QuantumScape: Too Much Volatility

Summary

- QuantumScape recently closed a $300 million offering, despite management saying that the company has enough cash to run until 2025.

- QuantumScape shares dropped more than 40% after the offering was announced, despite the offered shares representing only a 7% dilution.

- QuantumScape expects to start producing low-volume B samples in 2024 and higher-volume B samples in 2025.

- I believe QuantumScape will face tough competition from Solid Power due to the latter's better business model.

SouthWorks

Thesis

Solid-state batteries may be the future of EVs and mobile devices, but they still have a long way to go. So for the next few years, the only thing that we can judge solid-state battery companies on is how reliable their management is, how far they have come regarding their technology, and what their business model will be when they start generating revenue. I believe QuantumScape (NYSE:QS) has failed in at least two of these criteria. I see the company's business model of producing batteries itself as inferior to that of a company like Solid Power (SLDP) that will adopt a licensing model.

I also think the company's management failed shareholders with the latest $300 million offering since it showed a lack of confidence from management in the company. This capital raise came after management reiterated that its cash runway will extend into the second half of 2025 in the Q2 earnings call, indicating that the company did not need to raise capital now, especially at a 35% discount. For all of these reasons, I'm giving QuantumScape a sell rating.

QuantumScape Financials

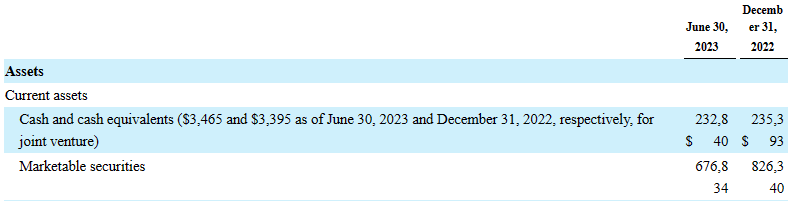

QuantumScape ended Q2 with around $900 million in liquidity, and management has reiterated its forecast for capital expenditures of $100 million to $150 million and cash operating expenses of $225 million to $275 million.

