Innovative Industrial: Top Cannabis Pick With 9% Dividend Yield

Summary

- Innovative Industrial Properties generates strong cash flow margins but trades near a double-digit dividend yield due to weakness in the cannabis market.

- IIPR is the largest publicly traded cannabis REIT and leases properties to well-known cannabis operators.

- Despite challenges in the sector, IIPR has a conservative balance sheet and strong growth profile, with regulatory reform being a surprising catalyst.

- The dividend yield is signaling danger, but between the low debt and high annual lease escalators, the market has got this one wrong.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

halbergman

Innovative Industrial Properties (NYSE:IIPR) is a curious phenomenon. The cannabis REIT is generating enviable 83.3% free cash flow margins yet continues to trade near a double-digit dividend yield. The source of the weakness appears due to the never-ending cannabis bear market, as cannabis prices across the nation continue to experience weakness. Wall Street appears to be focusing heavily on the lack of cash flow generation at many of its public tenants, but may be underestimating the long term opportunity for both the growth of the legal market as well as the potential for eventual normalization in tax and debt interest rates in the sector. I reiterate my strong buy rating for the stock as the current valuation is pricing in unrealistic amounts of bearishness and overlooking the long term tailwinds for the business.

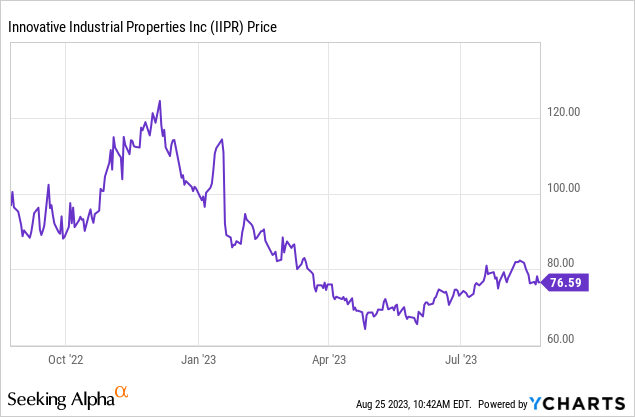

IIPR Stock Price

Given the carnage seen in the US cannabis sector, it is not unreasonable to suspect that IIPR’s positive cash flow generation and consistent dividend have been the only thing keeping the stock from imploding further.

I last covered IIPR in June where I rated the stock a strong buy on account of the double-digit dividend yield. The stock has risen since then, but not nearly enough, though it may be some time before the uncertainty overhang is resolved.

