MOAT: Don't Be Alarmed That The ETF Does Not Own Apple And Tesla

Summary

- The MOAT ETF has outperformed the S&P 500 Index by focusing on high-quality companies with wide economic moats.

- An analysis of MOAT's holdings show it doesn't hold popular stocks like Apple and Tesla, should investors be concerned?

- No, because the MOAT ETF has determined AAPL is overvalued and TSLA does not have a wide economic moat.

- While individual decisions are debatable, it is comforting as a shareholder to see MOAT's disciplined investment process in action.

Scott Olson

A few months ago, I wrote a bullish review on the VanEck Morningstar Wide Moat ETF (BATS:MOAT), noting that the MOAT ETF has outperformed the S&P 500 Index over the long run by focusing on high quality companies with wide economic moats.

For long-term investors, the MOAT ETF looks like a good bet as it leverages Morningstar's team of more than 100 equity analysts to identify high quality companies that should outperform over the long-run.

However, when reviewing the MOAT ETF's latest holdings, a few companies stand out for their absence. Namely, the MOAT ETF does not have positions in some market darlings like Apple Inc. (AAPL) and Tesla Inc. (TSLA). Should investors be concerned that the MOAT ETF does not have exposure to these strong YTD performers?

Brief Fund Overview

The VanEck Morningstar Wide Moat ETF gives investors convenient exposure to companies that are considered to have durable competitive advantages, according to Morningstar's equity research team.

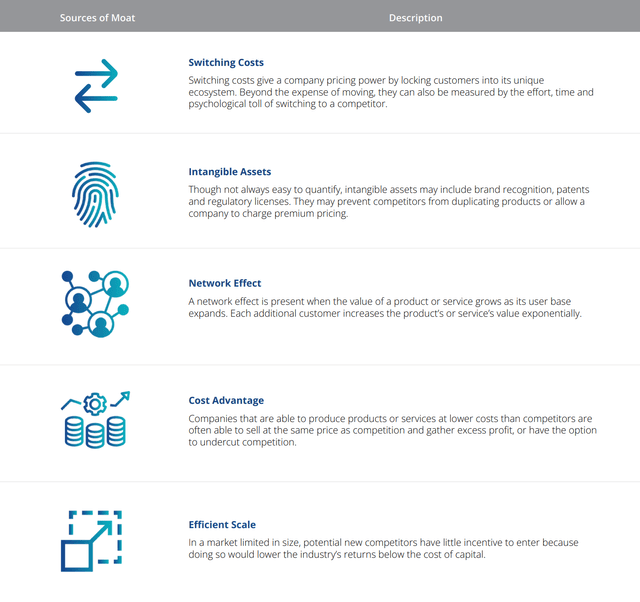

Morningstar's team of more than 100 equity analysts cover hundreds of companies globally using the same consistent research process to assess their Economic Moat. Five key attributes go into the determination of a company's moat: switching costs, intangible assets, network effect, cost leadership, and efficient scale (Figure 1).

Figure 1 - Morningstar's five sources of moat (vaneck.com)

Companies considered to have a wide moat scores well on one or more of the attributes mentioned above and is expected to be able to sustain its competitive advantage for at least 20 years. Companies that are expected to maintain an economic advantage for 10 years is considered to have a narrow moat, while companies without an economic moat ether has no advantage or one that is expected to disappear quickly.

Out of Morningstar's equity research coverage, only 10-15% of companies are considered to have a wide moat.

The MOAT ETF has been quite successful, garnering $10.5 billion in assets while charging a modestly high 0.46% expense ratio.

