Tesla: Still Undervalued With Cybertruck Deliveries Coming Soon

Summary

- My previous call about Tesla's stock aged well because it has rallied over 30% since then, outperforming the broad market.

- Despite the harsh environment, Tesla continues to demonstrate strong revenue growth momentum and has a very promising pipeline of new offerings to the market.

- According to my valuation analysis, the stock is still substantially undervalued.

Dimitrios Kambouris

Investment thesis

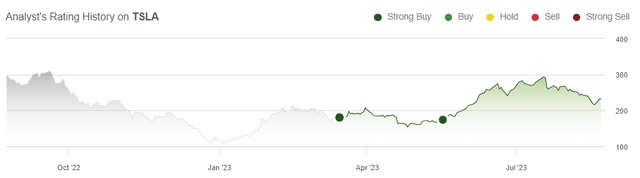

My two previous bullish articles about Tesla's (NASDAQ:TSLA) stock worked really well, with the stock rallying more than 30% since the latest thesis went live.

Today, I would like to reiterate my bullish thesis after analyzing the recent developments and updates incorporated into my valuation analysis. Tesla continues demonstrating strong revenue growth momentum despite navigating a very harsh environment. Profitability metrics are under pressure, but I believe they are temporary due to inflationary pressure and Tesla's massive discounts on vehicles. I consider it a smart strategic move since in the EV market, it is crucial to capture a significant market share in physical terms, given massive cross-selling opportunities related to software services delivered "on air". All in all, I assign TSLA a "Strong Buy" rating once again.

Recent developments

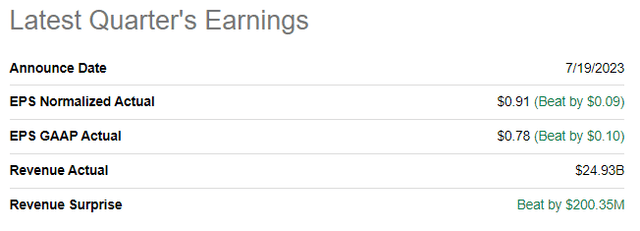

Tesla announced its latest quarter's earnings on July 19, when the company topped consensus estimates on revenue and the bottom line. Revenue demonstrated stellar growth momentum with a 47% YoY increase. The bottom line followed the revenue by expanding from $0.76 to $0.91.

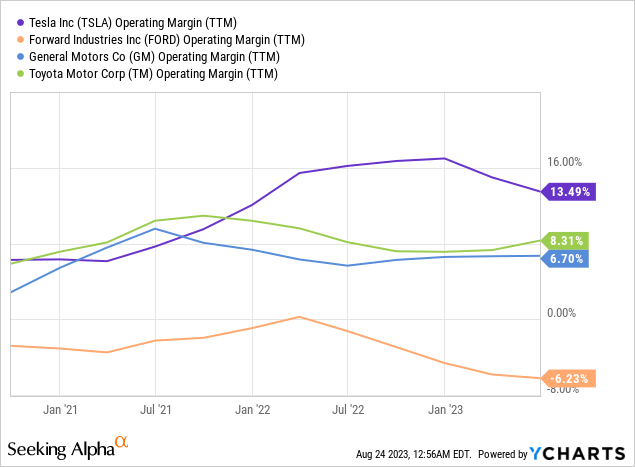

Due to the harsh environment and Tesla's discounts on EVs to boost sales, profitability metrics have deteriorated on a YoY basis. The gross margin narrowed from 25% to about 18%, and the operating margin decreased from almost 15% to below 10%. While Tesla's quarterly profitability metrics are deteriorating, from the TTM perspective, the operating margin is still higher than giant legacy automakers demonstrate.

