Hyliion Holdings: Valuation Is Cut As Growth Prospects Dwindle Away

Summary

- Hyliion Holdings' valuation has been cut by 70% in the last year as the market turns sour on unprofitable EV start-ups.

- The company lacks positive metrics and presents a high risk to investors, making it a sell rating.

- HYLN focuses on designing electrified powertrain solutions for the commercial vehicle sector but faces intense competition and the need for differentiation.

vice_and_virtue

Investment Rundown

The valuation of Hyliion Holdings Corp. (NYSE:HYLN) has been declining by nearly 70% in the last 12 months as the market is turning sour on unprofitable EV start-ups. The company lacks basic positive metrics and presents far more risk to investors right now than potential. No revenues and the highest amount of operational expenses in the company's history paint a very bleak picture unfortunately right now. I don't think they will last the next decade if they can't manage to get production online.

The EV space is filled with companies with far more capital than HYLN and far better prospects for growth as well. Going with the largest players is not always bad as they have the funds available to make moves that HYLN can. Margins are likely to stay poor for a long time here, and for that reason, I am rating HYLN a sell right now.

Company Segments

HYLN is focused on designing, developing, and marketing electrified powertrain solutions tailored specifically for the commercial vehicle sector. With a keen focus on innovation and sustainability, the company is positioning itself as a leader in revolutionizing how commercial vehicles are powered and operated. The market is incredibly difficult to maneuver and navigate in and the hopes used to be that HYLN would quickly be able to capture demand and drive revenue growth.

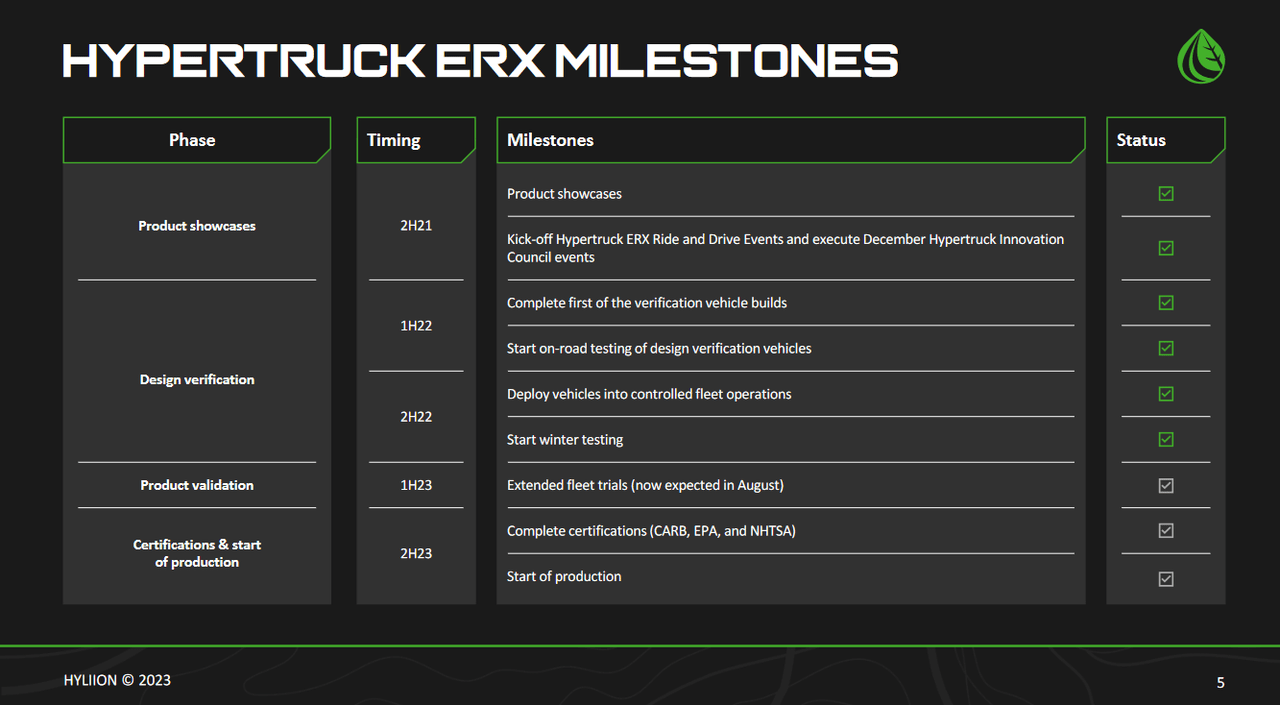

Company Progress (Investor Presentation)

A significant aspect of HYLN's offerings lies in its battery management systems. These systems play a pivotal role in both hybrid and fully electric vehicle applications, ensuring optimal performance and efficiency of the powertrain.

Beyond battery management systems, the company is aiming to deliver advanced battery packs and drive significant revenue growth. These packs serve as the heart of electrified powertrains, providing the necessary energy to propel vehicles while reducing reliance on traditional fossil fuels. As the automotive industry experiences a seismic shift towards sustainability, HYLN battery packs cater to the growing demand for cleaner transportation solutions. The market is rapidly growing and establishing strong relationships and manufacturing deals are crucial for companies like HYLN.

