Deutsche Telekom: Industry Leading Performance Set To Continue

Summary

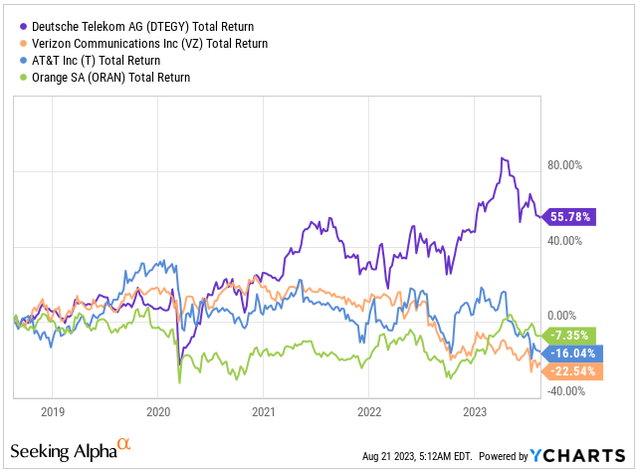

- Deutsche Telekom has consistently outperformed its competitors in total returns over the past 5 years, and this trend is poised to continue via excellent execution.

- Q2 earnings displayed expansion of EBITDA AL and FCF growth. Revenue dipped by 2.4%, but debt reduction led to a BBB+ rating upgrade.

- I anticipate Deutsche Telekom to achieve a CAGR growth of 2.0-2.5% over the next 10 years, surpassing industry norms through increased stake in T-Mobile US and European expansion.

- Coupled with growth outpacing the industry, the company's current trading price holds a 25% discount to its fair value, leading me to rate it as a Strong Buy.

Alexandros Michailidis

Investment Thesis

Deutsche Telekom (OTCQX:DTEGY) (OTCQX:DTEGF), recognized as one of the world's largest telecommunications companies, has consistently exhibited impressive performance over the last five years, surpassing the overall returns of its counterparts like Verizon (VZ), AT&T (T), and Orange (ORAN).

Total Return Performance (Seeking Alpha / YCHARTS)

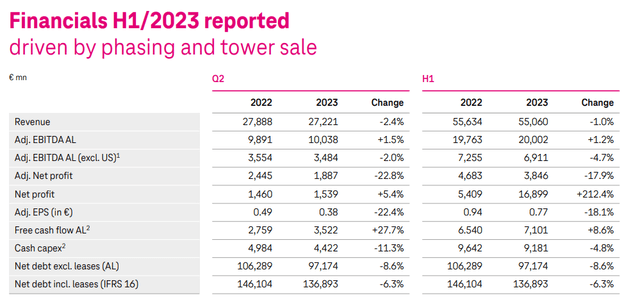

The Q2 2023 earnings report has once again highlighted the company's robust performance. It witnessed an expansion in both EBITDA AL and FCF, alongside a reduction in debt. This positive trend has culminated in the company receiving an upgrade to BBB+ from all three major credit rating agencies.

Looking ahead, I anticipate the company's revenue to sustain a growth trajectory of no less than 2.0% to 2.5% CAGR over the next decade. This growth will be predominantly driven by the expansion of T-Mobile US (TMUS) and the enhancement of profit margins in the European market.

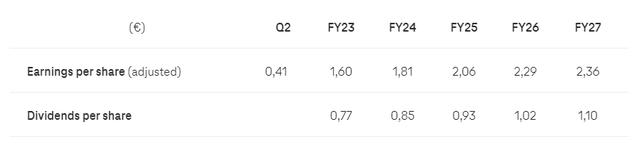

Although the company's dividend yield is not the industry's highest, currently at 3.72%, being roughly half of its peers. However, the projected growth and capital appreciation in the forthcoming years are expected to yield superior returns when compared to its industry counterparts. Simultaneously, the company's management aims to substantially increase the dividend at a rate of no less than 7% CAGR, aligning with the expansion of its earnings per share, while maintaining the healthy target dividend payout ratio of 40-60%.

