BJ's Restaurants: Good Near-Term And Long-Term Growth Prospects

Summary

- BJ's Restaurants, Inc. has good near as well as long-term growth prospects.

- The company plans to implement additional price increases and focus on improving customer satisfaction and brand loyalty.

- BJ's Restaurants is also investing in remodeling existing restaurants and accelerating new restaurant openings to drive future sales growth.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

BJ’s Restaurants, Inc. (NASDAQ:BJRI) has good multi-year growth prospects with near-term revenue growth benefiting from the carryover impact of previous price increases and additional price increases moving forward in the year. In addition, value offerings at different price points, and improving customer satisfaction and brand loyalty should also support sales in the near term. In the long-term, the company should benefit from accelerating remodeling of its existing restaurant base, and net restaurant unit development.

On the margin front, the company should benefit from price increases, cost-saving measures, four-wall margin improvement initiatives, and productivity gains due to improved staffing levels at restaurants. Moreover, the valuation is reasonable, which combined with the good revenue and margin growth prospects to make the stock a good buy at the current levels.

Revenue Analysis And Outlook

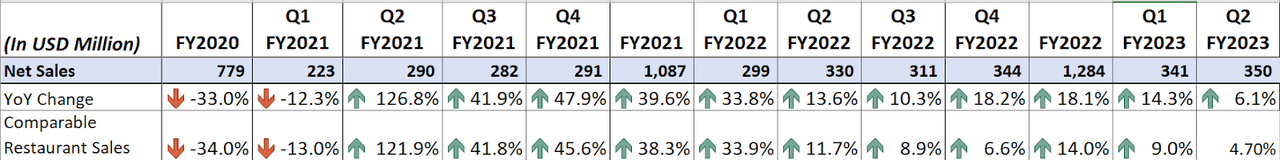

In my previous article on BJ’s Restaurants, I discussed the company’s good growth prospects ahead, benefiting from price increases and improving customer satisfaction. The company reported its earnings for the second quarter of 2023 since then and similar dynamics were seen there as well. In the second quarter of 2023, the company’s sales growth benefited from carryover price increases from the second half of 2022. In addition, improving staffing and guest satisfaction also benefited sales growth. Moreover, good consumer traction gained on the remodeled restaurants also boosted the top line. This resulted in a 6.1% YoY increase in sales to $349.7 million. On a comparable basis, sales increased by 4.7% reflecting a 7.6 percentage point benefit from price increases and a 2.9 percentage headwind from lower guest traffic and negative mix.

BJRI’s Historical Revenue (Company Data, GS Analytics Research)

Looking forward, I believe the company should continue to deliver sales growth benefiting from price increases, improving customer services, remodeling, and accelerated new restaurant openings.

Over the last year, BJRI increased its prices to protect the margins from inflationary headwinds. These price increases have helped it support comparable sales growth. However, the company did not increase prices significantly across the menu like many other peers in the industry. This has left the company some leeway to further increase prices on its menu. So, the company plans to take another round of pricing in September. I expect the carryover impact of previous price increases and new price increases should continue to help its comparable sales growth.

One interesting thing management is doing is being selective in terms of price hikes and to take price increases only on specific menu items rather than across the board price hikes. This should limit the impact on price-sensitive consumers. Moreover, the company has been consistent with its balanced approach by providing menu items across different price points. BJ's Restaurant chose not to raise prices for its lunch menu or for items that customers could easily make at home. This strategy is aimed at drawing customers to these menu items, emphasizing the extra value provided by the full-service dine-in experience. By doing this, BJRI offers customers a diverse selection of affordable food options. So, I believe the company should be able to sustain its comparable growth moving forward.

The company is also implementing various strategies to boost future sales growth. One of these strategies involves enhancing restaurant operations to enhance guest satisfaction and loyalty to the brand. As part of this effort, the company has been increasing the number of staff in its restaurants to ensure smooth service. This has had a positive impact on both the table turns and overall guest satisfaction. Additionally, the company has introduced janitorial services to ease the workload of table servers, which should further improve table turnover rates and enhance brand loyalty as guest satisfaction increases due to improved and fast service.

