Evelo Biosciences: May Be Worth A Small, Highly Speculative Long Position Considering Upcoming Psoriasis Phase 2 Results

Summary

- Following recent cash raise, EVLO has enough (barely) cash to the next catalyst, phase 2 readout in psoriasis. The event is binary and can make or break the company.

- Prior failure of EVLO's platform in atopic dermatitis is concerning. However, psoriasis is a different indication (different pathophysiology) and de-risked by positive results in a prior phase 2 study.

- Ongoing phase 2 trial in psoriasis is being conducted with a second generation candidate, EDP2939, which is expected to have better efficacy and now represents EVLO's sole clinical-stage candidate.

- A positive phase 2 in psoriasis would not only unlock potential to enter a multi-billion market, but would also provide proof-of-concept of EVLO's platform with potential to expand to multiple other indications.

iLexx/iStock via Getty Images

Overview of the thesis

With recently raised cash, Evelo Biosciences (NASDAQ:EVLO) should have enough cash to fund its operations until its phase 2 results in psoriasis. Despite prior failure in atopic dermatitis, there are good reasons to believe that results in psoriasis will be better, including de-risking by a prior phase 2 study. This would be a major catalyst for EVLO not only unlocking the potential for future commercialization in a big market, but also because it would provide proof-of-concept of EVLO's platform, with significant potential for expansion to other indications.

Overview of EVLO's platform

EVLO's platform aims to control systemic inflammation through the Small Intestinal Axis (SINTAX). Specifically, EVLO is developing orally-delivered microbiome-derived medicine that act in the small intestine but can exert systemic therapeutic effects. The approach has strong preclinical evidence to support it, and has demonstrated proof-of-concept clinical efficacy in a phase 2 study in psoriasis. Notably, in mice models EVLO's approach appears to be at least as good (and even better) than currently approved anti-inflammatory treatments, including dexamethasone, anti-TNF and JAK inhibitors. Additionally, this approach so far seems safe and well-tolerated, and can avoid immunosuppressive side effects of current biological treatments. This, if proven, will represent a new class of medicines, with potential for use in multiple inflammatory conditions.

Following failure of its 1st generation candidate in a phase 2 trial in atopic dermatitis, EVLO currently has only 1 clinical-stage candidate which has completed a phase 2 study in moderate psoriasis. Results of this study, expected in early Q4 2023, will either make or break the company.

Small intestinal axis (SINTAX) (EVLO's company presentation)

For interested readers, I refer them to EVLO's publication explaining in more detail the rationale and supporting evidence for targeting SINTAX to control systemic inflammation.

EVLO's potential in psoriasis

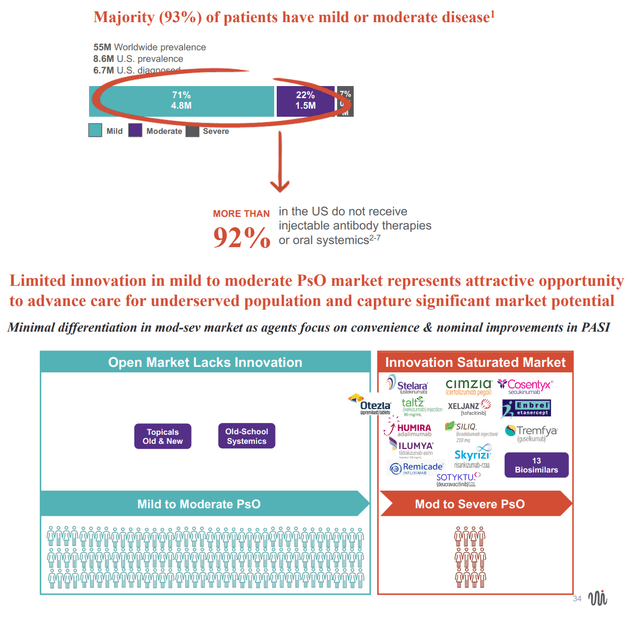

As highlighted in EVLO's company presentation, the vast majority (93%) of psoriasis patients have mild/moderate disease. Biologic injectables and systemic oral therapies are typically reserved for those with more severe disease because of cost and potential toxicity. EVLO envisions that EDP2939 could be established as a backbone therapy (alone or in combination with other currently approved treatments) for all stages (mild-moderate-severe) of psoriasis. Oral (vs injectable) route of administration, placebo-like safety and tolerability and durable efficacy, if accompanied by a reasonable price mean that EVLO may indeed achieve the above goal.

