Orkla: A Lot To Like About Quality FMCGs At Good Valuation

Summary

- Orkla is an international FMCG company with the potential for significant growth but also heightened risk.

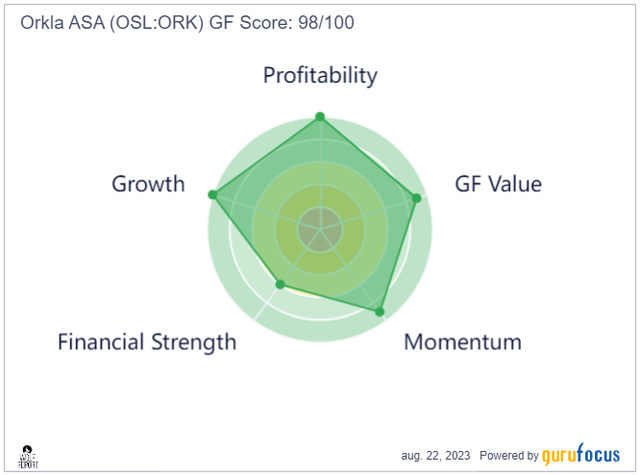

- The company has strong profitability, growth potential, and valuation, scoring high in these areas.

- Orkla's recent 2Q results were excellent, with double-digit growth in its largest stakes, despite challenges in the European Pizza segment.

- I consider Orkla a "Hold" here and will revisit the company as we move after the CMD at the end of this year.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Jelena Safronova/iStock via Getty Images

Dear readers/followers.

I would consider myself apt at forecasting and evaluating the levels of certain companies and their overall appeal at certain valuations. Orkla (OTCPK:ORKLY) is certainly one of those businesses that I consider myself able to "BUY" or "HOLD" at good levels, as you can see from my recent 3-5 coverage articles on the company. My last rating for Orkla was a conservative "HOLD", as I saw the company as having gone too high. The performance since that article speaks I favor of my stance at the time.

Seeking Alpha Orkla (Seeking Alpha Orkla)

Now that Orkla has dropped compared to the S&P500, is it in a materially more attractive position? Has the company's recent result justified a higher valuation, a higher price target? What about the impacts from the current macro?

These are questions that I mean to answer in this article, around 3 months after my latest one on the company.

Orkla - International expansion of quality FMCGs to future growth geographies

So, one of the main differences in Orkla from when I started investing in the company many years ago is its now-international profile. I don't consider this to be necessarily a bad thing as it offers potential for significant growth - but I do consider it to come with a heightened amount of risk compared to the traditional mostly-Scandinavian FMCG company I bought 10 years back.

Those core operations still remain. And they are profitable - but as the company moves more and more into its international segments, it's not a strange notion that we're going to see a net overall risk increase for this business operations.

Orkla is best invested in through the native Norwegian ticker ORK. It's one of the safer FMCG companies out there. I've looked at company profitability, fundamental strength, growth potential, and valuation - and the fact is the company scores high in all of these. Financial modeling and valuations need to understand the company though, and it's my experience that very few do this. It's easy to declare that Orkla is qualitative. Services and modeling as we find on GuruFocus do this.

It's not easy to find companies that score above 95/100 here. Doing so requires streamlined and proven operations with good profitability, a good valuation, and solid financial foundations. Very few companies have these as good as Orkla does.

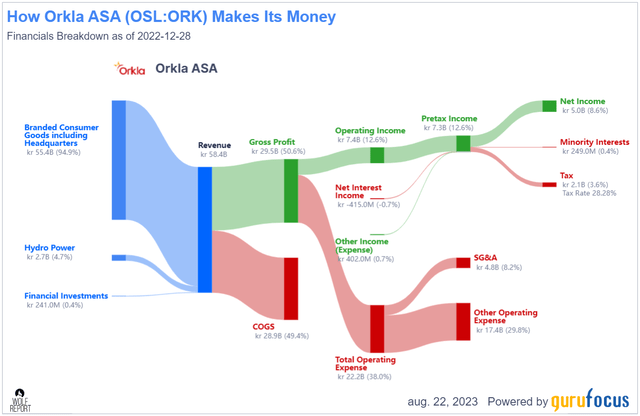

Furthermore, very few FMCGs offer the company's double-digit margins on an EBIT level - 11.5%, and a net margin of 8.28%. This is compared to FMCG/Grocer margins of usually below 4%, or around 4% here in Scandinavia. So Orkla, selling food and doing so profitably, is doing extremely well. Its operational strength and efficiency can be highlighted in the following chart.

