VUG: The Growth Party Is Ending As Momentum Slows

Summary

- Vanguard Growth ETF has recovered most of its losses from 2022, rising by 33% YTD due to AI interest and "discount" buying activity.

- VUG's high valuation suggests a possible "double top" and potential reversal for the ETF, mainly due to rising long-term interest rates.

- The Vanguard Growth ETF faces challenges from higher interest rates, slowing growth, and excessive concentration in very few companies.

- Most of VUG's top holdings have stagnate sales growth outlooks, but could improve EPS due to margin expansion efforts.

- I believe the fund is a solid short opportunity due to the "perfect storm" of technical and fundamental trends.

wildpixel/iStock via Getty Images

After over a decade of consistent outperformance, growth stocks faced significant declines throughout 2022. Throughout 2022, the popular Vanguard Growth ETF (NYSEARCA:VUG) lost just over a third of its value. However, throughout 2023, the ETF has retraced most of its losses, rising by 33% YTD. VUG is currently around 15% below its 2021 all-time high after facing a 4-5% decline over recent weeks. That said, the growth stock fund remains highly priced today, almost as if 2022's strains never occurred.

In my view, VUG's current positioning indicates a possible "double top," indicating a potentially significant reversal for the ETF. The same may also be valid for the Nasdaq 100 (QQQ) and the Technology Sector (XLK), which usually trade closely with VUG. Fundamentally, the growth stocks in VUG have performed well due to the immense market capitalization expansion of a few stocks, mostly technology giants. As such, VUG has become highly concentrated in a small number of companies, notably Apple (AAPL) and Microsoft (MSFT), which command ~25% of its total AUM today.

Other negative factors facing growth stocks include higher long-term interest rates, slowing growth amongst technology giants, and growing consumer-driven economic strains. On the other hand, some analysts remain very bullish on mega-cap growth stocks and expect a more significant breakout led by higher EPS growth. The merit of that view depends on the profit expansion of numerous growth stocks driven by sharp declines in operating costs. Indeed, while it is true that growth stocks are improving EPS by lowering overhead, I believe it is unclear how long these firms will benefit from their efficiency efforts. Overall, it looks pretty likely that VUG and most of its constituents will face significant volatility over the coming weeks and months.

The Growth-Interest Rate Conundrum

Higher interest rates would disproportionately harm growth stocks if we lived in a world where companies were always valued based on discounted future cash flows. Growth stocks usually have lower immediate cash flows but are valued on expectations of higher future cash-flow growth. Thus, if long-term interest rates rise, those future cash flows are much more discounted. For example, if a 10-year Treasury bond has a ~4.4% yield, it is likely more attractive than a stock with a 4.4% earnings yield at some point.

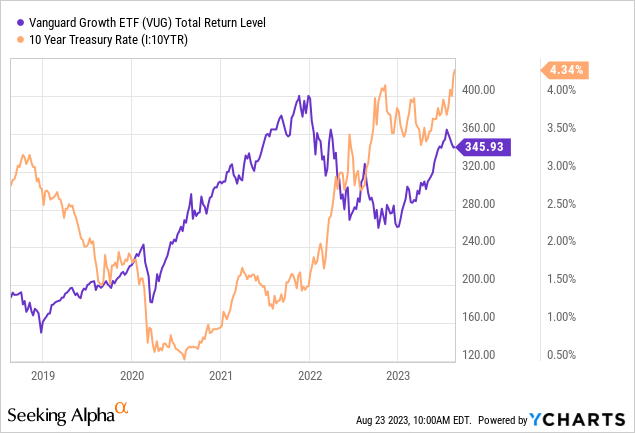

VUG currently has a very high weighted average "P/E" ratio of 37X or a 2.7% earnings yield. As such, the companies must effectively double their EPS over the next decade to be on par with Treasury bond yields. VUG's valuation is much richer than other market indices, with the total stock market ETF (VTI) having a 22.7X "P/E" and the Vanguard Value ETF (VTV) trading at a 17X "P/E." Of course, long-term interest rates may also increase, increasing the "opportunity cost" factor. Indeed, the 10-year Treasury yield has broken higher in recent months, usually portending a negative movement for growth stocks. See below:

