X4: De-Risking By WHIM Indication, Promising Potential For Expansion To Larger Market

Summary

- X4 is nearing approval of its lead candidate for WHIM syndrome and aims for label expansion to a much larger market of chronic neutropenias.

- Despite very small WHIM target population, orphan designation (=premium pricing) and potential for non-dilutive funding from monetization of a priority review voucher justify upside potential.

- Early data from 3 patients in ongoing phase 2 study in chronic neutropenia patients are promising and showing durable responses. More data are expected in December.

- Considering de-risking by pending approval in WHIM syndrome, cash runaway into 2025 (not including monetization of PRV), and promising potential for expansion to larger chronic neutropenia market, I recommend XFOR stock as a "Buy".

Md Babul Hosen/iStock via Getty Images

Overview of the thesis

X4 Pharmaceuticals (NASDAQ:XFOR) is nearing approval of its lead candidate, mavorixafor, for WHIM syndrome, for which indication mavorixafor is eligible for a priority review voucher (typically worth $100M). Despite having a very small target population, orphan designation allows for premium pricing and considering XFOR's current enterprise value there is upside potential just from WHIM indication. Available clinical efficacy and safety data are very convincing in my opinion and in combination with "breakthrough therapy" and "orphan" designations support approval (although regulatory delays cannot be excluded). Additionally, there is promising (based on preliminary phase 2 results) potential for label expansion to the much larger market of chronic idiopathic/cyclic/congenital neutropenias. XFOR has enough cash to support operations into 2025, not including potential monetization of a priority review voucher upon approval for WHIM indication.

Overview of X4 Pharmaceuticals

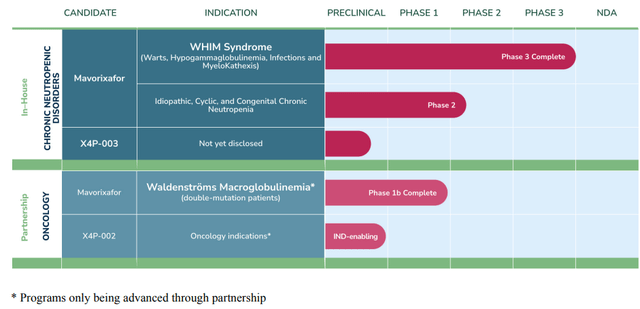

XFOR pipeline focuses on targeting the CXCR4/CXCL12 axis which controls trafficking of white blood cells within the body. Currently the main candidate in XFOR's pipeline is mavorixafor, an oral CXCR4 inhibitor. Inhibition of CXCR4 can help mobilize white blood cells from the bone marrow to the blood, hence the rationale for targeting chronic neutropenias. XFOR also has a pre-clinical program which has been paused to concentrate on mavorixafor, and an oncology program for which XFOR is looking for partners.

XFOR's pipeline (From XFOR's 10-K)

Overview of WHIM syndrome and the mavorixafor solution

WHIM (Warts, Hypogammaglobulinemia, Infections, Myelokathexis) syndrome is an extremely rare autosomal dominant primary immunodeficiency caused by activating mutations in CXCR4 chemokine receptor, resulting in white blood cells getting trapped in the bone marrow, frequently causing both neutropenia (low levels of circulating neutrophils) and lymphopenia (low levels of circulating lymphocytes), which predispose patients to infections, including warts (related to HPV infection).

Considering that the cause of WHIM syndrome is activating mutations of CXCR4, using a CXCR4 antagonist (mavorixafor) for treatment makes a lot of sense. Therefore, XFOR decision to target WHIM syndrome first, despite being a much smaller indication, was smart in my opinion. Following a positive Phase 2 study, XFOR has completed a 52-week, global, randomized, double-blind, placebo-controlled study assessing the efficacy and safety of oral, once-daily mavorixafor in people aged 12 and older diagnosed with WHIM syndrome. The study showed:

- increased time above neutrophil count threshold (primary endpoint); 15.04h vs 2.75h

- 60% reduction in annualized infection rate

- reduction of severe infection; 7% vs 29%

- reduction in mean total time with infection; 2 vs 7 weeks

All above results were statistically significant and clinically meaningful. Additionally, mavorixafor was well-tolerated with no serious adverse events nor any discontinuations due to safety events, and 90% of patients have elected to continue to the open label extension study.

