Bitcoin: Will History Repeat?

Summary

- Bitcoin has broken down and could re-test the $20K level, erasing the immediate bullish case.

- A sell-off ahead of the halving is in line with previous cycles, and altcoins may outperform.

- Bitcoin's technical outlook and historical evidence suggest a potential sell-off/distribution phase before the halving. Altcoins may have already bottomed or be close to it.

- Looking for a portfolio of ideas like this one? Members of The Pragmatic Investor get exclusive access to our subscriber-only portfolios. Learn More »

BrendanHunter/iStock via Getty Images

Thesis Summary

After trading in a range for the last few months, Bitcoin (BTC-USD) has finally broken down. From a technical perspective, this erases my more immediate bullish case, and I believe we could now re-test the $20K area.

A sell-off here ahead of the halving would be very much in line with how Bitcoin has behaved in previous halving cycles.

If, indeed, history is repeating itself, we might actually see the altcoins outperform now, so this might be a good time to start dipping our feet in.

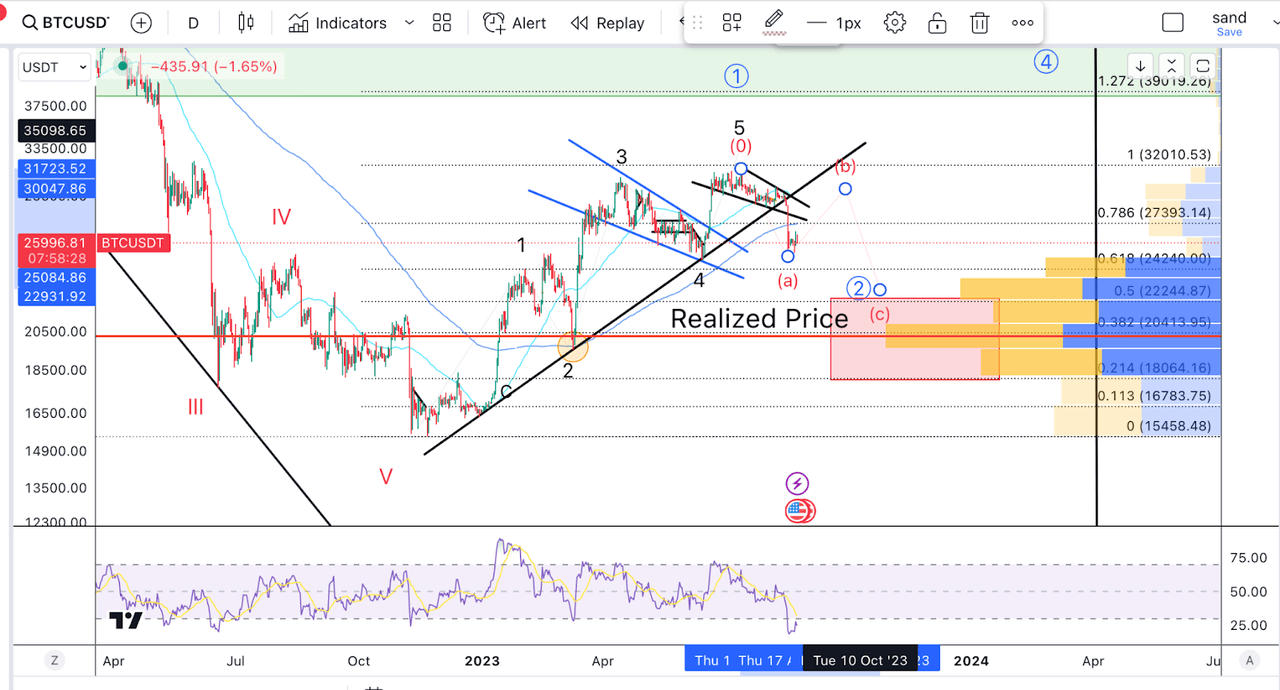

The Bitcoin Chart

With the latest sell-off, which took us below $20K, I now expect Bitcoin to retest lower levels:

