W. P. Carey: 30 Big-Yield REITs, Risk-Reward Edition

Summary

- Fearful investors have dumped shares of W. P. Carey (-17.5% ytd), and the dividend yield mathematically has climbed to 6.6%.

- After sharing comparative data on over 30 popular big-dividend REITs, we review 10 attractive W. P. Carey qualities, followed by 5 big risks.

- We conclude with a few more top big-dividend ideas, and our strong opinion about investing in W. P. Carey.

- Looking for a portfolio of ideas like this one? Members of Big Dividends PLUS get exclusive access to our subscriber-only portfolios. Learn More »

Big-dividend Real Estate Investment Trusts ("REITs") have been weak over the last two years, and W. P. Carey (NYSE:WPC) has been particularly weak, especially this year. The company's most recent quarterly financial results were strong, but overall macroeconomic concerns remain prevalent. After sharing comparative data on over 30 popular big-dividend REITs, we review 10 attractive WPC qualities and five big risk factors. We conclude with a few more big-dividend ideas, and our strong opinion about investing in W. P. Carey.

30+ Big-Dividend REITs

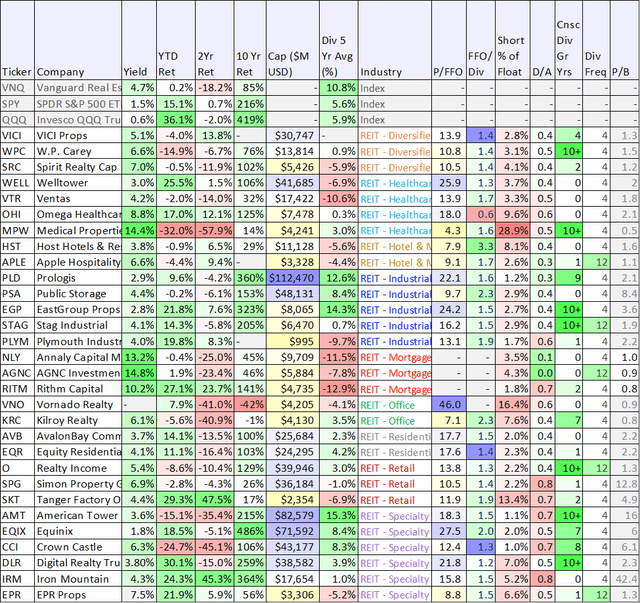

Before getting into the details on WPC, it's important to note that REITs come in a wide variety of shapes and sizes, such as the 30+ well-known REITs in the following table (we'll refer back to this table throughout the report).

data as of 24-Aug-23, source: StockRover (VNQ) (VICI) (MPW) (PLD) (STAG) (NLY) (AGNC) (RITM) (O) (SPG) (AMT) (CCI) (DLR) (SPY) (IRM)

Overview: W. P. Carey (WPC), Yield 6.5%

W. P. Carey specializes predominantly in single-tenant net lease commercial real estate, primarily in the U.S. and Northern and Western Europe.

It is one of the largest owners of net lease real estate and among the top 20 REITs in the MSCI US REIT Index (current market cap is $13.9 billion). WPC's portfolio is highly diversified by geography, tenant, property type and tenant industry. And the company has a successful track record of investing and operating through multiple economic cycles since 1973-led by an experienced management team. WPC also has an investment grade balance sheet with access to multiple forms of capital (more on this later), as well as stable cash flows (derived from long-term leases that contain strong contractual rent bumps).

Investment Strategy:

The WPC investment strategy is to generate attractive risk-adjusted returns, protecting against downside by combining credit and real estate underwriting with sophisticated structuring and direct origination.

WPC works to acquire "mission-critical" assets essential to a tenant's operations. And to create upside through rent escalations, credit improvements and real estate appreciation. WPC also works to capitalize on existing tenant relationships through accretive expansions, renovations and follow-on deals

WPC believes the hallmarks of its investment approach include diversification by tenant, industry, property type and geography. As well as disciplined, opportunistic, proactive asset management and a conservative capital structure.