To sum up, mavorixafor:

- has completed a phase 2 study (published in Blood, top in the hematology field) and a phase 3 study.

- is a major improvement compared to current standard of care for WHIM (which requires subcutaneous G-CSF injections with side effects),

- has shown statistically significant and clinically meaningful improvement in clinical outcomes

- is safe ("Demonstrated tolerability in >200 individuals, some for >4 years")

- has been granted Breakthrough Therapy Designation, Fast Track Designation, and Rare Pediatric Designation in the U.S., and Orphan Drug Status in both the U.S. and European Union.

These seem more than enough to me to support approval, at least from a clinical perspective (other causes of regulatory delays are unpredictable). Of note, upon approval of mavorixafor for WHIM, XFOR is eligible to receive a priority review voucher (typically worth $100M), which could be a major source of non-dilutive funding.

XFOR plans for NDA submission in 2H 2023. If all goes well, FDA approval is expected within 6 months from submission (priority review) and XFOR plans for potential launch in 1H 2024.

WHIM syndrome market size

Exact prevalence or incidence of WHIM syndrome in the general population is unknown, although it has been estimated at about 0.2 per million live births (study). Based on about 3.7 million live births per year in US and 4.1 million in Europe, this corresponds to only 0.7 and 0.8 new patients per year, respectively. With improved and earlier detection in the future these numbers may prove to be higher. Currently, median age at diagnosis is 5.5 (range 2 weeks–51 years). Prevalence can be estimated based on incidence and disease duration;

prevalence= incidence * disease duration

Detailed data on disease duration (i.e. life expectancy of affected patients) are not available to my knowledge, but with current standard of care patients may well reach into adulthood. Median age of WHIM patient cohorts range from 13 to 29 years old, but include patients aged> 60 years (of note currently XFOR aims for approval in patients aged 12 years and older). Assuming (very conservatively) mean life expectancy of 30 years, incidence of 0.2 per million live births, and US population under 50 of 212M the estimated prevalence of WHIM patients in US is 1272 patients (6 per million). This matches XFOR's estimation of "more than 1,000 individuals with WHIM syndrome in the U.S." (in XFOR's latest 10-K even more optimistic estimations suggest "that there may be as many as 3,700 WHIM patients in the United States"). An update by XFOR on potential WHIM market size is expected in Q4 2023.

Considering orphan drug designation annual pricing of >$100K (others have predicted a pricing of $200-300K/year) per patient is not unlikely, corresponding to market opportunity of >$100M (x1.6 if European patients are included). Considering efficacy in the phase 3 trial and current lack of alternative treatments for WHIM syndrome, XFOR should be able to capture a big share of the above market opportunity (as long as the estimated 1000 WHIM patients can be found). Conservatively assuming just 20% market share, i.e. just 200 patients, this would correspond to peak revenue of >$20M just in US. Based on an EV/revenue multiple of 7.1 a fair EV at peak sales would be $140M (compared to a current EV of $96M). Add to that patients outside US as well as the potential for priority review voucher (typically worth $100M).

My point is that based on just (conservatively estimated) market potential for WHIM syndrome XFOR seems undervalued. Therefore, even in case of setbacks with the rest of the pipeline downside risk is limited.

Outside US, XFOR has partnered with Abbisko Therapeutics for development and commercialization of mavorixafor in Greater China. According to the deal XFOR is eligible to receive potential development, regulatory and commercial milestone payments of up to $214 million. XFOR is also entitled to royalties in the low double-digits.

Plerixafor vs mavorixafor

Plerixafor is another CXCR4 antagonist, which is currently approved for hematopoietic cell mobilization prior to (1) autologous transplantation in non-Hodgkin lymphoma and multiple myeloma or (2) prior to betibeglogene autotemcel gene therapy in beta thalassemia. Plerixafor has been used successfully as salvage therapy in WHIM syndrome and results from a small phase 3 trial were recently published. In that study plerixafor did not outperform G-CSF (the current standard of care) with regards to total infection severity score (the primary endpoint), but was better at some secondary endpoints. Comparison with mavorixafor's phase 3 is difficult considering different control groups (mavorixafor vs placebo, plerixafor vs G-CSF). A major limitation of plerixafor is the need for twice daily subcutaneous injection (compared to once daily oral treatment with mavorixafor). Plerixafor is currently used in only a minority (5%) of WHIM patients. Plerixafor is NOT approved for WHIM syndrome. Based on the above I doubt that plerixafor (if it ever gets approved for WHIM) can compete with mavorixafor.

