HPS: Good Income Fund, But Premium Valuation A Turn-Off

Summary

- John Hancock Preferred Income Fund III offers a high level of current income with a 9.60% yield, attracting income-focused investors.

- The fund's performance has been negatively impacted by rising interest rates, but overall performance has been respectable over the long term.

- HPS is heavily invested in the banking sector, which may concern risk-averse investors, but it is common for preferred stock funds.

- The fund failed to cover its distributions during the most recent period, but not by very much. The payout should be reasonably safe.

- The fund is currently trading at a premium valuation, which is a bit expensive.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

Marat Musabirov

In various previous articles, such as this one, I discussed how the high inflation currently dominating the United States economy has caused numerous people to make efforts to increase their income. The John Hancock Preferred Income Fund III (NYSE:HPS) is one method through which this goal can be accomplished. This is a closed-end fund that specializes in providing a high level of current income to its shareholders, which is immediately evident in its 9.60% yield. This is obviously a much higher yield than most other things in the market, particularly the S&P 500 Index (SPY) and even the ICE Exchange-Listed Preferred & Hybrid Securities Index (PFF), which is bound to be attractive to any income-focused investor. Unfortunately, the fund has not been performing very well lately in the market as its shares are down 15.14% over the past twelve months:

This poor performance could very easily be explained by the fact that interest rates have risen significantly over the period and thus pushed down the price of just about anything that is focused on income. We will discuss that more in the article, as well as show that the fund's performance has overall not been as bad as this chart would lead one to believe.

As some readers may recall, I last discussed this fund in October of 2021. My thesis at the time was similar, as the whole point of this fund was to provide its investors with income. However, none can argue that the market environment has changed substantially since the "easy money" days of 2021 so this article will focus specifically on highlighting these changes. It will also provide an update on the fund's finances since obviously, those have changed over the past two years. Let us investigate and see if this fund could be a worthwhile investment today.

About The Fund

According to the fund's webpage, the John Hancock Preferred Income Fund III has the objective of providing its investors with a high level of current income while still ensuring the preservation of principal. That objective makes a great deal of sense considering the fund's strategy. As we can see here, the fund specifically states that it seeks to achieve its objective by investing in a portfolio of preferred stock and convertible preferred securities:

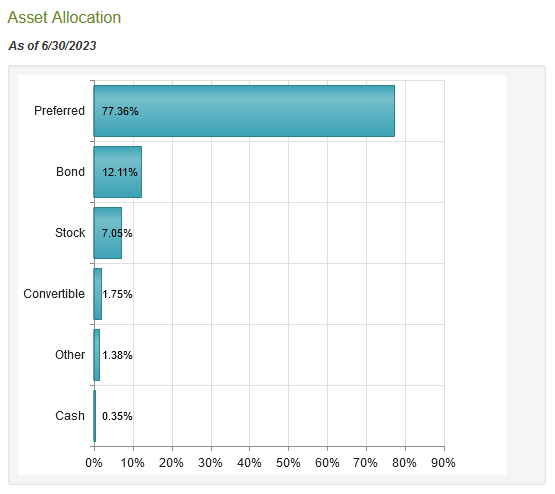

The fund's portfolio as a whole seems to comply with the strategy described on the webpage. As we can see here, 77.36% of the fund's assets are invested in preferred stock with the remainder invested in bonds and convertible securities. Surprisingly though, the fund does have a 7.05% allocation to common stock:

CEF Connect

For the most part, preferred stock and bonds tend to be less volatile than common stock. This is the reason why many fixed-income funds state that they are attempting to preserve principal as part of their investment objectives. In fact, it is impossible to lose money by investing in bonds if you hold the security to maturity, unless the issuer defaults. This is because a bond is purchased at face value when it is first issued and redeemed for its face value upon maturity. Preferred stock is quite similar, except that it does not have a maturity date. However, since neither security has any inherent link to the growth and prosperity of the issuing entity, it typically stays relatively stable over time, at least compared to common stock. This is pretty obvious if we look at the price return for the S&P 500 Index, the Bloomberg US Aggregate Bond Index (AGG), and the ICE Exchange-Listed Preferred & Hybrid Securities Index over the past ten years. Here is the chart:

As we can see, both of the fixed-income indices were much more stable than the S&P 500 Index over the ten-year period. Thus, investing in these securities tends to be a better way to preserve principal than taking on the added risk of stocks. Stocks do have a much higher potential for returns because of their higher risk though, so the fact that the John Hancock Fund includes some exposure to these securities allows it to benefit from that.