Q2 Earnings:

WPC recently announced second quarter earnings, whereby the company delivered AFFO (Adjusted Funds from Operations) of $1.36 (beating expectations by $0.07) and delivered revenue of $452.6M (beating estimates by $22.12M). Here is what CEO Jason Fox had to say:

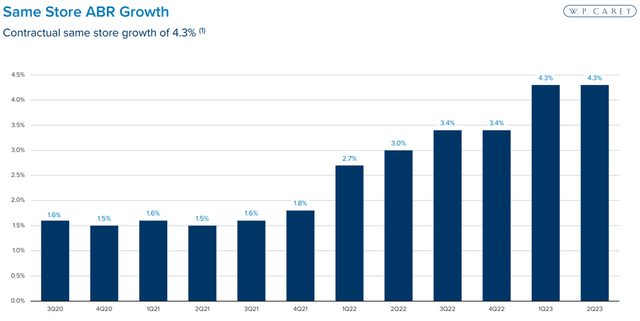

"Our performance over the first half of the year continued to be driven by the strength of our investment activity - completing close to $1 billion of investments - and contractual same-store rent growth that remained over 4%." And "we expect further deal momentum over the second half of the year, given the competitiveness of sale-leasebacks as an alternative source of financing and the investment spreads we're achieving. We're also confident in our ability to fund our investments and other capital needs without having to raise additional capital this year, something we view as a distinct competitive advantage in the current environment. Furthermore, we expect rent growth to remain elevated, reflecting the lagged impact of CPI on rents, as well as higher fixed increases."

10 Things We Like About W. P. Carey:

In additional to the healthy earnings results (described above), there are a wide variety of things we like about WPC.

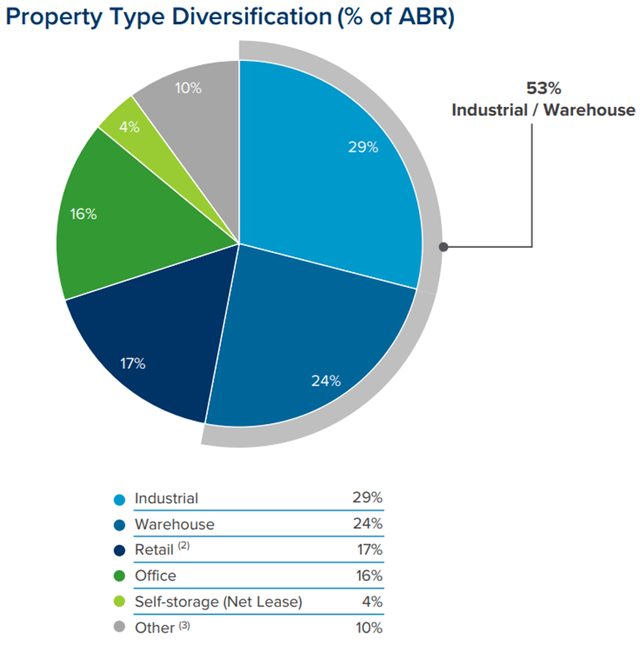

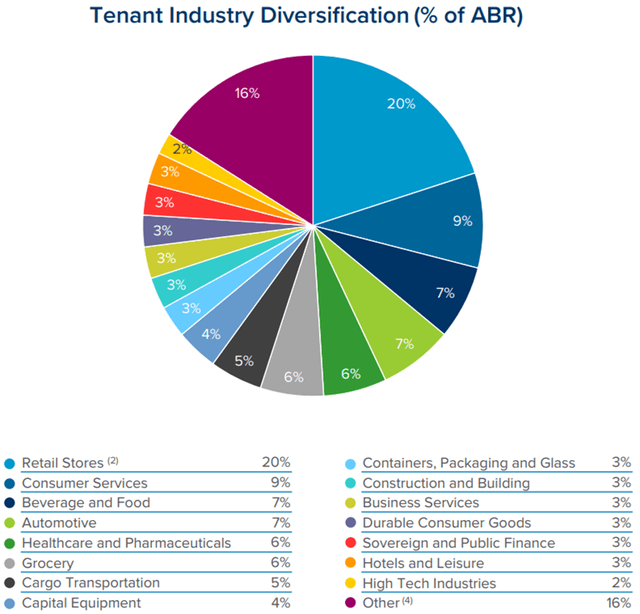

1. Diverse Investment Portfolio: W. P. Carey's investment portfolio spans various sectors, providing diversification and risk mitigation. The company has been successful in capitalizing on opportunities in North America and Europe, finding attractive deals in warehouse and industrial sale leasebacks, among others. The ability to source captive deal flow from existing tenants and private equity sponsors adds further strength to WPC's investment strategy.

2. Solid Fundamentals and Rental Growth: W. P. Carey's recent investment activity has been fruitful, with a significant volume of accretive new investments during the second quarter. The company's contractual same-store rent growth remains robust, making it a standout performer in the net lease sector. The favorable environment for sale leasebacks enables WPC to apply upward pressure on capitalization rates, further enhancing the potential for value creation.