H1 2023 Was Challenging Period, But Deutsche Telekom Keeps Delivering

The initial half of 2023 marked a span of economic difficulties, propelled by elevated inflation in both the US and Europe, coupled with monetary tightening that affected people's available income. Deutsche Telekom was not immune to these challenges, and they had an impact on the company's financial performance. Nonetheless, the company succeeded in attaining encouraging results. To be precise, they not only achieved positive outcomes but also adjusted their FY23 EBITDA AL projection upwards for the second time this year. However, it's worth noting that the company anticipates these challenges to continue throughout the latter half of the year.

In the first half of 2023, Deutsche Telekom disclosed a minor 1% reduction in Revenue, tallying up to EUR 55.06 billion. This decrease was attributed to the strong currency benefits experienced in the previous year and was additionally influenced by diminished earnings from T-Mobile US, along with the divestiture of T-Mobile Netherlands. Despite the dip in Revenue, the company achieved a growth of 1.2% in EBITDA AL, pushing it beyond the EUR 20 billion milestone. This upturn in EBITDA AL was primarily driven by a 0.8% expansion in margins.

The substantial surge in Net Income during this period was largely propelled by the sale of the cell tower business in Germany and Austria, yielding a total of EUR 10.70 billion. However, Deutsche Telekom still retains partial ownership of 49% in this business, which holds an estimated value of around EUR 6.10 billion. While the sale of this business undoubtedly had a significantly positive impact on the EPS, when accounting for this transaction, the EPS actually amounted to EUR 0.77. This represents an 18.1% decline compared to the same period in the previous year.

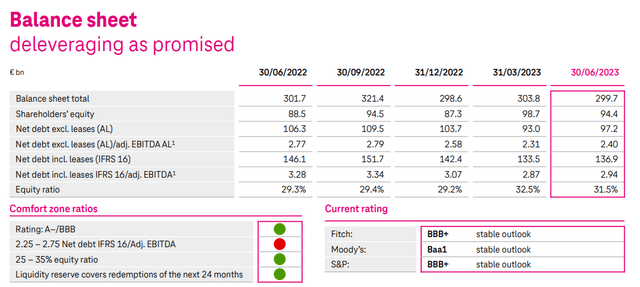

Thanks to the outstanding generation of free cash flow and the proceeds from the sale of the cell tower business, Deutsche Telekom was able to reduce its debt by 6.3% from same period last year, bringing it down to €137 billion. This was achieved while maintaining a cash position of €8.7 billion, which had also increased by 3% since the beginning of the year. These figures clearly demonstrate that DT's remarkable performance has led to a substantial enhancement in the health of its balance sheet. Consequently, S&P Global raised its long-term rating for Deutsche Telekom AG from BBB to BBB+ with a stable outlook.

Now, let’s have a closer look at the performance of each geography during Q2 2023.

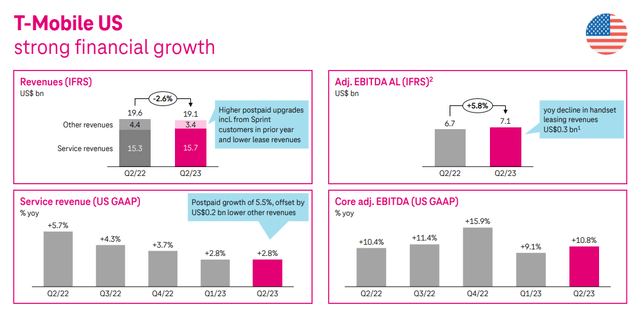

T-Mobile US

T-Mobile US stands as the largest business and geographical segment within Deutsche Telekom. During Q2 2023, it accounted for approximately 65% of the overall revenue generated. Unfortunately, the business was negatively affected by the lengthening of phone replacement cycles, leading to a decrease in equipment revenue compared to the previous year. However, this was somewhat balanced by a 2.8% expansion in Service Revenue. As a result, the company reported a 2.6% decrease in revenue, totaling USD 19.10 billion for the quarter. Despite this decline in revenue, the company successfully boosted its EBITDA AL by 5.8%, reflecting a notable 10.8% growth compared to the previous year.