Mavorixafor for other causes of chronic neutropenia

In WHIM syndrome mavorixafor targets the cause of the problem, which is trapping of white blood cells in the bone marrow ("myelokathexis"). In other words bone marrow can produce white blood cells but they cannot be released to the blood. In other causes of chronic neutropenia things are more complicated. Chronic neutropenia includes a heterogeneous group of conditions; e.g. autoimmune/idiopathic neutropenia, cyclic neutropenia, congenital neutropenia (WHIM being a very small subset of congenital neutropenias). A variety of mechanisms can cause these neutropenias broadly grouped as follows:

- Decreased neutrophil production/differentiation in bone marrow

- Redistribution of circulating neutrophils to the vascular endothelium or to the spleen (termed "margination")

- Immune destruction (e.g., drug reaction, autoimmunity)

In the latter 2 cases bone marrow functions normally and bone marrow reserves are normal (i.e. can respond to an infection by increasing neutrophil mobilization and production). As such, affected patients usually don't need treatment and some cases are even transient (i.e. resolve spontaneously). In the first case (problem in the bone marrow) patients are much more likely to suffer from recurrent infections and thus need treatment (which typically involves daily subcutaneous injections of G-CSF). The rationale for using mavorixafor in these cases is to reduce G-CSF dosing or even allow cessation of G-CSF (remember that mavorixafor is dosed orally once daily, while G-CSF is administered by subcutaneous injection once/twice daily and is associated with side effects including bone pain and risk of myelodysplastic syndromes). My main concern here is whether mavorixafor can result in durable increases in white blood cells, because simply mobilizing neutrophils from the bone marrow doesn't really solve the problem (which is reduced production or increases apoptosis of neutrophils in the bone marrow). Theoretically, for durable increases in peripheral neutrophil counts increased mobilization should be accompanied by a matched increase in neutrophil production.

XFOR is currently conducting a 2-part study in patients with idiopathic/cyclic/chronic neutropenia. In the first part (phase 1b) patients received a single oral dose of mavorixafor and were monitored for 8 hours. The study enrolled n=25 patients with a variety of chronic neutropenia causes (n=16 idiopathic, n=3 cyclic, n=6 congenital). Mavorixafor treatment resulted in robust responses in all patients and normalization of neutrophils in all neutropenic (n=14) patients (both as monotherapy and in combination with G-CSF). However, this study does not address my concerns on durability of treatment effect. Transient increases in neutrophil count following a single mavorixafor dose are to be expected, but whether these increases can be durable over the long term remains to be proven.

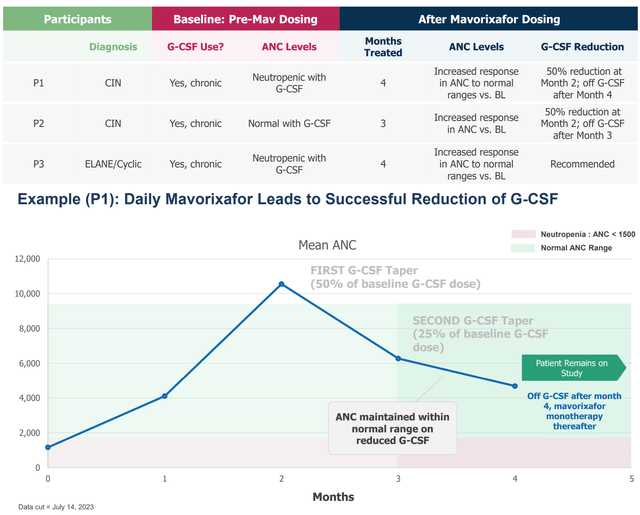

In Part 2 of the above study (phase 2) patients are being treated for 6 months. XFOR recently reported interim positive preliminary results from three participants (2 had chronic idiopathic neutropenia and 1 had cyclic neutropenia) receiving G-CSF and once-daily oral mavorixafor showing robust increases in neutrophils, maintenance of neutrophil levels in the normal range, and the ability to reduce G-CSF dose. Considering neutrophils have very short half-lives (a few hours), durable responses in these 3 patients over 3-4 months are very encouraging. Additional data from the phase 2 study are expected in Q4 2023 (December ASH meeting) and XFOR aims to start a phase 3 trial in 1H 2024. Hopefully, enough data will be available then to address my concerns regarding durable activity of mavorixafor in non-WHIM chronic neutropenia.

