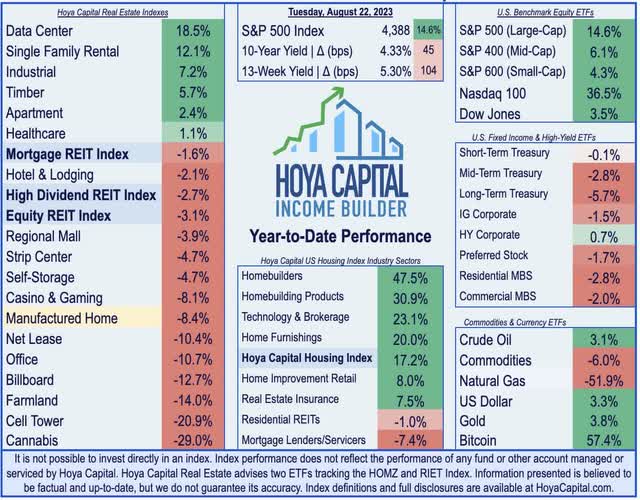

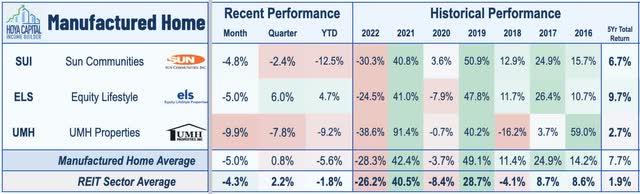

The Hoya Capital Manufactured Housing Index has declined by roughly 8% this year - underperforming the broad-based Equity REIT Index, which has posted year-to-date declines of roughly 3%. MH REITs declined 28% last year compared to the 25% decline on the broader All Equity REIT Index - snapping a nearly decade-long streak of outperformance over the broader benchmark. Notably, both major MH REITs are now trading below their pre-pandemic levels seen in late 2019 despite delivering cumulative FFO growth of nearly 35% and cumulative NOI growth of over 25% during this time.

Equity Lifestyle has held-up better than its peers with positive returns of 4.7% this year, while Sun Communities has declined by 12.5% and UMH Properties has dipped 9%. Longer-term performance remains highly impressive despite the recent stumbles. Over the past five years, MH REITs have delivered average annual returns of 7.7% - triple the broader REIT average of 1.9% during that period. Notably, SUI is still the top-performing REIT since 2005 while its peer ELS is not far behind.

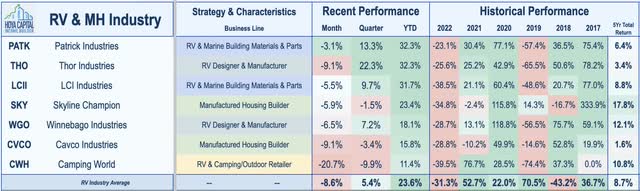

The non-REIT players in the manufactured housing and RV industry have performed substantially better this year, however, led by RV manufacturer Thor Industries (THO) and marine parts dealers Patrick Industries (PATK) and LCI Industries (LCII) which have each rallied more than 30%. Both major manufactured housing builders - Skyline Champion (SKY) and Cavco Industries (CVCO) - have also gained over 15% this year, as has RV builder Winnebago Industries (WGO). For these non-REIT players, the rebound this year comes after punishing declines of over 30% last year and mirrors the performance trends observed across the single-family homebuilding industry.

Deeper Dive: Inside Manufactured Housing

Roughly one-in-twelve Americans live in a factory-built manufactured home, and shipments of these units represent roughly 10% of housing starts in a typical year. MH REITs comprise 2% of the "Core" REIT ETFs and also represent 4% of the Hoya Capital US Housing Index, the benchmark that tracks the performance of the US housing industry. These REITs generally own communities in the higher tiers of the quality spectrum and are more "retiree-oriented" than the average MH community. The quality and appearance of MH parks can vary significantly from communities that are nearly indistinguishable from a typical single-family master-planned community to the stereotypical "trailer parks." Often misunderstood by investors, manufactured homes are generally not "mobile" (except for recreational vehicles "RVs") as about 80% of MH units remain where they were initially installed, and while units are generally built to higher-quality standards than commonly believed, the JCHS report noted the MH homes were among those most "in need of repair."

For residents, the economics of manufactured housing takes on the qualities of both renter and homeowner. Residents generally own their home but lease the land underneath it, paying an average of $70k for a new 1,500-square foot prefabricated home. The average monthly lease to set their home on a site and hook up to utilities in MH or RV community can range from $300 to $1,000 per month. By foregoing the investment in the land, however, property appreciation is generally minimal, and as a result, MH homeowners in land-lease communities generally cannot finance MH or RV purchases with traditional mortgages, and as with RVs, owners must finance the acquisition with a personal property (chattel) loan at a higher interest rate.

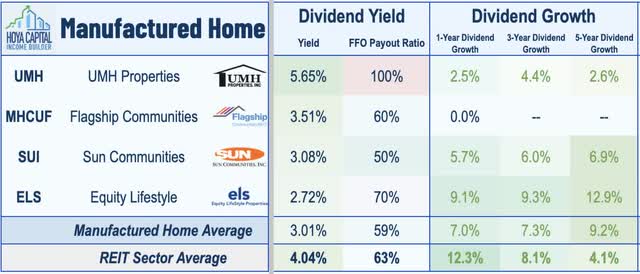

Manufactured Housing REIT Dividend Yields

Manufactured Housing REITs pay an average dividend yield of 2.9%, ranking toward the bottom of the REIT sector and below the market-cap-weighted average of 3.9%. MH REITs, however, have delivered one of the strongest rates of dividend growth over the last five years. ELS and SUI are two of only a dozen REITs that raised their dividends in 2020, 2021, and 2022. MH REITs pay out just 59% of their available cash flow, implying strong potential for future dividend growth and more free cash flow to fund external growth.

Among the four MH REITs, UMH pays the highest dividend yield in the sector at 5.65% but went nearly two decades with zero dividend growth before finally raising its distribution for the first time since 2008 last year. SUI pays a dividend yield of 3.08%, while ELS pays a dividend yield of 2.72%. ELS has delivered average annual dividend growth of 12.9% over the last five years, among the best in the REIT sector, while SUI has taken a more growth-oriented approach with a lower payout ratio, achieving five-year dividend growth of 6.9%. Overall, MH REITs have delivered average annual dividend growth of over 9%, which is more the double the REIT sector average.

Takeaways: High-Conviction Positive Outlook

Following nine-straight years of outperformance over the REIT Index, Manufactured Housing REITs have uncharacteristically stumbled over the past year, pressured primarily by direct and secondary effects of higher interest rates. Interest rate-related risks have been compounded by concerns over "climate risk" exposure and the effects of a post-COVID demand normalization in the recreational vehicle and marina business segments. Domestically, fundamentals within these REITs' core manufactured housing segment are as strong as ever. Propelled by COLA-effects, rent growth has accelerated this year even as broader residential rents have moderated. Longer-term MH REIT fundamentals remain compelling given the lack of supply growth, persistent barriers to entry for new development, and a lingering unmet need for affordable housing, and we reiterate our high-conviction positive outlook.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SUI, ELS, UMH, RIET, HOMZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)