July 2023 Passive Income Update

Summary

- Our portfolio has underperformed the market once again this month year-over-year but beat out the TSX.

- We sold off our Stanley Black & Decker position for an 11% profit.

- We trimmed down our Microsoft position.

- With the USD funds we had from the sales, I decided to pump up our Home Depot position.

Anastasiia Yanishevska

July 2023 Passive Income Update

- 3 sources of passive income

- $879.81 from dividends

- 30 stocks/units dripped in June

- Trailing 12-Month Portfolio Return +3.20%

S&P 500 12-Month Total Return +13.02% for July 2023

S&P/TSX Composite Index 12 Month +1.86% August 22nd, 2023

Our portfolio has underperformed the market once again this month year-over-year but beat out the TSX. These interest rate-sensitive stocks have taken a beating recently. It's tempting to add to them more at the moment.

Alright, Let’s Get To Our July 2023 Passive Income

Raises/Cuts

Last month was a quiet month once again for dividend announcements.

Total Added Income from Dividend Raises in 2023 - Negative $-48.24

Still underwater from that 1 dividend cut this year… Soon enough, we will be positive though.

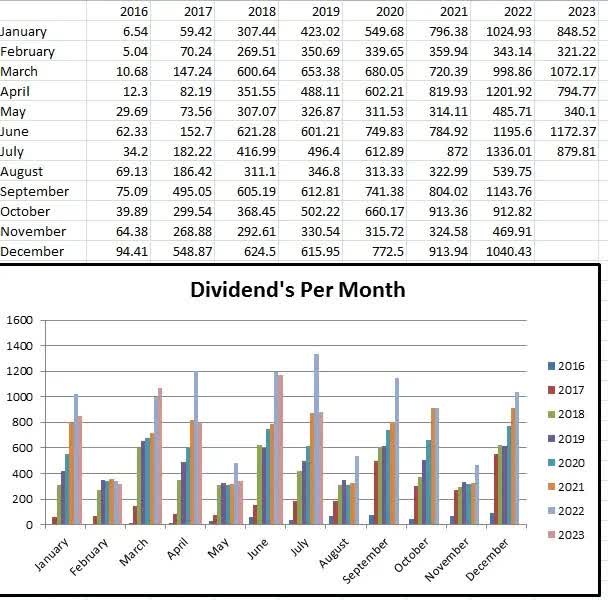

July 2023 Dividend Income

9 companies paid us this month.

| Stocks | July 2022 Income | July 2023 Income |

|---|---|---|

| Restaurant Brands (QSR) | 100.87 (1 Drip) | sold |

| RIT ETF (RIT:CA) | 67.56 (3 Drips) | sold |

| Bank of Nova Scotia (BNS, BNS:CA) | 110.21 (1 Drip) | sold |

| Smart Centers | 35.61 (1 Drip) | sold |

| Couche-Tard (OTCPK:ANCTF, ATD:CA) | 16.50 | 26.74 |

| Nutrien (NTR, NTR:CA) | 29.69 | 42.10 |

| Aecon (OTCPK:AEGXF, ARE:CA) | 113.04 (8 Drips) | 120.25 (9 Drips) |

| Cisco (CSCO) | 52.82 (1 Drip) | 55.77 (1 Drip) |

| TELUS (TU, T:CA) | 135.10 (4 Drips) | 30.18 (1 Drip) |

| Algonquin Power (AQN, AQN:CA) | 196.23 (11 Drips) | 125.88 (12 Drips) |

| TD Bank (TD, TD:CA) | 170.88 (2 drips) | 120 (1 Drip) |

| TC Energy (TRP, TRP:CA) | 155.70 (2 Drips) | 169.26 (3 Drips) |

| Bell Canada | 151.80 (2 Drips) | 189.63 (3 Drips) |

| Totals | 1336.01 | 879.81 |

30 stocks/units dripped in July.

Lots of drips but the income has dropped quite a bit. That’s understandable though as we sold off lots of stocks to pay off our HELOC last fall.

Our Drips (Dividend Reinvestment Program) added $41.49 bucks to our forward income. Nice!

Other Income

Private Investment Payment - $1000.00

1k a month, very nice!

Solar Panel Income

In June (we always get paid a month later), our solar panel system generated 1,144 kWh. Since we bring in a fixed rate of 28.8 cents per kilowatt hour, Hydro One (OTCPK:HRNNF, H:CA) deposited $329.65 into our chequing account this month.