IIPR Stock Key Metrics

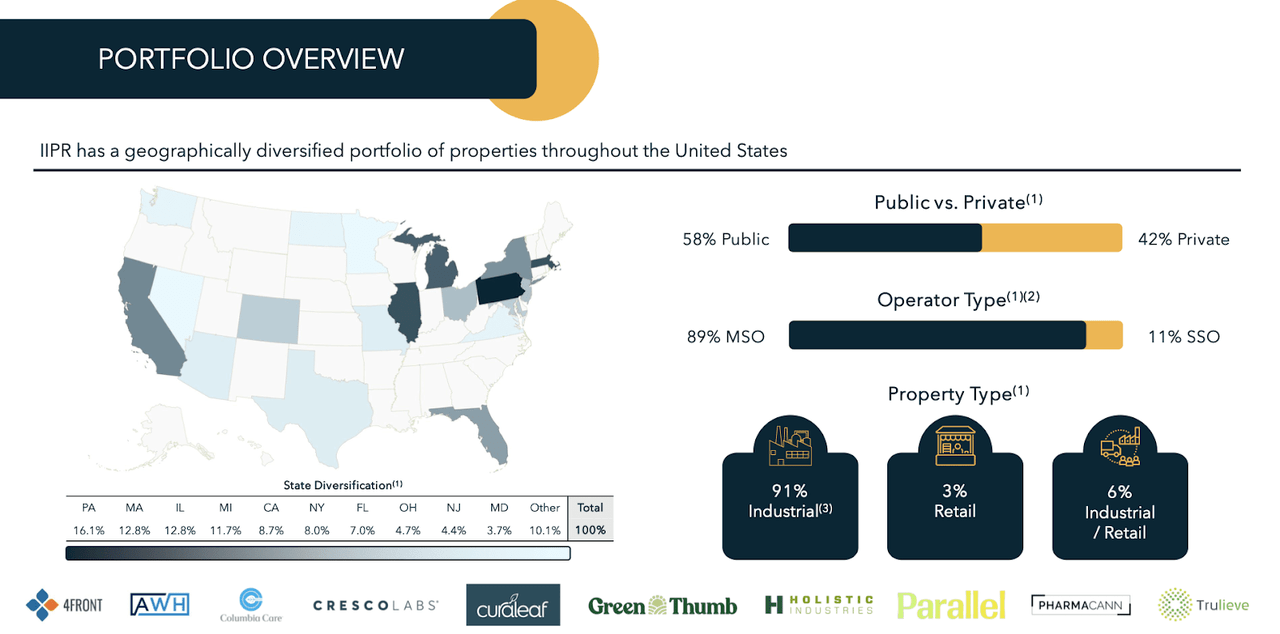

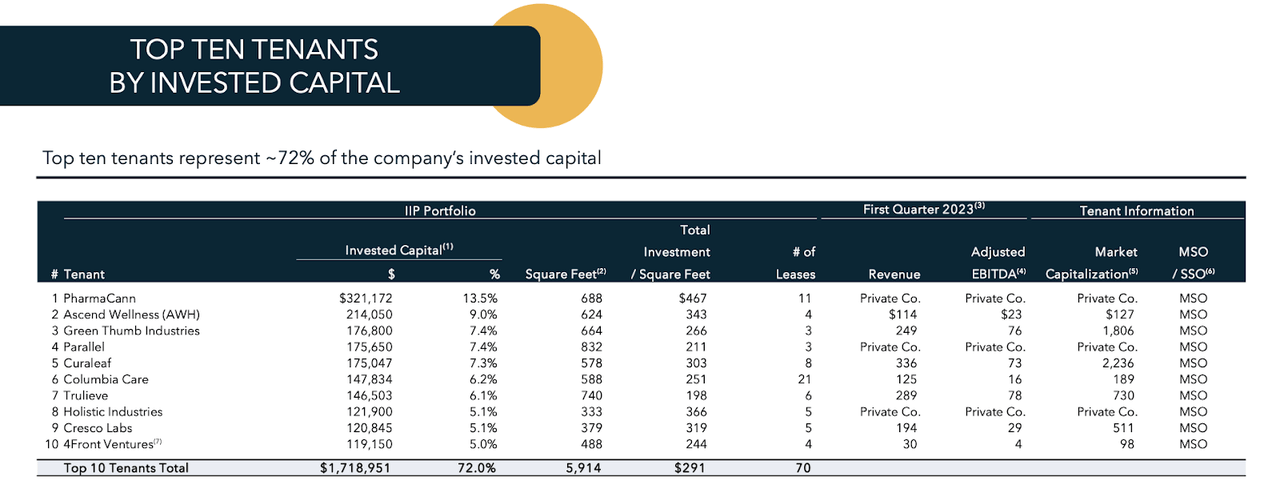

IIPR is the largest publicly traded cannabis REIT in the country. IIPR leases properties to some of the most well-known cannabis operators including the likes of Green Thumb Industries (OTCQX:GTBIF), Trulieve (OTCQX:TCNNF), and Curaleaf (OTCPK:CURLF).

