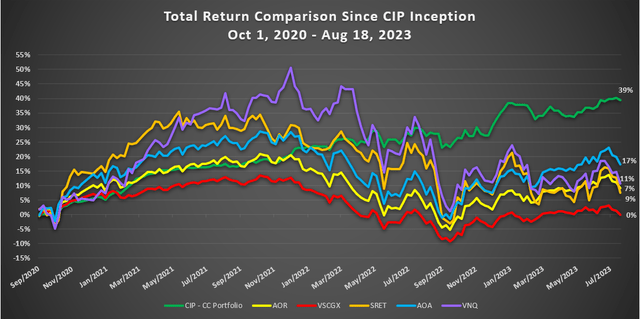

UTF: A Look At This 8.2% Yielding Infrastructure Closed End Fund

Summary

- Cohen and Steers Infrastructure Fund invests in infrastructure companies, which provide the physical framework for society.

- The fund has delivered solid returns over the long term and its current leverage is better financed than many other CEFs.

- We look at the price at which this would be attractive to us.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

Artur Nichiporenko

Cohen and Steers Infrastructure Fund (NYSE:UTF), as the name indicates, invests in infrastructure companies. This closed end fund's factsheet provides good color on the meaning and the businesses covered under the infrastructure umbrella.

Infrastructure companies typically provide the physical framework that society requires to function on a daily basis and are defined as utilities, pipelines, toll roads, airports, railroads, marine ports, telecommunications companies and other infrastructure companies.

Source: Fund Factsheet

The aim of this $3.2 billion fund is to earn high current income for its unitholders, and for that it has chosen its sectors well. The most recent data is as of June 30, and it shows that about 40% of the assets are invested in the utilities sector.

Fund Factsheet

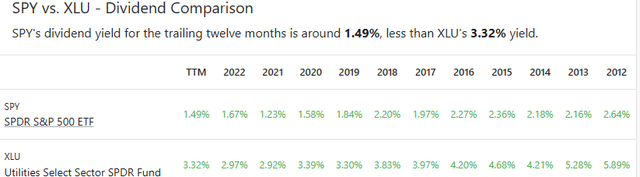

Along with being one of the more defensive sectors, utility companies have historically paid higher dividends than the broader market.

portfolioslab.com

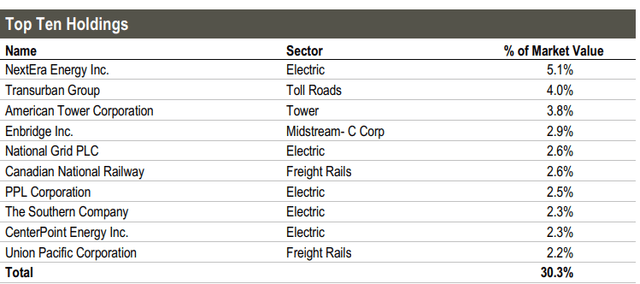

The last published numbers for UTF show that the portfolio is comprised of over 230 holdings, with a little over 30% concentrated in the top 10.

Fund Factsheet

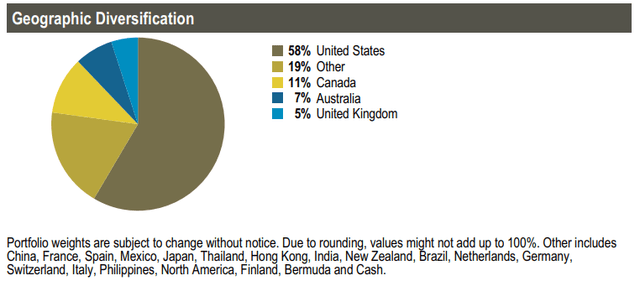

The above list has several known names, a couple of which, we have covered on this platform like American Tower Corporation (AMT) and Enbridge Inc. (ENB). Some may find UTG's 30% allocation to the top-10 names less than desirable, however, we do not see it that way. Investors typically do not bet all their money on a single fund, so UTF's portfolio concentration provides a satisfactory diversification taking that into consideration. We covered another closed end fund earlier this year, the Reaves Utility Income Fund (UTG). That fund had less than 50 holdings versus the 245 held by UTF, and the top 10 held 45% of the portfolio. That passed muster with us, so UTF is even better in that regard. As is evident from the above listing, the majority of the holdings are US and Canadian, with Australia and United Kingdom occupying just enough real estate to be listed separately and not being grouped with the "other" category.

Fund Factsheet

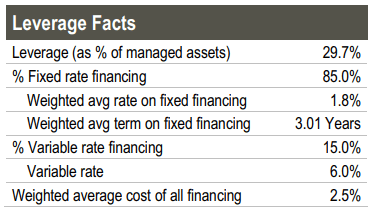

The leverage at 29% is higher than UTG (around 21%) and close to DNP Select Income Fund (DNP) (around 27%), another utility based closed end fund in our coverage list. UTF has one thing going for it here is that the vast majority of the leverage expense is fixed rate. While the term of that financing is low, the 1.8% financing is really an awesome buffer today.

Fund Factsheet

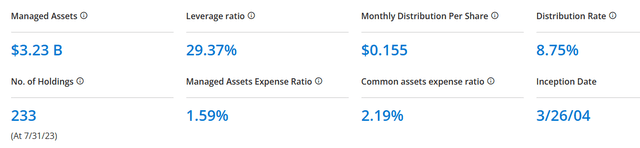

The funds common assets expense ratio is 2.19% as reported on the website.