Last June, the system generated $386.83, so this month has brought less sun. Kinda expected as we have gotten more rain this season than anytime I have ever remembered.

Total Income for 2023 - $1,193.87

System Installed January 2018

Total System Cost - $32,396.46

Total Income Received - $13,366.16

_____________________________________________

Amount to break even - $-19,030.30

Bring on the sun!

Total July 2023 Passive Income - $2,209.46

June 2022 Passive Income - $2,7,22.84

Down as well but over 2.2k is still very sweet!

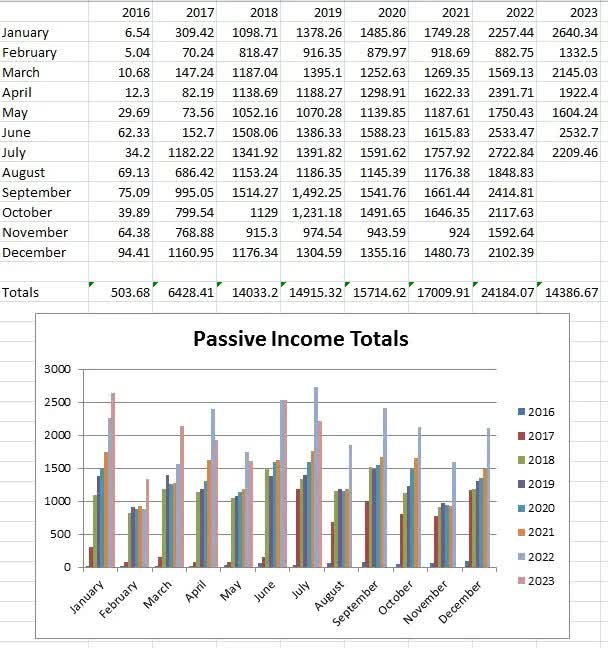

Totals For 2023

Dividends Year To Date Total - $5,428.96

Other Passive Income Year to date - $8,957.71

Total Passive Income for 2023 - $14,386.67

Year End Goal - $26,000 (55.33%)

7 months in and we continue to be behind the goal. Setting them high and missing is better than being low and hitting I guess. 5 months left though!

July Stock Purchases/Sales

This month, we made 2 purchases and 2 sales.

Sales

We sold off our Stanley Black & Decker (SWK) position for an 11% profit. I just didn’t find myself wanting to add to this position anymore and the stock took off a bit so we sold out. We sold 27 shares at 98.91 per share, losing $87.48 in forward income.

We trimmed down our Microsoft (MSFT) position. I know crazy! You never sell Microsoft. I hear you all, but at a 39 P/E ratio, I thought it would be a good idea to just take some profits. The AI hype drove this position to 8.4% of our portfolio and I wanted to lower our exposure and add to another US position. We sold 8 shares at $362.49 per share, losing $21.76 in forward income. Microsoft is still in our top 3 holdings.

Purchases

With the USD funds we had from the sales, I decided to pump up our Home Depot (HD) position. Love the company and its dividend growth. Also, if you know me, I love Halloween, in particular, Halloween animatronics. This year, HD came out swinging, and out of all the main retail stores, I think it's safe to say HD has the best ones out there. Such a small factor in their business, I know, but you gotta own the companies you like!

We bought 19 additional shares for $316.48 per share, adding $158.84 in forward income.

TELUS (TU, T:CA) - We continued to build back our position in TELUS. We bought 87 shares at $23.80 per share. This purchase adds $126.53 in forward income.

All in all, we added $176.13 in future yearly dividend income with these purchases. And eliminated a holding in our portfolio.

Total added forward dividend income from purchases in 2023 - $797.25.

Bitcoin

Bitcoin pulled back a bit the last month but we continue to add 20 bucks a week to our position.

Financial Goals Update

Charities

- We continue our monthly donation to The Nature Conservancy of Canada of $85.

ETF Monthly Minimum Purchase of $250

- This month, we added 0 more units of XAW ETF (XAW:CA).

- Questrade* is great because it offers free ETF trades and cheaper stock trading options than most Canadian brokers. $250.00 a month would kill us if we needed to pay high trading fees.

- * Note the Questrade link is an affiliate link and at no additional cost to you, I would get a little payment if you were to sign up. You could get $50 in free trades by using my affiliate link, though.

We didn’t add this month as I felt like our purchases offered a better opportunity at the moment.

July 2023 Passive Income Conclusion

Overall, a great month and a fun summer with the family. Time is flying by as we quickly approach September already. Just crazy!

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.