2023 Q2 Presentation

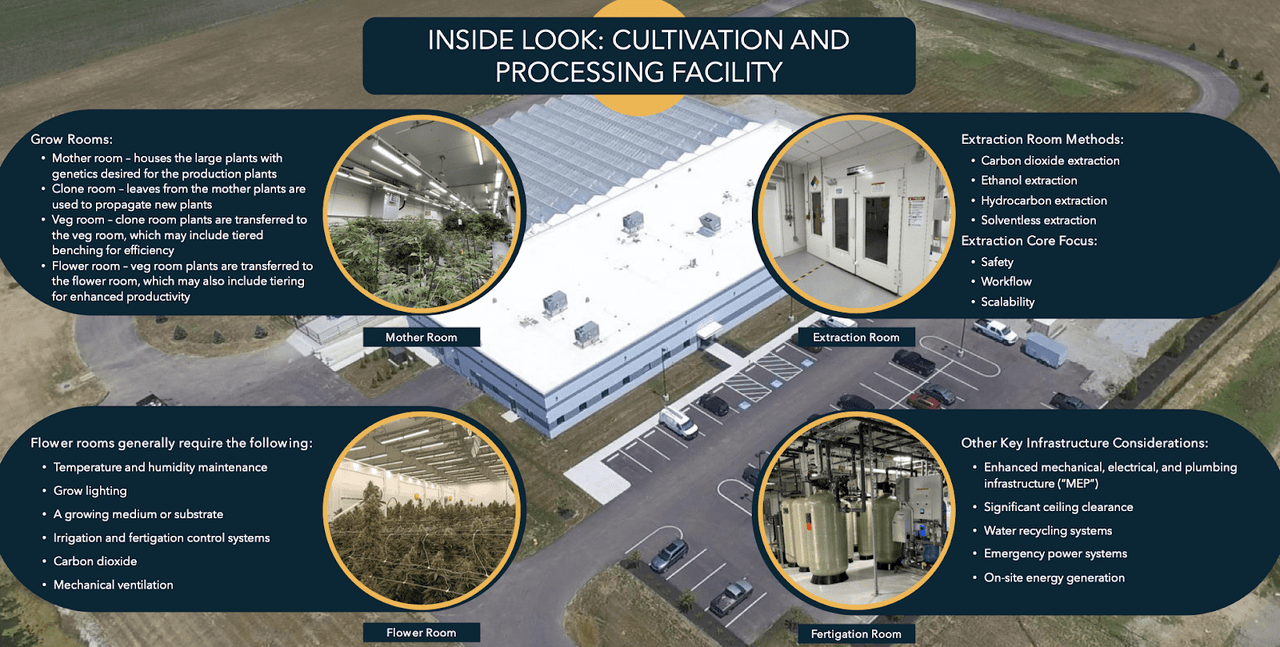

The vast majority of its properties are large cultivation and processing facilities specially designed for cannabis products.

2023 Q2 Presentation

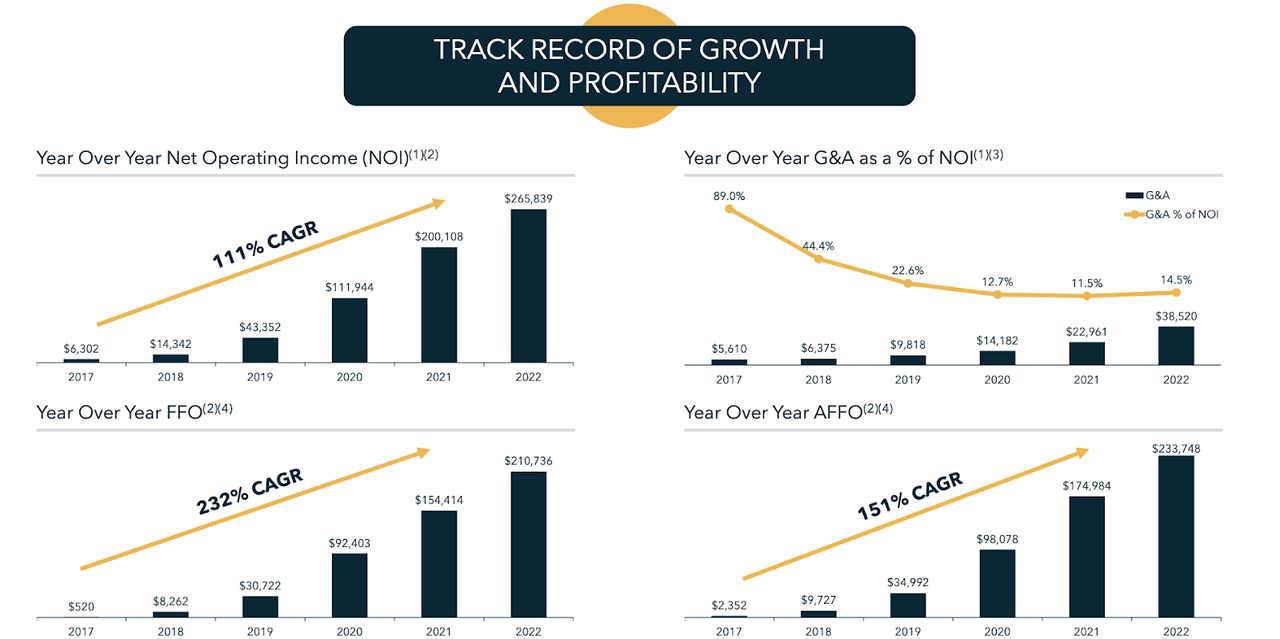

Due to the limited availability of capital in the US cannabis sector, IIPR has been able to show incredible growth, especially considering that net lease REITs (‘NNN REITs’) typically show modest growth even in the best of conditions.