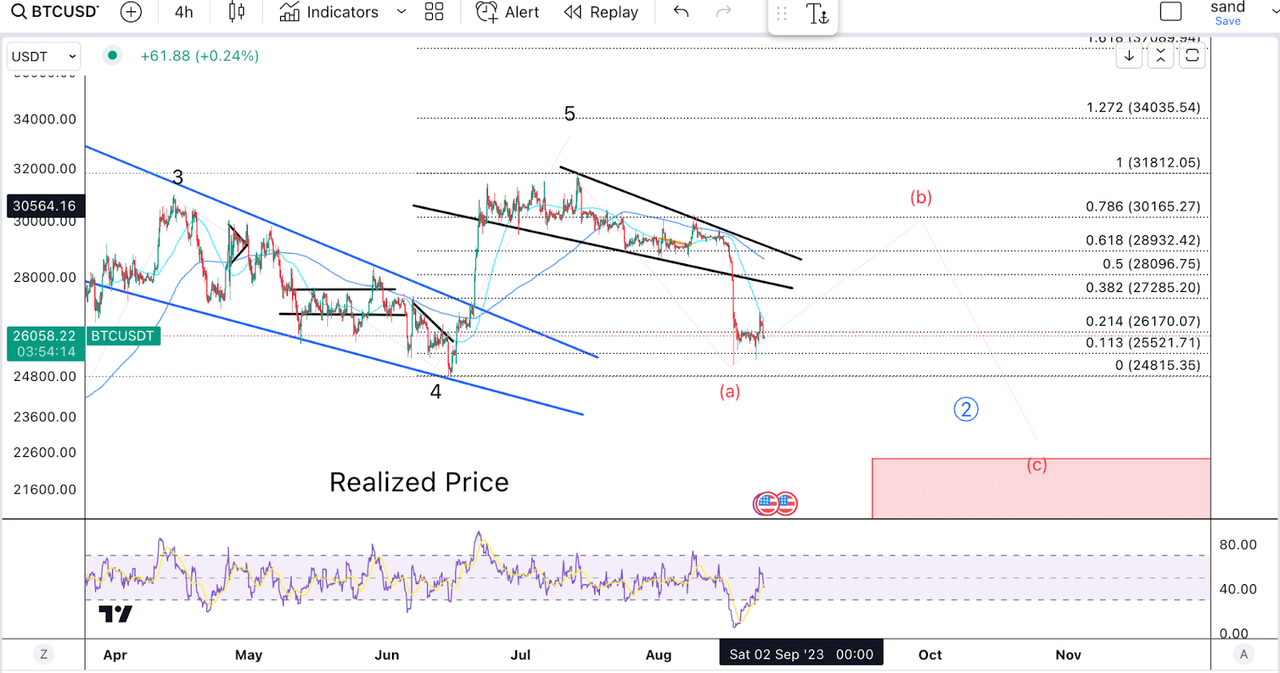

From an EWT perspective, we can make the case that BTC has formed a 5-wave impulse to the upside. This is not the best structure, in my opinion, with such a short wave 5, but it is, for the moment, the most bullish case I can make.

While I originally thought that BTC could be setting up for a breakout higher, the latest sell-off has changed this dramatically.

Firstly, if we zoom into the more recent action, we can see that we have retraced over 78.6% of the last rally (wave 5).

Though a set-up for higher isn’t technically invalidated until we break below the low set in June, odds have now strongly increased that we are heading down first.

Looking back at the daily chart, we can also appreciate that BTC has broken below the 50 and 200-day MAs and also below the trendline support.

Momentum has clearly shifted, and bears are in control.

So, where can we expect to find support?

The 61.8% retracement of the whole rally from the October lows takes us all the way down to $20,400. We can also see, as marked by the VRVP, that this is a strong area of volume, and this is also close to where the Realized Price is, an on-chain metric that reflects the market’s average Bitcoin cost.