T-Mobile US Performance (DT IR)

In spite of the setback in revenue, the growth in customer numbers remained quite impressive. Notably, the company added 1.6 million net customers, a figure surpassing the combined additions of AT&T and Verizon. This increase in customer base led the management to raise their guidance for FY23. The growth was primarily fueled by the addition of 760,000 postpaid phone net customers, representing the strongest Q2 performance in 8 years. Notably, the churn rate achieved an industry-leading record low of 0.77%. Additionally, T-Mobile US has managed to extend its 5G network to cover approximately 98% of the U.S. population, which in my opinion provides industry leading foundation for further expanding its customer base.

In the last quarter, Deutsche Telekom boosted its ownership in T-Mobile, going beyond its former 50% share to now hold a majority stake of 51.3% in T-Mobile US operations. From my standpoint, this deeper connection with T-Mobile US deserves recognition as a smart move in carrying out its growth plan. This is particularly evident because the company keeps surpassing its competitors in the U.S. telecommunications sector, and it's quite impressive to see how its customer base is growing across different product categories. This solid groundwork seems poised to help the company increase both its revenue and profits in the region for years to come.

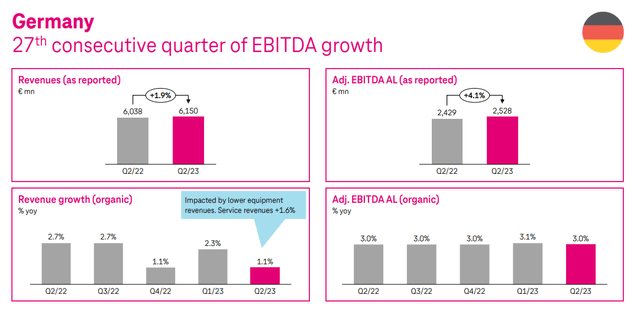

Germany

Germany, the second-largest market globally, following the United States, contributes approximately 22.5% of the revenue generated during the second quarter. The revenue has seen a 1.9% increase compared to the previous year, reaching EUR 6.15 billion. Similar to the challenges faced in the US market, the German region has encountered hurdles. These challenges are reflected in the decline of equipment revenue due to the extended duration of the phone replacement cycle. However, this setback was partially balanced by the 1.6% growth in Services and a notably accelerated growth rate of 2.1% in the Mobile sector. The company's management anticipates that similar growth rates will persist in the upcoming quarters of 2023.

DT Germany Performance (DT IR)

Beyond the rise in revenue, the EBITDA AL in Germany witnessed a significant surge of 4.1%, reaching EUR 2.53 billion. This milestone not only signifies the 27th consecutive quarter of growth but also marks an impressive stretch of expansion spanning 7 years. This growth was primarily driven by the expansion of higher-margin service revenues and the implementation of more effective cost-saving measures. Consequently, the margin saw an increase to 41.1%. In my view, with the German market approaching maturity, the company will likely prioritize the evident margin expansion, leading me to anticipate expansion in the upcoming years.

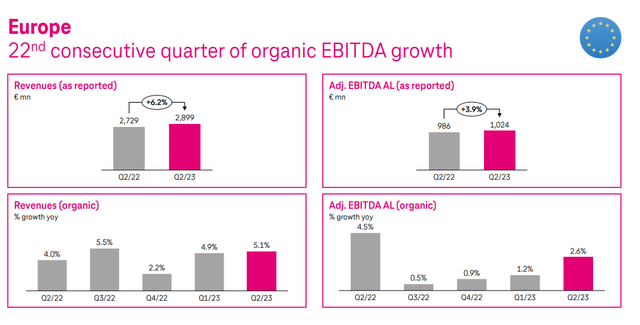

Europe, excl. Germany

Excluding Germany, Europe contributed 10.6% of the overall revenue basket during Q2. This particular region truly stood out during the quarter, boasting the most substantial growth among the three, with revenue surging by 6.2% to reach EUR 2.90 billion. I found the robust growth in this area quite surprising, although it can be easily attributed to the strength of the Polish Zloty and Czech Koruna against the Euro. The organic growth, however, was slightly lower at 5.1%.