In my previous article on the John Hancock Preferred Income Fund III, I pointed out that the fund is heavily invested in the banking sector. That continues to be the case, although it does have some exposure to other sectors. We can see this by looking at the fund's largest positions. Here they are:

As we can see, many of the companies on this list are banks or other financial institutions, although we do have three utilities and a midstream partnership. The prevalence of banks among the fund's holdings may be concerning to some risk-averse investors, after all, there were a number of large bank failures earlier this year. However, it is a common situation for a preferred stock fund. I explained why in my previous article on this fund:

The first thing that we notice here is that all of these companies are either utilities or banks. This is not uncommon for a preferred stock fund because banks and utilities are the largest issuers of preferred stock in the market. As a result, almost any preferred stock fund will be very heavily weighted towards these two types of entity. With that said though, usually the overwhelming number of companies in the top ten list are banks. This is due to international banking regulations that require banks to hold a certain percentage of their assets in the form of Tier One capital. Tier One capital refers to that proportion of a bank's assets that are not simultaneously a liability to somebody else (such as a depositor). When regulators require that the bank increase its Tier One capital, its only options are to issue either common or preferred stock. The bank will often choose to issue the preferred stock in order to avoid diluting the common stockholders. A utility does not have these regulations to follow but they become heavy issuers of preferred stock due to the cost of their infrastructure. It is extremely expensive to build a network of utility-scale infrastructure over a wide geographic area. The utility company will often finance the construction of this infrastructure with debt, but the company will usually want to avoid taking on too much debt and becoming overleveraged. Thus, it will often issue preferred stock to partially cover the expenses so that it can avoid too much debt or common stock dilution."

There have been a number of changes to the top ten list since we last discussed this fund. These include all of the following:

Removed From Largest Positions | Added To Largest Positions |

DTE Energy Company (DTE) | PNC Bank (PNC) |

JPMorgan Chase & Co. (JPM) | Citigroup (C) |

NextEra Energy (NEE) | Energy Transfer (ET) |

Duke Energy (DUK) | CMS Energy (CMS) |

The Southern Co. (SO) | Athene Holding |

Please note that some of these positions are preferred stock, not common stock. However, the fund's monthly portfolio list is strange. It specifically states that some of these positions are either corporate bonds or preferred stock. However, it does not state what specific issue they are, and the ticker symbol provided by the fund sponsor is specifically for the common stock. As such, we cannot say anything more than the fact that they are some type of security issued by the respective company. The monthly positions list can be downloaded from the fund's website if you want to peruse it yourself.

The fact that a fairly large number of securities in the largest positions list were changed since the last time that we discussed this fund does not necessarily mean that its annual turnover is high. After all, it has been almost two years since that previous article was published. In fact, the John Hancock Preferred Income Fund III only had a 20.00% annual turnover as of July 31, 2023, so it is not particularly active in trading securities. This is nice due to the fact that it helps to keep the fund's trading expenses down.

The John Hancock Preferred Income Fund III has performed exceptionally well against index funds over the past ten years. As we can see here, the fund delivered an 82.50% total return over the trailing decade, which is substantially above both the Bloomberg U.S. Aggregate Bond Index and the ICE Exchange-Listed Preferred & Hybrid Securities Index:

This is something that will undoubtedly appeal to any investor. However, it is important to keep in mind that the above chart assumes that all distributions received by the funds are reinvested. A lot of people who invest in income-focused funds are not reinvesting the entire distribution that they receive, so their returns would be lower due to the lower compounding. Nonetheless, the John Hancock Fund still would have served you better in the long run. It is also important to keep in mind that past performance is no guarantee of future results. In particular, we can see that this fund tends to drop much more than either of the indices in both late 2018 and 2022, which were periods in which the Federal Reserve was raising interest rates to slow the economy. That will likely continue to be the case going forward due to this fund's use of leverage. Analysts are currently expecting that Chairman Powell will suggest that rates will stay higher for longer at his Jackson Hole speech later this week. If that happens, this fund may decline more than either of the indices.

