VinFast: More Risks Than One Can Bite, A Strong Sell

Summary

- VinFast's stock is trading at irrational levels and should be avoided due to uncertain production schedules, low trading volume, and unsustainable valuation.

- The company's valuation is extremely high compared to other automakers, despite its weak financial health and lack of profitability.

- The risk of cost overruns and delays in mass production, as well as uncertain demand for VinFast vehicles, make it a risky investment option.

Michael M. Santiago/Getty Images News

Introduction

Mr. Market, in the short-term, is not always right. Whatever the reason may be, in the short term there are sometimes irrational phenomena that should be avoided at all costs, and today, I strongly believe that VinFast's (NASDAQ:VFS) stock is trading at irrational levels.

For investors who are unaware of VinFast: VinFast is a Vietnamese automaker that is targeting global aggressive growth, which includes the company's ambition in the US. The company is building a factory in North Carolina with an expected production to take place in 2025 to tackle the US EV market. However, as is the case with all new players in the market, the company is not yet profitable and has not reached mass production levels yet.

In an ideal world, VinFast could be a perfect investment target. The company is small and has an ambition to become the next Tesla (TSLA). Mass production goals are just around the corner, and significant funding has been secured through the public market debut. Also in this ideal world, one could assume that there will be insatiable demand for these vehicles. Why not also assume that today's high valuation is a result of a future potential?

In reality, much of the hype that is supporting the current obscenely high valuation of VinFast stock is a reason to sell the stock. Production schedules are tentative dates as investors have seen in other EV newcomers such as Rivian (RIVN) and Lucid Motors (LCID), only 1% of the company's stock is being traded in the public market posing extreme volatility risks, and future demand for these vehicles is uncertain, and the company's valuation is simply unsustainable. For these reasons, especially the fact that only 1% of the company's outstanding shares are publicly traded, I strongly believe that investors should sell VinFast.

Valuation

Before talking about the multitude of reasons why VinFast may have a difficult journey ahead of the company, I would like to talk about the company's valuation first. It is natural for a young company to receive higher premiums on future potential even when accounting for some risks; however, for VinFast, because the company is valued for absolute perfection, I believe it is reasonable to point out all the risk factors.

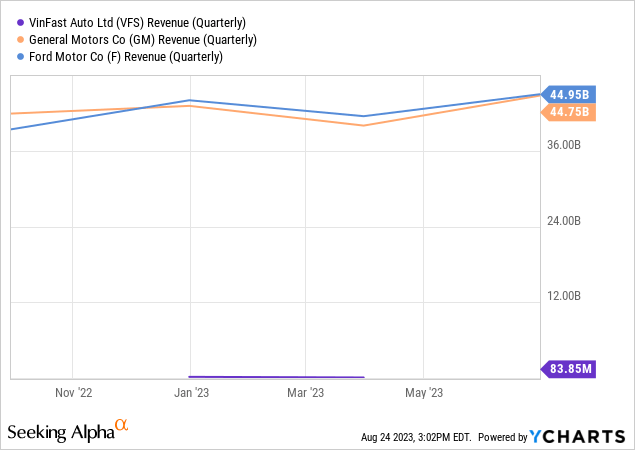

VinFast, at the time of writing (8/24) has a market capitalization of about $110 billion, which makes VinFast more valuable than numerous reputable global automakers including GM (GM) and Ford (F). In fact, VinFast is worth more than both GM and Ford combined. Even when comparing VinFast to Rivian and Lucid Motors, VinFast's market capitalization far outweighs these automakers.

Without even diving deep, one can quickly understand the absurd premium VinFast is receiving. The chart below shows the three companies' quarterly revenue, and as the chart shows, VinFast's revenue seems nonexistent compared to GM and Ford.

(Chart created by author using YCharts)

Revenue is not the best way to measure a company's valuation, but given that VinFast is not profitable with no clear path to profitability in sight, I believe the chart above is enough to convey that the company's market capitalization is absurd.

On top of VinFast's market capitalization being extremely high compared to other automakers, the company's financial health and quarter-over-quarter revenue growth are weak.

In Form 20-F submitted to the SEC, the company had current assets of about $5 billion, which included about $159 million in cash and a total of about $1.87 billion in current assets. However, The company had about $1.75 billion in long-term interest-bearing loans and a total of about $7.2 billion in liabilities surpassing the total assets bringing the stockholder deficit to about $2.15 billion.

I believe the balance sheet is extremely weak, especially for a company that is not profitable with no clear path to profitability in the near future. Understandably, going public likely provided the company with billions in extra cushion on top of the backing from Vietnamese conglomerate VinFast Group, but the fundamental problem still plagues the company's already weak balance sheet.

On the revenue and operating loss aspects, the situation is even direr for the company. In the quarter ending on March 31st, the company lost about $600 million, which is about 63% higher than the previous year. The increased losses are likely normal as the company is investing heavily in expanding its manufacturing footprint; however, as an investor, it is hard to look past the company's financial situation.

Overall, I believe VinFast's current valuation is too expensive. Despite the company having a poor balance sheet, heavy losses with no clear sight of profitability, and significantly lower revenue than its peers, VinFast is trading at a higher market capitalization than GM, Ford, Rivian, Lucid Motors, and many other established and new automakers.

