This Is Where You Should Turn Bullish On Alibaba And Why

Summary

- Market confidence in the Chinese economy has fizzled as investors grapple with recent data, unleashing a selloff in Alibaba's stock.

- But spanning the property slump, consumer weakness, a sputtering economy, regulatory uncertainties, and geopolitical risks, there isn't much that's new news here.

- The following analysis will discuss why we continue to think Alibaba will find support in the high $80s.

Robert Way

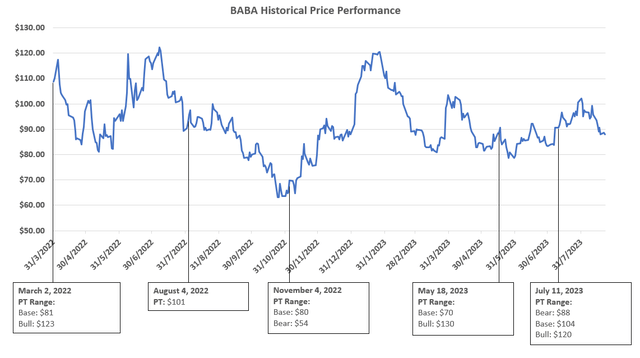

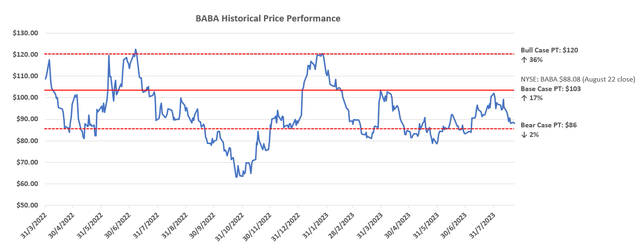

Alibaba's stock (NYSE:BABA) has largely traded range-bound this year - finding repeated support at the $80s and resistance at the low $100s since topping $120 at the beginning of the year. The trend is consistent with the stock's latest rally from the low $80s in June towards the low $100s in early August, driven primarily by anticipated improvements to Alibaba's operating environment. Yet, optimism has since fizzled, as observed by the stock's rapid decline back to the $80s, as investors come to grips with recent data that points to a still sputtering Chinese economy.

Alibaba's trading range has remained consistent with our views over the past year, with the exception of our call in November. And we continue to expect Alibaba to trade rangebound between a bottom of about $86 to a peak of $120, as markets see-saw through fluctuating intensity over the same plate of regulatory, geopolitical and economic risks facing Chinese investments.

Fundamental Considerations

Specific to Alibaba's underlying business performance, the company has pulled off a strong kick-off to fiscal 2024, after announcing its restructuring of business groups. Yet, even when paired with management's optimism for continued improvements in monetization, supported by the implementation of company-specific growth strategies and optimization of operating efficiency, it has done little to assuage investors' concerns over the impact of China's increasingly dour economic outlook.

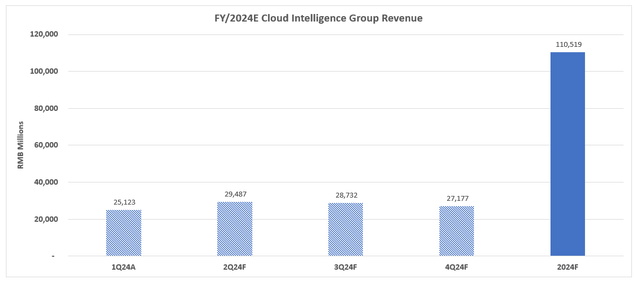

Specifically, Alibaba Cloud has restored slight re-acceleration in the business, despite consistently stabilizing content delivery network demand after mobility restrictions were lifted in China, and revenue loss from a "top customer". Yet despite returning tailwinds to its core cloud-computing demand environment, which is likely buoyed by AI momentum, Alibaba's supply-constrained segment sales during the fiscal first quarter are consistent with our expectations held since last year. We had been cautioning that U.S.-implemented export restrictions on advanced chip technology should not be overlooked as a potential limitation on Alibaba Cloud's forward performance, while the majority of the market's focus was on chipmakers at the time.

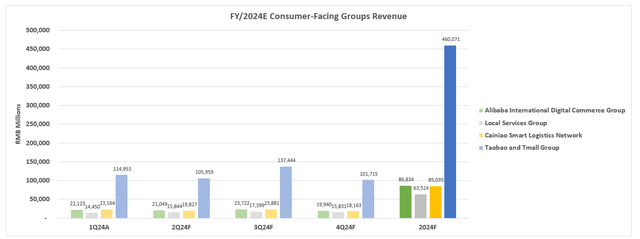

Meanwhile, Alibaba's improving commerce business at home underscores the benefit of an easier prior year comparison due to pandemic restrictions at the time. This has been further amplified by management's shift to a "value-for-money" strategy to better address increasing consumer price sensitivity, which likely bolstered demand during the 6.18 Shopping Festival in June. Despite the value-for-money strategy's slightly adverse impact on Taobao and Tmall Group's fiscal first quarter profitability, the positive result on revenue reinforces management's aims to further scale and optimize related investments to overcome "competitive dynamics [and] volatility" in the industry. We believe management's commitment to investing in customer and merchant experience in the Taobao and Tmall Group will also complement continued expansion of its Local Services Group and International Digital Commerce Group, which together will translate to further acceleration in the supporting Cainiao Smart Logistics Network.

