PGMs- A Contrarian Approach With SPPP

Summary

- Platinum group metals (PGMs) include iridium, osmium, palladium, platinum, rhodium, and ruthenium, and they have high melting points, heat and corrosion resistance, and unique catalytic properties.

- Palladium has been in a bear market since reaching a record high in March 2022, while platinum has been in a brutal bearish trend since its all-time high in 2008.

- PGM supplies come mainly from South Africa and Russia, with Russia producing the most palladium and South Africa producing the most platinum. PGMs have various industrial.

asbe

Platinum group metals include iridium, osmium, palladium, platinum, rhodium, and ruthenium. The platinum group is a set of six transition metals sharing similar properties. Transition metals or elements occupy a central block in the periodic table of elements. Chemically, they show variable valence and a strong tendency to form coordinated compounds. Valence is the ability of an atom to combine with other atoms, measured by the number of electrons it will lose, add, or share.

The platinum group metals have high melting points, high heat and corrosion resistance, and unique catalytic properties. While all platinum group metals have industrial applications, only platinum and palladium trade in the futures market on the Chicago Mercantile Exchange’s NYMEX division. The NYMEX division trades energy products, including oil, oil products, and natural gas futures. Platinum and palladium futures trade on NYMEX because of their requirements as catalysts found in oil and petrochemical refineries.

PGM prices can be highly volatile. Over the past months, platinum, palladium, and rhodium prices have been under significant selling pressure. The Sprott Physical Platinum and Palladium product (NYSEARCA:SPPP) owns physical platinum and palladium bullion and is an alternative to bars, coins, and futures for market participants seeking exposure to the two most liquidly traded platinum group metals.

I wrote about SPPP on Seeking Alpha in March 2023, when the ETF's price was at the $11.69 per share level. Platinum, palladium, and the SPPP have declined since March, but the scarce nature of the metals, industrial demand, and illiquidity continue to make the ETF a compelling value at the $11 per share level.

Platinum group metals have moved significantly lower

Palladium has been in a bear market since reaching a record $3,380.50 high in March 2022.

Long-Term NYMEX Palladium Futures Chart (Barchart)

The long-term chart dating back to the 1970s shows before late 2017, the all-time peak in the palladium futures market was the 2001 $1,035 high. Increasing demand, inflation, Russia’s invasion of Ukraine, sanctions on Moscow, and Russian retaliation caused the price to soar to the March 2022 $3,380.50 high, where it ran out of upside steam. Palladium has made lower highs and lower lows over the past seventeen months, falling 64.5% to a $1,201.50 low in August 2023. At the $1,248.50 level on August 24, palladium futures remain in a bearish trend within a stone’s throw from the recent low. Technical support is at the 2001 $1,035 high, as the long-term resistance has become the long-term technical support.

While palladium experienced boom and bust price action, platinum has been in a brutal bearish trend since its all-time 2008 peak.

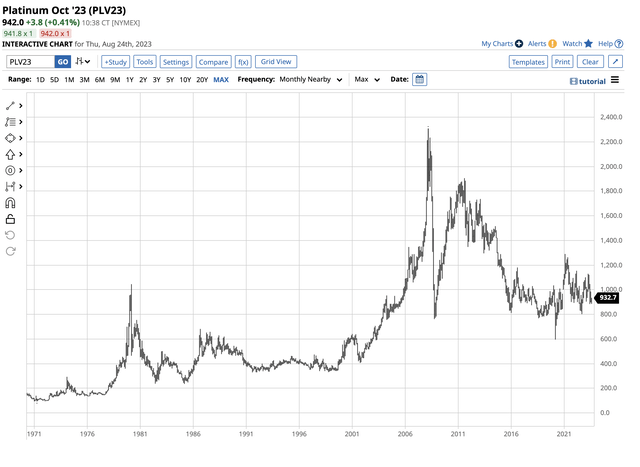

Long-Term NYMEX Platinum Futures Chart (Barchart)

After trading to a $2,308.80 high in March 2008, platinum has made lower highs, falling below $600 on a spike to the downside in March 2020 as the global pandemic gripped markets. At below $1,000 on August 24, platinum remains closer to the low and in a bearish trend. Since March 2022, platinum futures have fallen 18.4% from $1,154 to $942 per ounce.

