Unilever: Unfinished Turnaround, Not Yet Ready

Summary

- Unilever is a multinational consumer goods company with three primary business segments: Personal Care, Cleaning, and Food.

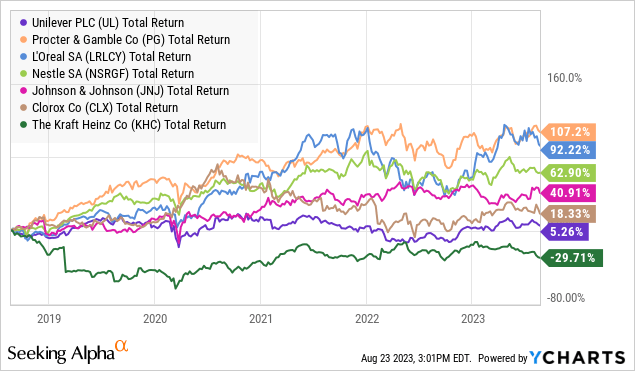

- Stock performance has been weak compared to competitors in these segments, likely due to lower revenue growth and margins historically.

- Management has taken action, leading to increased profit margins and a portfolio focused on higher growth.

- Because the turnaround is incomplete, however, my rating is Sell.

wildpixel

Unilever (NYSE:UL) is a multinational consumer goods company dating back to 1930 when the British soap-makers Lever Brothers and the Dutch margarine producer Margarine Unie merged. Now a global household name in more than 100 countries, their three primary business segments are Personal Care (into which I have included Beauty), Cleaning, and Food.

The firm has been transitioning their brand lineup through a series of disposals and acquisitions so as to align the portfolio with a premiumization strategy. A trimmed product lineup and improved efficiency have already led to a marked uptrend in profit margin. Revenue growth has been problematic so investment into developing their currently more-premium brands is the logical next step and may lead to future top-line growth. Digital commerce is up noticeably, and once investments begin to show some results, I would reconsider Unilever. As of now, my rating is Sell.

Industry & Market

Operating in the Consumer Staples sector, Unilever encompasses a wide range of products essential to people's daily lives. This sector includes companies that manufacture and distribute items such as food, beverages, personal care products, and cleaning supplies. Consumer demand for these products remains relatively stable even during economic downturns.

As part of their Q2 2023 Results Announcement, Unilever reported these segments as accounting for 43% (Personal Care), 20% (Cleaning Products), and 37% (Food) of H1 2023 revenue. The segments are balanced to the degree that each is relevant to the company's finances.

Listed here by business segment are some of Unilever's brands and competitors, after which is shown the 5-year total return of each company's stock.

Personal Care (including Beauty) targeting skincare, haircare, deodorants, and fragrances: Dove, Vaseline, Rexona, and Axe.

- Procter & Gamble (PG)

- L'Oréal (OTCPK:LRLCY)

- Johnson & Johnson (JNJ)

Cleaning focused on household cleaning and laundry products: OMO, Cif, Domestos, and Seventh Generation.

- Procter & Gamble

- Clorox (CLX)

- SC Johnson, which is privately held

Food encompasses soup & seasoning mixes, mayonnaise & sauces, and ice cream: Knorr, Hellmann's, Magnum, Ben & Jerry's, and Breyer's.

- Nestlé (OTCPK:NSRGF)

- Kraft Heinz (KHC)

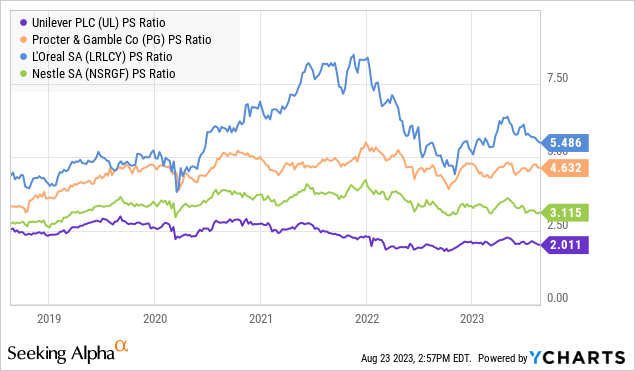

Unilever's stock has been underperforming on an absolute basis, and regardless of the segment, relative to peer firms. The top performers from each business segment - Procter & Gamble, L'Oréal, and Nestlé - will be used going forward for a diversified comparison set.

