Redfin: How Far From The End?

Summary

- Redfin's stock performance has plummeted from all-time highs to all-time lows, with a drawdown of nearly 97%.

- The company's lack of profitability and declining revenues raise concerns about its survivability.

- Recent data shows a decline in existing home sales, further impacting Redfin's prospects. Data supported by Seeking Alpha's quant system also supports this stock as a Sell.

jhorrocks

Even without an official recession, Redfin (NASDAQ:RDFN) is performing poorly. Normally, homeownership and home ownership-related businesses are closely tied to economic conditions. While there is plenty of doom and gloom, the economy is still going strong, and I am not entirely sure where this business would land if we see the economy at its worst. That made me wonder how much gas is still left in the tank for Redfin, i.e. where they are now, and how things could get worse from here.

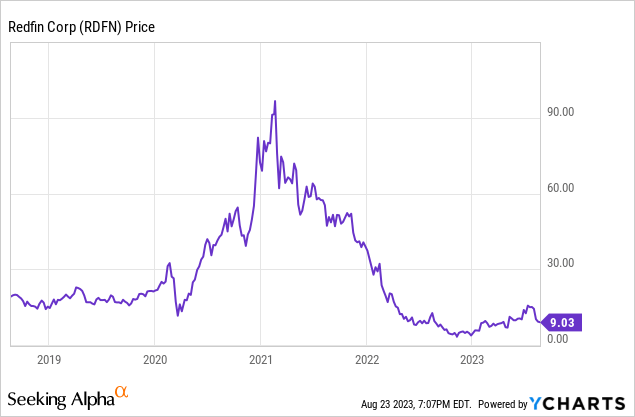

Stock Performance

In a span of 2 - 3 years, the company went from trading from its all-time highs to all-time lows and had the highest drawdown of close to 97% in this time! There is no way to sugarcoat this performance, and it is quite fascinating to see how the sentiment for this stock changed so quickly. This sentiment could also indicate that Mr. Market is highly pessimistic about the company's future.

But how warranted is this? Revenue has fallen as evidenced in the last 3 quarters and the company has shown losses for the last decade. So, like many other stocks on the market, the whole pandemic high occurred on the back of revenue growth with not much regard for profitability. But the reality has set in and when you take away the only driver of the stock price (revenue growth), you end up with a massive drawdown on the stock price.

Survivability

In my view, the biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital

-Li Lu

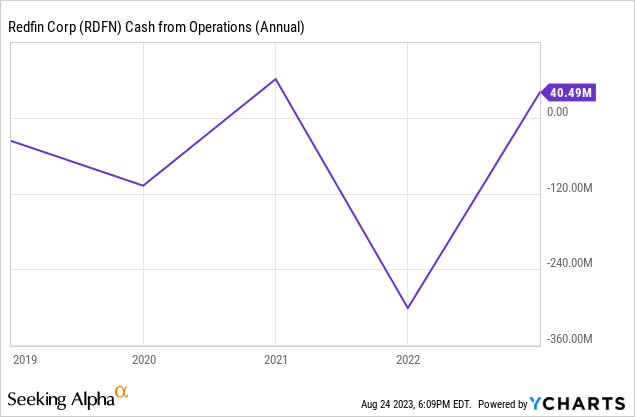

When this is the case, where the company has not shown profitability and is faced with falling revenues, survivability always comes into question.

Redfin has a total shareholder equity of $49.4M, and their low equity is mainly due to their long-term debt of close to $800M. At such a low level of equity, their debt-to-equity ratio starts to lose meaning. So we need to look into other areas to assess them. Their current ratio at 1.5 is sufficient but their quick ratio at 0.75 spells trouble.

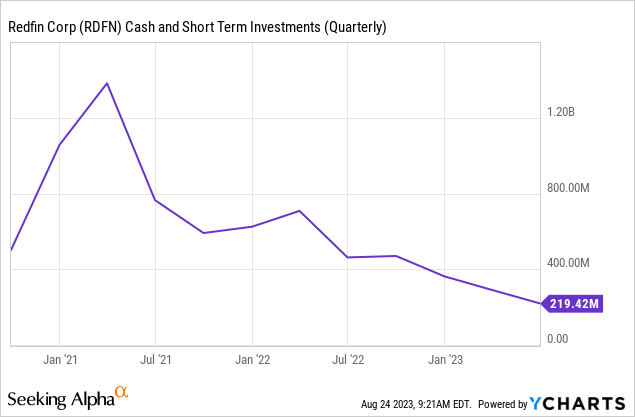

Considering their LTM EBIT was -311M, declining cash reserves and inconsistent cashflows mean that the company may have to count on raising money to continue its operations should these conditions continue.

Looking into the recent earnings, Revenue has fallen 27%, Gross margins are at 36.4% (an improvement of 4.5% from the last comparable quarter) and operating expenses have increased by 1.1% from the last comparable quarter. This shows that while revenues have fallen drastically, costs have not adjusted enough to keep the company in shape. Q3 outlook also shows the company projected to have a decline of 9 to 13% in revenues, while also projecting a net loss of $21 - $30M. This outlook coupled with the recent news doesn't inspire confidence in the company.