Furthermore, the company has placed emphasis on renovating its current restaurants to better suit the preferences of today's customers and generate more interest in its dine-in services. The remodeling initiative encompasses a range of potential enhancements, such as increasing seating capacity, installing new lighting, introducing artwork, revamping booths and tables, and updating the bar area, including a more contemporary bar featuring a new 130-inch television. These restaurant remodels have helped in supporting the sales growth to date through incremental guest traffic in those restaurants and seeing this positive traction the company has increased its target of remodeling the restaurants in 2023 from a previous target of 30 restaurants to now 35-40 restaurants in 2023. This increasing number of restaurant remodels should further drive guest traffic to the restaurants and also boost guest loyalty as their satisfaction increases from a good dine-in ambiance, resulting in sales growth moving forward.

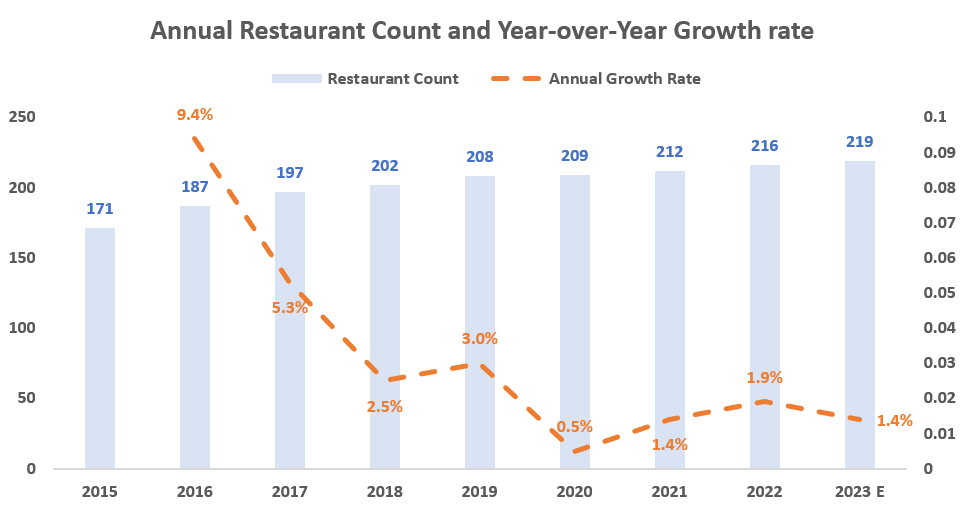

Lastly, the company should also benefit from accelerated new store openings. In recent years, BJRI has faced challenges in new store opening due to a shortage of labor and rising real estate costs after the pandemic. This has negatively impacted unit growth. However, with these challenges easing somewhat, I expect the company’s new unit growth to accelerate.

BJRI’s Historical Net Restaurant Unit Development (Company Data, GS Analytics Research)

The company currently has 215 restaurant units compared to over a thousand restaurants of bigger full-service peers like Chilli’s, Applebee's, and Buffalo Wild Wings. Management is targeting ~5%Y/Y annual new unit growth from FY25 onwards and this can help accelerate the company’s overall sales growth in a meaningful way.

So, I remain optimistic about both the near-term as well as long-term growth prospects benefiting from price increases, value offerings, improving guest satisfaction, benefits from remodeling efforts and unit development acceleration.