Financials

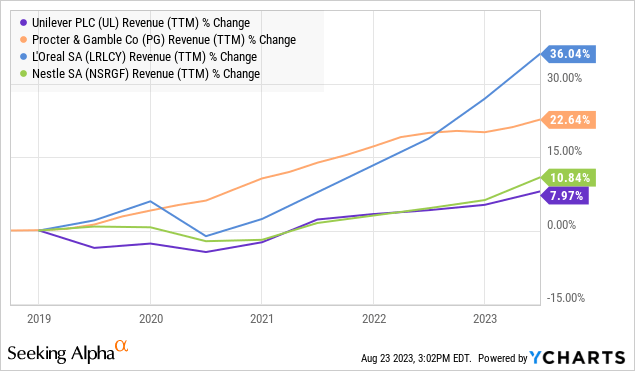

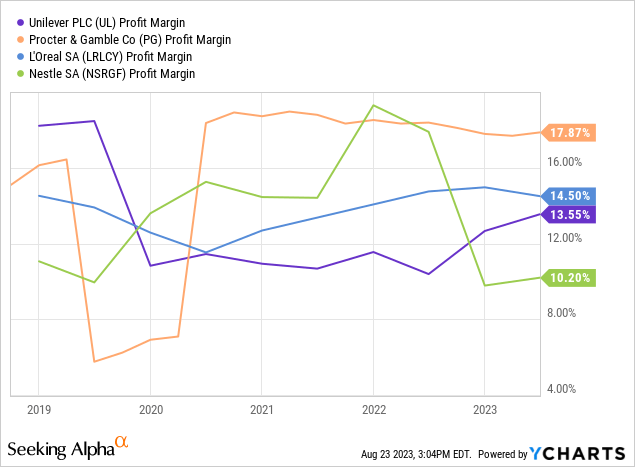

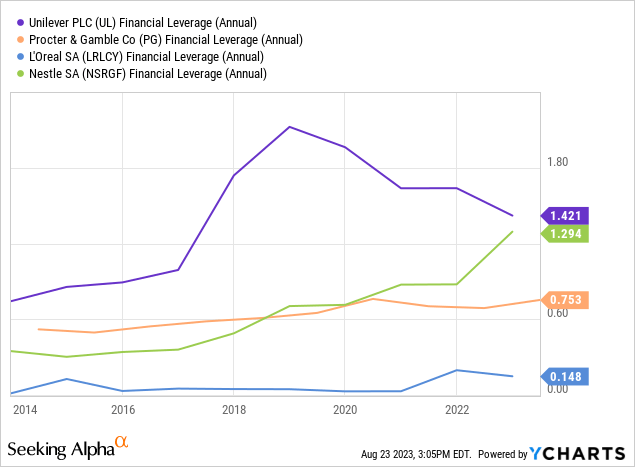

While stock price does not tell the whole story, a few aspects of Unilever's financials coalesce to tell a story that makes UL stock performance seem expected. Revenue growth lags and the capital structure has shown leverage higher than peers historically (although that is changing). Recently increasing profit margin is a bright spot as is growth in digital commerce, but on balance, the market values Unilever at a discount and has done so consistently for several years.

Revenue

Revenue growth over the past 5 years has lagged that of competitors on average. This is tough to overcome as revenue qualifies as the starting point of a firm's financial positioning. Unilever has addressed this in the past under former CEO Alan Jope by targeting their brand portfolio into higher growth spaces: disposal of some slow-growth units (tea and margarine-type spreads) as well as acquiring some higher-growth brands within Personal Care. The company's future plans under new CEO Hein Schumacher (H1 2023 Earnings Call) include higher investment (R&D, advertising, capital expenditures) in the current portfolio with more selective (read fewer) acquisitions and disposals. Digital commerce, up 16% and now itself 16% of revenue per the same earnings call, is a key focus that should be supportive of revenue growth going forward.

Profit Margin

Unilever's margins were low relative to these competitors until the increase seen over the past year. Net SKU reduction, or eliminating products "with low gross margin," as well as annual productivity savings on the order of 2 billion Euro over each of the past few years were cited by CFO Graeme Pitkethly as reasons for the improving margins. This recent uptrend in profit margin is something worth tracking going forward.

Capital Structure

The manner in which Unilever's assets are organized shows higher leverage than its competitors. At the same time their ROA is 18% lower than that of P&G, ROE is 27% higher (data source: YCharts).

| Unilever | P&G | L'Oréal | Nestlé | |

| ROA | 10.2% | 12.4% | 12.0% | 7.2% |

| ROE | 41.9% | 32.9% | 21.5% | 23.8% |

| Financial Leverage (Annual) | 1.4 | 0.75 | 0.15 | 1.3 |

It turns out that Unilever has a history of employing higher leverage going back 10 years. In 2019 just before the COVID pandemic, leverage peaked at just over 2, which was approximately three times P&G's leverage at the time. While relatively high leverage would not be considered desirable for a Consumer Staples firm, this situation also has been improving over the past few years.

Valuation

Unilever's valuations are lower than its competitors whichever metric is chosen, which should not be surprising given the stock price history. Fair or not, the market's aggregated perception is that Unilever's enterprise is worthy of investment at discounted prices. Below is the 5-year history for Price/Sales.

Discussion

There are a few subjective comments to be made regarding Unilever. The firm sells some products under many different names in different countries. OMO detergent - and this is just one example - is sold under 8 different names across Europe, Asia, and South America. If this is an astute strategy, then why does their Dove soap go by the same name everywhere?

Another topic is their strategy in Personal Care toward premium products (H1 2023 Results). In that document are cited supermarket products with pricing that qualifies as average (AXE) or only slightly elevated (TRESemmé). During the H1 2023 Earnings Call, there was mention of some of the other premium brands - within "Prestige Beauty and Health & Wellbeing" such as Liquid I.V., OLLY, Dermalogica, Paula's Choice - but no commentary on their complementary contributions to Unilever's increasingly premium portfolio strategy. Because the future offers no concrete data, management should offer a more specific narrative on this strategy. Minimizing any perception of inconsistency or vagueness would only serve to increase investor confidence.

Conclusion

Given the current economic climate - moderated economic growth and continued elevated inflation - Consumer Staples firms like Unilever have the relative advantage of producing products that are essential to people's lives. The situation at Unilever can be considered a mixed bag: revenue growth and margins have lagged but profit margin is improving. They have taken genuine first steps, but a successful turnaround is not a foregone conclusion at this point in time. My rating for Unilever is Sell.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.