Fund Website

This ratio is poised to rise as more interest rate hikes flow through to the bottom line. Over longer time frames, even that fixed rate will have to be refinanced at a far higher rate, and that will mean more pressure on the fund to sustain its distributions.

Outlook and Verdict

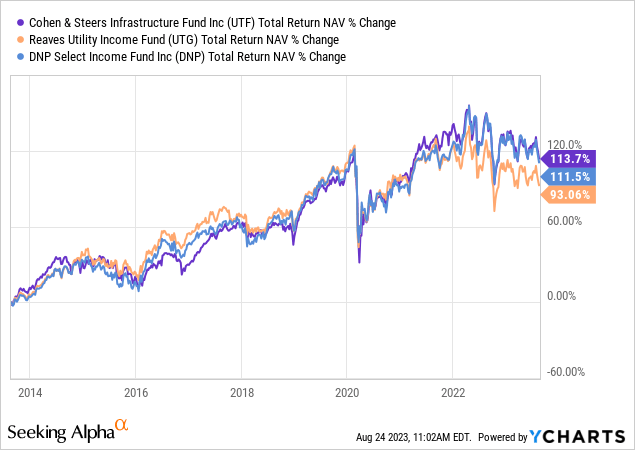

We can see that UTF leads the pack in terms of the total return NAV performance over the last decade, although DNP is not far behind at all.

The utility sector has become less expensive now compared to earlier this year when it was close to 19X, and we covered UTG and DNP.

MacroMicro

It is still higher than what our risk appetite will permit, therefore we reiterate our stance from March 2023.

In this climate, utilities should be trading at a sub 14X multiple. While that may sound low, keep in mind that in 2002 and 2009, utilities bottomed at under 9X earnings. So 14X seems extremely generous given the near 90% probability of a recession within 12 months. The P/E ratios are also likely to turn out completely incorrect. That is, earnings will come up short. This will be influenced by the upcoming recession as well as the huge jump in interest costs for these heavily indebted utilities.

Source: DNP and UTG: Updating Our Outlook On 2 Utility CEFs

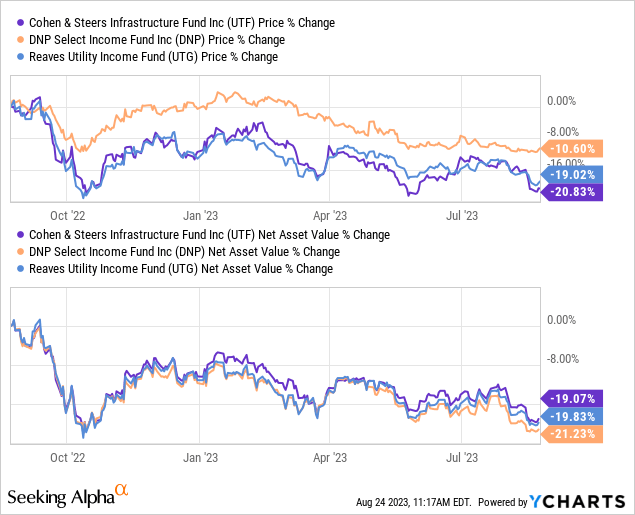

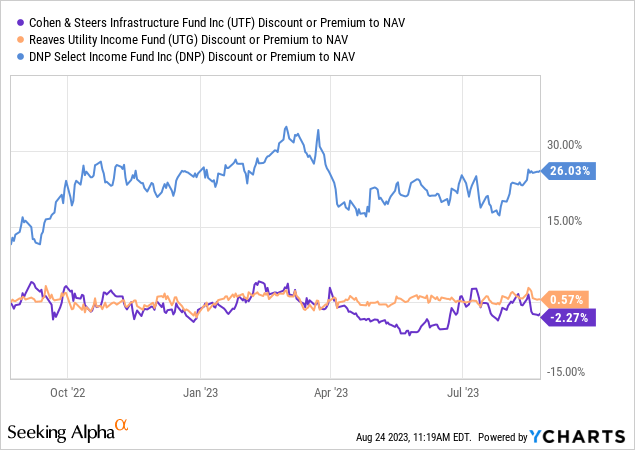

Add leverage of the underlying holdings to the mix, and we stick with our expectation of seeing NAV losses in this cycle. UTF distributes around 8.6% based on the $0.155 monthly payouts and the current price of $21.52. Since the NAV is in the same postal code, distribution on NAV is not very different. This mouthwatering yield from a collectively defensive group of companies will face pressure as the underlying holdings feel more pain. While both the price and the NAV of the three funds have been battered in the last year, the market has favored DNP of the three.

The NAV, however, begs to differ. The premium for DNP continues to be stunningly disproportionate with no bearing on reality, and we do not see any reason to change our rating on this CEF from our past coverage.

While UTF is the most discounted, it is insufficient at present to chase a leveraged fund, and we rate it a hold. We would look for a buy point about 10% lower in NAV with a widening discount (closer to 7-10%). That may seem far-fetched, but so was the concept of 5.5% risk-free interest rates 18 months back.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ENB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.