QuantumScape Cash Balance, Q2 Earnings Report

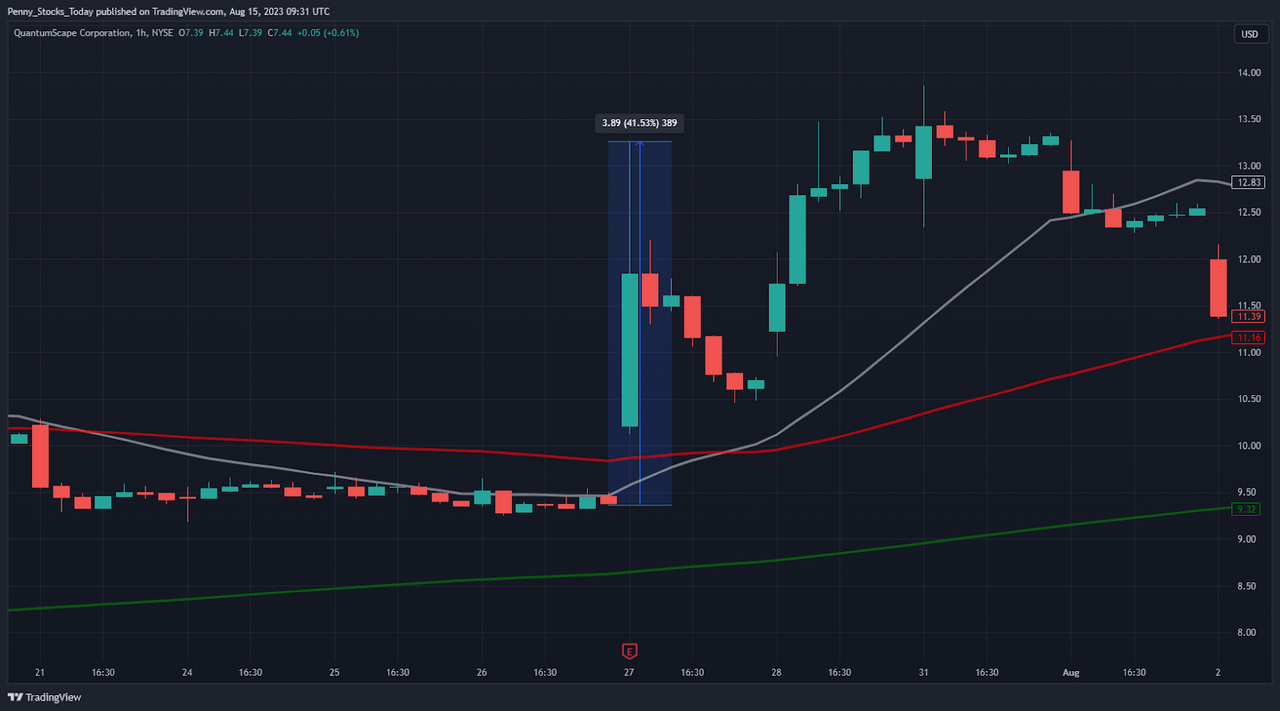

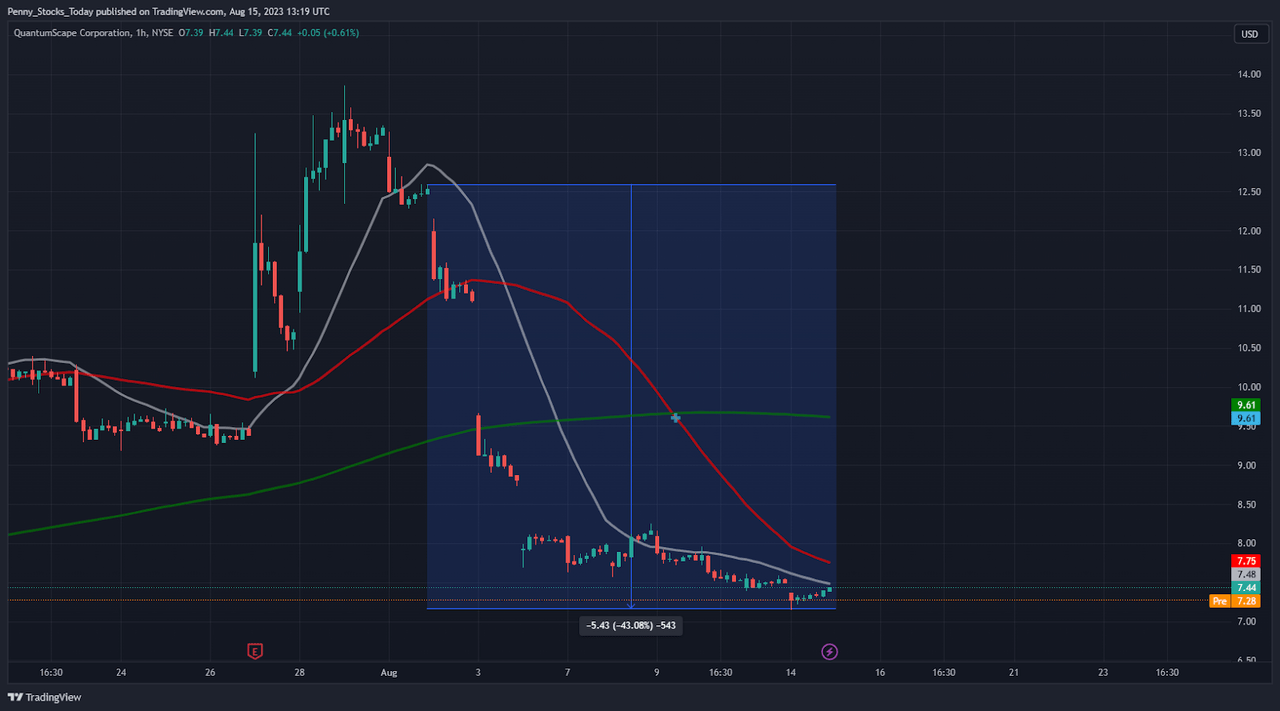

Management also said that its cash on hand will be enough for the company to keep operating until the start of the second half of 2025, which is why the latest offering made me scratch my head. If the company has enough cash to operate for around 21 months, why did management choose to dilute its shareholders now? I think this offering shows that management doesn't trust its own company. The public sentiment around QuantumScape after the earnings call was quite positive, which is apparent from the 41% run it had.

So why would management decide to announce an offering now when it could've waited for it to start production of the B-sample, which should've seen its stock price increase since it is a huge milestone for the battery maker? Another thing is that, despite the offered shares representing only 7% of the outstanding shares at the time, they were priced at $8, a 35% discount from the trading price at the time of the offering, which led the stock to fall more than 40%.

Tough Competition

QuantumScape has two main competitors in Solid Power and SES AI Corporation (SES). I believe determining who would come out on top here would be tricky since I think every company has a piece of the puzzle.

SES is currently ahead of other SSB companies in terms of timeline since it is currently transitioning to B-sample and expects to enter C-sample in 2025, unlike QuantumScape and Solid Power, which don't expect their B-sample anytime soon.

That said, I don't think being ahead is the only thing that matters since QuantumScape is better capitalized, which is one of the most important things for pre-revenue companies, and in my opinion, Solid Power has by far the better business model.

While both SES and QuantumScape are planning to produce their own batteries and sell them, Solid Power will generate revenue by licensing its technology to EV manufacturers and only producing the electrolyte and selling it to manufacturers. For me, this makes so much sense. Solid-state batteries are too expensive, and they're also prone to cracks in the assembly process, which makes them really expensive to produce. Also, this business model would avoid the problem of scalability since Solid Power wouldn't have to produce millions of batteries annually to meet demand, unlike QuantumScape, which will have a lot of scaling to do if it successfully reaches commercialization.