2023 Q2 Presentation

A lot of that growth has come from the elevated 13% cap rates that the company has demanded on sale and leaseback transactions, far surpassing the typical 6% to 7% rates of traditional peers. Between an expensive stock price (IIPR once traded well above $200 per share) and the unusual accretion from external acquisitions, IIPR had been able to benefit from what was almost like “free and easy” growth by simply issuing stock and acquiring new properties.

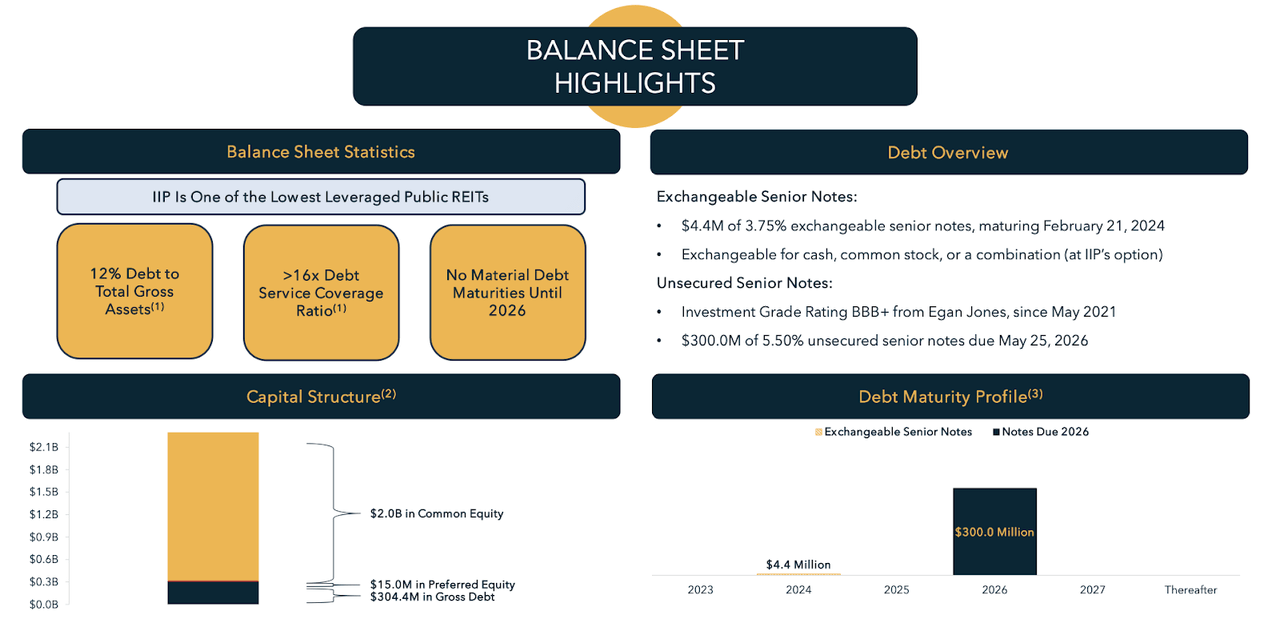

Those growth days are over, with the stock valuation being prohibitively expensive to fund new acquisitions. But today’s more modest growth is still best-in-class, as IIPR is still benefiting from its 3% annual lease escalators (1% is the industry norm). In its latest quarter, IIPR delivered 5.1% YOY growth in AFFO per share to $2.26, up sequentially from $2.25. That kind of growth rate is similar to what traditional net lease peers report in the best of times - nowadays most REITs in general are struggling to post solid growth rates due to higher interest costs. IIPR does not have that issue due to not only a lack of floating rate debt but also a significantly underleveraged balance sheet position. Total debt recently stood at just around 1x debt to EBITDA as of the latest quarter, far below the typical 5.5x to 6x norm.

2023 Q2 Presentation

Between the conservative balance sheet and stronger growth profile, investors may be surprised to see IIPR trade at a deep discount to the typical 5% to 6% dividend yields of NNN REIT peers.

