BCAT: Shareholder Activism Might Lead To Tender Offer

Summary

- Boaz Weinstein, head of Saba Capital Management, is taking on BlackRock over a number of closed-end funds.

- Weinstein aims to switch BlackRock Capital Allocation Term Trust from a closed-end fund to an open-end fund to eliminate the discount to NAV.

- BCAT's total return performance since inception has been disappointing, but it offers a nice dividend yield and exposure to private investments.

ayo888

Boaz Weinstein, the head of hedge fund Saba Capital Management and portfolio manager of Saba Closed End Funds ETF (CEFS), is taking up a fight against BlackRock over a number of closed-end funds. It concerns among others the BlackRock Capital Allocation Term Trust (NYSE:BCAT).

The London Whale

The “London Whale” is the nickname of a former JPMorgan trader who took massive positions in credit default swaps (CDS) , insurance policies that pay-out when borrowers default. He earned this nickname among hedge funds who took the opposite position. One of those hedge funds was Saba Capital Management, a credit-focused hedge fund headed by Boaz Weinstein.

The “London Whale” was selling billions of dollars of notes for the so-called Investment Grade Series 9 10-year Index CDS. Noticing that the price index was lower than Saba's models indicated, Weinstein began buying CDSs on the index. In the end, JPMorgan had reportedly lost $6.2 billion.

CDSs were created in the early 1990s by Bankers Trust. When Weinstein joined Deutsche Bank in January 1998, the bank had just acquired Bankers Trust. He became the only person at the bank trading CDSs and made nice money when Russia defaulted and during the LTCM-crisis.

By 2001 Weinstein was managing an internal hedge fund within Deutsche Bank with about $30 billion in positions. He named his proprietary trading group “Saba” (which is a Hebrew word for grandfather). In 2009 Weinstein left Deutsche Bank to set up his own hedge fund: Saba Capital Management.

A limited term fund

BCAT has a contingent limited term structure and will offer investors a liquidity event at net asset value either at the Dissolution Date or in connection with an Eligible Tender Offer.

BCAT isn’t a so-called “target date” or “life cycle” fund whose asset allocation becomes more conservative over time as its target date, often associated with retirement, approaches.

To increase awareness of this limited term structure, BCAT’s name was changed earlier this year from “BlackRock Capital Allocation Trust” to “BlackRock Capital Allocation Term Trust”. The Dissolution Date remained September 27th 2032.

Just like other BlackRock limited term funds like the BlackRock Innovation and Growth Term Trust (BIGZ) and BlackRock ESG Capital Allocation Term Trust (ECAT), BCAT intends to dissolve on the Dissolution Date, the first business day following the twelfth anniversary of the effective date of the its initial registration statement.

The Board may, without shareholder approval, vote to extend the Dissolution Date: (i) once for up to one year, and (ii) once for up to an additional six months, to a date up to and including eighteen months after the initial Dissolution Date (which date shall then become the Dissolution Date).

Within twelve months prior to the Dissolution Date at the discretion of the Trust’s Board, the Trust may conduct a tender offer to purchase 100% of the then outstanding common shares at a price equal to the NAV per common share on the expiration date of the tender offer (an “Eligible Tender Offer”).

Following the completion of an Eligible Tender Offer, the Board may vote to eliminate the Dissolution Date without shareholder approval and provide for the Trust’s perpetual existence. If an Eligible Tender Offer would result in the Trust having aggregate net assets below $200 million, the Eligible Tender Offer will be cancelled and the Trust will dissolve on its Dissolution Date (at NAV).

Closed-end fund arbitrage

Closed end funds are, like their name suggests, closed end funds, unlike ETFs, which are open end funds. Both ETFs and CEFs are traded on an exchange, but ETFs trade always close to their net asset value while closed end funds can trade at a discount or a premium to their NAV.

CEFs may become the subject of an activist campaign by a shareholder whose aim is to eliminate or reduce the discount to the NAV. This is called closed-end fund arbitrage.

One way to reduce the discount to NAV is to switch the closed end fund to an open end fund. Such funds always trade at NAV and by switching a closed end fund that trades at a discount to an open end fund eliminates in one go the discount to NAV. This is exactly what Boaz Weinstein wants to achieve with BCAT. He doesn’t want to wait until the fund’s dissolution date in 2032 to get paid the NAV. He wants it as soon as possible.

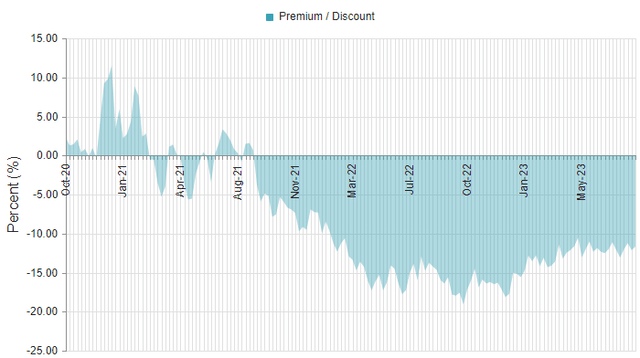

BCAT is trading at a discount to net asset value of 11.7%. If Weinstein succeeds to get what he wants, he and the other BCAT shareholders will pocket a gain of more than 13%! BCAT’s discount to NAV is already shrinking and is currently lower than its 52 week average of 14.2%.

Figure 1: Discount to NAV (cefconnect.com)

At the start of the fund, BCAT used to trade with a premium.

According to BlackRock, Weinstein’s activist campaign seeks “seeking to force tender offers, open-endings or liquidations to enrich itself at the expense of other shareholders”.

It’s not entirely clear to us how an immediate gain of more than 13% would be detrimental to the BCAT shareholders.