The sharp rise of growth stocks from 2019 to 2021 was primarily driven by a sharp decline in interest rates that boosted the comparative value of stocks, particularly growth stocks, which are more exposed to discount rate changes—combined with immense inflows from retail investors using stimulus savings, a bubble formed amongst most growth stocks, particularly those companies with little current income. Last year, as capital costs grew sharply, the bubble appeared to pop until it potentially returned this year, defying the most recent sharp increase in long-term rates.

For VUG to be pretty valued today despite higher long-term interest rates, its primary holdings must have a dramatically improving EPS growth outlook. Apple and Microsoft dominate VUG, but its top seven holdings combined carry roughly half of its total AUM. Specifically, 13.5% for Apple, 11.5% for Microsoft, 6.7% for Google (GOOGL), 5.4% for Amazon (AMZN), 5.1% for Nvidia (NVDA), 3.3% for Tesla (TSLA), and 3.3% for Facebook (META). Mostly, these companies have seen significant declines in two-year sales growth outlooks. Over the past 180 days, AAPL, MSFT, AMZN, and GOOGL have all seen no improvements in sales growth outlooks, following sharp negative outlook changes earlier this year. See below:

Revenue Estimates 2 Years Ahead (YCharts)

The same is true for Tesla, but its figure is too volatile to fit into the chart above. Facebook has a 10% increase in its sales growth outlook following a sharp deterioration in its sales outlook throughout 2022. Nvidia is the only standout with a robust sales outlook growth of ~60%; however, its "P/E" ratio is a stupendously high 241X. Nvidia is not a "pre-earnings" company that can trade at valuation extremes due to a lack of income. It is a relatively old and established company that has generated a positive income for many years, so its valuation is only reasonable if it can achieve extreme growth; however, AI proliferation supports this view in many analysts' eyes.

The fact is that most of the largest stocks in VUG are hardly growth companies. Their sales outlooks are relatively stagnant, which is reasonable considering they've already achieved market dominance over the past decade. Apple and Microsoft, specifically, as consumer-driven companies, seem to have reached total potential market power in key segments such as device sales and others. Apple is seeing its sales decline faster since many people are not replacing iPhones as often as before, likely exacerbated by mounting consumer discretionary headwinds.

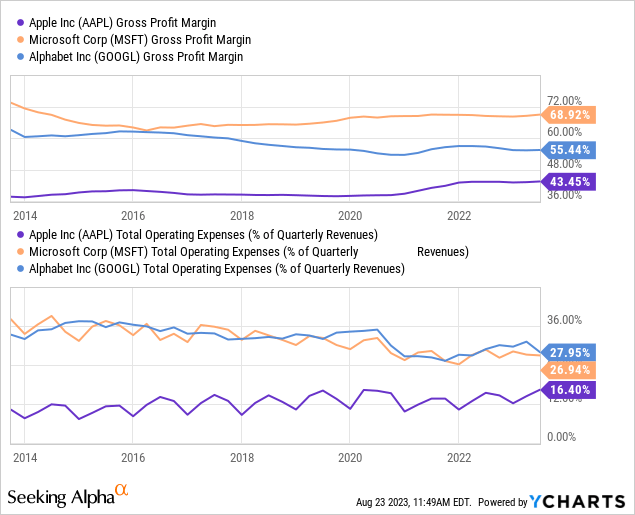

However, there is some focus on these firms to increase profit efficiency, particularly in the technology giants that dominate VUG. Since 2020, there has been a general decline in operating costs to sales and an increase in gross margins. Microsoft and Google have improved on both ends, while Apple's gross margins have risen significantly due to its sharp iPhone price increases. See below:

To me, the top holdings in VUG show an evident pattern. These companies are no longer expanding sales at such a rapid pace since they've already become behemoths. However, as their sales growth slows, they focus on reducing unnecessary costs to improve EPS profit margins. Accordingly, the technology sector has had massive layoffs since 2022, including many large and smaller firms within VUG. Some of these companies have cited AI as a reason for layoffs, indicating that some workers are likely to be replaced by AI. Indeed, the growth of AI in 2023 is potentially a significant factor contributing to VUG's stronger improvement; however, I believe the extent of gains these companies may receive from AI is currently overestimated.

