Finding The Long-Term Winners In The Cannabis Sector, August 2023 Update

Summary

- I will attempt to assess and rank the relative growth potential of the separate competitors in the industry.

- The industry faces multiple catalysts and is trading near 52-week lows.

- The cannabis ETFs are full of cash burning companies, so I am forced to research my own basket of stocks.

- When the next industry-wide catalyst arrives, I plan on buying into several of the most attractive companies at the beginning of the rally.

Ivan-balvan/iStock via Getty Images

Thesis

In this article I will attempt a comparative analysis on the cannabis industry. Because it is still an emerging industry, I will assess and rank the relative growth potential of the separate competitors.

This is the second article of this nature I have written; I plan on updating it every quarter going forward. In my first article, I merely looked at revenue growth and margins as a measure of viability and didn't also attempt to include cost of expansion or ability to capture market share. As all their financial metrics have changed since my first article, and will change as new earnings reports arrive, each time I return to this topic, I will start the process over again.

The Plan

I first began researching the cannabis industry in early 2021. At the time, cannabis stocks were in the middle of a euphoria driven rally and were trading at unreasonably high valuations. Most of the companies were busy raising cash with market offerings. Because almost all of them were extremely unprofitable, I decided to hold off on buying.

In the two years since then, a majority of the sector has failed to improve their margins enough to reach profitability and are still burning cash. Valuations across the industry are near 52-week lows. However, the industry is facing major catalysts from a shift in how the United States federal government treats cannabis. Momentum for SAFE Banking is building, every several months, a newly modified version of it is voted down, each time with more votes in support. I have confidence that congress will eventually find a version of it which will pass. And on Oct 6, 2022, Biden asked the Department of Health and Human Services to begin the process of re-examining the available evidence around cannabis and assess its viability for rescheduling. Considering the fact that this was a political maneuver, and Biden has an election coming up next year, I expect the DHHS to feel increasing amounts of pressure to announce findings as the election approaches.

With the next euphoria driven rally primed to hit the cannabis sector, I find myself eager to gain exposure. However, with most of the industry still burning cash, all the cannabis ETFs are mostly full of unprofitable companies. I am faced with the prospect of building my own 'mini' ETF.

Instead of attempting to gain broad exposure to the entire industry, I am going to try and select targets based on relative growth potential. After filtering out companies which have been unable to grow revenue, and also ones which are not profitable, I am going to take a look at their potential cost of expansion and try and assess their ability to capture market share. I will then use Weighted Analysis to rank the companies from most competitive to least.

Long-Term Trends

The United States cannabis industry is expected to experience a CAGR of 14.2% until 2030. The Canadian cannabis industry is projected to have a CAGR of 13.26% until 2027. Several of these companies have announced their intention to expand into Germany, so it's also relevant to bring up its expected CAGR of 14.01% through 2027. Globally, CBD is expected to experience a CAGR of 31.5% until 2031.

A Look At Margins And Growth In The U.S.

Because cannabis is currently considered a Schedule-1 substance by the federal government, the United States market is currently operating under the extremely oppressive 280e tax obligation and no one is allowed to ship cannabis across state lines.

Most of the states have not set up protections for their local producers. In a similar manner to what is already happening in Canada, when the legal barriers to shipping it across state lines goes away, I expect a price war to break out. While the removal of 280e will immediately make all of these companies more profitable, a majority of these companies should also face increased competitive pressure from out of state growers.

Cost of High Quality Cannabis by State (Oxfordtreatment.com, April 18, 2023)

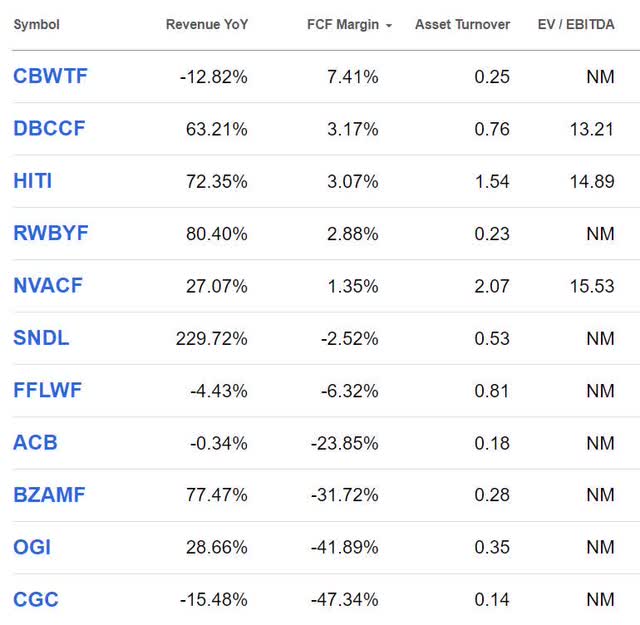

I should note that I am excluding Scotts Miracle Grow (SMG) and Innovative Industrial Properties (IIPR) because they are merely industry ancillaries. These 27 companies have the highest revenue in the United States and are shown sorted by Free Cash Flow Margin. By filtering out the companies with negative revenue growth or negative cash flow, most of this list will not move on to the next step.