Furthermore, a lot of EV manufacturers, like Tesla (TSLA) and BYD (OTCPK:BYDDF), make their own batteries, so licensing the technology would make more sense for these companies than abandoning their production and buying complete batteries from another party. As for other companies that buy their batteries from a battery producer like Hyundai (OTCPK:HYMTF), Solid Power can just license its technology to the producer. That means that QuantumScape's competition wouldn't be Solid Power itself, but the current traditional lithium-ion producers that could license the technology from Solid Power.

Risks

Since QuantumScape lost around 40% of its value due to a 7% dilution, investors may consider the stock undervalued, which could see it slowly getting back to levels slightly below its pre-dilution value.

Furthermore, among solid-state battery companies, QuantumScape is currently better capitalized, especially with the latest $300 million capital raise, and capitalization is one of the important aspects to look for in pre-revenue companies. This is the case since having the best technology or business model wouldn't matter if the company went bankrupt before realizing any revenue. Also, QuantumScape is partnered with Volkswagen (OTCPK:VWAGY), the third-largest EV producer in the world, which means that if it reaches commercialization, Volkswagen would help it increase demand for its batteries.

Conclusion

While QuantumScape is one of the biggest players in the solid-state battery space and is well capitalized, it has tough competition from SES, which is ahead in terms of technology, and Solid Power, which has a better business model that is suitable for the current battery market. Additionally, I think the company's management failed its shareholders with the latest offering and showed a lack of trust in its own stock. If the company had enough cash to operate, then it wouldn't make sense to dilute its shareholders. While the company could be an amazing company in the solid-state battery space, I don't believe investing in a volatile stock like QuantumScape is a good idea, which is why I'm giving it a sell rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.