MOAT Returns Have Been Strong

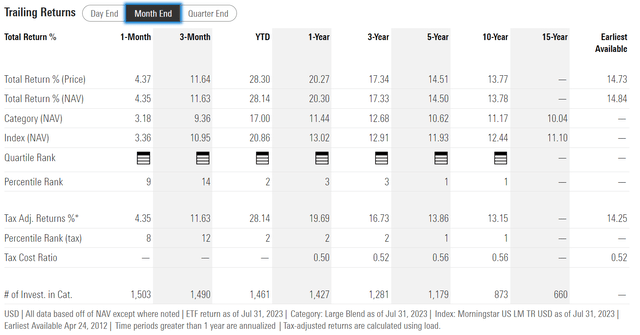

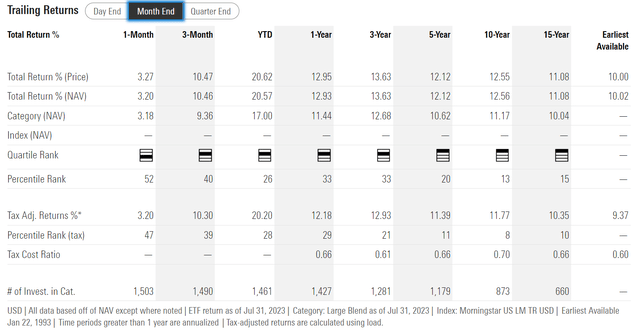

As I have discussed in my prior article, returns for the MOAT ETF have been impressive, with the MOAT ETF (Figure 2) outperforming the SPDR S&P 500 ETF Trust (SPY) on a 3/5/10 yr basis (Figure 3), with 17.3%/14.5%/13.8% in total returns to July 31, 2023, compared to 13.6%/12.1%/12.6%.

Figure 2 - MOAT historical returns (morningstar.com) Figure 3 - SPY historical returns (morningstar.com)

Should Investors Be Concerned About Lack Of Market Darlings?

However, one potential concern / interesting observation I have with MOAT's portfolio is that it does not hold market darlings like Apple and Tesla.

Since these are supposedly some of the best companies in the market right now, is the MOAT ETF missing out by not holding these stocks?