The company may, and how I've always viewed it when investing, best be viewed as a very good "savings account", with the potential for a capital upside - but only at the right price. if you buy it too expensively, it's essentially a savings account with a capital downside. Most analysts don't seem to, as I see it, understand this company and how it trades. The fact that some services or analysts give this business a target of above 100 NOK/share means they fail to understand some of the cyclicality or risk in the business - at least compared to how I model.

Nonetheless, we had some very good 2Q results to consider, which also caused the company's share price to bounce a bit.

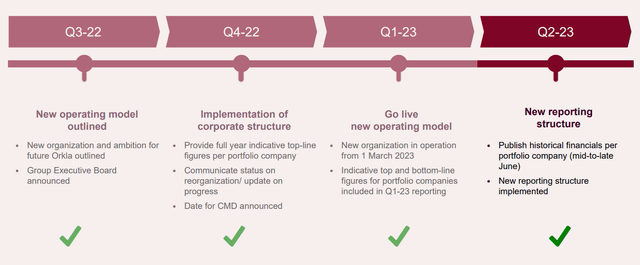

The company is currently going through an impressive bout of restructuring and a new operating model. Most of this is already phased in - and as of the latest quarter, 2Q23, we also have the new reporting structure in place.

The current priorities for the company are the consolidation of the current potential plans in both the Foods Europe and the Food Ingredients segments, as well as the other company subsectors. This consolidation has actually started now - in August and going into September of this year, before the company comes with capital investment guidelines and allocation priorities.

These things are important. Very important. Because they will be key in dictating what sort of growth we can expect from Orkla on a forward basis, by which I also mean growth in the company dividend which has stagnated for several years.

Oh, there's some growth. But certainly not much now, or even expected. Even if some analyst called for significant dividend growth here, I would question such a prediction based on the company's plan to voice its investment and allocation guidelines, hopefully in 3Q of this year - though likely as late as 4Q, which means early 2024, not this calendar year.

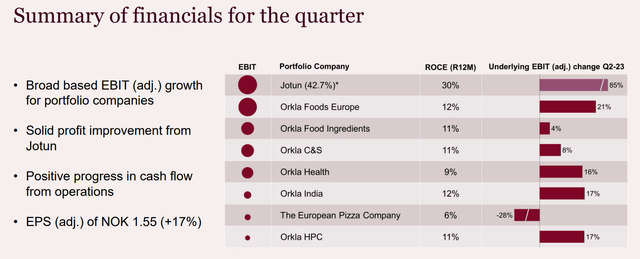

For 2Q though, results were excellent - stellar even.

As you can see, the only problem was the company's segment in the European Pizza Company - and this is a very small stake on a comparatively larger basis. The fact that the company's largest stakes grew by double digits is cause enough for celebration, as I see things here.

How did the company do this?

Power pricing is down. That was one of the major headwinds impacting the company in the last few quarters, and which is now slowly normalizing. There was a non-trivial increase in net debt to around 2.3x of EBITDA as of this quarter, but this was mostly due to Dividends/buybacks as well as the impacts of the very negative FX we're seeing. Also, Orkla is investing plenty of Capital into company growth plans - over 1B NOK went into expansion CapEx and net M&A.

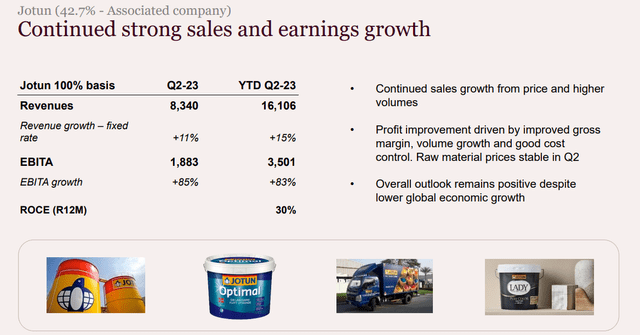

Jotun, of which Orkla owns over 40%, remains a solid performer. Orkla isn't your typical FMCG - it also owns part of coating/paint company Jotun, which saw double-digit top-line and bottom-line growth performance.

Despite cost inflation and other sector negatives, the company's food sales performance in Europe has been absolutely stellar. The company's products are obviously pricier than store brands, but nonetheless are seeing strong sales traction as consumers "vote with their wallets", and declare that they continue to be willing to pay for the brands they love. It's somewhat a volume increase but also a price/mix increase and margins are flat, meaning the company is mostly staying ahead of inflation here. ROCE stands at 11.9% here.