Meanwhile, rhodium, the platinum group metal that only trades in the physical market, experienced the most price carnage.

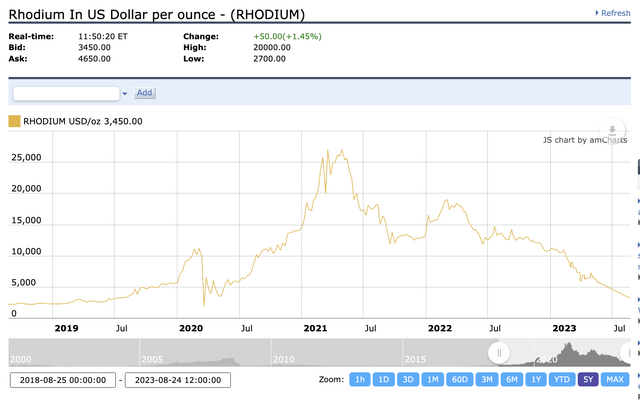

Chart of Physical Rhodium Prices (Kitco)

Rhodium traded at a $27,000 per ounce high in April 2021. At a $4,050 midpoint on August 24, the price suffered an 85% collapse.

Platinum group metals have been under siege in 2023.

PGM supplies come from two of the BRICS countries

South Africa and Russia dominate worldwide platinum group metal production.

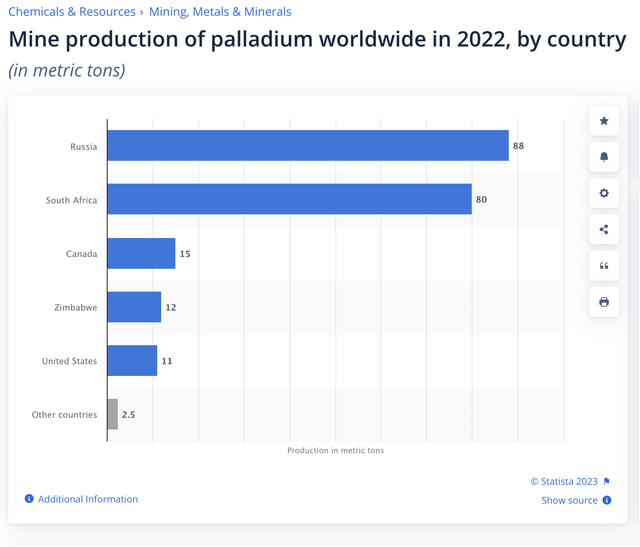

In 2022, the world produced a total of 210 tons of palladium.

Palladium Production by Country (Statista)

The chart shows that 80% of the global output came from Russia and South Africa, with Russia producing eight more tons than the second-leading producing country.

Annual platinum output is around 190 metric tons. South Africa dominates platinum production with 140 tons, or over 73%, while Russia is second with 20 tons, or 10.5% of the global supplies.

Annual rhodium output is around 30 metric tons. South African output of 17 tons was 57%, and Russia’s 1.8 tons accounted for 6% of worldwide supplies. Platinum group metals are byproducts of Russia’s nickel output in Siberia’s Norilsk region. However, most of these metals come from the BRICs bloc of countries, and consumption is ubiquitous, with China, Europe, and the U.S. the leading consumers.

PGMs are precious and industrial metals

PGM’s supplies make them precious, while their composition makes them critical industrial metals. The density, corrosion, and heat resistance create the utility in catalytic converters, which decrease hydrocarbon, carbon monoxide, and nitrous oxide emissions in automobile exhaust and from crude oil and petrochemical refineries. Meanwhile, many other applications include jewelry, jet engine, missile parts, glass and fiberglass manufacturing, steel, and semiconductors. PGMs have also attracted investors because of their scarcity.