Ten years ago, AAPL had a TTM "P/E" of just ~14X. Since then, its EPS has risen by ~320%. However, its valuation is over twice as high today, while long-term rates are much higher, implying that AAPL should grow its EPS significantly over the following decade. Based on its stagnating sales growth outlook and sheer size, I believe that view is highly unrealistic. Of course, AAPL is just one of many in VUG, but it is the largest and is a decent example of many of the situations of many mega-cap stocks in VUG. Apple and its peers may see EPS growth through 2025 due to margin expansion, but that could easily be upset by shifting economic fundamentals.

Overall, I do not believe corporate or economic fundamentals support the 2023 rebound in VUG. Economic fundamentals clearly show a negative consumer discretionary buying power trend, which I think will continue over the next year or two. Most of VUG's top holdings are very consumer-sensitive, including Apple, Microsoft, Amazon, and Tesla; however, Google and Facebook (advertising-driven) will face indirect pressures as consumer demand falters. Further, I firmly believe these firms, excluding Tesla and Nvidia (which trade at extremely high valuations), have far less growth potential than they did 5-10 years ago.

The Bottom Line

I have a bearish outlook for VUG and expect the fund to decline considerably over the following year. In my opinion, the ETF's most significant holdings do not have the fundamental growth outlook necessary to justify their current elevated valuations. This issue is particularly true regarding slowing consumer power and higher long-term interest rates. VUG has seen strong growth this year as investors buy back into the fund at a discount, potentially due to AI hopes and improvements in profit margins. Profit margin growth will help their EPS mildly in the short term but is unlikely to be a significant long-term growth driver. Indeed, as these companies seek to reduce operating overhead, they may see less growth in the long term as R&D and sales employees are laid off.

I believe the most significant factor benefiting VUG in recent months has been a speculative momentum trade driven primarily by concentration issues. Since Apple and Microsoft are the most extensive stocks, investors buying market-cap-weighted ETFs will disproportionately buy those two companies, causing their market value to rise even more, potentially creating a positive feedback loop. This issue has become so extreme that those two firms now account for roughly 45% of XLK. Accordingly, market breadth was extremely low during the first half of 2023, with only the largest stocks driving nearly all gains in most indices. In my view, this is not due to those firms' strong fundamental improvements (given their lack of sales outlook growth and higher interest rates) but to ETF market mechanics, which cause excessive inflows toward high-concentration firms in market-cap-weighted funds.

While it may be too early to tell definitively, the declines in VUG over recent weeks may be a sign that a "double top" has been created. I do not have an explicit price target for VUG since its constituents can change, but I anticipate it will materially underperform the S&P 500, value ETFs, and small-cap ETFs over the coming year. Since it appears to be significantly overvalued, I believe VUG is a solid short opportunity. Surprisingly, VUG's implied volatility is subdued at 17%, well below its historically normal range, likely due to the broader compression of the VIX index. As such, put options on VUG may be a particularly undervalued means of betting against the fund with defined risk.

It may be wise to use some hedge protection if betting against VUG since its rally may not be over, with some potential of rising to or above its all-time high. In my view, speculative momentum surrounding growth stocks will inevitably slow due to the sharp declines in financial market liquidity and weakening economic prospects, so I do not believe the total upside potential in VUG is exceptionally high. That said, while I think the top is in for VUG, there has been some increase in discount buying activity in recent days that could potentiate a rebound. In my view, a breakdown in the bond market (BND) below its support level is likely the best indicator of a decline for growth stocks due to its inverse historical relationship with long-term interest rates.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.