Autodesk's Dominant Position And 'Switching Moat' Prime It For Strong Returns

Summary

- Autodesk holds a firm and dominant leading position in the digital design industry.

- Autodesk's switching moat provides the business with a sustainable competitive advantage.

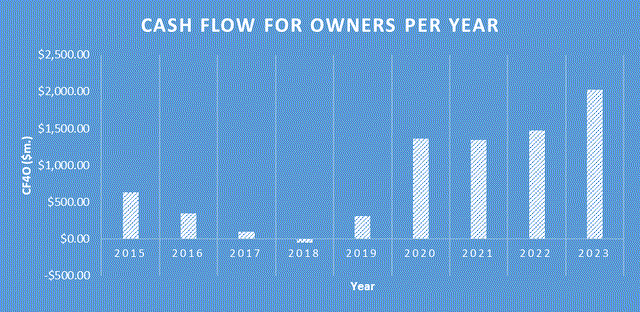

- Autodesk's billing transition impacts short-term cash flow; expected recovery by FY2026, with steady growth thereafter.

- ADSK is primed for a 9% annual return over the next 5 years at current valuations.

Parradee Kietsirikul/iStock via Getty Images

Investment Thesis

I'm of the opinion that Autodesk, Inc. (NASDAQ:ADSK) stock presents a strong buy opportunity. Autodesk has firmly established itself as a frontrunner in the digital design sector, consistently demonstrating its innovative capabilities and industry expertise. A key pillar of its success is the "switching moat" approach, which not only solidifies its market standing but also provides Autodesk with a lasting edge in a dynamic industry landscape. Although the company's recent shift in its billing strategy introduces near-term cash flow concerns, forecasts suggest a robust rebound by FY2026. Such adaptability highlights Autodesk's proactive and strategic mindset. Moreover, given the present market assessments, I anticipate an annual return of around 9% over the next five years, positioning Autodesk, as an attractive investment proposition.

Company Overview

Autodesk is a global leader in providing 3D design, engineering, and entertainment technology solutions. The company's diverse product portfolio includes AutoCAD, a professional design and drafting software; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Maya and 3ds Max, which offer 3D modeling, animation, and rendering solutions. Autodesk's products cater to professionals in architecture, engineering, construction, manufacturing, and the media and entertainment industries.

Autodesk has transitioned from a traditional licensing model to a subscription-based model. This shift allows customers to access Autodesk's suite of products through monthly or yearly subscriptions, providing flexibility and ensuring they always have the latest software versions. The subscription model generates recurring revenue for Autodesk, making its revenue streams more predictable. Furthermore, Autodesk's cloud-based solutions, like Fusion 360, enable collaborative work, allowing multiple users to access and work on projects simultaneously from different locations. This cloud approach aligns with the modern trend of remote work and collaboration. Autodesk's diverse product portfolio, combined with its subscription-based business model, positions the company as a leader in the design and engineering software industry. The company's commitment to innovation and adapting to modern work trends further solidifies its standing in the market.

A Dominant Player Innovating in the Design Landscape

Central to this leadership is AutoCAD, a ground breaking product that transformed the landscape of computer-aided design. Launched in the early 1980s, AutoCAD swiftly became the gold standard for professionals across various sectors, from architects and civil engineers to graphic designers. Its intuitive interface, coupled with powerful drafting and modelling capabilities, democratized digital design, enabling both novices and experts to bring their visions to life with unparalleled precision.

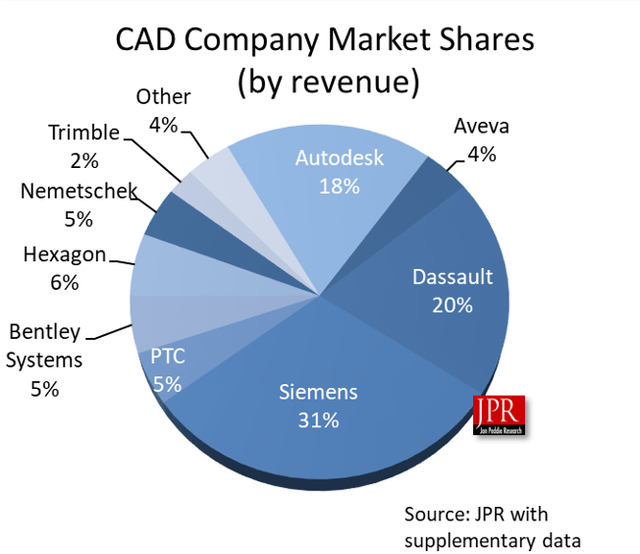

But Autodesk's leadership extends beyond just product offerings. The company's foresight in recognizing industry shifts and adapting accordingly has been instrumental in maintaining its dominant position. For instance, as the world gravitated towards cloud computing and collaborative work environments, Autodesk was quick to integrate cloud-based functionalities into its suite of products, ensuring users could access and collaborate on projects from anywhere in the world. This adaptability has not only kept Autodesk's offerings relevant but has also set industry trends, with competitors often playing catch-up. As can be seen below Autodesk has an 18% market share on global CAD company revenue.