Valuation Also Matters In Picking Stocks

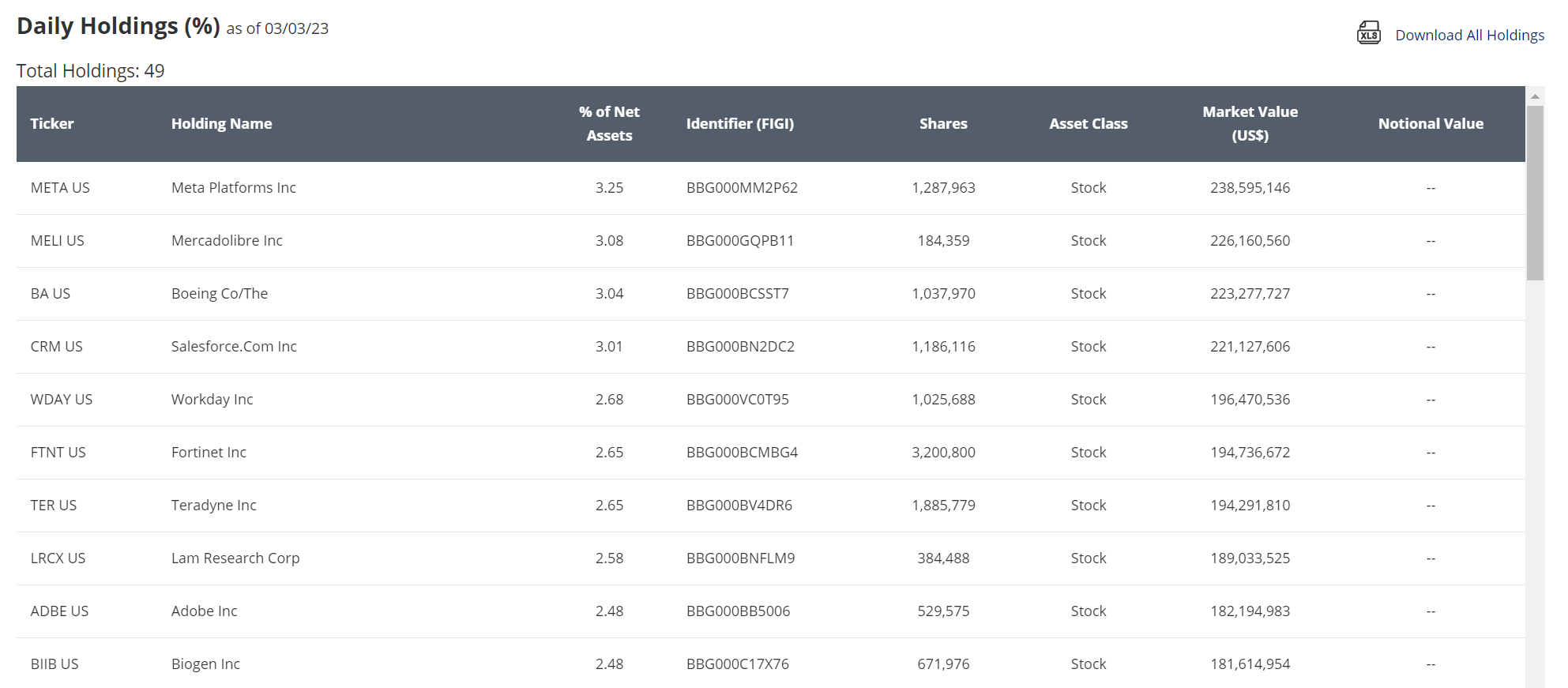

I believe the answer to my question above is valuation. For example, in my prior article, we can see that Meta Platforms Inc. (META) was the largest holding in the MOAT ETF (Figure 4).

Figure 4 - META was largest holding in March (vaneck.com)

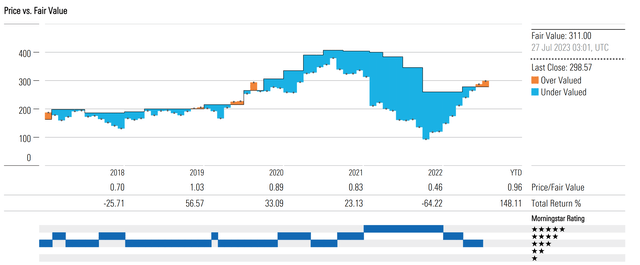

However, since META has gone up dramatically in the past few months, it has narrowed the gap between its stock price and Morningstar's estimate of fair value (Figure 5).

Figure 5 - META has narrowed gap to Morningstar's estimate of fair value (Morningstar report via RBC Direct Investing)

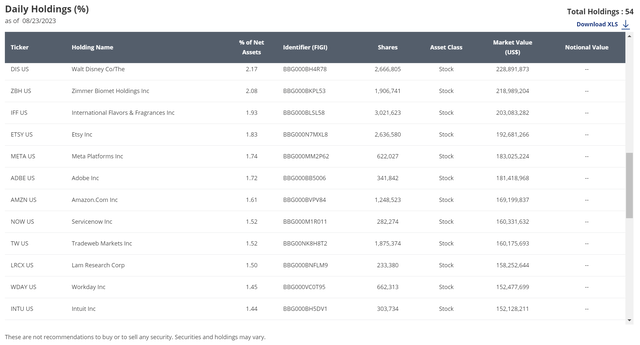

Therefore, it makes sense that the MOAT ETF has reduced its holdings in META, from 3.3% of the fund to 1.7% of the fund currently (Figure 6).

Figure 6 - META position has been reduced to 1.7% weight (vaneck.com)

