2020 Bulkers: A Call Option On The Bulk Charter Rates

Summary

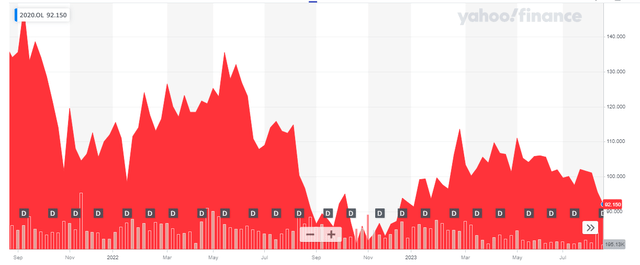

- 2020 Bulkers' share price has dropped 33% since September 2021 due to falling bulk charter rates.

- Despite the share price decrease, the company has remained a solid dividend payer, with total dividend payments since September 2021 making up for the decrease.

- The company's fleet of eight Newcastlemax vessels, which are relatively new, and its balance sheet flexibility make it an interesting investment opportunity.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

HuyNguyenSG/iStock Editorial via Getty Images

Introduction

As it has been almost two years since I first discussed 2020 Bulkers (OTCPK:TTBKF), an update is definitely overdue. Back in 2021 I liked the company's young fleet and very straightforward dividend policy which was targeting superior dividend payouts after servicing the debt payments. As the bulk charter rates have come down, 2020 Bulkers' share price was hit as well and the stock is currently trading 33% lower than where it was trading at in September 2021.

I would strongly recommend to trade in 2020 Bulkers' shares through the facilities of the Oslo Stock Exchange where the company is trading with 2020 as its (easily recognizable) ticker symbol. There are currently 22.6M shares outstanding and at 92 NOK per share the market cap is approximately 2.1B NOK. That's around $200M using the current exchange rate.

Bulk charter rates have come down

And while the share price has lost about a third of its value since my article was published in September 2021, let's not forget 2020 Bulkers has been a solid dividend payer. The total dividend payments since September 2021 come in at $3.21 and almost entirely make up for the share price decrease.

But of course, as the charter rates for bulk carriers have fallen pretty substantially and the YTD dividend payment is just $0.27 per share. That's just under 3 NOK per share.

The company still has a fleet of eight Newcastlemax type vessels and these are relatively new vessels (four were delivered in 2019 and the remaining four were delivered in 2020) and every vessel has a capacity of 208,000 dwt. The average time charter equivalent earnings came in at just $23,800 per day (on a gross basis) during the second quarter and it looks like the third quarter may be slightly worse than the Q2 result as 2020 Bulkers confirmed its July charter rates came in at $21,200/day.

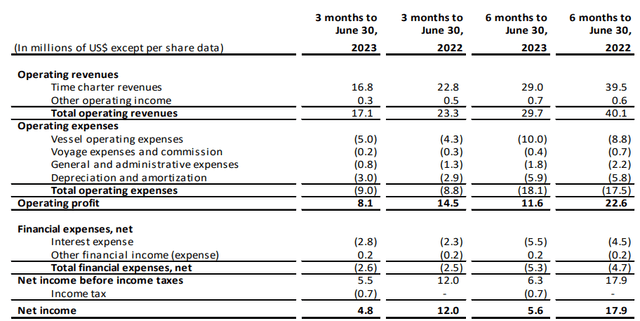

The total revenue in the second quarter was approximately $17.1M (the company uses the US dollar as base currency for its financial reporting) and the total operating expenses came in at $9M. This includes $3M in quarterly depreciation and amortization expenses.

2020 Bulkers Investor Relations

As you can see in the income statement above, the company definitely remained profitable and the Q2 net income of $4.8M was substantially higher than the $5.6M recorded in the first quarter of the year when the average charter rates dipped below $20,000 per day.