JPR Data

Furthermore, Autodesk's commitment to education and community engagement has solidified its leadership credentials. By offering educational licenses, training resources, and community platforms, Autodesk has nurtured a loyal user base that spans generations. This entrenchment of their products among professionals makes it extremely difficult to leave Autodesk for a competitor, only further establishing the company's market position.

The Power of the Switching Moat

Autodesk's strategic evolution over the years showcases a classic example of a "switching moat" in the business world. A switching moat refers to the barriers that prevent a company's customers from changing to a competitor's product or service due to the high costs, in terms of time, money, or effort, associated with making such a switch. Autodesk, with its suite of software solutions, has masterfully embedded this moat into its business model.

When professionals across industries, be it architecture, engineering, or entertainment, invest in Autodesk products like AutoCAD or Maya, they're not just purchasing a software; they're investing in a comprehensive ecosystem. This includes training, certification, integration with other tools, and often a deep familiarity with the software's interface and functionalities. Over time, as companies and professionals become more entrenched in the Autodesk ecosystem, the perceived cost of switching to a different platform becomes prohibitively high. It's not just about the financial cost of new licenses, but the potential downtime, retraining, and inefficiencies that would arise from transitioning to a new system.

Moreover, Autodesk's move from perpetual software licenses to a subscription-based model further reinforces this switching moat. This transition mirrors the successful shift made by Adobe (ADBE), which saw a significant boost in its recurring revenue and customer loyalty after adopting the subscription model. With regular updates, cloud functionalities, and continuous support, users are enticed to stay within the Autodesk fold. The subscription model ensures that users always have the latest features and security updates, making the idea of switching to a potentially less updated or secure platform less appealing.

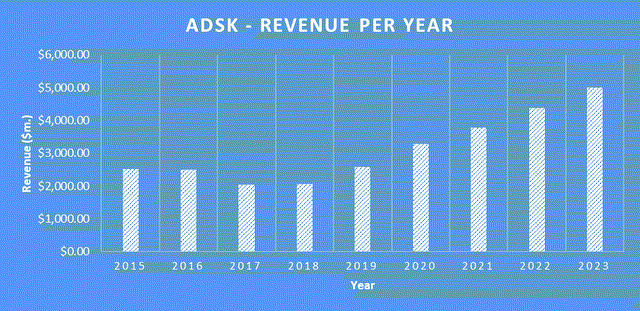

Autodesk made the switch to a subscription-based model in 2016. We can see that the company took a revenue hit in 2017 and 2018 as a result, however since 2018 the business has been able to consistently growth reoccurring revenue. Moving forward, over the long-term I expect Autodesk to continue this trend as more and more users get ‘locked’ into the ecosystem.

DJTF Investments

Additionally, Autodesk's commitment to education has led to its software being a staple in academic curriculums worldwide. As students become proficient in Autodesk tools during their formative years, they carry this familiarity into their professional lives, further perpetuating the cycle of reliance on Autodesk products.

In essence, Autodesk's switching moat is a blend of strategic product development, a user-centric approach, and a deep understanding of industry dynamics. By making the process of transitioning away from their products complex and costly, and by emulating successful strategies like Adobe's subscription model, Autodesk ensures customer loyalty, recurring revenue streams, and a dominant position in the markets they serve.

Free Cash Flow will be a Short-Term Problem

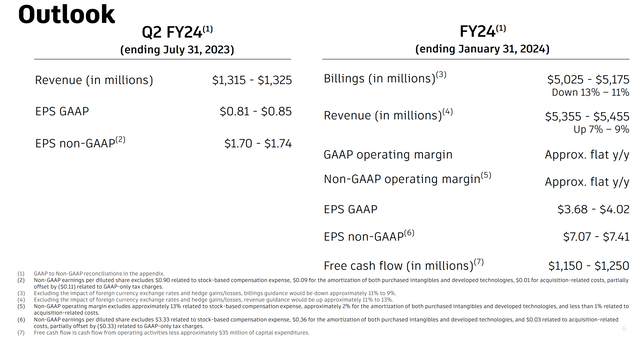

Autodesk is undergoing a pivotal transition in its billing approach for multiyear customers. Historically, like many in the industry, Autodesk charged these customers upfront, collecting payments for several years of service at the contract's outset. However, they are now shifting to an annual billing system, spreading out these payments year by year. This change is expected to exert pressure on the company's free cash flow, particularly in fiscal years '24 and '25. This billing transition commenced on March 28, and its financial implications will be more discernible from the second quarter post this date.