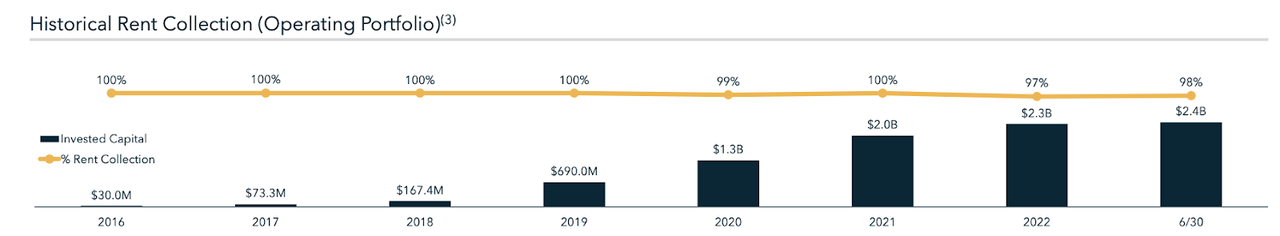

The issue has to do with the ongoing pricing pressures in the sector and impact it has had on rent collection. In this most recent quarter, IIPR reported 97% rent collection which is inclusive of $1.5 million of applied security deposits. The largest driver of the uncollected rent came from tenant Parallel which defaulted at one of the properties in Pennsylvania.

Sub-100% rent collection is something that IIPR has only recently faced.

2023 Q2 Presentation

Parallel makes up 7.4% of overall invested capital with another troubled tenant in Holistic making up 5.1%. It should be noted that both these tenants are multi-state operators (‘MSOs’), meaning in theory different properties in different states may be performing stronger.

2023 Q2 Presentation

That said, on the conference call management noted that cross-default provisions were included for only 42% of their portfolio, and it is not so trivial for the company to pursue damages given that many of these tenants are heavily leveraged and IIPR might not be willing to own equity in their businesses. Management noted that Parallel is still current on obligations to their properties owned in Florida, a historically profitable state for cannabis operators.

Management noted that they had begun pre-leasing a project under construction in Cathedral City, California, one of the projects from the 2022 troubled tenant King’s Garden. Given that California is arguably the most competitive market in the country, I expect the company to be able to show stronger recoveries in Pennsylvania and other limited license states.

Management expressed cautiousness in M&A due to the high cost of capital - in spite of the company being underleveraged, it might not be so trivial to raise debt capital in the current environment. On the flip side, I am of the view that this higher interest rate environment is forcing operators across the board to focus on cost rationalization and driving profitability. These efforts arguably should have been done far earlier, but late is better than never.

Is IIPR Stock A Buy, Sell, or Hold?

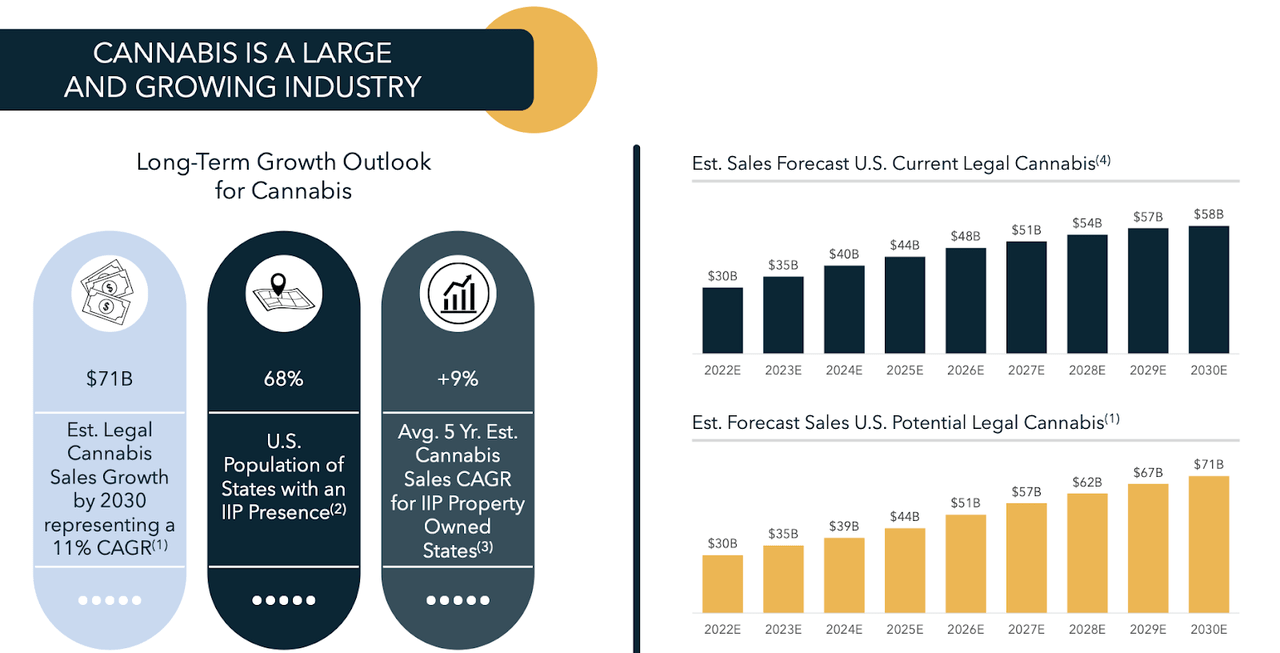

The battleground for IIPR stock is clear. On the one hand, we have the nagging fear that the legal US cannabis business model is not viable. On the other hand cannabis remains one of the most promising long term growth stories as more and more states legalize the plant for adult use.

