PG&E's Financial Conundrum: Navigating Investment, Capital Expenditure, And Debt

Summary

- PG&E plans to invest $53 billion from 2022 to 2026 in renewable energy and modern infrastructure.

- The company's extensive investment needs come with financial risks and regulatory complexities that could strain its cash flows.

- PG&E's high debt levels and pension commitments pose challenges to its financial flexibility and credit ratings.

Justin Sullivan

In the utilities sector, PG&E Corporation (NYSE:PCG) stands out as a leading figure. Renowned for their dedication to renewable energy and addressing climate change, they have set ambitious targets. However, they are also navigating significant financial challenges.

A Deep Dive into Investment Requirements and Capital Expenditure

The company's foray into renewable energy and contemporary infrastructure is more than just a business decision; it is a result of changing market dynamics and customer expectations. Their planned capital expenditure, a whopping $53 billion from 2022 to 2026, underlines this imperative.

This figure represents the company's commitment to greener solutions and is a testament to its proactive approach to a transforming energy universe. However, it's worth noting that such extensive investment needs come with a set of risks. High capital expenditures often tie up significant funds that might otherwise be used for debt reduction, dividend payments, and share repurchases. In a volatile market, this can expose companies to unprecedented financial vulnerabilities.

Moreover, PG&E's significant capital commitments are intricately woven into a tapestry of regulatory complexities. Regulatory bodies pose a unique challenge to utility providers. For PG&E, these would create timing discrepancies, particularly when accounting for expenses and adjusting revenue metrics. Such mismatches can strain the company's cash flows, challenging its ability to finance its ambitious investment plans seamlessly.

PG&E also reaffirmed that it would not issue new equity in 2023 or 2024. Thus, I would expect that PG&E needs to sell more assets and take on much more debt financing for its planned capital expenditures.

The Debt Mountain: A Looming Challenge

For any corporation, debt is a double-edged sword. On the one hand, it can provide the necessary capital to fund growth initiatives. On the other hand, excessive debt can restrict a company's financial flexibility and expose it to potential solvency issues.

PG&E's debt situation is concerning. With a commitment to offset a mere $2 billion of parent debt by 2026, the company's approach seems a tad inadequate, especially when viewed against its staggering consolidated net debt of nearly $55 billion. The implications of this debt are multifaceted:

1. Interest Expenses: With a high debt load come significant interest obligations. PG&E's EBIT/Interest Expense ratio of 1x tells investors that the company's operating earnings just about cover its interest expenses, leaving little room for unforeseen operational challenges.

2. Financial Flexibility: Excessive debt can hamper a company's ability to invest in growth opportunities or pivot its business strategy in response to changing market dynamics. With PG&E's substantial commitments to renewable energy integration, this limited financial flexibility could be a significant hindrance.

3. Credit Ratings and Borrowing Costs: High debt levels can lead to lower credit ratings. This, in turn, can increase borrowing costs for the company, further leveraging its balance sheet and straining its cash flow.

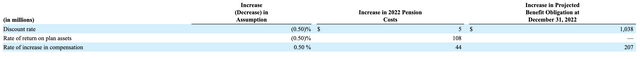

Amid these financial intricacies, PG&E's pension commitments showcase the company's vulnerability to seemingly small percentage changes. A mere 0.5% reduction in the discount rate can elevate the 2022 pension costs by $5 million. More alarmingly, this adjustment could swell the projected benefit obligation by an astonishing $1.038 billion by year-end.

This sensitivity underscores the fragile nature of PG&E's financial landscape. While on the surface, a 0.5% change might seem trivial, its ripple effect on the company's obligations is significant, emphasizing the critical need for meticulous financial management.

Valuation: A Double-Edged Sword

PG&E's market valuation, as it stands, might seem inflated, especially when juxtaposed against its financial challenges. A valuation of more than 30x EV/EBIT is on the higher side, nearing its highest level of 37.4x in 2016.

High valuations, while often a sign of market confidence, can also signal overvaluation. Furthermore, if PG&E fails to meet market expectations, a high valuation poses a risk of significant stock price corrections.

Key Takeaway

The company's trajectory toward renewable energy integration, infrastructural rejuvenation, and stakeholder commitment will require a delicate balance. As PG&E forges ahead, its ability to manage its high investment requirements, navigate its considerable capital expenditures, address its looming debt concerns, and justify its high valuation will be the true test of its resilience and foresight in the utility landscape

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.