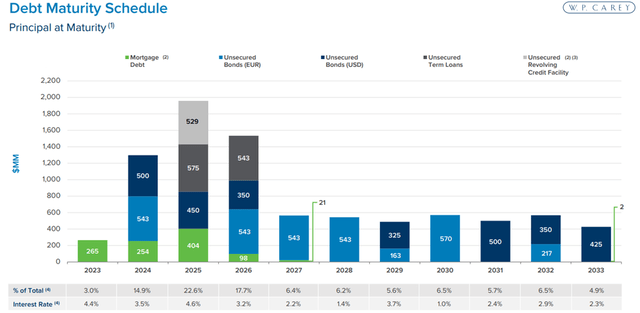

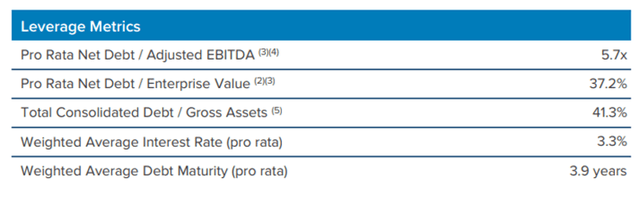

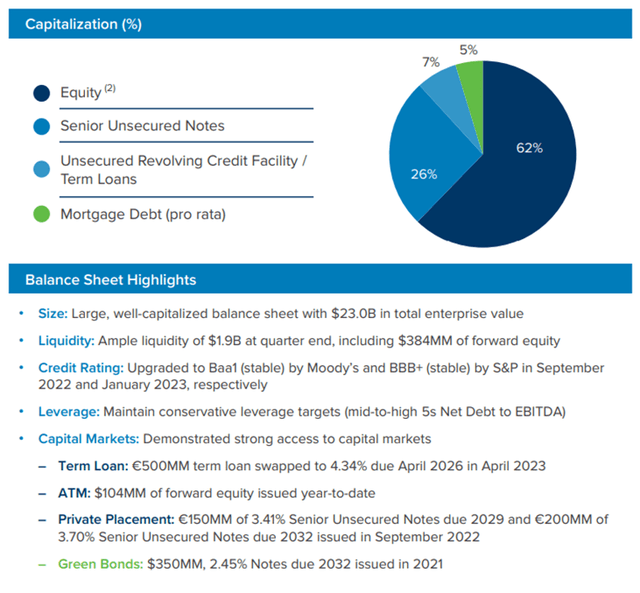

3. Capital Positioning and Flexibility: W. P. Carey's strong balance sheet positions the company well to manage its near-term debt maturities effectively. The company's prudent capital raising strategies and diverse sources of capital provide a competitive advantage in uncertain market conditions. With the ability to raise capital from various sources, including unused capacity on the revolving credit facility, unsettled equity forwards, and anticipated disposition proceeds, WPC can fund its investments without the need to raise additional capital in the near term.

Investor Presentation Investor Presentation

4. Stable Sale-Leaseback Market: The sale-leaseback market has remained stable throughout the year, particularly in the U.S. This stability indicates a healthy market for W. P. Carey's core business model, providing sale-leaseback financing solutions for operators.

5. Larger Transactions: W. P. Carey has seen larger transactions this year, indicating growth in deal sizes, with some deals ranging around $75 million. This expansion suggests the company's ability to handle bigger transactions and potentially drive higher revenue.

6. Competition Thinning: The competition has thinned out for W. P. Carey, particularly among private equity real estate peers, due to increased costs and reduced availability of mortgage financing. This favorable competitive landscape may provide more opportunities for W. P. Carey to secure attractive deals.

7. Decreased Office Exposure: The company has been strategically reducing its exposure to the office sector, decreasing it significantly from over 30% to about 16% of its total portfolio. This shift reflects W. P. Carey's focus on other asset classes like industrial warehouses, which are currently more attractive.

8. Positive Rent Bumps: The company has experienced positive rent bumps, with contractual same-store increases at 4.3% in the first two quarters of the year. This growth trend is expected to continue into the future, with projected rent bumps at around 4% for the back half of the year and an average of 3% for 2024. Positive rent bumps contribute to the company's revenue growth and overall financial performance.

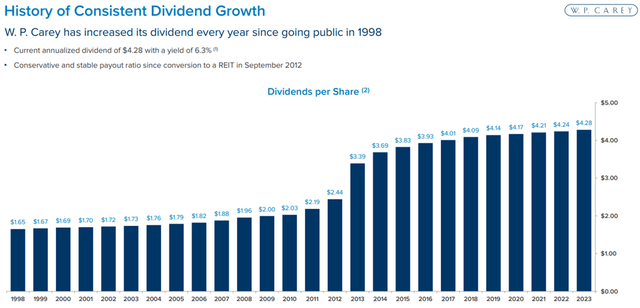

9. The Dividend: W. P. Carey has a robust history of dividend growth, having increased its dividend payout for 12 years in a row. This consistent track record of dividend growth reflects the company's stability and commitment to rewarding shareholders. For income-focused investors, a reliable and growing dividend stream is a crucial factor when evaluating potential investments. And WPC recently raised its quarterly cash dividend to $1.069 per share, equivalent to an annualized dividend rate of $4.276 per share. This suggests that W. P. Carey is committed to returning value to its shareholders through dividends.