Recent News That Doesn't Inspire Confidence

In comparison to the previous year, there has been a 16.6% decline in existing home sales. The current sales activity is influenced by two primary factors:

1. The availability of inventory

2. Prevailing mortgage rates.

Unfortunately, both of these factors have not been in favor of potential homebuyers. The inventory of unsold existing homes stands at 1.1 million units. This is equivalent to a supply lasting for approximately 3.3 months, based on the current pace of monthly sales. In the preceding month, the inventory was slightly lower at 1.08 million units, or a 3.1 months' supply. This data underscores the ongoing challenge of limited inventory in the housing market.

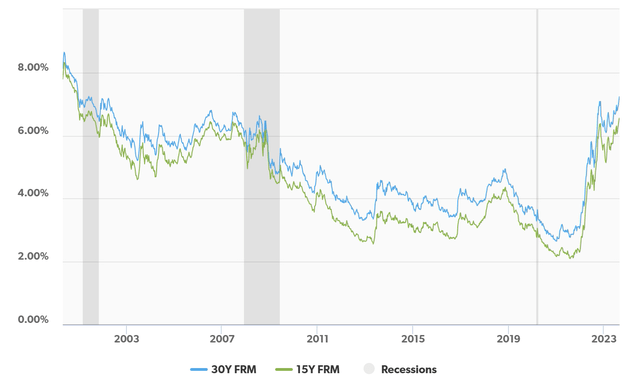

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 7.09% as of August 17. That’s up from 6.96% the prior week and 5.13% one year ago.

Mortgage Rates (Freddie Mac)

The 30-year fixed-rate mortgage has reached its peak level since 2001, and signs of persistent economic strength are expected to maintain upward rate pressure in the near future. With rates staying elevated and the inventory of unsold homes being notably insufficient, it makes sense that recent data shows a continued decline in existing home sales.

Sell Supported by Seeking Alpha's Quant Rating

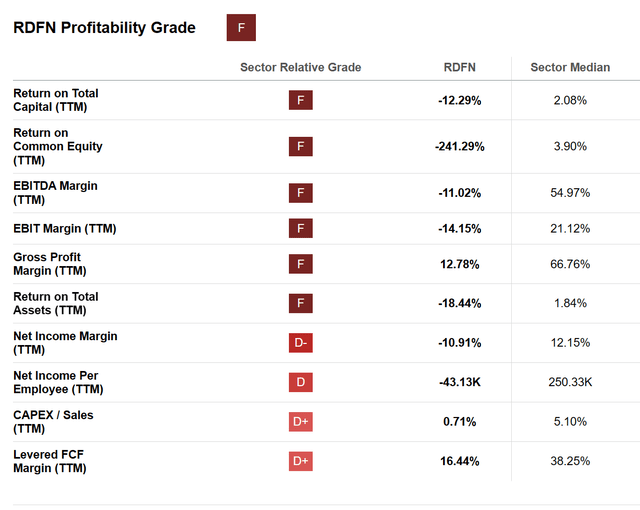

I rate this company as a Sell. Most indicators show that this company could perform badly in the coming months. The company has a Return on Total Assets (TTM) of -18.44% while the Real Estate sector median is 1.84%

Seeking Alpha

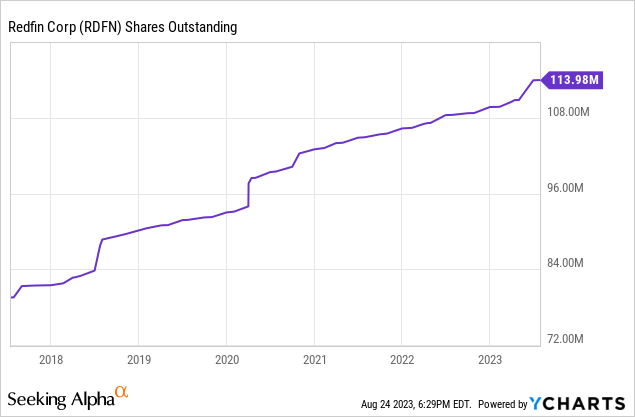

Its debt levels indicate its survivability could come into question should these conditions continue. It is hard to provide a timeline as the company could turn to multiple avenues to prolong its survival (e.g. equity raise). In fact, its stock dilution has seen a steady increase in the last 5 years and may see more dilution going forward as the company looks to different avenues to raise capital.

What Could Change This Thesis?

A possible way we can see this situation getting better is if we have another boost in home sales that we saw during the pandemic highs, which means we need low interest rates coupled with a short supply of inventory. This would be clearly out of the company's control, however. While the market has been expecting the Fed to cool off or "pivot" in the near term, a recent statement by Jerome Powell, had a clear message for the market.

We are prepared to raise rates further if appropriate. It is the Fed's job to bring inflation to the 2% goal and we will do so.

The other factor would be for the company to drastically bring down the costs to the point where it would start showing profitability (Improvement in Gross margins for the recent quarter is a step in the right direction). This would be quite unexpected and would definitely boost the price of the stock. It would also allow them to bring the balance sheet in shape, avoid the worst-case scenario, and ensure their survival till the macro gets better.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.