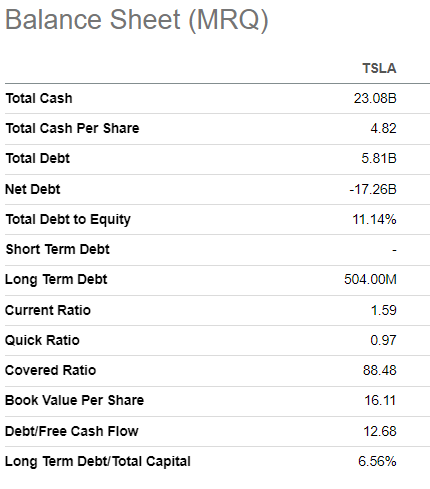

Despite severe headwinds and deteriorating profitability metrics, Tesla still managed to generate $877 million of free cash flow [FCF] during the quarter. Having a positive FCF even during the current uncertain environment is a solid bullish sign and makes the company's balance sheet even stronger. As of the latest reporting date, the company was in an above $17 billion net cash position with strong liquidity metrics.

Seeking Alpha

Generating the best-in-class profitability metrics and having a fortress balance sheet enables the company to invest heavily in innovation. During Q2 Tesla invested $943 million in R&D. The company has a promising pipeline of products and services where Cybertuck is an apparent pearl in Tesla's crown. Cybertruck deliveries start is close to commencement as the official delivery event is expected soon. Trucks are very popular in the U.S., where Ford's (F) F-150 model has been an absolute bestseller every year over the past half-century. Given a massive queue of Cybertruck of almost 2 million preorders, this new Tesla product is poised to boost the revenue and profitability of the company significantly. Apart from Cybertruck, Tesla continues working hard on its other promising projects which are likely to unlock new massive growth drivers. Full self-driving [FSD] beta has already surpassed over 300 miles driven, meaning the technology is constantly improving and is on its path to reaching the ultimate goal of making autonomous driving safer than human driving. Having FSD fully available for Tesla vehicles will make them much more valuable for customers. The company plans to generate an extra $15,000 per FSD-powered vehicle, which would be a huge boost since there would be almost no incremental costs for it - major costs are incurred at the R&D stage. The company also has several other potential moonshot projects like the improvement of batteries' energy density and humanoid robots. That said, I think the company does a great job of building long-term competitive advantages and value for shareholders.

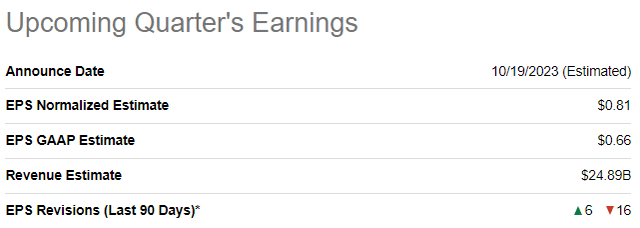

The upcoming quarter's earnings are planned to be released on October 19. Quarterly revenue is expected by consensus at $24.89 billion, indicating a solid 16% YoY growth. The adjusted EPS is expected to be under pressure again, with a decrease from $1.05 to $0.81.

Overall, temporary headwinds are apparent. But the company's profitability is still unmatched and the new offerings pipeline is very promising. The company has a vast potential for further exponential revenue growth, and profitability headwinds are temporary and not secular. The balance sheet is a fortress and will enable the company to weather the storm even if it lasts over multiple quarters. I am very optimistic about the company's long-term prospects, given the strong track record of innovation and the ability to introduce sensational products to the market.