Mass Production Risk

One may argue that VinFast's future potential justifies the company's rich valuation, but I do not believe this is the case. VinFast's delivery numbers as of today are merely 11,300 for EVs and 20,000 for E-scooters year-to-date. Then, what about future production capabilities? The company claims that they have the capacity to produce 300,000 vehicles annually with an additional 150,000 vehicles once the US plant starts production in 2025. As the company has also shown in an infographic, without exact detail, the Vietnam factory has the ability to scale further, and the actual planned production capabilities could be higher. Yet, whether the 2025 production capability of EVs and E-scooters is 450,000 or 900,000 does not justify the current valuation as the company has proved nothing as of today.

It is impressive that VinFast was able to enter the EV market at a breakneck speed, but as has been the case for all new competitors in the industry, there are too many risks and uncertainties. One can claim that they will achieve A and B, but the reality may be different for a multitude of reasons.

Numerous companies, both legacy and new companies have shown that mass production is difficult and prone to unseen problems. In 2018, Tesla struggled to bring its now-popular Model 3 to mass production. Rivian and Lucid Motors in recent years have also had their own respective hiccups in mass production. But, these hardships are not isolated to new companies. GM is also seeing delays in producing Lyriqs. As such, whether the hindrance to an ambition plan is supply chain issues, demand issues, macroeconomic issues, or technical difficulties, numerous companies have shown that mass-producing electric vehicles is difficult. Thus, until VinFast can prove, to some extent, that its ambitious goals are realistic, I believe the risk of cost overruns and delays is inevitable.

Also, one thing to note for VinFast investors is that VinFast is slightly different from its North American counterparts. The company also sells inexpensive electric vehicles including e-scooters and mini trucks priced at far below vehicles sold in the North American or European markets. For example, while 11,300 electric vehicles were sold, 20,000 e-scooters were sold showing that reaching certain production goals could be less profitable for VinFast than other companies. Although it is hard to tell today as the company has just gone public, I believe it is important to note that there is more to it than just the headline numbers.

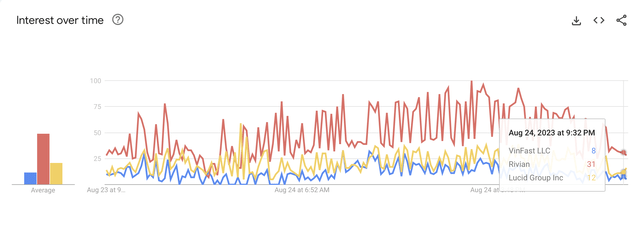

Finally, even if the company is able to achieve mass production in a timely manner with minimal cost overruns, the demand for the company's vehicles is questionable. The picture below is a comparison of Google (GOOG) search trends, and it clearly depicts that VinFast has lower brand recognition or interest compared to Lucid Motors and Rivian, a new player in the North American Market. Considering that Lucid Motors is producing almost double the number that the company is delivering due to demand, it is questionable if VinFast could successfully deliver all the vehicles the company has. It is too early to conclude whether my concerns are legitimate or not, but I believe VinFast is exceptionally ambitious in targeting 150,000 production goals in North America starting in 2025.

Overall, I believe it is a stretch to argue that VinFast will be able to not only achieve its aggressive production goals but also create customer demand for its vehicles in a short span of time.

Only 1% Outstanding Shares Traded

Finally, my biggest concern apart from the company's valuation comes from the available shares. Only 1% of VinFast's outstanding shares are traded in the public market. I believe this to be risky and likely the reason behind the extreme volatility in the company's stock. With thin volumes, share price movements become more volatile or risky for long-term investors.

On top of the volatility potential investors have to endure from a thin volume of publicly available shares, I believe the management team's intent is not aligned with the new shareholders of the company. It is, in my opinion, clear that the management team does not want to share any voting power with the public while wanting to gain as much capital from the public. It seems as if the company is viewing its investors not as a partner or a co-owner but as only a source of capital. Likely knowing that the company's shares will be volatile by only making 1% of the shares available, it is hard to conclude that the management's interest is aligned with its public shareholders.

Further, the management team has created an environment where the majority of the company stock's trading volume comes from retail investors. VinFast has not allowed any derivatives trading. One cannot trade options on the company's stock. With extreme volatility and no easy way of hedging the position, big investment firms will likely steer away from the company's stock leaving only retail investors.

With a combination of thin volumes and a reduced institution's presence, VinFast's stock will likely continue to be extremely volatile, and I do not believe that this is in the shareholders' best interest as it likely promotes short-term trading over long-term investments. Thus, as the management team has created this unique environment, I do not believe that the management team will act in favor of the shareholders in the long term, and even if my claim is wrong, I do not believe it is safe to invest in VinFast today due to extreme volatility that will likely ensue from this unique environment.

Summary

I strongly believe that VinFast is not a great investment option. The company's valuation is extremely rich as VinFast is worth more than numerous established and new automakers who are ahead of the competitive curve. Further, the company has not yet proven if the company will be able to achieve mass production or have enough demand to deliver the vehicles. There are too many promises and no real proof yet. Finally, I believe the potential volatility coming from small tradable shares along with no options to hedge one's position creates immense risks for long-term investors. Therefore, I strongly believe that VinFast is a sell.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.