Looking at the EBITDA AL, the region saw a growth of 3.9%. The contrast between the higher revenue growth and the comparatively lower EBITDA AL is explained by the greater-than-average inflationary pressures in the Eastern European countries. Nonetheless, this region has seen notable growth in both Mobile and FMC net additions, which has had a positive impact on both the top and bottom lines.

DT Europe, excl. Germany Performance (DT IR)

Growth outlook

As the need for enhanced telecommunications quality and faster internet speeds rises, largely due to remote work and the widespread adoption of 5G technology, as well as its applications in sectors like healthcare, transportation, and logistics, the growth prospects for not only Deutsche Telekom but also other telecom companies in the US appear promising. The industry in the US is expected to experience a CAGR of at least 1.52% from 2023 to 2030. I believe this projection holds significant importance considering that 65% of the company's revenue comes from the US market. Additionally, with the company's plans to increase its stake in T-Mobile US, it implies that the dependency on the US market will likely intensify in the coming years.

The anticipated growth of the European industry is expected to be somewhat more robust when compared to the US, with a projected rate of approximately 2.73% between 2023 and 2030. Nevertheless, I believe that through the introduction of inventive offerings and an expansion of market share in Europe, the company has the potential to achieve growth that outpaces the overall market. In fact, I foresee the company reaching a growth rate close to 3.0% in Europe.

Given the industry's upward trajectory and the company's effective strategies for boosting its ownership in T-Mobile US over the upcoming years, it seems reasonable to anticipate that the portion of total revenue attributed to the US business will expand from the current 65% to at least 70% within the next 3 years. Equally crucial will be the approach taken in the European market. It's important for the company not only to keep pace with the industry's growth but also to secure additional market share.

Considering these factors, I'm inclined to believe that Deutsche Telekom could experience growth in the range of a CAGR between 2% and 2.5% until 2030.

Valuation

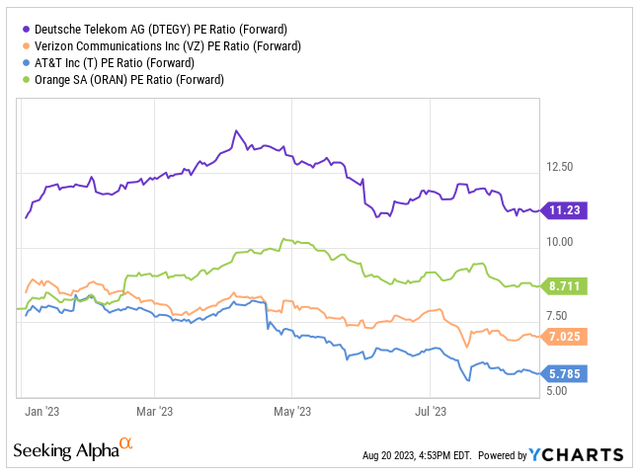

Lately, telecommunication companies have faced a degree of pressure stemming from rumors about Amazon's potential entry into the sector with a value-oriented offering. Personally, I'm inclined to think that these rumors might be exaggerated, considering the considerable costs and challenges associated with entering such a competitive market. Nonetheless, this situation has resulted in an interesting opportunity. Valuations have dipped even lower, following a period during which the industry hasn't exactly been in favor.

Nevertheless, it's important to note that Deutsche Telekom doesn't come across as inexpensive when compared to its industry counterparts. The company is currently trading at a notable premium in comparison to esteemed telecommunication players like Verizon, AT&T, and Orange. All of these are recognized for their high-quality operations within the sector.