United States Cannabis Sector (Seeking Alpha)

A Look At Margins And Growth In Canada

It has been almost 5 years since Canada legalized recreational use and still most of the sector is unprofitable. Overproduction and high competition drive the need to slash prices to retain customers. Excess production is often dumped onto the market before it expires; growers end up undercutting each other just to avoid write downs. The situation is so dire that I typically describe it as a desperate knife fight in the gutter.

As a way of emphasizing to you all just how brutal the level of competition is in Canada: Fire & Flower Holdings (OTCQX:FFLWF) was covered in my last article and will not be in this one because they were forced to declare bankruptcy and are currently trying to figure out how best to liquidate their assets.

These 11 companies have the highest revenue in Canada and are shown sorted by Free Cash Flow Margin. Just as with those in the United States, I am filtering out any that haven't been able to grow revenue or aren't free cash flow positive.

Canadian Cannabis Sector (Seeking Alpha)

Who Got Cut And Why

Before I move on, I must note that several of the largest companies in the industry did not make it past this last filter. This is because they have already proven that they are either unable to grow revenue in the face of competition or are unable to produce profits with their present business model.

Because this is an attempt to measure long-term competitiveness, I have to cut companies such as Aurora Cannabis Inc. (ACB), SNDL Inc. (SNDL), and Canopy Growth (CGC). These companies have had 5 years to find profits and yet are still unable to. It doesn't really matter to me how much cash they have on hand, or how much they will be able to raise during the next major rally. If either their revenue growth or cash flow is negative, it will force me to assign negative values for their Equal Weight Product later on. In short, if their business models are cash burning or they have shrinking revenue, I refuse to consider them as investments.

If any of these companies were able to find profits and begin growing revenue, they will make it past this filter during future analyses. The industry is in constant flux, so I expect that every time I do an industry analysis such as this, a different set of companies will make the cut each time.

Estimating Growth Advantage

In a similar way to how Value Investing provides a mindset for evaluating the intrinsic value of a company, I am going to use Game Theory to provide a framework for assessing competitiveness.

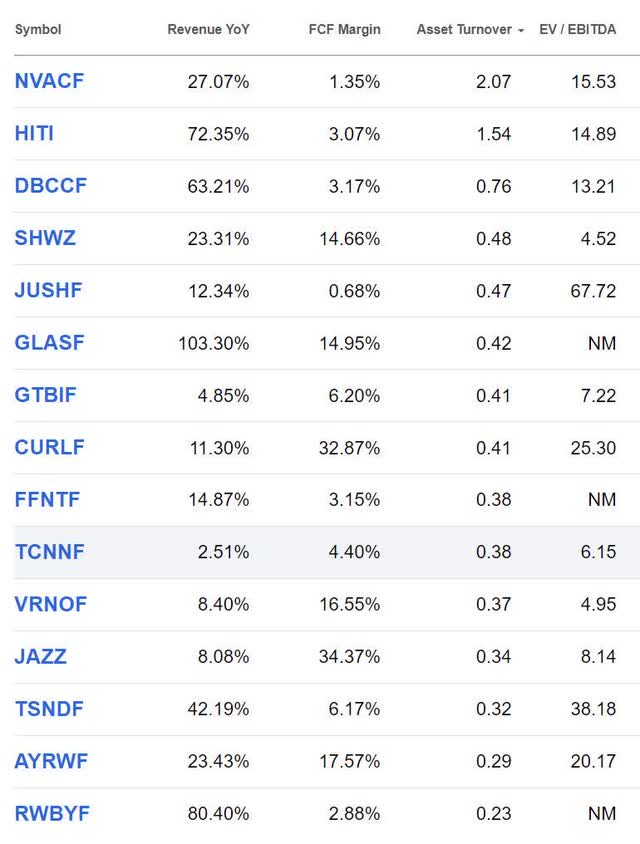

These players are competing for the same maximum potential customer base, so I need to assess their ability to expand into new markets. Producing estimates for their long-term cost of expansion by digging through 10-Ks and earnings calls is too daunting. So instead, I am looking at Asset Turnover Ratio as a very rough guide for the expected costs the companies might need to saturate a new market with stores. I have to be clear that Asset Turnover Ratio is not New Market Revenue/Cost of Expansion, it is ttm Revenue/Assets. However, it does tell a story; one that helps make clear that some companies are currently generating higher revenue with fewer assets.