10. Valuation: The current P/FFO valuation ratio of 10.8 times (see table earlier in this report) is notably low compared to historical standards. This suggests that the shares may be undervalued (but also faces risks, as discussed in the next section), thereby presenting an opportunity for investors to acquire shares at a favorable price. An undervalued stock with a strong dividend yield can provide an attractive combination of income and potential for capital appreciation.

5 Risks Investors Should Consider:

However, there are also risks that WPC investors should consider.

1. Interest Rate Volatility: Fluctuations in interest rates can impact the cost of borrowing for W. P. Carey, potentially affecting the profitability of its investments and financial performance (and its own valuation). For perspective, here is a look at the company's upcoming debt maturity schedule (below). This matters because as interest rates have recently risen sharply (and remain dynamic) refinancing maturing debt will likely come at higher rates.

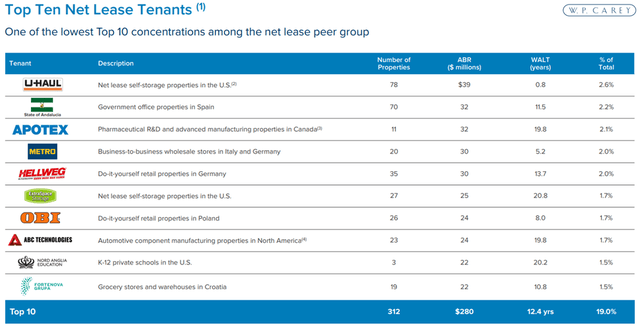

2. Tenant Credit Risk: W. P. Carey's revenue depends on the creditworthiness of its tenants. If major tenants face financial difficulties or default on lease payments, it could impact the company's cash flow and operations. Fortunately, as mentioned earlier (and as described in the graphic below), WPC is well diversified and has a relatively low tenant concentration. Nonetheless, the company's reliance of major tenants, such as Apotex and ABC Technologies, could lead to significant revenue exposure if any of these tenants face financial difficulties or fail to meet their lease obligations.

3. Economic Downturn: A broader economic downturn or recession could lead to higher vacancies and reduced rental income as tenants may struggle to meet their lease obligations. And this scenario could potentially be exacerbated by higher interest rates, as described earlier.

4. Office Portfolio Exposure: While W. P. Carey has been reducing its exposure to office properties, a significant portion of its portfolio (~16%) remains invested in this sector. Demand for office space may be influenced by economic conditions, remote work trends, and changing business needs. In particular, office property performance has continued to deteriorate dramatically in recent years following the pandemic and increased work-from-home.

5. Market Conditions and Competition: W. P. Carey faces competition from other real estate investment firms in the sale-leaseback market. Increased competition may make it challenging to find attractive deals or lead to higher acquisition costs. For example, the net lease transaction market has experienced slowdowns over the past year, making it challenging to find attractive investment opportunities. If the market continues to slow down or experiences unfavorable conditions, it may impact W. P. Carey's ability to deploy capital and acquire new properties. Further still, real estate valuations can be subject to fluctuations due to changes in demand, economic conditions, and other factors. A downturn in the real estate market could adversely affect the value of W. P. Carey's properties, leading to potential losses or reduced income.

The Bottom Line:

Overall, we believe WPC's growth has slowed (as evidenced by the slowing growth rate of its dividend increases), but it is still growing (thanks in large part to rent escalators), and it is well positioned to benefit going forward (considering its relatively strong financial position and very solid real estate portfolio). In fact, we believe the shares are attractively priced (i.e. an attractively low valuation), despite the risks, because the market will recover (knock on wood) and WPC is in a better position than peers to benefit.

We ranked W. P. Carey at #10 in our new report: Top 10 Big Yields: REITs, BDCs, CEFs, MLPs. And although we don't currently own shares (it's one of only two names in the top 10 that we don't yet own) we have owned W. P. Carey in the past, and we may add shares again soon. If you are an income-focused investor, WPC is increasingly attractive, and the shares are absolutely worth considering for investment.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Finally, if you are looking for more high-income opportunities, consider joining Big Dividends PLUS. Members get instant access to our 27-position High Income NOW Portfolio, currently yielding 9.9%.

*August Flash Sale: A significant price hike to our service is coming soon. So take advantage of a 20% Discount off all new annual subscriptions now.

This article was written by

Helping you manage your own investments.

- - - - - - -Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in WPC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

Seems increasingly compelling!