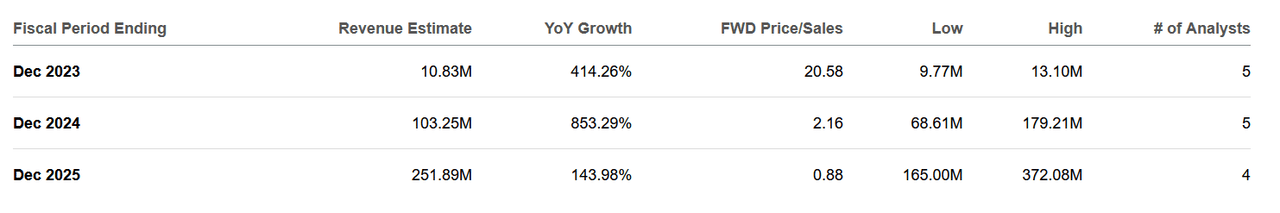

Revenues are first in 2024 beginning to look decent. Based on the forecasted growth, HYLN would deliver incredible top-line growth if everything goes to plan right now. The prospects are decent but there needs to be proof of concept before I could suggest them to be a buy. In the second half of 2023, production is anticipated to start and if there is a failure or delay in that I think the share price for HYLN will quickly fall. Where I am slightly worried as well is the pricing power of the company. Tesla (TSLA) has recently started cutting prices for their cars as competitiveness and turbulence is hitting the market of EV cars. This worries me as other companies might start to follow and that places pressure on suppliers like HYLN who need to remain competitive with prices. Perhaps when production begins, the forecast revenue may not hit those targets as prices would have already gone down. Then, HYLN begins to look more expensive and a further fall in the share price might follow.

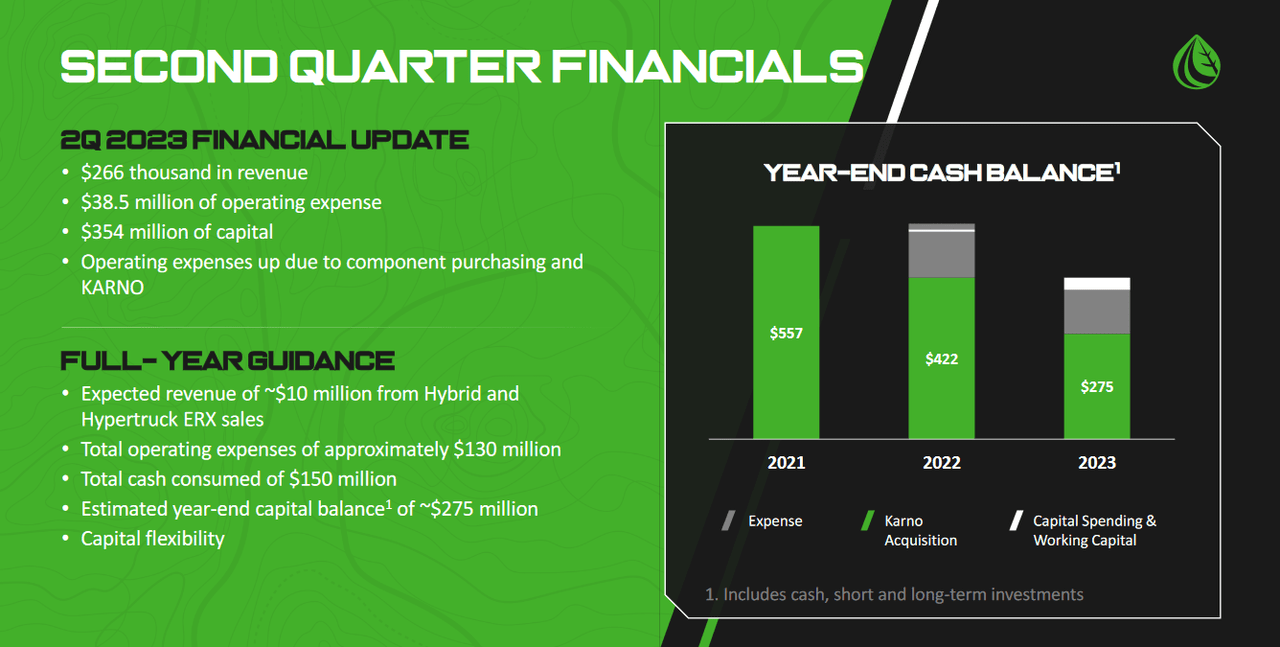

Q2 Results (Earnings Presentation)