Support levels for platinum and palladium

Platinum and palladium are the most liquid PGMs, and they trade in the futures arena on the CME’s NYMEX division. The futures contracts are far less liquid than gold and silver that trade on the CME’s COMEX division because of less annual production and identifiable above-ground stocks. Therefore, platinum and palladium have very limited forward or futures markets beyond the cash market, making put and call options virtually impossible.

The bear market in palladium has taken the price nearly 65% lower since the 2022 high and could have more to fall. Critical technical support stands at the 2001 $1,035 high. Platinum prices have traded around the $1,000 pivot point over the past years. The first technical support is at the August 2021 $804 per ounce low on the continuous NYMEX futures contract. Buying platinum and palladium at the current price levels is a contrarian trade. Still, the illiquid nature of the markets could make going against the flow the optimal approach for the future. Bids to purchase tend to disappear during bear markets, sending prices to irrational, illogical, and unreasonable lows. Conversely, during rallies, offers to sell can evaporate, leading to upside price spikes, as we witnessed in the palladium market that soared to highs in March 2022.

SPPP holds its assets in physical platinum and palladium bullion

The rising demand for industrial metals that address climate change and are critical technological inputs could cause sudden recoveries in the platinum group metals. The market for physical bars and coins is most direct investment route in platinum and palladium. The NYMEX futures contracts provide a physical delivery mechanism, but they are leveraged and margined and can suffer from illiquid periods.

The Sprott Physical Platinum and Palladium Trust (SPPP) is an alternative for investors and traders seeking exposure to platinum and palladium without venturing into the physical or futures arenas. The fund profile for SPPP states:

Fund Profile for the SPPP Product (Seeking Alpha)

SPPP holds most of its assets in physical platinum and palladium bullion. At $11.00 per share on August 24, SPPP had $116.53 million in assets under management. SPPP trades an average of 37,650 shares daily and charges a 0.50% expense ratio.

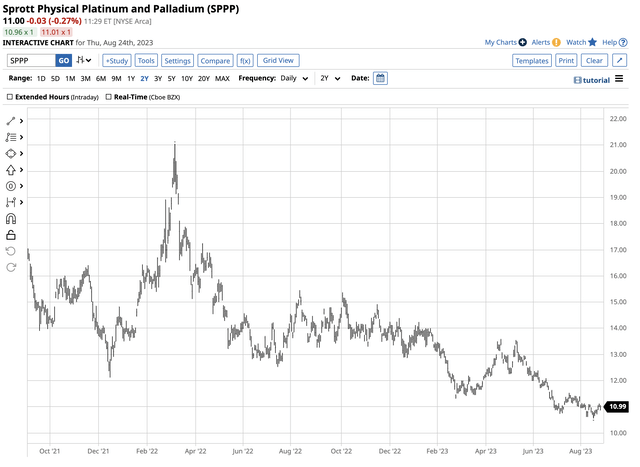

SPPP has followed platinum and palladium prices lower since the March 2022 record high in palladium.

Chart of the SPPP Product (Barchart)

The chart shows a 47.7% decline from the March 2022 $21.05 high to the August 2023 $11.00 per share low. While SPPP underperformed the price action in the platinum futures market since March 2022, it outperformed palladium futures over the period.

SPPP is a contrarian asset for market participants seeking platinum group metals exposure. The limited supplies, Russian and South African production issues, trade sanctions, and rising demand for specialty metals could eventually cause a significant recovery in the platinum and palladium markets. SPPP holds the physical bullion and could be an excellent proxy for owning the metals or futures contracts that suffer from illiquid conditions.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls, directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount for new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis. The author is long physical platinum.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)