With that said, any decline due to interest rates will likely be a short-term phenomenon. It is difficult to believe that the Federal Reserve will be able to keep rates at today's levels for an extended period of time due simply to the Federal Government's budgetary problems. To put it simply, the United States Government cannot afford 4%+ interest rates on Treasuries indefinitely. This fund's leverage will work in its favor when interest rates do start to decline due to its effect of boosting gains.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the John Hancock Preferred Income Fund III is to provide its investors with a high level of current income. In order to achieve that objective, it invests in a portfolio of preferred stocks that deliver most of their investment returns via direct payments to their owners. These securities tend to have a fairly high dividend yield as a result. The fund then applies a layer of leverage to boost the effective return of its portfolio. It then pays out most of its investment profits to its own shareholders. As such, we can assume that the fund has a very high yield itself. That is certainly the case as the fund pays a monthly distribution of $0.11 per share ($1.32 per share annually), which gives it a 9.60% yield at the current price. The fund has generally been very consistent with its distribution over time, although it has varied on occasion:

This is actually much more stable than many other fixed-income funds have been recently. Indeed, we can see that the John Hancock Preferred Income Fund III did not adjust its distribution at all in response to the Federal Reserve's change in monetary policy last year. In fact, the last distribution change was all the way back in October 2019. This could endear the fund to those investors who are seeking a safe and secure source of income to use to pay their bills or finance their lifestyles. As is always the case though, we want to ensure that it is sustainable.

Fortunately, we do have a somewhat recent document that we can consult for the purposes of our analysis. As of the time of writing, the fund's most recent financial report corresponds to the six-month period that ended on January 31, 2023. It will thus not include information about the fund's performance over the past six months, but it will still give us a good idea of how well the fund's management navigated the challenging conditions that existed last year. A management team's ability to handle difficult conditions can sometimes be more valuable than its ability to perform during easy conditions.

During the six-month period, the John Hancock Preferred Income Fund III received $15,858,767 in dividends along with $9,437,925 in interest from the investments in its portfolio. After we net out the money that the fund had to pay in foreign withholding taxes, we get a total investment income of $25,243,352 for the period. It paid its expenses out of this amount, which left it with $16,227,179 available for the shareholders. That was unfortunately nowhere near enough to cover the $21,001,965 that the fund actually paid out in distributions. This is concerning as we generally want a fixed-income fund to cover its distributions solely out of net investment income.

With that said, the fund does have other methods that can be employed to obtain the money that it needs to cover its distributions. For example, it might be able to earn capital gains that can be paid out. Fortunately, the fund did have some success at this, as it reported net realized gains of $4,493,299 during the period. When we combine that with net investment income, we get $20,720,478, which was unfortunately still not enough to cover the distribution, but the fund did get pretty close. Its net unrealized losses during the period were $17,858,666, which offset most of its gains. Overall, the fund's assets declined by $17,417,269 after accounting for all inflows and outflows. Technically, the fund failed to cover its distribution.

At this point, some eagle-eyed readers might notice that the fund's net asset decline was actually less than its net unrealized losses. This is despite the fact that net investment income plus net realized gains was not sufficient to cover the distributions. This can be explained by the fact that the fund's shareholders reinvested $722,884 worth of the distributions that were paid out. This money came back into the fund and was used to support the distribution. In effect, some of the distributions were paid in shares of the fund instead of cash. It is probably nothing to worry about since the fund did get very close to covering its distributions, but it is still something that we should keep an eye on.

Valuation

As of August 22, 2023 (the most recent date for which data is currently available), the John Hancock Preferred Income Fund III has a net asset value of $13.18 per share but the shares currently trade for $13.76 each. That gives the fund a 4.40% premium on net asset value at the current price. That is better than the 5.36% premium that the fund's shares have averaged over the past month, but it is still a premium. As such, buying shares of this fund essentially means that you are paying more than the underlying assets are actually worth. I personally do not like to buy any fund at a premium for that reason.

Conclusion

In conclusion, investors today are desperate to maintain their income due to the rapidly rising prices throughout the economy. The John Hancock Preferred Income Fund III is a good way to obtain such much-needed income, and for the most part, this is a solid fund. The only real negative is that the fund is a bit expensive right now. It also failed to cover its distribution in the six-month period that ended back on January 31, 2023, but not by very much. The fund is definitely worth considering if it can be obtained at a discount to net asset value, but the premium valuation is a big turn-off.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)