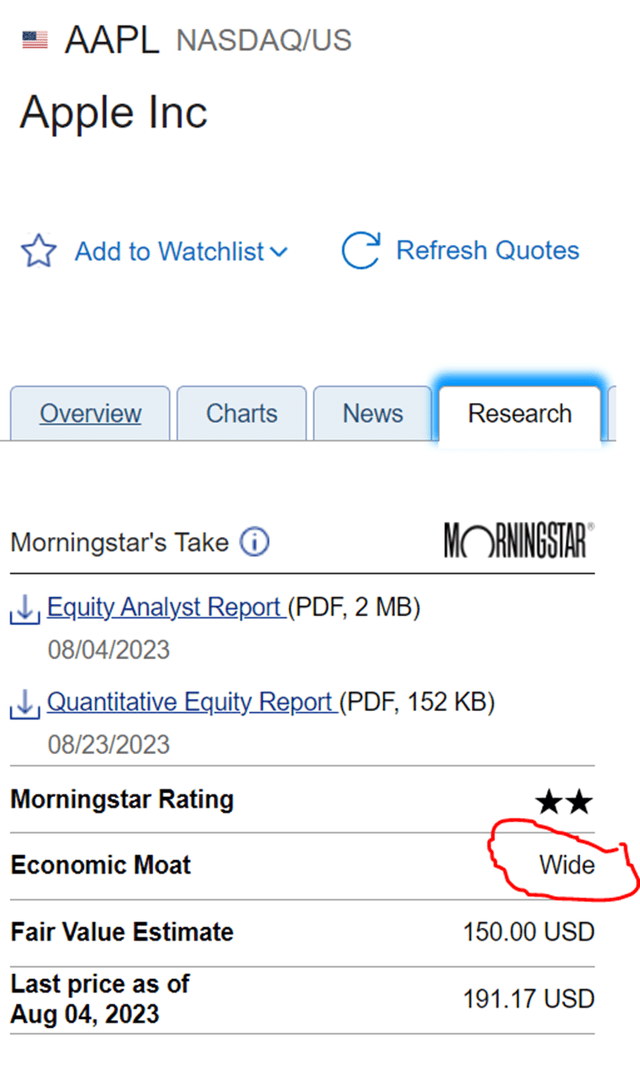

For AAPL, although Morningstar considers the company to have a wide moat, it has traded past what Morningstar estimates to be fair value for AAPL's shares, hence the MOAT ETF does not have a position in AAPL (Figure 7).

Figure 7 - AAPL is trading above Morningstar's estimate of fair value (Morningstar via RBC Direct Investing)

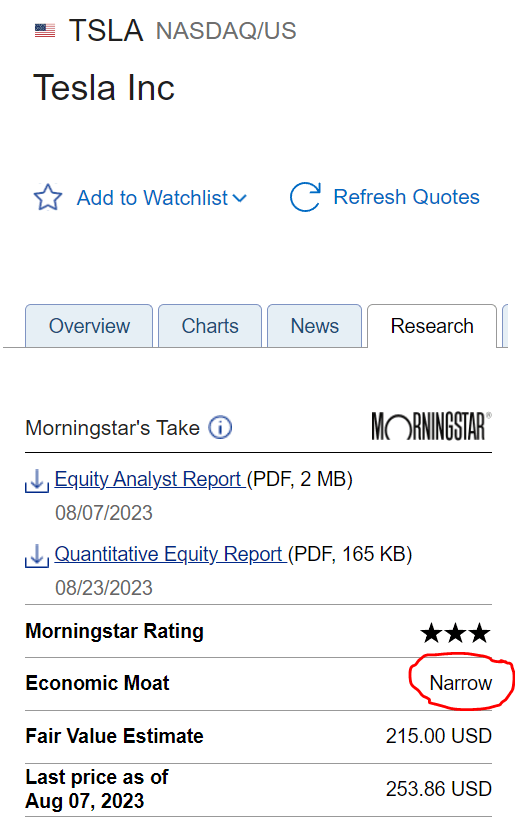

For Tesla, Morningstar does not consider the company to have a wide moat, hence the company does not qualify (Figure 8).

Figure 8 - TSLA is not considered to have a wide moat (Morningstar via RBC Direct Investing)

While investors can debate whether Tesla should be considered to have a wide moat or not, it is comforting as to see that the MOAT ETF has the discipline to reduce holdings of top performing stocks like META, if the returns potential to fair value is not as attractive. Similarly, it takes courage for a large-cap fund like MOAT to not hold large index weights like AAPL altogether due to valuation, as it constitutes a lot of basis risk for the fund manager.