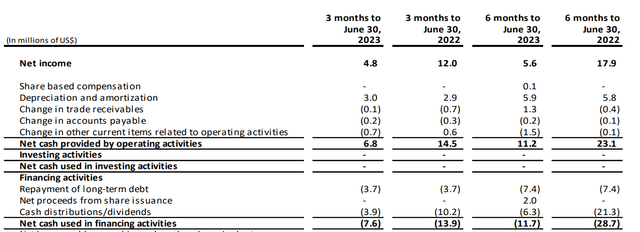

The reported net incoming free cash flow was obviously quite a bit higher as there are no investments needed for the fleet. As you can see below, the operating cash flow was $6.8M during the second quarter and this includes about $1M in working capital investments.

2020 Bulkers Investor Relations

The adjusted operating (and free) cash flow was $7.8M and 2020 Bulkers used $3.7M to repay debt.

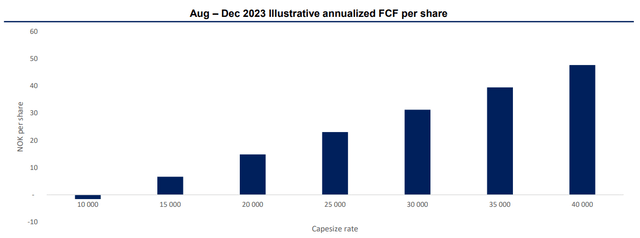

2020 Bulkers also provided a sensitivity analysis outlining the impact of higher charter rates on the free cash flow result per share. As you can see below, a capesize-based charter rate of $25,000 per day would result in a free cash flow of in excess of 20 NOK per share which would indicate the company is trading at 5 times free cash flow. However, at a charter rate of $20,000 per day, the free cash flow per share will be stuck in the mid-teen range.

2020 Bulkers Investor Relations

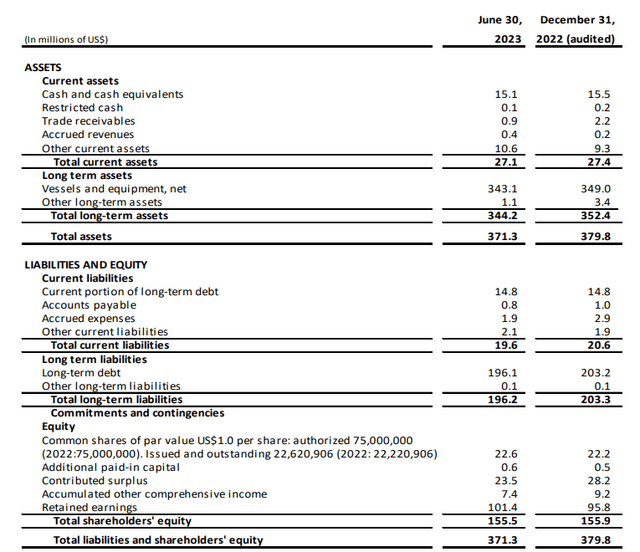

Balance sheet flexibility

As of the end of June, the company had about $15M in cash and about $211M in financial debt for a net debt level of around $196M. As 2020 Bulkers continues to repay the debt at a pace of $15M per year, I don't see any balance sheet issues.

2020 Bulkers Investor Relations

And while a net debt level of almost $200M sounds pretty high considering the book value of the vessels is just $343M, I think the fair value of the Newcastlemax vessels is higher than the book value.

I couldn't immediately find newbuilt and second hand prices for Newcastlemax vessels, but earlier this summer, a 2016 built Newcastlemax was sold for $46.5M. That vessel was a few years older than 2020 Bulkers' fleet, so I think it would be acceptable to use a pro forma value of $50M per vessel and a fair value of approximately $400M. This means the loan to vessel value ratio is less than 50% and that's quite acceptable considering the company is repaying debt on a quarterly basis.

This also means the shareholder equity is likely closer to $200M instead of $155M and using a $200M equity value would result in a book value of $8.85 or around 94 NOK per share.

Investment thesis

This means 2020 Bulkers is currently reasonably priced. The company is still profitable and cash flowing and is trading at a level close to its estimated fair value. That makes 2020 Bulkers a very interesting vehicle to speculate on increasing bulk charter rates (and the world economy).

I don't think Q3 will be strong as the charter rates will be lower on a QoQ basis. And while I'm on the sidelines, 2020 Bulkers could be appealing for investors with a bullish outlook on the dry bulk charter rates.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.