2023 Q2 Presentation

The pricing pressure over the last few years may have made many investors think of cannabis as just a commoditized product, but I have differing views. First, the current demand environment is arguably artificially low given that a negative stigma will likely remain until cannabis is fully decriminalized both on a federal and state level. Anecdotally, even in my home state of California, where cannabis has been legalized for adult-use for nearly a decade, cannabis still is often seen as not being too dissimilar from hard drugs like cocaine. There is great irony in the fact that alcohol is generally accepted as a cultural norm in spite of being over 100x more dangerous in terms of mortality risk than cannabis. Personally I have been positively impacted by the medicinal benefits of the plant, which range from helping insomnia, anxiety, and chronic pain.

Second, the uncertain political state of the plant has allowed the illicit market to operate more or less uninhibited. There has been some reluctance to crack down on illicit operations as there are some conflicting messages sent with regards to social equity efforts, but the way things stand today, illicit operators are able to undercut legal operators on pricing due to not being subject to the same onerous 280e taxes. Regarding that last point, 280e taxes prevent cannabis operators from deducting operating expenses from the calculation of taxable operating income, leading many operators to have such high tax rates that they may be paying income tax even if they have an operating loss. While we are subject to the timeline of our politicians, I expect these issues to be eventually resolved at the regulatory level, meaning that the current financial struggles faced at many of its tenants is not forever.

In the meantime, IIPR continues to trade near its lowest valuations since coming public over five years ago.

Seeking Alpha

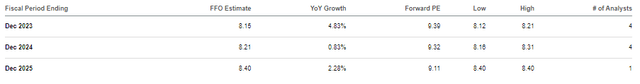

Consensus estimates have IIPR showing minimal earnings growth over the coming years. Perhaps the idea is that the ongoing 3% annual lease escalators might be offset by ongoing tenant troubles.

Seeking Alpha

I am of the view that IIPR deserves to trade at a premium or at least in-line with NNN REIT peers, which trade at around 12x to 14x FFO and at 5% to 6% dividend yields. That implies around 25% potential upside just to trade in-line with traditional net lease peers, but the stronger long term growth rate arguably demands a sizable premium.

What are the key risks? Sometimes investors cite regulatory reform as being a risk, but at these valuations it is a tailwind. Perhaps if IIPR were trading above $200 per share, a valuation which can only be justified by continued over-earning on external acquisitions, then I might consider potential regulatory efforts like the passage of SAFE banking or decriminalization of the plant as being risks. But with the stock trading at near a double-digit yield, reducing cap rates of acquisitions from 13% to 8% isn’t thesis breaking whatsoever. IIPR’s leases have long lease terms and will continue to have the elevated 3% annual lease escalators even following any regulatory reform. That means that IIPR could still grow at a faster pace than NNN REIT peers even following the leveling of the playing field. Any regulatory reform would likely bolster the credit profiles of its tenants, helping to address what appears to be the main source of the undervaluation today. Thus regulatory reform is the most direct catalyst to sparking upside in IIPR stock, at least from current valuations today.

The real risk is thus continued pressures to margins in the sector. Recent results from the top operators have shown some signs of stabilization, but cash flow generation remains difficult under the current regulatory environment. Even though I expect IIPR to continue generating enough cash flow to justify valuations, the uncertainty overhang may persist. It is worth noting that IIPR could see its revenues decline by 37% overall and the stock would still be trading at around 12x FFO. A lot of pessimism is being priced in here, and I am doubtful that we will come remotely close to any apocalyptic scenarios. It is worth noting that the company’s unsecured bond maturing in 2026 offers a yield to maturities above 10% and may be an attractive alternative to certain investors. Jeremy LaKosh covered those bonds here. I reiterate my strong buy rating for IIPR stock as the high dividend yield is not giving enough credit to the long term growth profile of this business.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IIPR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)