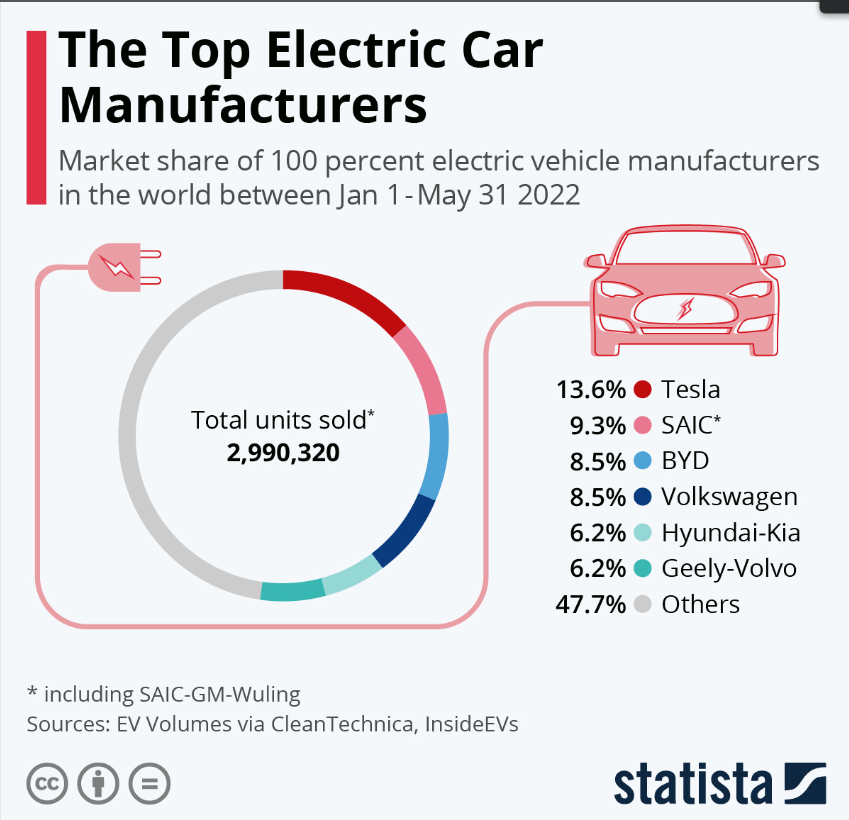

Looking at the guidance provided by the company, it seems clear that maintaining a solid balance sheet and financial state is a key priority. Right now, the company is estimating it will have around $275 million in capital balance, which leads HYLN to trade at a P/B of just 0.68 on a FWD basis. This discount is still somewhat misleading as companies that are operating with no revenue are often trading at low multiples like this in terms of book value. Discounted valuations are given to companies that aren't yet generating revenues to display the risks associated with it. Looking at a peer like Hyzon Motors (HYZN), the P/B is low for both of them and below the sector. That is not to say you are getting a good deal as there isn't a possibility of earnings being passed on to shareholders. Total TTM operating expenses are right now at $164 million for the company and there is a clear need right now for them to get production online, otherwise, the capital the company has will only be sufficient for another 1.5 years before running out. This risk further adds to the sell case for the company. Even revenues are starting to be showcased. I don't think HYLN could be trading far above where major automakers are. BMWYY, for example, has a P/S of 0.42 and Ford (F) 0.29. Even if HYLN manages to hit $251 million in revenues in 2025, the P/S would be at 0.88 if the current share price remains the same. That is quite a large premium in comparison to these major automakers, and I don't think such a premium is warranted if the top line isn't growing at least 20% YoY consistently over the long term. The growth trajectory though one has to admit is quite impressive if it comes true for HYLN. A lot of companies focusing on EV applications and cars are seeing strong demand, growing at 35% in EV car sales as compared to 2022. If HYLN can capture that, it could be an interesting play in the long run.

Risks

While the investment thesis surrounding Hyliion does hold promise, investors must weigh the potential rewards against the significant risks that could impact both the company's profitability and growth trajectory. As the commercial electric vehicle market experiences a notable influx of entrants, Hyliion finds itself in a competitive landscape where differentiation is paramount.

Amid this intense competition, Hyliion's technological innovations, cost-efficient strategies, and robust customer relationships become essential elements for its success. The company must leverage its advancements in electric propulsion systems and other related technologies to stand out in a market where innovation is a driving force. Furthermore, maintaining cost efficiency is crucial as competition may lead to price pressures.

Electric Car Brands (Statista)

As Hyliion aims to establish itself among the new startups and established players in the commercial electric vehicle domain, it must also navigate the evolving sustainability narrative. Environmental consciousness is becoming increasingly central to consumer and investor decisions, and Hyliion's commitment to eco-friendly solutions could impact its reputation and market positioning.

Final Words

HYLN right now presents a dangerous investment in my opinion as production is yet to be established, and without revenues, the company becomes speculative. Even if the productions are set to start in the second half of 2023, the fact remains that the company is still expensive based on industry metrics using major automakers' multiples. The company can't face any challenges or delays in beginning production as that would send the share price down immensely, in my opinion. Besides that, companies like Tesla are cutting back on costs and that makes me question the actual pricing environment for HYLN in the future and that it might not be as positive as it once thought. Rating HYLN a sell now until we see solid performance and margin expansion once productions get online.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.