Burlington: Pessimism Overdone, Reiterate Buy

Summary

- Burlington Stores reported strong earnings with comp sales growth at 4% at the higher end of their guidance and beat at the bottomline.

- Shares tumbled as the street increasingly focused on the macro headwinds to its low-income core consumer and BURL not following the suit of raising guidance like other peers.

- We remain positive on BURL as it navigates the current macro challenges prudently reflected in their guidance and its increased focus on store expansion provides better visibility for 2024.

pixelfit

Investment Thesis

As per my last article where we began covering Burlington Stores (NYSE:BURL), it reported a strong quarter with strong comp sales growth accelerating sequentially and at the above end of the guidance with robust bottomline beating estimates. Street was pessimistic on the impact to its core consumer and no upward revision to its guidance, however, we believe the reaction was overdone. We believe despite the macro headwinds the company is poised to grow in a burgeoning off price retail sector with significant white space opportunity (having expanded its store growth by 60+ through BBBY leases committing to its 100+ net new store growth in FY24), efficiency improvements and margin expansion opportunities through product mix and enhancing product sourcing.

Earnings Beat

BURL reported a strong quarter despite the macro headwinds with total sales up 9% YoY driven by 4% growth in comparable sales at a higher end of their guidance and ahead of street estimates and further accelerating from Q1's 2.3% comp growth. Comp sales growth was primarily driven by increase in customer traffic in addition to higher conversion and increase in units per transaction partially offset by lower AURs as it expanded price points. Gross margins expanded by 280 bps to 41.7% on the back of 150 bps margin improvement tied to higher markup along with 130 bps improvement on freight tailwinds. SG&A deleveraged by 90 bps to 27% of sales driven by timing of marketing spends, increase in product sourcing costs due to an uptick in supply chain costs along with ~10 bps impact due to BBBY leases. Adj. EBIT margin improved 100 bps to 3.1% above management's own guidance of 10 - 50 bps improvement as a result of strong gross margins. It reported adj. EPS of $0.63 (excluding the $0.03 negative impact due to BBBY leases) significantly ahead of the estimates pegged at $0.46.

On Balance sheet front, BURL ended with $1.34 bn in liquidity including $521 mn in cash as well as over $800 mn availability in its ABL facility. Total debt outstanding further reduced to $1,362 mn down from $$1,477 mn last quarter driven by principal repayments with Net Debt / EBITDA further improving to just 1.2x providing additional financial flexibility. Inventory position improved as inventories declined 8% YoY while comp store inventories increased just 1%. Reserve inventory position remains stable at 45% vs 44% sequentially and 52% YoY.

What's Next in Store?

Street sent the stock lower in trade as it focused more on the challenge within its core consumer category than the moving parts of its ability to navigate the challenge and coming strongly entering in H2 and beyond in 2024. BURL guided Q3 comp store sales growth of 5 - 7% above the street estimates and an EBIT margin improvement of ~200 bps with Q3 EPS to be $0.97 - $1.12 excluding the 11c impact of BBBY lease costs.

We're very happy with our sales trend August month-to-date and that trend gives us further confidence in the guide. We know that if the trend turns out to be stronger then we can chase it. And in this environment where availability is exceptionally strong, we know we can find great merchandise to support a stronger trend.

- Michael Sullivan, CEO, Burlington Stores

Looking ahead for H2 23, BURL expects comp store sales growth of 2 - 4% on a 4 year geometric comp stack basis, consistent with the current YTD performance, de-risking the H2 geo-stacks with full year comp sales growth expected to be between 3 - 4% vs 3 - 5% earlier (also has rounding off impact). The guidance seems to be prudent amidst stronger execution (product mix and improvement in merch margins) offset by macro headwinds to its core consumer (BURL catering to the lower income of consumer with avg salaries of <$60k compared to other off price retailers). It expects EBIT margin to expand 90 bps excluding BBBY lease expenses driven by strong merch margins offset by sticky SG&A costs. It reiterated FY23 EPS guidance at $5.75, while tightening their range to $5.60 - $5.90 (vs $5.50 - $6.00 previously) excluding the lease cost expenses.

We are enthused with BURL's commitment to take over 62 store leases from BBBY as part of its bankruptcy proceedings, further demonstrating its commitment to 100-120 annual net new opening target beginning in FY24 and beyond. It noted that new stores will have higher comp growth above the chain average for the first few years and will be margin accretive by next year, further emphasizing its focus on smaller and profitable prototype stores.

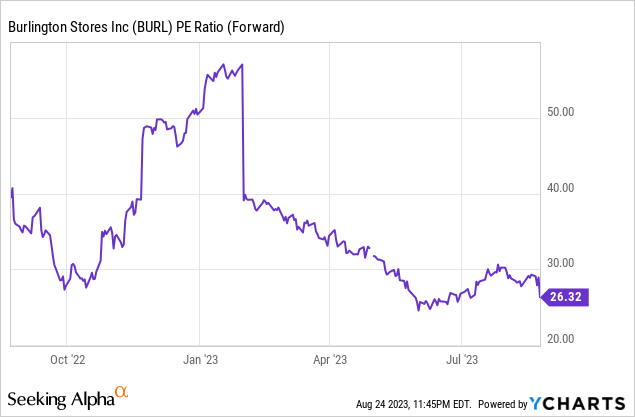

Valuation

BURL trades at 26x Forward P/E compared to its pre-pandemic average of 30x. We reiterate our buy at 30x P/E, however, slightly reducing our target price of $175.

In addition, the company has an authorization of $270 mn on its current repurchase program till Feb 2024, having acquired $27 mn worth of common stock during the current quarter. It has further authorized an additional $500 mn in share repurchases which may be executed till 2025 to boost shareholder value.

Risks to Rating

Risks to rating include

1) Prolonged macro headwinds that can significantly impact BURL's low income consumer market which can lead to deterioration in SSS

2) Student loan repayments which begin in October can reduce discretionary income of its core consumers which can further impact their topline

3) decline in comparable sales as a result of promotional environment and management's inability to gauge the market as seen during Q3 2022

4) Continued increase in product sourcing costs and lack of inventory availability can impact its ability to provide better value for money deals to its consumers

Final Thoughts

We believe BURL offers a compelling opportunity to participate in off price retail's outsized growth at the cost of other departmental stores and specialty retailers. While the street increasingly focused on the impact to its core consumer, we believe the share price reaction was overdone and the company has the moving parts for growth in 2023 and beyond. Reiterate Buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.