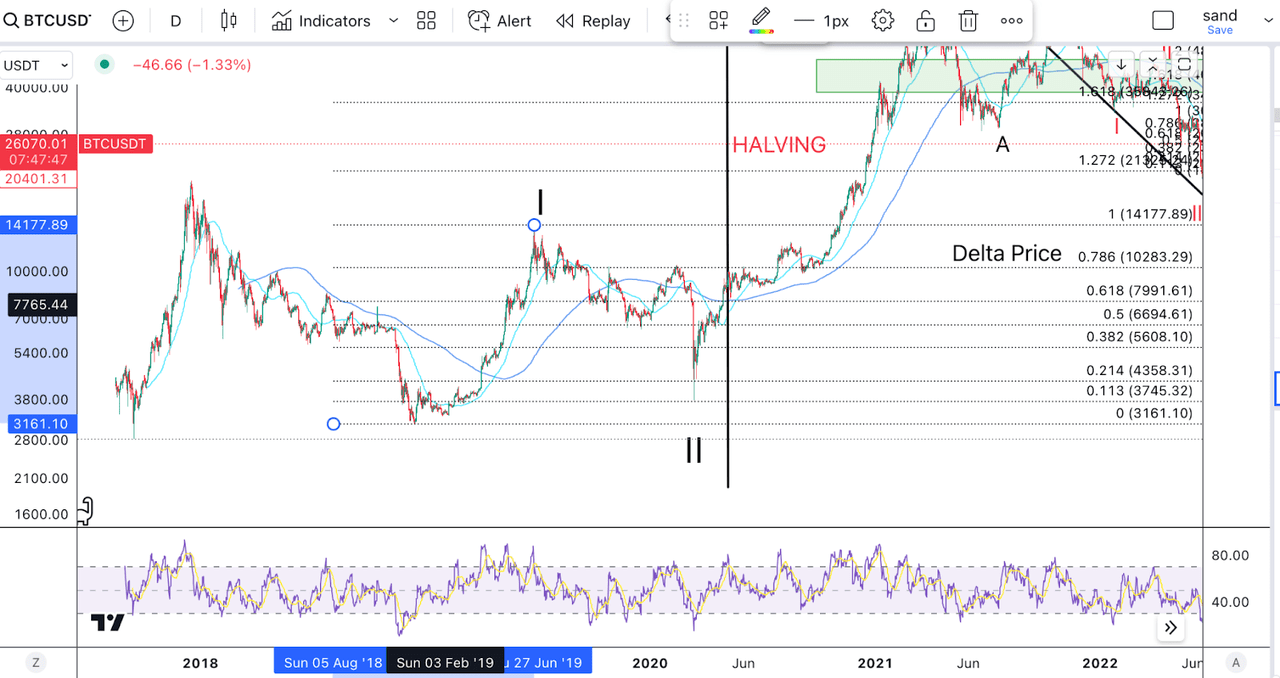

Is this just like last time?

As I have pointed out numerous times before, a sell-off/distribution phase ahead of the halving is exactly what you would expect, given historical evidence:

BTC price in 2020 (Author's work)

Before the last halving in 2020, Bitcoin rallied all the way up to $14,000, actually getting quite close to its previous all-time highs. From there, it sold off over 70%. We can see that it actually even reached the 88.7% retracement level.

It’s worth mentioning that BTC did dip just below its realized price at its lowest point, though it reversed quite quickly.

They say history rhymes, and this could certainly be the case with Bitcoin. Not only does the technical outlook support this but so does the macro environment.

Treasury yields are continuing to rise above what a lot of people expected, and the dollar is, for the time being, showing strong signs of strength as other currencies like the Yen and Yuan struggle.

With that said, China is beginning to ease its monetary policy, and the Fed should be near the end of its hiking cycle. The short-term outlook is not great, but in the medium term, the environment should be more supportive.