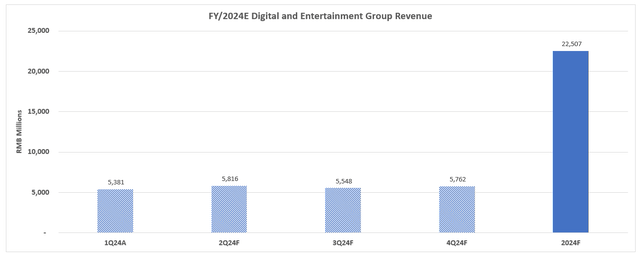

Resilient growth and profitability in Alibaba's Digital Media and Entertainment Group also supports loosening of Beijing's regulatory grip over the private sector. The segment's growth of 36% y/y and RMB 63 million ($8.8 million) adjusted EBITDA during the fiscal first quarter is a stark reversal from last year's regulatory turmoil that has resulted in divestments and tightened operating conditions.

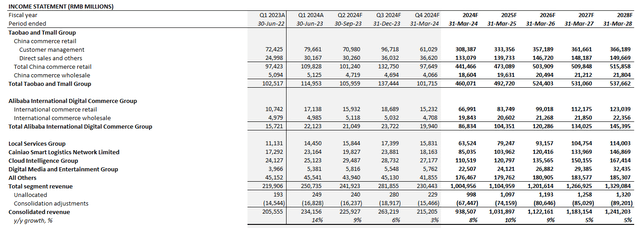

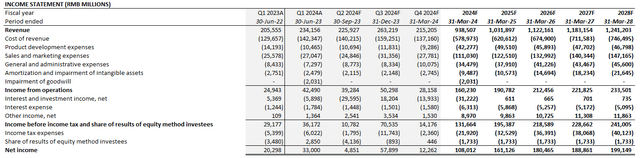

Taking into consideration Alibaba's actual performance during fiscal Q1, which primarily supports company-specific strength driven by a value-for-money and improved monetization strategy critical to overcoming the weak and price sensitive consumer backdrop, we expect consolidated revenue growth to accelerate from 2% in fiscal 2023 to 8% in fiscal 2024. We have also updated our model for the company's recent restructuring, which expects the International Digital Commerce Group, Cainiao Smart Logistics Network, and the Cloud Intelligence Group to be the longer-term growth drivers in offsetting anticipated stabilization in Alibaba's core Taobao and Tmall Group. Taken together with unallocated revenue and consolidation adjustments, we expect Alibaba's total revenue to expand at a 5-year CAGR of 6%.

Alibaba_-_Forecasted_Financial_Information.pdf

Valuation Considerations

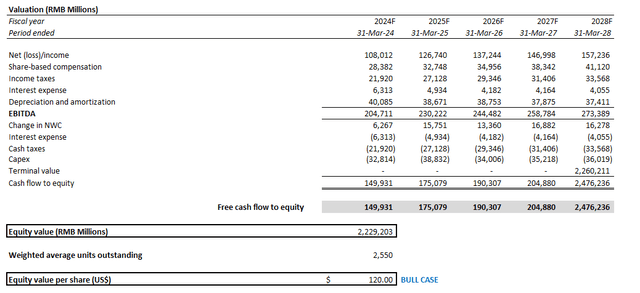

From a valuation perspective, the discounted cash flow approach, applying an 11% WACC and 8x terminal value multiple (or 1.5% estimated perpetual growth rate), estimates an equity value of $120 apiece for the stock. This is in line with our previous bull case price target. While Alibaba's fiscal first quarter results have improved, it was largely consistent with expectations driven by ongoing implementation of operational efficiencies management had previously cited, as well as the 6.18 Shopping Festival boost. Looking ahead, there is also incremental seasonal support entering the second half of calendar 2023, with the 11.11 Shopping Festival likely to complement the ramp-up of Alibaba's newly implemented value-for-money battle, and drive better capture of demand from price sensitive consumers. Related cash flow considerations factored into the DCF valuation analysis are largely consistent with those discussed prior to the fiscal first quarter earnings release.