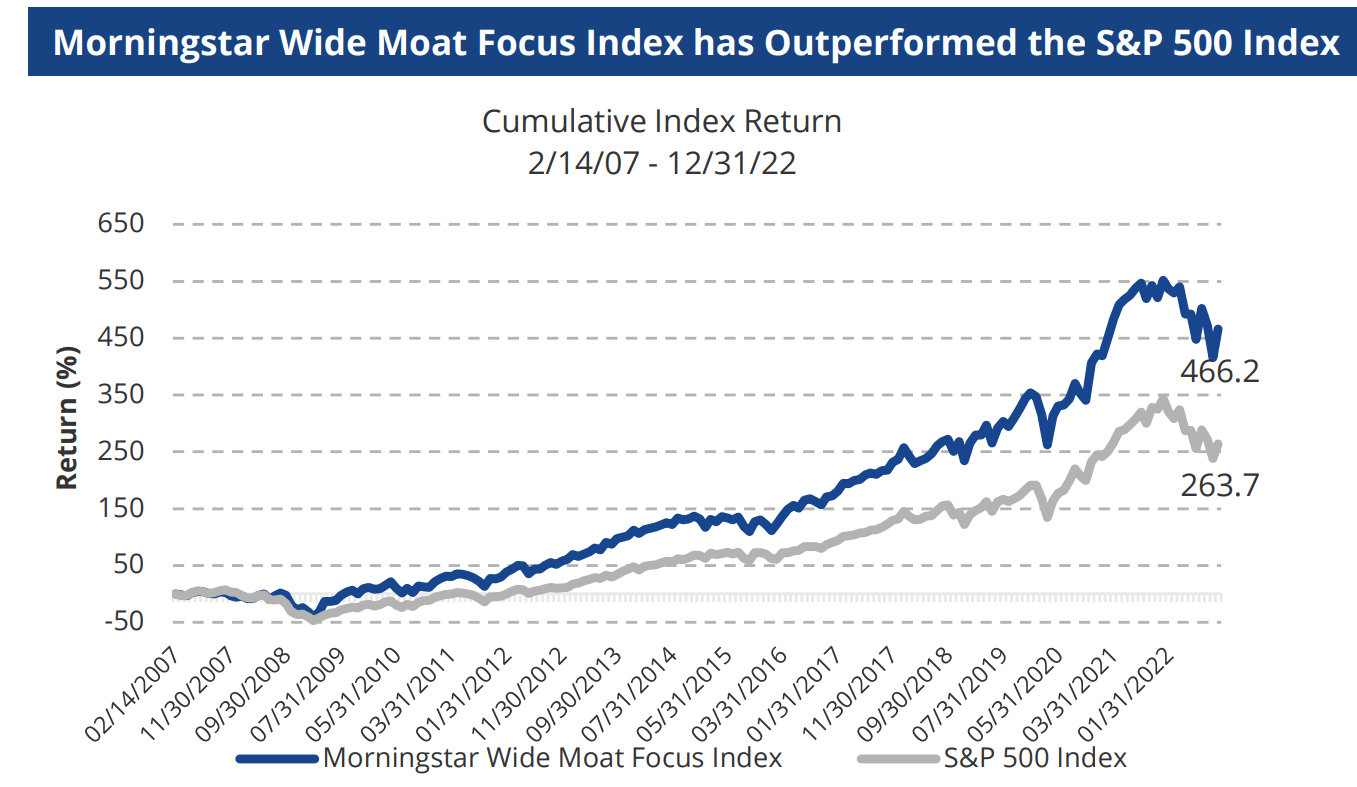

Over the long run, the MOAT ETF's disciplined approach to investing has produced excellent results. The index underlying the ETF, the Morningstar Wide Moat Focus Index, has outperformed the S&P 500 Index by over 200% since inception in 2007 (Figure 9).

Figure 9 - MOAT Index has outperformed S&P 500 Index by 200% since inception (vaneck.com)