Another Lesson From History

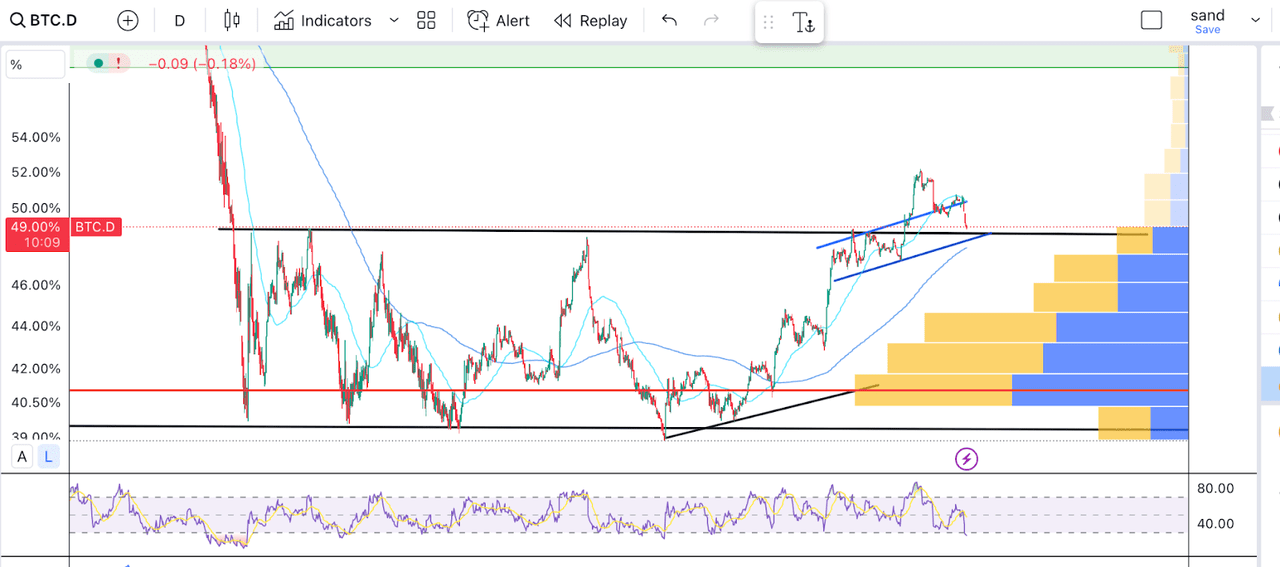

One of the highlights of this year in crypto has been the increase in the Bitcoin dominance, meaning that Bitcoin has been outperforming the other cryptocurrencies.