Unmet need in psoriasis (From EVLO's company presentation)

Implications of failure in atopic dermatitis

EDP1815 was better than placebo in a double-blind, placebo-controlled Phase 1b trial; EASI50 clinical response was shown in 4 of 16 (25%) EDP1815-treated patients vs 0/7 in placebo. However, EDP1815 was not better than placebo in a phase 2 trial, in which trial placebo response was much higher than expected and even higher than in EDP1815-treated patients (placebo 44.7% vs 37.9%). Following these results, EVLO has decided to cease further development of EDP1815 in atopic dermatitis. However, failure in atopic dermatitis indication, although concerning, does not preclude efficacy in other indications because:

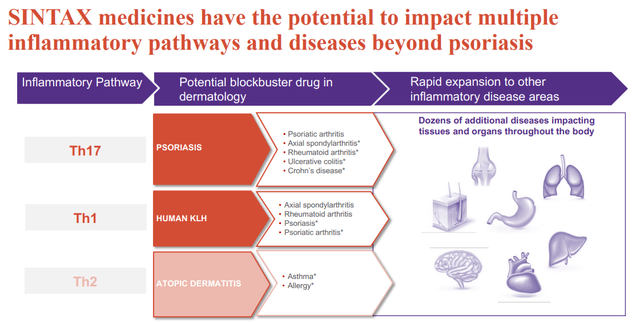

- Pathophysiology and inflammatory pathway in atopic dermatitis is different compared to other indications (predominantly Th2 in atopic dermatitis vs Th17/Th1 in other indications, including psoriasis, although this is an oversimplification).

- In contrast to atopic dermatitis, psoriasis indication is de-risked by a positive double-blind, placebo-controlled phase 2 trial (will be discussed below). On the other hand, atopic dermatitis did have a positive double-blind placebo-controlled ph1b before the failed ph2, highlighting that success of the ongoing phase 2 in psoriasis is not guaranteed.

- Ongoing phase 2 in psoriasis is being conducted with a second generation candidate (EDP2939 vs EDP1815), advantages of which will be discussed below.

*Simplified and non-exhaustive view of inflammation. Many inflammatory diseases are complex and involve multiple pathways of the immune system. (EVLO presentation)