Cannabis Stocks Worth Watching (Seeking Alpha)

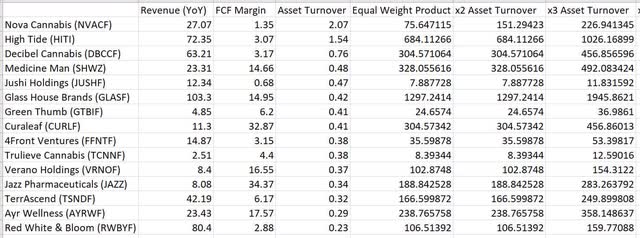

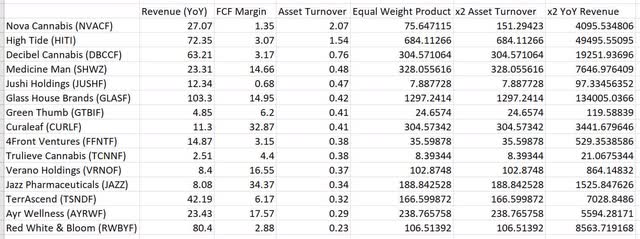

By multiplying together their values for recent annual revenue growth, FCF Margin, and Asset Turnover, I can produce an equal weight product of the three variables. Because I view it as a way to quantify how lean their business models all run, I believe it is correct to weight the Asset Turnover Ratio more heavily than either of the other two variables.

The problem here is that I don't know the ideal weighting for the asset turnover ratio compared to the other two. And this is one of the core problems people come up against when trying to use weighted scoring to determine ranking. Without a predetermined way to know how important this weighting is, I am left choosing fairly arbitrary multiples. To the left of the equal weight product, I have included a column which weights the asset turnover at double, and another which weights it at triple. Moving forward, I am going to use the values in the x2 column.

Cannabis Sector Weighted Scoring (By Author)

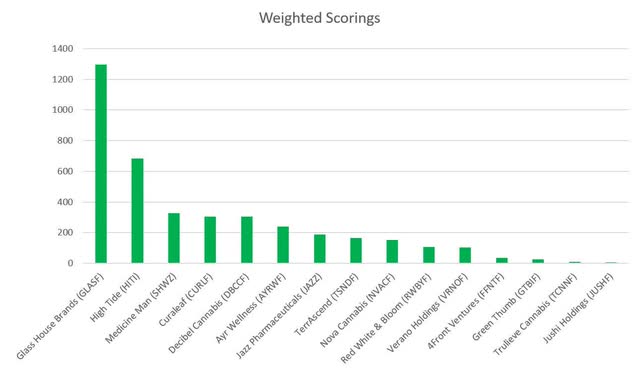

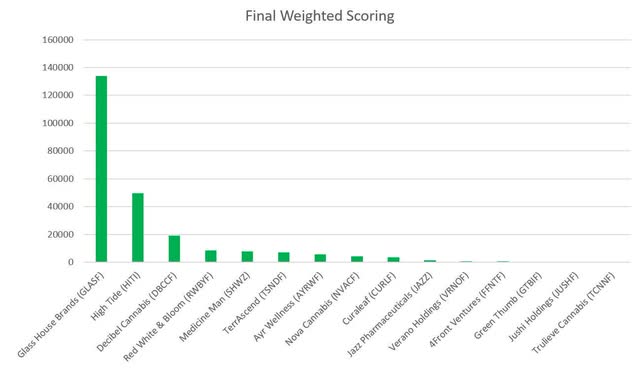

Here is the results of x2 column sorted and displayed as a chart.

Cannabis Sector Initial Weighted Scoring (By Author)

I also need to assess their ability to steal market share from other players. I have been referencing YoY Revenue growth this entire time instead of forward-looking revenue growth. This is because I am not trying to assess their future growth in isolation, I am trying to assess their ability to take customers away from competition. Because these companies have already been competing against each other using their present business models, this is one instance where I am more interested in a rearward-looking metric than a forward-looking one.

Similar to my complaints about overweighting the asset turnover ratio; without data telling me by how much additional weighting I should be adding to YoY Revenue, I am left guessing. I am going to double their revenue growth, and note that the magnitude increase was fairly arbitrary.

Cannabis Sector Final Weighted Scoring (By Author)

I should be clear that the metrics I am using to measure these companies are:

2(Revenue Growth)*(EBITDA Margin)*2(Revenue/Assets).

This roughly translates to:

2(Growth)*(Profitability)*2(Efficiency).