Forward PE vs. Peers (Seeking Alpha / YCHARTS)

In my view, the reason for this premium valuation can be attributed to the significant growth opportunities that Deutsche Telekom is positioned to capture. The upcoming growth is expected to be chiefly driven by the advancements of T-Mobile US, as highlighted earlier. In comparison, its peers are already matured businesses, with less levers for growth. The potential for substantial expansion within the US market, coupled with the company's ongoing initiatives to strengthen its foothold in Europe, plays a key role in justifying the premium valuation.

As I mentioned earlier, I anticipate that the company's growth will fall within the range of 2.0% to 2.5% CAGR over the next decade. This growth will be propelled by industry expansion and the introduction of innovative products. If my projections hold true, Deutsche Telekom's revenue could reach around EUR 136.8 billion, accompanied by an operating profit of about EUR 14.46 billion by the year 2032.

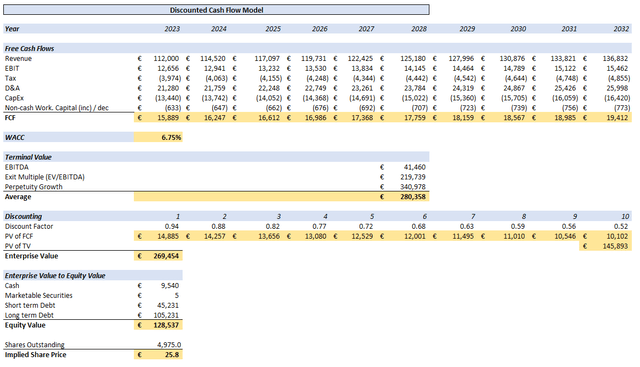

To determine the Fair Value of Deutsche Telekom, I'm employing a DCF Model. In addition to the growth assumptions outlined above, I'm factoring in a WACC of 6.75%, a tax rate of 31.4%, and a terminal growth rate of 1%. Based on historical data, I've estimated that Depreciation & Amortization and CAPEX will likely represent around 19% and 12% of the Revenue, respectively.

The Average Terminal Value is calculated by multiplying EBITDA with an EV/EBITDA ratio of 5.3 and then adjusting the Perpetuity Growth Value based on the WACC. After discounting these values over the next ten years, the PV of FCF adds up to approximately EUR 123.5 billion. Furthermore, PV of TV reaches nearly EUR 146 billion. This aggregation leads to an assessed total Enterprise Value of EUR 269 billion.

Upon accounting for Cash, Marketable Securities, Short & Long-term debt adjustments, the resultant Equity Value is determined to be around EUR 129 billion.

DCF Model, Fair Value (Author's Table)

Based on my calculations, the company's Fair Value is estimated at EUR 25.8. This implies an undervaluation of approximately 25.5% compared to the current price of EUR 19.20.

Conclusion

It's quite impressive to see how Deutsche Telekom has managed to maintain its strong and stable performance in the face of economic challenges during the first half of 2023. It's no secret that the global economy has been facing some serious headwinds, but the fact that the company has been able to weather them speaks volumes about its resilience.

Looking ahead, it's clear that these challenges aren't going away anytime soon, and it's commendable that Deutsche Telekom is staying proactive. The company's commitment to expanding its market share in both the US and Europe shows a forward-thinking approach, and its increased focus on T-Mobile US, with majority ownership now in play, indicates a strategic move to capitalize on growth opportunities.

What's particularly noteworthy is the company's dual strategy of not only pursuing growth but also managing its financial health. The efforts to reduce debt and strengthen the balance sheet reflect a balanced and prudent approach to long-term sustainability. It's not just about short-term gains; it's about building a solid foundation for the future.

Given the current valuation, which I find very attractive, my calculation indicate a potential undervaluation of over 25%. Based on this analysis, I rate Deutsche Telekom stock as a Strong Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DTEGY, DTEGF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.