LifeStance Health Group: Rating Upgrade As Stock Price Is Now Attractive

Summary

- LifeStance Health reported strong 2Q23 revenue growth of 24%, exceeding expectations.

- Management increased their guidance for FY23 revenue, reflecting optimism in sustained productivity gains.

- Despite a recent stock price decline, the potential for improved productivity supports a buy rating for LFST stock.

Renata Angerami

Summary

Readers may find my previous coverage via this link. My previous rating was a hold as I believed LifeStance Health Group (NASDAQ:LFST) would see pressure as I expect EBITDA to be muted in the near term. I was right, as the stock price has declined by 12% since then. I am revising my rating from a hold to a buy as I see the stock price as attractive today. The improved productivity should drive faster revenue growth, possibly leading to faster than expected EBITDA growth.

Financials / Valuation

LFST reported 2Q23 revenue of $259.6 million, a growth of 24% which was at the top end of management’s guided range ($250 million to $260 million) and consensus of $255.1 million. Increased visit volume as a result of improved productivity and more clinicians, as well as modest payor rate increases, drove revenue growth. The adjusted EBITDA of $14.1m was within the range that management had predicted ($10m to $16m), and it was also higher than the consensus estimate of $13.4m. Adjusted EBITDA margin, however, fell from 7.0% in 2Q22 to 5.4% in 2Q23 (a 155 bps y/y decline).

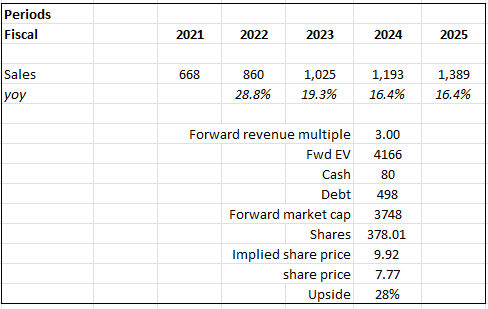

Based on author's own math

Based on my view of the business, LFST should be able to grow faster than my initial expectations, given that management continues to focus on productivity. I have increased my growth expectations slightly higher to reflect this, which is also somewhat in line with consensus expectations. Another change in my model is that I now expect the valuation multiple to be 3x forward revenue rather than 3.5x, as the industry (peers include other health care service providers: Accolade, Agility, Addus Homecare, American Well, 23andme, etc.) has derated. However, given that LFST's share price has fallen, I now see the upside as attractive. The upside catalyst remains the same. If LFST can show faster than expected EBITDA growth, the stock valuation multiple should go up as investors look for accelerating profit growth.

Comments

Despite the drop in the stock price, LFST 2Q23's top line exceeded my expectations. Importantly, management increased their forecast, showing that they are more optimistic about future productivity growth. However, EBITDA is still expected to be relatively subdued in the near term because of management's emphasis on operational enhancements. This was reflected in the results for the second quarter of FY23 (margins shrank) and the revised outlook for FY23 (EBITDA forecast remained unchanged).

As a result of the higher productivity seen in 1Q and 2Q being expected to continue into the second half, management has raised their guidance for FY23 revenue to a range of $1.01 to $1.04 billion, implying growth of 17.5 to 21%. I expect the current rate of productivity to hold steady throughout the year, and I don't anticipate any problems with LFST being able to meet this target. As mentioned above, EBITDA guidance of $50 to 62 million was left unchanged. That said, the medium-term outlook just got better, as I expect a faster revenue growth rate to drive more operating leverage, leading to faster EBITDA growth. With more revenues, it would also enable management to invest in the business earlier, reducing the overall "investment" duration.

The main focus during the quarter was on enhancing productivity, resulting in significant growth in the volume of activity. The second quarter of 2023 witnessed a 21% rise in total visits, reaching 1.705 million. This increase was attributed to a higher number of clinicians and improved productivity. The management observed ongoing enhancements in utilization, which were brought about by improvements across various stages of the marketing funnel. Beginning from the top, there was an increase in primary care referrals and organic patient traffic online. In the middle, higher productivity from LFST led to better scheduling and improved patient matching through OBIE. At the bottom, an enhanced conversion rate contributed to a reduction in cancellation rates, which decreased by 200 basis points to 10%. Given the sustained high demand in the industry, I anticipate that this improved productivity will continue to drive growth in revenue. By analyzing the disclosed metrics, there are leading indicators that suggest the growth trajectory will persist. During the second quarter of 2023, LFST saw a rising demand for in-person visits, with virtual visits accounting for 73% of total visits, in comparison to 75% in the first quarter of 2023.

In terms of cost structure, I note that management accomplished its goal of slashing contracts by 30%, all of which saw very low visit activity, to allow the internal teams to operate more efficiently. This should further optimize the cost structure of the business.

Risk & conclusion

I upgraded LFST from hold to buy due to the current attractive stock price and the potential for improved productivity to drive faster revenue and EBITDA growth. Despite a recent 12% stock price decline, the company's Q2 2023 revenue exceeded expectations, supported by enhanced productivity and increased visit volume. Management's increased guidance for FY23 revenue reflects optimism in sustained productivity gains. While near-term EBITDA may remain modest due to operational focus, the outlook for operating leverage and growth is positive.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.