Valuation update

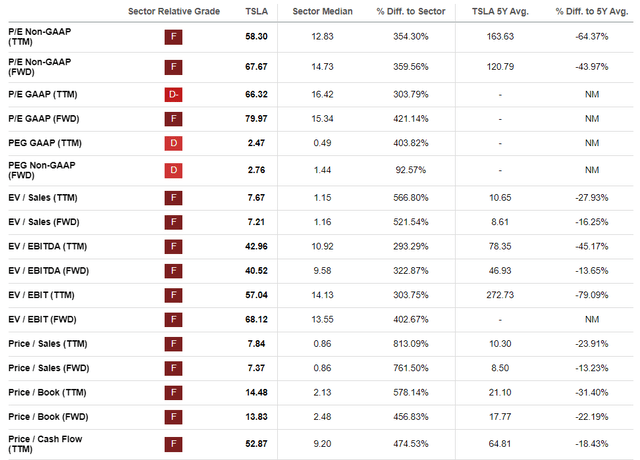

The stock demonstrated a massive 120% year-to-date rally, significantly outperforming the broad U.S. market. Seeking Alpha Quant assigns TSLA the lowest possible "F" valuation grade due to high multiples compared to the sector median. However, given the company's leadership in the EV market combined with the pace of revenue growth and wide profitability metrics, I would better compare TSLA's valuation ratios to historical averages. From this point, the stock looks massively undervalued because current multiples are double digits lower than the five-year averages across the board.

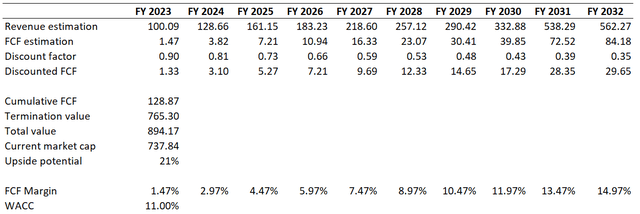

Now, let me update my discounted cash flow [DCF] simulation and adjust it to the temporary headwinds for the FCF margin and updated revenue consensus estimates. I use the same 11% WACC as I did earlier for TSLA's valuation analysis. The FCF margin I use for this fiscal year reflects TTM performance ex-stock-based compensation. I expect the FCF margin to start rebounding back to normal by expanding by 150 basis points yearly.

Even given below five percent FCF margin assumed for the next three fiscal years, the stock still looks about 21% undervalued. It is also important to remember that the company is in a substantial $17 billion net cash position, which makes the stock even more attractively valued.

Risks to consider

While I consider Elon Musk a genius, sometimes his behavior causes wild volatility in Tesla's stock price. As Tesla investors, we are taught that Mr. Musk can be very unpredictable. Being the most followed person on Twitter means that some of the Tesla CEO's tweets can cause significant market overreaction. We also saw in recent several months how much panic there was regarding Tesla stock when Elon Musk bought Twitter or when he partially sold his stake in the company.

That said, investors should be ready for short-term volatility in Tesla stock prices. Having a long-term mindset and dollar-averaging is the best remedy for Tesla investors, in my opinion.

Bottom line

To sum up, Tesla's stock is still a "Strong Buy". Near-term headwinds are obvious, but I like how the company navigates the challenging environment. Long-term prospects are bright, given the revenue growth momentum, which is highly likely to be fueled by the upcoming new products and software releases. Given the stellar revenue growth pace and best-in-class profitability metrics, the stock should trade with a premium in my view. However, according to my valuation analysis, the stock trades with above 20% discount, making it a compelling investment opportunity.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

I hear the same stories every week....fsd, ct, ai, charging stations. Lots of promises still be told from 3 years ago, and at anytime its gonna happen so the stock is really worth 2x value from now.....what?

0.65, 0.95, 1.07, 0.95, 0.73, 0.78, 0.66

Does that look like huge growth? No, it looks like it's going down. All of Tesla's wonderful high-growth, high-profit businesses are in those numbers.Then the author points out 47% sales growth by comparing one quarter to a COVID quarter when everything shut down.Free cash flow was 866 million. That's 28 cents per share for a 0.12% yield.Net cash position is $5.48 per share. Share price: $233.But don't worry, there are new products on the way, the main one being a truck that they can't manufacture that will have a few demo models out this year and production in the 2nd half of next year. And that production schedule is subject to "Elon time" so don't get your hopes up.From the numbers above, here is how I would summarize this article:Tesla is doing OK as a company. They are turning a profit and generating cash. However, the price is ridiculously high and it makes the metrics per share terrible. The earnings string above can't possibly justify $233 per share. But it's still possible to make money on this stock because someone might pay you more than $233 for it.