Results in first 3 patients enrolled in the chronic neutropenia phase 2 study. ANC= absolute neutrophil count, CIN= chronic idiopathic neutropenia (XFOR presentation)

Chronic neutropenia market potential

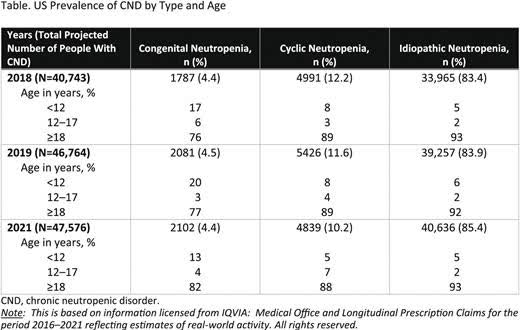

According to XFOR's research based on US medical claims there are close to 50000 patients with chronic neutropenia in the US.

Prevalence of congenital, cyclic and idiopathic neutropenia in US (XFOR presentation, published in Blood)

Notably, not all patients with chronic neutropenia need treatment. Based on XFOR estimates, XFOR is currently aiming an initial target market of 15000 patients. This includes only patients with history of severe/recurrent infections and/or history of G-CSF treatment and excludes patients younger that 12 (phase 3 will enroll only patients older than 12) and those with chronic neutropenias unlikely to respond to mavorixafor. Generic filgrastim costs about $270 per 300mg. Assuming a single dose per day this corresponds to annual cost of about $100K. Even at half the price ($50K per patient per year) this corresponds to a market potential of $750M. Even capturing just 20% share would correspond to $150M and a fair enterprise value of $1B (based on EV/revenue multiple of 7.1), compared to a current EV of $96M. Market expansion (according to XFOR) opportunities include; patients younger than 12, mild/moderate disease (I wouldn't be too optimistic about this) and patients intolerant to G-CSF.

Risks

Risks to the thesis include the following;

- Delays (CRL by FDA) in approval of mavorixafor for WHIM syndrome. Although I believe available data clearly support approval, there are other (unpredictable) reasons that could lead to a CRL.

- Even if approved, successful commercialization is not guaranteed.

- Updated results from ongoing phase 2 in chronic neutropenia could be underwhelming.

- XFOR's estimation on target market, and my estimations on market potential, could be wrong and prove to be overestimated. On the other hand, WHIM target market may actually be much larger than the 1000 estimated patients in US.

- Competition. According to XFOR's 10-K there are other companies developing CXCR4 inhibitors [BioLineRx (motixafortide), Noxxon (NOX-A12), Upsher-Smith, Polyphor (Balixafortide), and GlycoMimetics (GMI-1359)]. However, these are being developed for other indications (hematopoietic cell mobilization and oncology) and mavorixafor's once daily oral dose (vs intravenous/subcutaneous) is a major advantage. According to a search in PubMed no publications relevant to the potential use of these CXCR4 inhibitors in neutropenia were retrieved.

Financials

Based on Q2 2023, XFOR has cash and cash equivalents of $142.3M. Total operating expenses were $25.8M (R&D $15.6M, G&A $10.2M). In August XFOR also announced closing of $115M loan facility, of which $22.5 has been drawn down. Therefore, available funds are ~$160M which XFOR considers sufficient to fund operations into 2025. That's reasonable assuming operating expenses remain the same, although I expect increased expenses to support phase 3 trial in chronic neutropenia and to prepare for commercialization for WHIM indication. Notably, this runaway guidance does NOT include potential monetization of a possible priority review voucher, in case of approval for WHIM indication.

Recommendation

Based on de-risking by upcoming approval for WHIM syndrome, promising potential for label expansion to a much larger target market of chronic neutropenias, cash runaway for at least a year, and potential for non-dilutive funding by monetization of a priority review voucher, I recommend XFOR as a "Buy". Of course there are risks to my thesis, the most important being underwhelming results in ongoing phase 2 trial in chronic neutropenia and significant delays in approval for WHIM indication.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XFOR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.