Margin Analysis And Outlook

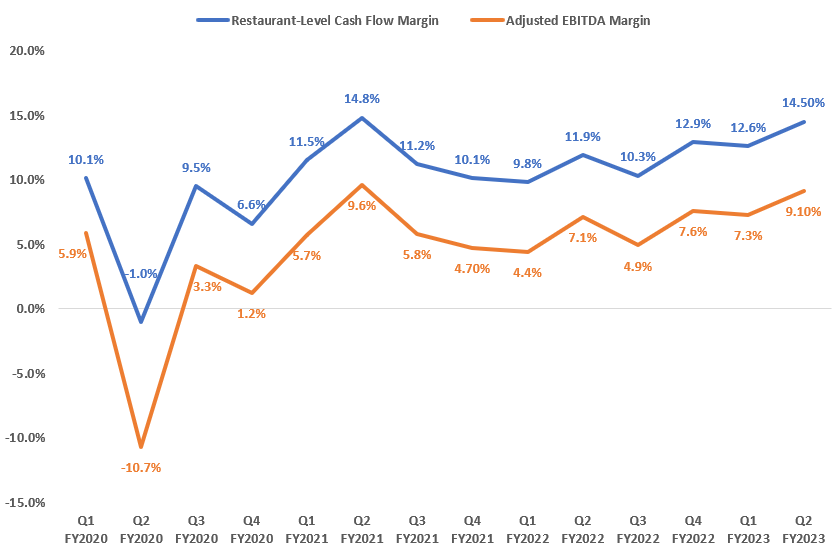

In the second quarter of 2023, the company’s margins saw good benefits from the carryover impact of previous price increases and increasing cost-saving and productivity gains. In addition, a 170 bps YoY decrease in the cost of sales due to flat year-over-year food costs also benefited the margins in the quarter. This resulted in a 260 bps YoY increase in restaurant-level margins to 14.5% and a 200 bps YoY increase in adjusted EBITDA margin to 9.1%.

BJRI’s Historical Restaurant-Level Cash Flow Margin and Adjusted EBITDA Margin (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to continue delivering margin growth. BJRI has been focused on improving the 4-wall margins by implementing cost-saving measures. The company targets to achieve $25 million in annual cost savings by evaluating different sourcing strategies of key inputs such as chicken breast, salmon, and avocados. In line with this, in the previous quarters, the company saw benefits from shifting its chicken sourcing from pre-cooked to raw chicken, which resulted in ~$4 million in annualized cost savings. The company did a similar shift in sourcing salmon which is also resulting in cost savings.

The company plans to further accelerate cost-saving measures in the coming quarters. One way the company is planning to drive cost savings is through contract renegotiation with supply vendors. As the supply chain has now significantly improved as compared to the previous year, the company has been able to find additional opportunities to work with vendors to take on additional items or different product at lower costs. These renegotiated costs are expected to run through the P&L in the second half of 2023. Moreover, BJRI also rolled out a new menu in July that has 15% fewer items. These reductions in menu items should also lower the cost of service moving forward. So, I expect these cost savings initiatives to continue to support the 4-wall margins and support the overall margin expansion.

In addition, I also expect productivity to further increase in the coming quarters. In the second quarter of 2023, restaurant manager retention exceeded the same quarter in 2019, and BJRI continued to see improvements in hourly team member retention, narrowing the gap to pre-COVID levels. This should lower new hiring and training costs and also result in productivity gains as these team members and restaurant managers continue to become efficient day by day. So, this improvement in overall staffing levels should also help the company in growing margins. Lastly, as mentioned in the revenue analysis, the company plans to take additional pricing moving forward, which along with moderating inflation should also result in improved margins. Hence, I remain optimistic about the company’s margin growth prospects ahead.

Valuation and Conclusion

BJ’s Restaurants is currently trading at ~20.63x FY24 consensus EPS estimate of $1.44. The company is a multi-year secular growth story with a good potential to significantly increase unit count from the current levels. If we think about a mid-single-digit unit growth and a low-to-mid single digit comparable restaurant sales growth, the company can post high-single-digit revenue CAGR in the long-term. With some benefit from margin expansion, the EPS growth can easily post double-digit CAGR in the long-term. The good long-term prospects are complemented by strong near term prospects from price increases, improving guest satisfaction, remodeling benefits, accelerating cost savings and the 4-wall margin improvement initiative. I find the valuation reasonable given the company’s good long term as well as near term prospects and, hence, have a buy rating on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)