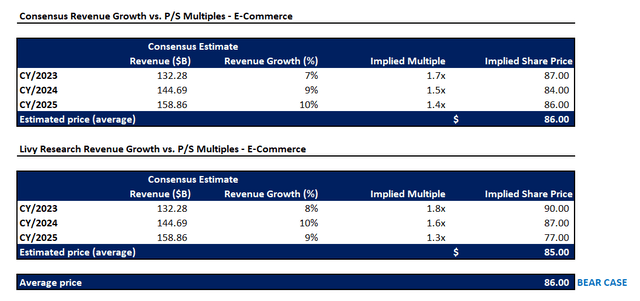

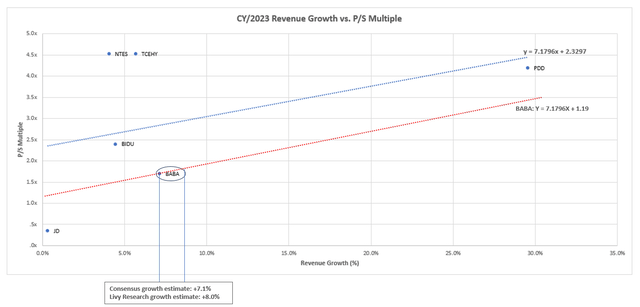

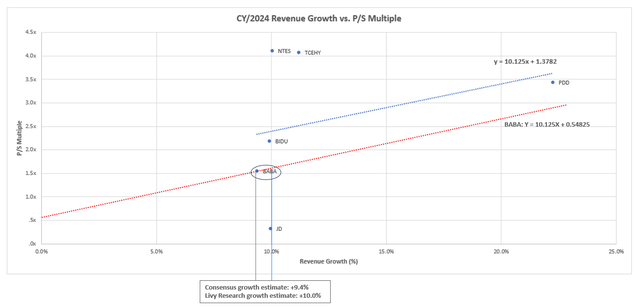

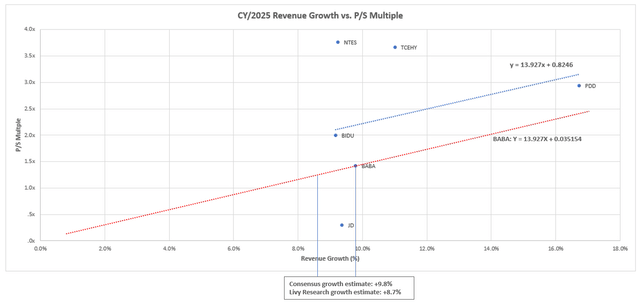

Meanwhile, the consideration of peer valuation multiples would likely explain why the stock has consistently found support in the $80 range.

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

Considering Alibaba's valuation multiple trend line (dotted red) in parallel to the broader Chinese internet peer group's (dotted blue) through calendar 2025, and applying them to both consensus and our own growth estimates, the stock is expected to trade at about $86 apiece.

The trough price of $77 under the valuation multiple approach based on our CY/2025 estimates is also pretty close to the stock's year-to-date lows. This potentially reflects the market's low visibility into what is beyond 2025 for Alibaba, or expectations for the business to mature further then, despite secular tailwinds surrounding e-commerce and cloud which the company's U.S. counterparts expect to extend through at least the end of the decade. This is also in line with CEO David Zhang's recent commentary about China's lagging share of cloud spend in IT budgets relative to what is observed in the U.S. While management stays optimistic that this metric is reflective of further headroom for growth at Alibaba Cloud, we are staying cautious considering regulatory and geopolitical constraints over the timing and potential of next-generation technology innovations to ensure adequate capture of long-term global growth opportunities.

Based on the foregoing analysis, we believe the midpoint price of $103 is an adequate reflection of the stock's near-term upside potential, as it combines both sentiment and fundamental driven prospects.

We believe that the multiple-based approach will remain a key indicator for how Alibaba will trade in the near term, as it reflects the market's sentiment for the stock. While fundamentals are important, and typically the driving force for a stock's performance, we do not think that is the case for Chinese equities prone to unquantifiable risks. We believe Alibaba and the broader cohort of U.S.-listed Chinese equities' performance driver is sentiment-heavy rather than fundamental-heavy. This is also consistent with Alibaba's stock performance over the past year, where sentiment over forward geopolitical, macroeconomic, and regulatory risk considerations, among others, have taken precedent over Alibaba's fundamental performance as an influence on its price.

The Bottom Line

We view Alibaba and the broader cohort of Chinese equities being faced with the same plate of risks and challenges over the past year, spanning macroeconomic deterioration, intensifying geopolitical tensions, and lingering regulatory restraints. And for each of these risks is a gauge that measures their intensity, influenced by factors such as fluctuations in key economic data (e.g., China GDP; retail sales; CPI/PMI), changes to U.S.-China relations, and updates to the regulatory environment.

Since the plate of said risks has not changed substantially (there's no surprise to China's sputtering post-pandemic recovery, uncertain regulatory agenda, and disagreements with the U.S.), with some such as regulatory headwinds actually showing signs of alleviation, we think related considerations have already been priced in. Essentially, we expect the stock to stay within the $80 to $100 range that has been consistently observed this year to reflect changes to risks facing Alibaba's operating environment. Any fluctuations within the range will likely be driven by changes to the intensity of each risk as they influence market sentiment. Unless there is substantial alleviation to any of said risks, we do not see Alibaba's tepid fundamental improvement taking precedent over market sentiment as a driver of its stock's performance in the foreseeable future.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service's key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!

This article was written by

Boutique investment research shop providing professional coverage on disruptive thematic equities. Our analysis provides a deep dive on growth drivers present in the secular market to identify outperforming investments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)