This shift, coupled with factors like a smaller multiyear cohort, foreign exchange fluctuations, and changes in the cash tax rate, is anticipated to have a pronounced impact on the company's free cash flow. Specifically, Autodesk projects its free cash flow for the upcoming period to fall between $1.15 billion and $1.25 billion. The midpoint of this projection, $1.2 billion, represents a substantial 41% decrease in free cash flow compared to fiscal '23. This decline is primarily attributed to the aforementioned billing transition. In essence, while Autodesk's billing strategy shift will pose short-term cash flow challenges, the company's leadership seems well-prepared to navigate this change and should lead to long-term benefits such as improved customer retention, reduced churn, and more predictable revenue.

Q2 2023 ADSK Earnings Presentation

Once this transition period has been completed, I expect free cash flow to return to FY2023 levels by roughly FY2025, then steadily growing at low double digits for the coming years after.

Financial Analysis

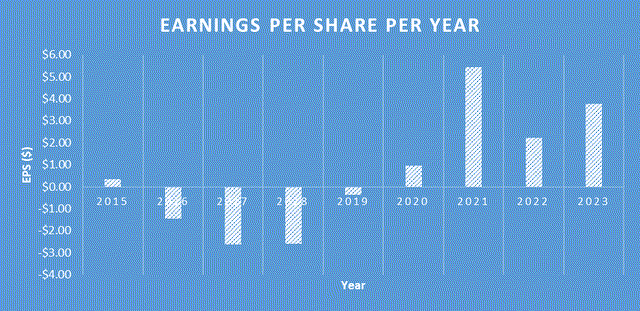

Over the past 5 years, the company has demonstrated remarkable financial performance. Its revenue has shown a consistent and strong growth, increasing from $2056.60 million in 2018 to $5,212.00 million in the last 12 months in 2023, representing a compound annual growth rate (CAGR) of approximately 19%. The earnings per share (EPS) have been equally impressive, in which the company flipped from being unprofitable as the business during the period they were transiting to their new subscription based model to now being very profitable with high margins. Earnings per share grew from -$2.58 in 2018 to $4.05 per share in the last twelve months, reflecting the company's ability to translate revenue growth into bottom-line success.

DJTF Investments

As of the most recent quarter, the company reported cash and cash equivalents of $2,073 million. The company's total debt stands at $2,281 million, a modest amount that reflects the company's conservative approach to leverage. This means that currently the business could pay almost all of its long-term debt directly from cash on the balance sheet, therefore balance sheet risk is not a concern for ADSK.

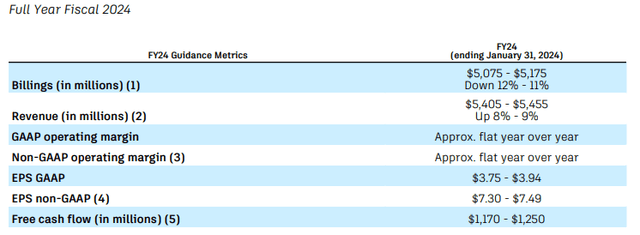

I expect Autodesk’s upcoming earnings results to be pressured for at least the next 12 months, as the transition in its billing approach for multiyear customers takes effect. As previously mentioned, the management team expect free cash flow to fall by about 43% in fiscal 2024, though free cash flow should return to growth in fiscal 2025 as the change in billing approach will be complete.

Looking beyond the next 12 months, assuming a continuation of the current favorable macroeconomic conditions, the company should maintain its strong revenue growth, and I fully expect the company to deliver to return to fiscal 2023 free cash flow levels by the end of 2026.

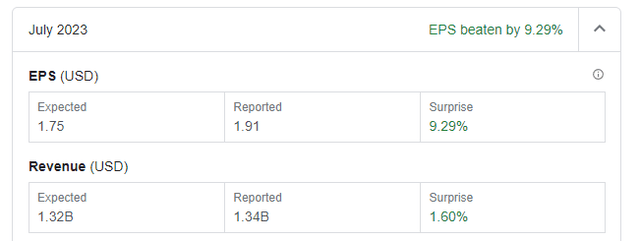

DJTF Investments

In terms of the short-term Q2 2024 earnings that were released on the 23rd of August, 2023, ADSK delivered results that exceeded analyst expectations. As you can see, EPS and revenue expectations were both exceeded which has resulted in a short-term rally in the share price, up over 5% in pre-market trading for the 24th of August 2023.