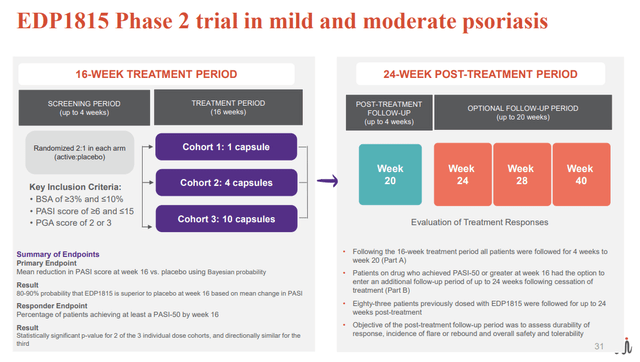

Phase 2 trial of EDP1815 in psoriasis

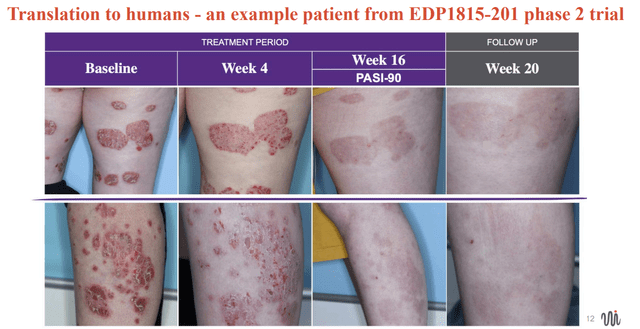

An earlier double-blind, placebo-controlled phase 2 study, using the first generation candidate (EDP1815) has provided proof-of-concept for EVLO's platform in psoriasis. The study enrolled patients with mild-to-moderate psoriasis (vs moderate psoriasis in the ongoing phase 2) and included 3 patient cohorts (increasing EDP1815 dose in each cohort) randomized 2:1 to once-daily EDP1815 or placebo. Patients were treated for 16 weeks, at which point treatment was stopped, and then followed for another 4 weeks and optionally to week 40 (to assess durability of responses after cessation of treatment).

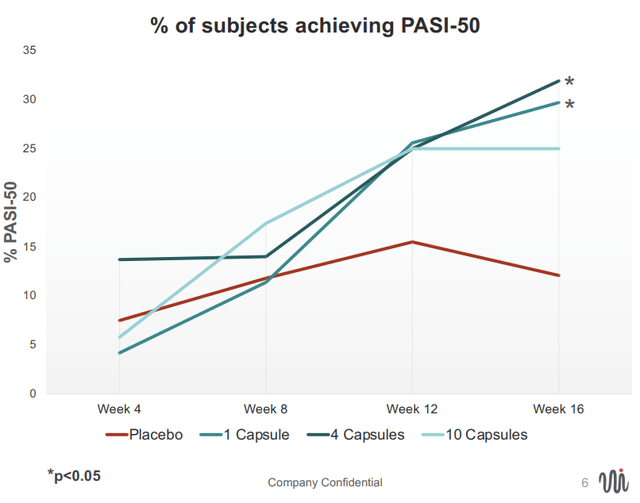

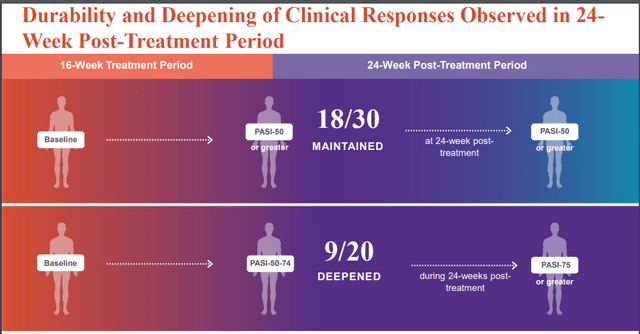

Results were positive (although not impressive); More patients in the EDP1815 arm achieved PASI-50 (50% improvement) clinical responses compared to placebo (25-32% across EDP1815 cohorts vs 12% in placebo). Notably, responses were durable and even deepened in some patients during up to 24-week post-treatment follow-up.

EDP1815 ph2 trial design (EVLO presentation)

PASI 50= 50% reduction in the Psoriasis Area and Severity Index (EVLO's presentation)

EVLO's presentation

EVLO's presentation

EDP2939 vs EDP1815

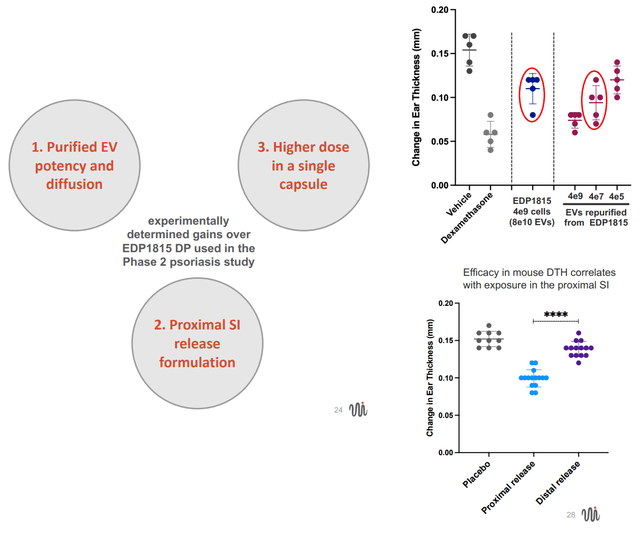

Both candidates are derived from the same Prevotella histicola strain (a bacterium), but first generation pill (EDP1815) contains both non-viables microbial cells and extracellular vesicles, while the 2nd generation pill (EDP2939) contains only extracellular vesicles. Advantages of EDP2939 include;

