EWA ETF: Wait On The Sidelines

Summary

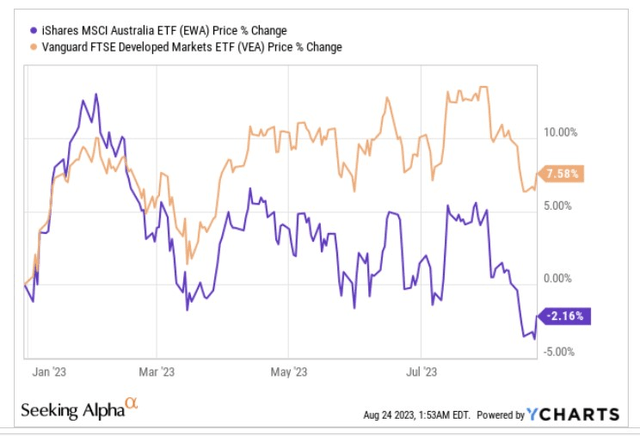

- iShares MSCI Australia ETF has had a disappointing year, down -2% YTD compared to the positive returns of the Vanguard FTSE Developed Markets ETF.

- The macro backdrop for Australian equities is uncertain, with GDP growth slowing and household spending declining.

- The asset quality of Aussie banks will likely worsen on account of a substantial rollover of low-cost fixed rate mortgages over the next two years.

- EWA's valuations are not cheap and the technical conditions don't look attractive either.

Abstract Aerial Art

Introduction

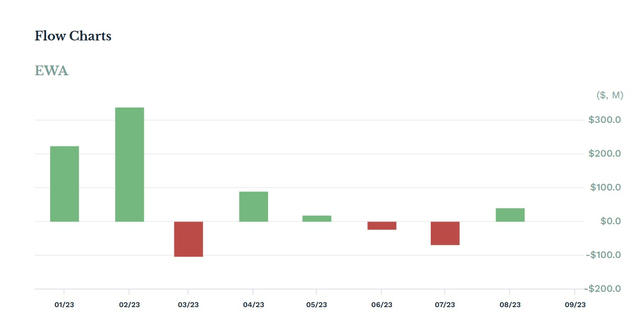

The iShares MSCI Australia ETF (NYSEARCA:EWA) a financial product that provides exposure to 59 large-and-mid-sized companies in Australia, hasn't enjoyed the greatest of years. Earlier in the year, there was a lot of fanfare about Australian equities potentially riding the tailwinds of a Chinese recovery (not to mention a more resilient domestic backdrop). Consequently, EWA witnessed sizeable fund flows in the first couple of months of this year (an aggregate figure of over $562m in just two months).

But the enthusiasm petered out with time, and on a YTD basis, EWA is actually down by -2%, even as the flagship developed markets ETF - Vanguard FTSE Developed Markets ETF (VEA) managed to generate steady positive returns of +8%. Could the situation reverse? Well, here are a few things that could prove to be instrumental in EWA's performance.

Macro Commentary

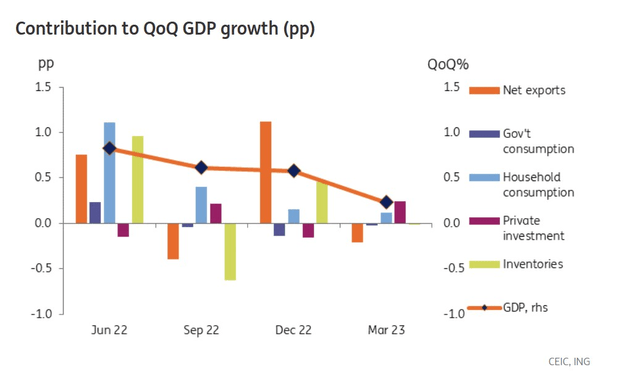

We're not sufficiently convinced that the macro backdrop will be resilient enough for Australian equities to truly flourish. GDP has been on a downward path since Q2 last year, and the year-end growth rate (1.9%) will likely only be half of what it was last year (3.7%).

Domestic consumption appears to have taken a real hit on account of the high-interest rate regime in Australia (400bps of rate hikes over 14 months). As per the most recent report, household spending only grew at 1.8% YoY (the lowest pace since February 2021), with discretionary spending declining for the third straight month (down by 0.7% in June).

Part of the cautiousness with domestic spending could likely be driven by the fact that a lot of these households are on course to enter an era where they won't quite have the salutary support of fixed-rate mortgage payments. It is believed that close to 900K fixed-rate mortgages will likely expire this year, with another half a million due to expire next year.

Needless to say, this scenario also means that Aussie banks are likely to be a lot more cautious in disbursing credit, as asset quality will almost certainly diminish and compress profitability. This is particularly pertinent for EWA as close to a third of the portfolio comes from Aussie banks (the largest sector exposure for EWA).

In fact, the country's largest bank, and EWA's second-largest holding - CBA has already flagged that debt arrears will likely increase going forward. Meanwhile, three out of four Aussie banks believe that the peak cash rate of 4.1% has been hit, so NII (net interest income) tailwinds too are likely to ebb, putting further pressure on the profitability.