In the meantime BCAT does seek to enhance shareholder value by purchasing its shares when trading at a discount to their NAV per share. BCAT has repurchased approximately $68 million of its shares, generating approximately $12 million in accretion to the Trust’s NAV.

Pull to NAV

In fixed income bond prices can move up or down above and below par as interest rates fluctuates. The market price of a bond gradually moves closer to its par value as the bond approaches its maturity date. This phenomenon is called “pull to par”.

A bit likewise the price of a closed end fund can move up or down to a premium or a discount to NAV. Because BCAT is a limited term fund, we can expect it to trade at NAV at the dissolution date (that lies a bit more than 9 years in the future). We can call this, for limited term closed end funds, “pull to NAV”.

BCAT has an expense ratio of 1.60%. But if we divide the current discount by the remaining life of the fund, we get a pull to NAV effect of 1.3%. Taken together this makes the expense ratio less expensive.

Of course, if BOAZ Weinstein gets what he wants, the remaining lifespan of BCAT as a closed end fund becomes much smaller and the pull to NAV effect gets an immediate effect.

BlackRock Capital Allocation Term Trust

The BlackRock Capital Allocation Term Trust is a closed-end fund that has “an unconstrained approach with the ability to invest in public and private markets across different asset classes.” BCAT is managed by Rick Rieder, BlackRock’s CIO for Global Fixed Income and Head of Global Allocation Investments.

BCAT invests in a portfolio of equity and debt securities. Generally, the portfolio will include both equity and debt securities. At any given time, however, BCAT may emphasize either debt securities or equity securities.

BCAT utilizes an option selling strategy in an effort to generate current gains from options premiums. As of June 30, 2023, BCAT sold options on approximately 10% of the fundamental equity positions.

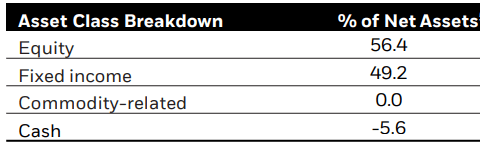

As of June 30, 2023, BCAT had a 56.3% weighting in equities, up from 53.5 % at the end of March.

Figure 2: Asset allocation (BlackRock)

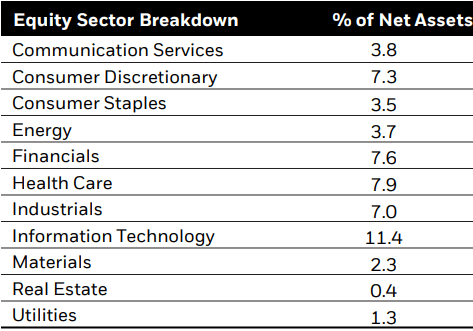

Technology represented the sector with the largest increase over the quarter and is the biggest sector in the equity part of the fund.

Figure 3: Sector allocation (BlackRock)

Technology positions are focused on enterprise software providers and companies that may benefit from the proliferation of artificial intelligence. Within AI, exposure is focused on infrastructure providers positioned to power growth across open AI platforms.

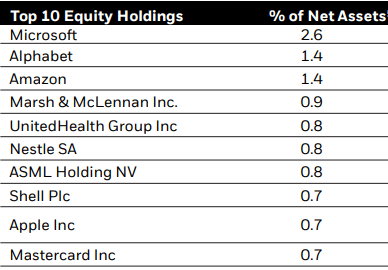

Figure 4: Top 10 holdings (BlackRock)

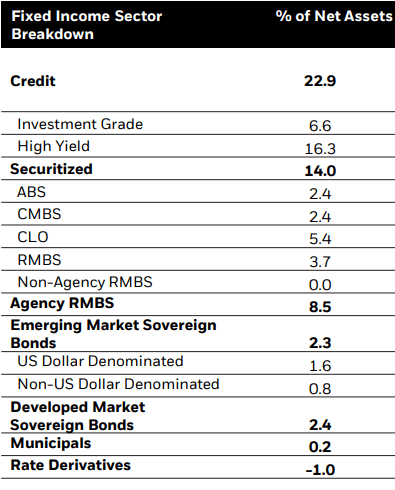

Within high yield, BCAT remains more cautious and patient around idiosyncratic opportunities, given continued dispersion across both sectors and quality buckets. As a result, it rotated a portion of the high yield exposure into investment grade credit.

Figure 5: Fixed income allocation (BlackRock)

Closed-end funds can provide investors access to private investments. BCAT continues gradually to build its allocation to private investments (currently 11.3%) and expects in the long run the exposure to be around 25%. The goal is to build a diversified portfolio of private investments with a general (but not exclusive) focus on technological innovation.

BCAT’s total return performance since inception is really disappointing. It underperforms asset allocation ETFs like the iShares Core Moderate Allocation ETF (AOM) and the iShares Core Growth Allocation ETF (AOR) or covered call ETFs like the Amplify CWP Enhanced Dividend Income ETF (DIVO).

Figure 6: Total return (Seeking alpha)

We rate BCAT a hold because of the nice dividend yield, the exposure to private investments it offers, the pull to NAV effect and the speculative appeal (thanks to the shareholder activism).

Conclusion

At the start of its life as a limited term closed end fund, BCAT used to trade with a premium to net asset value. Now it’s trading at a discount of more than 10% for quite a while. This led to shareholder activism by hedge fund manager Boaz Weinstein. If he gets what he wants BCAT is switched from a closed end fund to an open end fund and automatically and immediately trades at NAV. Such closed end fund arbitrage is beneficial to all BCAT shareholders.

We are disappointed in BCAT’s return since inception. Too disappointed to rate BCAT a buy. Nevertheless, the nice dividend yield, the exposure to private investments, the pull to NAV effect and the speculative appeal lead us to a hold rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIVO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.