The same price-driven growth trend can be seen in the ingredients sector - and the company is seeing solid growth here despite some ramp-up issues at key assets, namely the new Orkla biscuit factory. On the whole of it though, Orkla saw very solid EBIT growth during the quarter, driven by top-line growth, most of which was driven by price mix. The company is charging more for its products, but people are still buying. The company's growth vectors, including India, are also growing despite a softer overall topline and stronger inflation.

What about European pizza, the one segment seeing a significant challenge here?

Well, most of that negative was actually due to restructuring. Consumer sales were strong, but Germany saw significant restructuring cost, which took away the advantage of 3% sales growth and positive organic trends. So, my stance there would be to "wait and see". The segment is likely to see improvement.,

Going forward, I would keep my eye very simply on one thing.

The company's new capital allocation and investment priorities, which we'll see soon - but not yet. We have both a 3Q23 report which comes at the end of October, as well as a capital markets day about a month later - which I by the way will be attending in person. I hope at the time to get a better insight into what the company is set to offer its investors on a forward basis, and I expect to speak to representatives for IR and management at the time, to provide you with a qualitative relevant update for this business and for my readers.

I realize that not many follow this company - which is a bit sad because Orkla has a lot to offer, and knowing when to "BUY" here is a big thing.

Let's look at the company's valuation and why now is not the greatest time to "BUY" Orkla, despite some potential upside.

Orkla's Valuation - not necessarily expensive, but...

...the upcoming priorities with regards to capital allocation and investment specifics means that I would rather wait than go in too expensively here. As I've remarked before, Orkla is a great company. It has a 350+ year history, older than most nations here. But it's also a company that for a very long time has traded at a very specific range of share prices. Going outside this range should not be done lightly, and I've never done it.

My latest PT for Orkla was 77 for the Norwegian ticker, in NOK. The company is currently closer to 80 NOK. Based simply on this, I would not "BUY" the company here. I also won't be changing my stance on the company at this particular time.

Valuation targets from analysts for Orkla have been lofty at times, over 80, and low at times, under 70. Currently, the range is at 67 NOK to around 105 NOK. The 105 NOK target is ridiculous to me and requires some outsized/strange considerations on the part of the growth estimates for the company. Anything below 65 NOK becomes a "Must buy" to me. That's also why the current average of 87 NOK is one that I'm not too keen on investing in. And despite 7 analysts following the company, only one of those analysts is currently at a "BUY". The rest are mainly a mix of "HOLD", "Underperform", and even a "SELL" rating. So conviction for what is said here seems actually to be rather low.

Orkla has underperformed its historical premium for many years - all the way back to 2018. The reasons for this are clear though, the company hasn't performed all that well in terms of EPS growth. There is a case to be made here why a "good Orkla" could see significant, double-digit EPS growth on a forward annual basis, but given that we have a 3.75% yield here and are trading at around fair value for the company's current 15x P/E, I wouldn't jump head-over-heels into the investment here.

I've added to my position in Orkla slowly over time as the company has dipped below 65 NOK, and held onto it. I haven't really sold significant amounts of Orkla at any one time, but instead elect to hold them at very appealing PTs.

At this time, I would say that I'm waiting for the 3Q or the CMD - whatever brings me clarity to the next 3-5 years, at which point I will revisit my financial model and see what I expect. At that point, I may set a triple-digit share price. But I view this as premature at this time.

Sometimes you can find good cash-secured put premiums on Orkla - but it's rare. I've written options twice during this year, both times cashing very attractive premiums for around 65-67 NOK. That doesn't seem to be possible at this time.

Here is my current thesis on the company.

Thesis

- Orkla is a class-leading Scandinavian portfolio manager of attractive foods, a large paint company, and enhanced with some hydropower operations. It's a 350-year-old Norwegian giant that's family-owned, and with very motivated owners that also include an attractive, 2-4% dividend.

- At the right price, this company is a "must-BUY" to me, and that price is close to 60-65 NOK,

- I consider Orkla to be a "HOLD" here, due to the company trading close to 80 NOK, combined with the lack of clarity from the investment/allocation strategy. I see no reason to change this approach as of August of 2023.

- I'll revisit the company in 3-4 months and give you my view of the next 3-5 years at the time.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative and well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company is a "Hold" here - it doesn't have an attractive upside any longer.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management/wealth management for a select number of clients. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORKLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. The author's intent is never to give personalized financial advice, and publications are to be viewed as research and company interest pieces. The author owns the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in the articles. The author owns the Canadian tickers of all Canadian stocks written about.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.