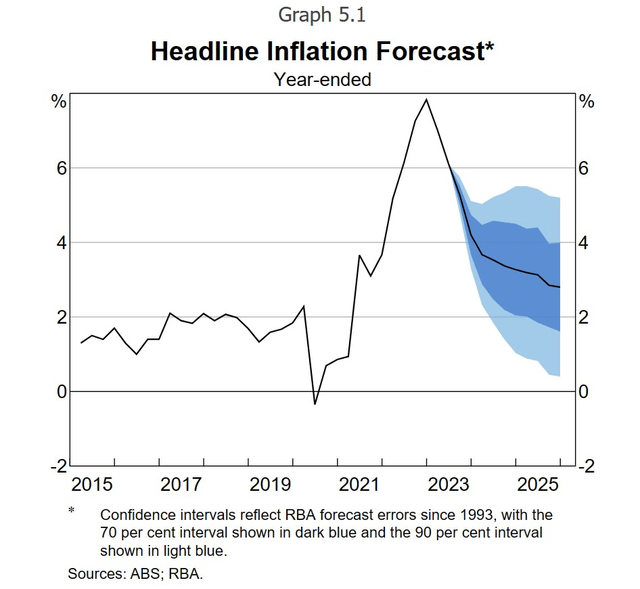

Inflationary pressures of around 6% could also continue to leave a mark on the cost-of-living, with the central bank stating that it will likely only drop to its target range of 2-3% by late 2025. Much of this is driven by services inflation, which is likely to be sticky.

Investors should also not dismiss the risk of goods inflation coming back, because of how weak the Aussie dollar has been of late. Interest rate differentials between Australia and the US have widened, whilst sub-par Chinese demand for bulk commodities has also left an adverse mark on the trade angle dampening the prospects of the Aussie dollar.

Closing Thoughts - Technical And Valuation Commentary

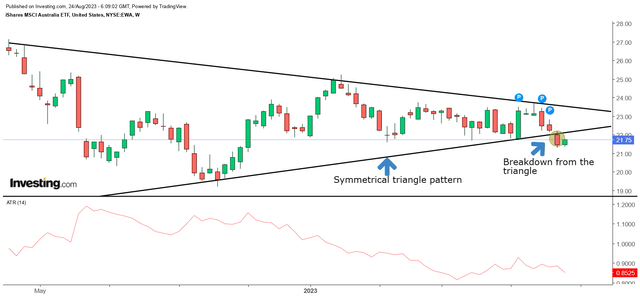

If one looks at EWA's weekly price imprints over the last 16 months, it looks evident that this fund had been going through a bout of volatility contraction, combined with a lack of leadership from either the bulls or the bears. This is exemplified by the formation of the sideways-oriented- symmetrical triangle pattern, coupled with significantly lower ATR (average true range) readings (the recent ATRs have been 25% lower than what they were in May 2022).

It appears that in recent weeks, the momentum may have tilted slightly towards the bears, as EWA broke down from the lower boundary of the triangle, but the ferocity of selling hasn't been too severe.

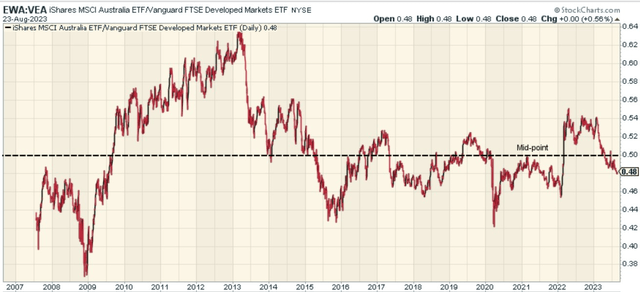

So, could EWA benefit from some bargain-hunting support? Well for that, we think Australian equities would need to come across as one of the most oversold pockets within the developed market universe. In contrast, the image below suggests that is hardly the case; the ratio shows that Australian equities as a function of developed markets are currently trading at around par levels and aren't the most attractive pocket to rotate into.

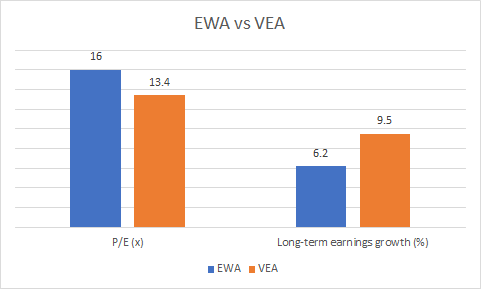

Finally, also consider that the valuation quotient and the level of earnings growth one gets at the multiple isn't the most attractive. According to Morningstar, EWA is currently priced at an elevated P/E of 16x, around 20% pricier than the corresponding P/E multiple for VEA. That premium multiple could be justified if EWA was offering a superior degree of long-term earnings growth, but its holdings are only expected to deliver 6% earnings growth, as opposed to 9.5% for developed markets.

Morningstar

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.