Here are the sorted results of x2 YoY Revenue column:

Cannabis Sector Final Weighted Scoring (By Author)

A Brief Look At The Companies

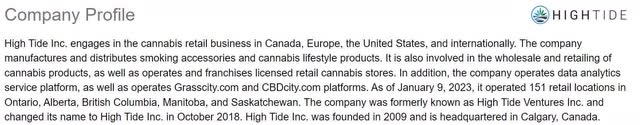

Most of these companies are vertically integrated and require new growing and processing facilities for each market they want to enter. High Tide has the unique advantage in that it doesn't grow the plant and instead sells it as a loss leader, already offering some of the deepest discounts in the industry. Medicine Man and Verano are both already armed with a wholesale segment; if demand suddenly spikes they are better equipped to meet it. Curaleaf and Jazz Pharmaceuticals both have the ability to cut into their already impressive margins if they were to decide to switch to a discount model to attract additional customers. Nova Cannabis has signed a franchise agreement with SNDL Inc. that I can only describe as oppressive. As always, the accuracy of my assessment of these companies is limited by my understanding and is always open to error from ignorance.

I have only written articles about a couple of the companies that made the final list, but am including links to those below. Because most of the larger companies are unprofitable or have been losing revenue, this list mostly consists of the smaller and medium-sized up-and-comers in the industry. They are listed in order of the final weighted scoring, from highest to lowest.

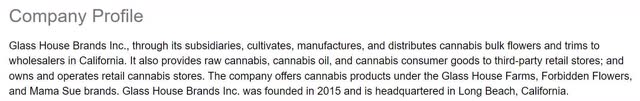

Glass House Brands (OTC:GLASF):

Glass House Profile (Seeking Alpha)

High Tide (HITI):

High Tide: Why I'm Buying With Both Hands

High Tide Profile (Seeking Alpha)

Decibel Cannabis (OTCQB:DBCCF):

Decibel Cannabis Profile (Seeking Alpha)

Red White & Bloom (OTC:RWBYF):

Red White & Bloom Profile (Seeking Alpha)

Medicine Man Technologies (OTCQX:SHWZ):

Medicine Man Technologies (Seeking Alpha)

TerrAscend (OTCQX:TSNDF):

TerrAscend Profile (Seeking Alpha)

Ayr Wellness (OTCQX:AYRWF):

Ayr Wellness Profile (Seeking Alpha)

Nova Cannabis (OTCQB:NVACF):

Nova Cannabis Is Sailing Against The Wind

Nova Cannabis Profile (Seeking Alpha)

Curaleaf (OTCPK:CURLF):

Curaleaf Profile (Seeking Alpha)

Jass Pharmaceuticals (JAZZ):

Jazz Pharmaceuticals Profile (Seeking Alpha)

Verano Holdings (OTCQX:VRNOF):

Verano Holdings Profile (Seeking Alpha)

4Front Ventures (OTCQX:FFNTF):

4Front Ventures Profile (Seeking Alpha)

Green Thumb Industries (OTCQX:GTBIF):

Green Thumb Industries Is Still Worth Buying

Green Thumb Industries (Seeking Alpha)

Jushi Holdings (OTCQX:JUSHF):

Jushi Holdings Profile (Seeking Alpha)

Trulieve Cannabis (OTCQX:TCNNF):

Trulieve Cannabis Profile (Seeking Alpha)

Conclusions

We clearly have some standouts. While I have already covered High Tide (HITI), and believe their business model is extremely competitive, most of the higher scoring companies are small enough that I have yet to dig into their business models or write articles about them. I know the whole point of this was to find answers, but as always with this sort of analysis, I have actually given myself a whole new set of questions. I will have to add Glass House Brands (GLASF), Decibel Cannabis (DBCCF), Red White & Bloom (RWBYF), Medicine Man Technologies (SHWZ), TerrAscend (TSNDF), and Ayr Wellness (AYRWF) to my list of companies to research.

With momentum building for both rescheduling and the passage of some form of SAFE Banking Act, and most of the sector trading near 52-week lows, my urgency to gain additional cannabis exposure is higher than ever. Although I waited almost six months since the first article, I intend to write another article of this nature in late November or early December after most of the industry has reported their Q3 results.

I currently own shares in High Tide, but not any of the other companies which made the first round of cuts. When the next major industry catalyst arrives, I will review my most recent notes and buy into the five or six most appealing companies for the rally.

What Am I Missing?

Because I started by selecting the companies in both sectors with the highest revenue, it is quite likely that there are diamonds in the rough that are worth taking a serious look at, yet did not make the initial 38 because their revenue is too small. If any of you have any other suggestions for cannabis companies worth researching, please let the rest of us know about it in the comments.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HITI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)