- Smaller size means potential to pack more in a pill (i.e. higher concentration of the active substance). Nevertheless, in the prior phase 2 an increase in the number of capsules of EDP1815 did not lead to a dose response, which is a major red flag (unless treatment effect plateaued at the lowest dose).

- Smaller size also means greater potential to reach target cells

- Pill formulation that allows release in the proximal small intestine, which in an animal model has been associated with increased efficacy.

Advantages of EDP2939 (purified EVs) vs EDP1815 (non-viable cells + EVs) (From EVLO's company presentation)

Ongoing double-blind, placebo-controlled phase 2 trial in patients with moderate psoriasis (vs mild-to-moderate in the above-described phase 2) is being conducted with EP2939 (vs EDP1815 in the above-described phase 2). Although EVLO reasonably expects better efficacy with the second-generation product this is not guaranteed (of note the prior failure in atopic dermatitis of an improved EDP1815 pill formulation, allowing proximal release). This, in combination with slightly different patient population, is a risk because prior results may not be replicated in the new phase 2 study.

Design of the ongoing phase 2 in psoriasis (From EVLO's company presentation)

Financials

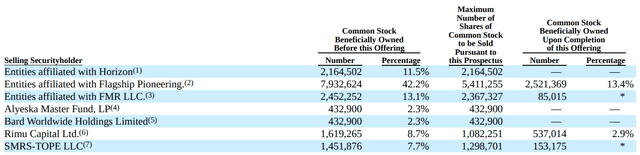

Based on the latest 10-Q, EVLO had cash and cash equivalents of $7.6M as of June 30, 2023. Total operating expenses in Q2 were $19.6M (including $13M for R&D and $4.9M for G&A expenses). EVLO expects that existing cash combined with recently raised $24.6M from the July 2023 private placement, will be sufficient to fund planned operations into 2024. Importantly, this means that EVLO has enough cash to phase 2 readout, although at current burn rate it is barely enough. Concerning is also that a significant portion (see image below from recent S-3) of total outstanding shares are eligible to be sold, which could cause significant drops in the stock's price. Even the perception in the market that the holders of a large number of shares intend to sell shares could reduce the market price (stock price has already dipped significantly due to this), which means there might be a better entry point to buy the stock before phase 2 results. On the other hand, at the time of writing, and considering recent cash raise and debt restructuring, EVLO trades at an enterprise value of just about $111M. Considering that >8 million people in US (125 million worldwide) have psoriasis the market potential just for psoriasis is huge (global market size $22.9B in 2021, projected to increase to $55.8B by 2031). Add to that the potential of the platform to work in other indications.

Selling securityholders (S-3 form, August 10)

Risks

Two major risks to the thesis are the following;

- Phase 2 results could be underwhelming. With no other clinical-stage candidates and current cash balance this scenario would be catastrophic.

- EVLO might elect to raise cash before the phase 2 results, which would likely be dilutive.

Recommendations

As long as investors understand the risks, EVLO may be worth a small, long position based on: (1) de-risking by prior placebo-controlled phase 2 study in psoriasis, (2) potential for expansion to multiple other inflammatory diseases, (3) sufficient cash to the catalyst, (4) asymmetric risk-reward. Please note that this is a highly risky investment and the upcoming topline results is a binary event that will either make or break EVLO. Risk-averse investors may prefer to wait for topline results in psoriasis before considering investing.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EVLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.