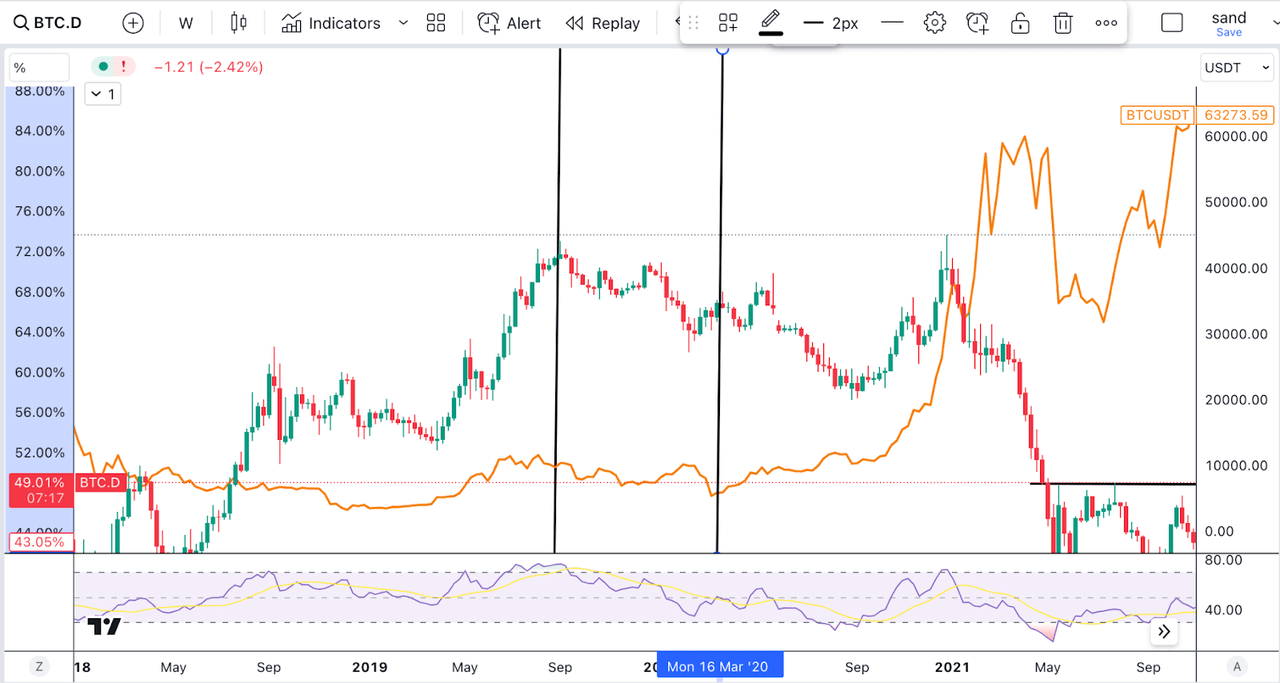

BTC dominance (TradingView)

As we can see above, BTC dominance reached close to 52% as the BTC price broke above $30K. However, we have seen a strong reversal following the latest sell-off.

Altcoins are once again outperforming BTC, and this is also what happened last time.

BTC dominance 2019 (TradingView)

In this chart, we can see BTC dominance and the BTC price in orange back in 2019-20. The black lines outline the period when BTC slid from its $14K high down to $3K ahead of the halving.

Notice how BTC dominance consistently fell during this period and, in fact, continued falling until September.

If this is the case again, and based on my analysis of many of the altcoin charts, then a lot of the altcoins could have already bottomed or be very close to putting in a bottom.

Takeaway

In conclusion, I think that BTC could be set to re-test the $20K level. This would be a great spot to buy and should set us up for the halving rally. In the meantime, crypto investors would be well advised to look at opportunities in altcoins, which could really begin to outperform in the coming months.

Crypto is a key element in building a truly diversified portfolio that will can protect your wealth from anything and anyone.

This is just one of many exciting cryptocurrencies you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the crypto space. Here's what you will get with your subscription:

Here's what you will get with your subscription:

- Access to our Crypto Portfolio.

- On-chain analysis of Bitcoin and Ethereum.

- Deep dive reports on Altcoins.

- Technical Analysis of major cryptocurrencies.

- News updates.

Crypto is changing the future, don't just watch it, be a part of it!

This article was written by

I am an economist and financial writer specialising in building robust and truly diversified portfolios that will preserve and increase wealth in the long term.

Having been born in Spain, to an English family, with extensive work experience in the US, and now living and travelling across Latin America and Asia, I believe this gives me a unique understanding of the global economy.

Only by investing in multiple assets around the globe can investors be truly diversified and protected from the ever-present risks posed by economic cycles and geopolitics.

My Links:

Investing Group: https://seekingalpha.com/checkout?service_id=mp_1401

Youtube: https://www.youtube.com/channel/UCUNZ28Ydsumo0P8FZ9OtquA

Podcast: https://open.spotify.com/show/7JVmqZUVhe1vvgDCstNBBJ

Substack: https://jamesfoord.substack.com/

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)

I'm whispering 20K, but see higher prices for 2024 as the Bitcoin Halving coincides with higher global liquidity.

seekingalpha.com/...I think we can rally for a few weeks then a drop along with equities. Risk Off in September.

It seems we may see higher highs at least to 36K$ first😎