Google Finance

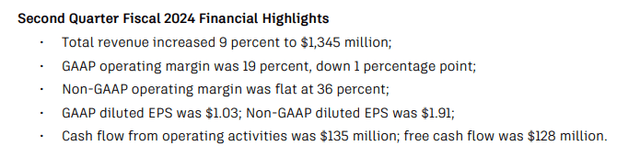

As you can see, ADSK revenue grew solidly at 9% YoY, despite a tougher than usual macro-economic environment, however we can see that EPS and free cash flow have been pressure as a result of the transition in its billing approach for multiyear customers.

Autodesk Q2 2024 Earnings

The management team also announced that they are raising their full year guidance as a result of:

Sustained momentum in the second quarter, and early expansion of some enterprise business agreements expected to renew later in the year, reduce the likelihood of our more cautious forecast scenarios.

Autodesk Q2 2024 Earnings

Overall, the recent Q2 2024 earnings further demonstrate Autodesk's strong competitive position, 'switching moat' and show that the decrease in free cash flow this earnings is very likely to be short-term in nature.

Valuation

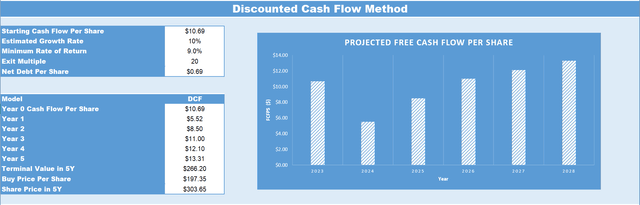

When considering valuation, I always consider what we are paying for the business (the market capitalisation) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cashflow analysis of the business as seen below.

DJTF Investments

ADSK’s current TTM Cashflow per Share as of Q2, 2024 (the latest earnings) is $10.21. Due to the transition in its billing approach for multiyear customers, I believe that 2024 free cash flow per share will be approximately $5.52, then should recover to about $11 per share by the end of 2026. Then there I expect the business to grow its free cash flow per share at a conservative rate of 10% annually from 2026 to 2028. Therefore, based on this outcome, the 2028 free cash flow per share is expected to be $13.31. If we then apply an exit multiple of 20, which is well below the mean price to free cashflow ratio for the previous 10 years, this infers a price target in five years of $303.65. Therefore, based on these estimations, if you were to buy ADSK at today's share price of $202.02, this would result in a CAGR of 9% over the next five years.

Risks

Firstly, Autodesk operates in the highly competitive software industry, where rapid technological advancements can quickly render products obsolete. If Autodesk fails to innovate or adapt to these changes promptly, it could lose its market share to competitors. The company's transition from perpetual licenses to a subscription-based model, while strategically sound, poses short-term revenue recognition challenges and depends heavily on customer acceptance. Any resistance or dissatisfaction from the user base could impact revenues.

Economic downturns or industry-specific recessions can also affect Autodesk's profitability, especially given its focus on sectors like construction, manufacturing, and entertainment. Global economic uncertainties, trade tensions, or disruptions in specific industries can lead to reduced spending on software solutions. Additionally, Autodesk's global operations expose it to risks associated with foreign exchange rate fluctuations, which can impact its financial results.

For example, Autodesk might earn revenues in one currency (e.g., Euros in Europe) and incur expenses in another (e.g., U.S. Dollars). If the Euro weakens against the Dollar, the revenue when converted to U.S. Dollars might be lower, while the expenses remain the same, leading to reduced profitability. Additionally, When Autodesk repatriates profits from its overseas operations back to the U.S., it needs to convert those profits from local currencies to U.S. Dollars. Any unfavorable exchange rate movement during this process can erode the value of these repatriated profits.

Cybersecurity is another concern. As Autodesk moves more services to the cloud, the risk of data breaches or cyberattacks increases. Any significant breach could not only result in financial penalties but also damage the company's reputation, leading to a loss of trust among its user base.

Lastly, regulatory changes, especially in international markets where Autodesk operates, can introduce compliance challenges or additional costs. Changes in tax laws, data protection regulations, or software licensing standards in any of Autodesk's key markets could impact its operations and profitability.

Conclusion

Autodesk stands as a dominant leader in the digital design realm, showcasing its prowess and innovative edge in the industry. Central to its strength is the "switching moat" strategy, which not only cements its position but also furnishes the company with a sustainable competitive advantage in an ever-evolving market. While the company's recent transition in its billing approach poses short-term challenges to its cash flow, projections indicate a promising recovery by FY2026. This resilience underscores Autodesk's adaptability and forward-thinking approach. Furthermore, based on current valuations, I estimate a 9% annual return over the forthcoming five years.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.