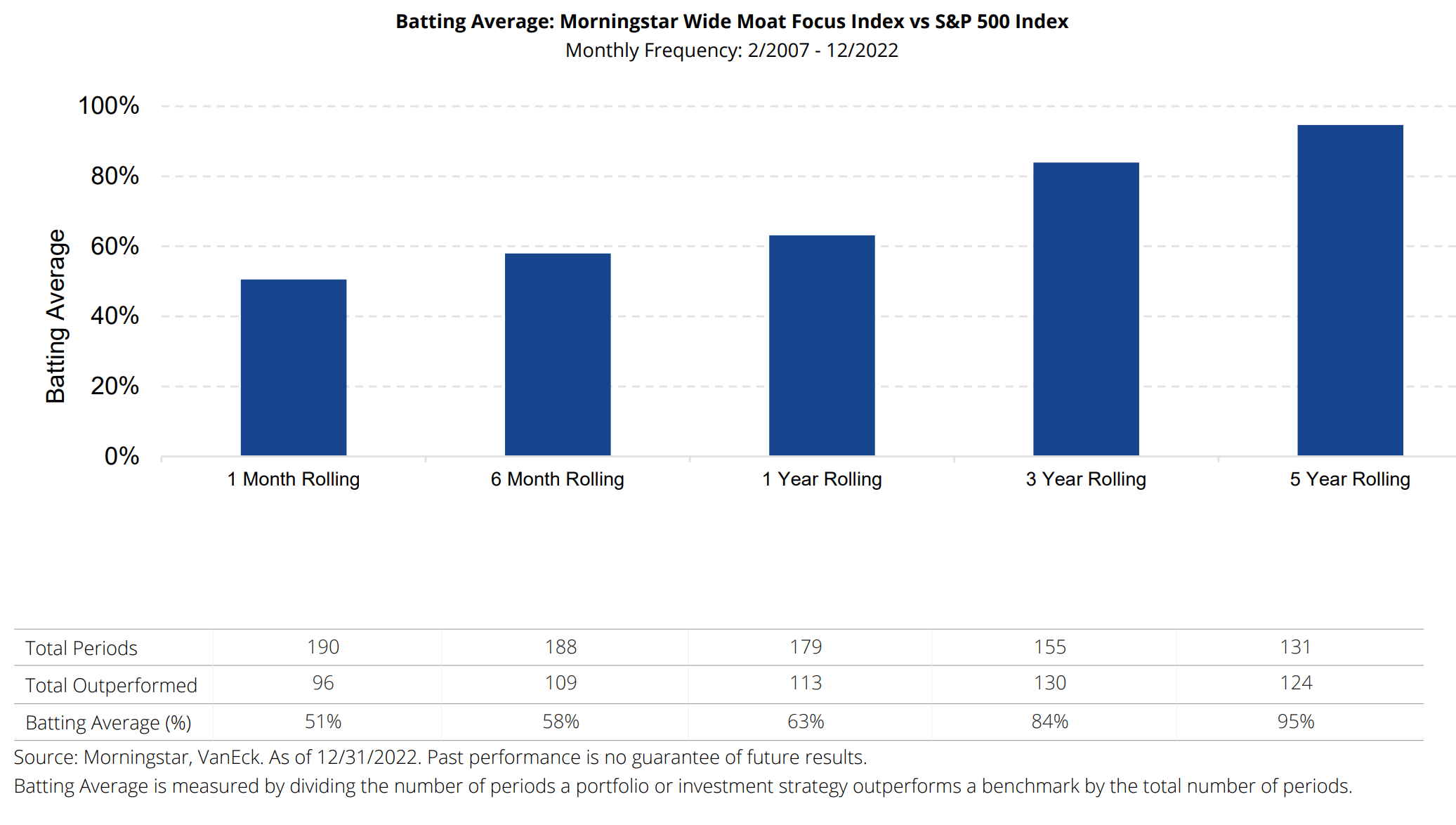

While markets can be irrational over short periods of time, over the long-run, the Morningstar Wide Moat Focus Index has outperformed the S&P 500 Index 84% of the time on a rolling 3-year time horizon and an incredible 95% of the time on a rolling 5 year time horizon (Figure 10).

Figure 10 - MOAT outperforms consistently (vaneck.com)

Conclusion

The VanEck Morningstar Wide Moat ETF continues to be one of my favorite funds, as its focus on companies with strong durable competitive advantages has continued to deliver excellent performance.

Analyzing the fund's holdings, it is comforting to see that the MOAT ETF has the discipline to reduce holdings like META as it nears Morningstar's estimate of fair value. It takes courage for a large-cap fund like MOAT to not hold large index weights like AAPL altogether, as it has traded beyond Morningstar's estimate of fair value. I continue to rate the MOAT ETF a buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MOAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.