Smarter Commodities Investing: Overcome Concentration And Roll Yield

Summary

- UBS Constant Maturity Commodity Index provides diversified exposure to commodities and helps mitigate negative roll yield.

- The UBS Constant Maturity Commodity Index addresses several drawbacks associated with commodity investing.

- CMCITR represents a broad basket of 29 commodity components across five sectors: energy, agriculture, industrial metals, precious metals and livestock.

B4LLS

UBS Constant Maturity Commodity Index provides diversified exposure to commodities and helps mitigate negative roll yield. Long available as a mutual fund, this strategy is now available as an ETF.

Commodity investing can be overwhelming. Despite all of its attractive characteristics, from diversification and inflation protection to participation in global growth, the complexities of investing in commodities often prevent some from considering the asset class. Add to that the fact that commodities can be volatile and investors can be left wondering how to approach the space.

The UBS Constant Maturity Commodity Index (CMCITR or the "Index") addresses several drawbacks associated with commodity investing:

- Concentration in individual commodities or commodity sectors.

- The deteriorating effects of "rolling" futures contracts.

Economically Significant and Diversified Exposure to Commodities

CMCITR represents a broad basket of 29 commodity components across five sectors: energy, agriculture, industrial metals, precious metals and livestock. The comprehensive Index considers economic indicators such as global consumer price indexes, producer price indexes, and gross domestic product along with global consumption data to provide exposure to commodities with liquidity-informed economic significance. The result is diversified exposure across sectors without the significant overweights that exist in other major commodity indexes.

For example, the S&P GSCI (GSCI), a first-generation commodity index, selects commodity components based on global production, which results in significant energy exposure. The Bloomberg Commodity Index (BCOM), which was among the first indexes to cap exposures and consider liquidity in its weighting scheme, has generally contained significantly more precious metal exposure than other indexes. Its 2023 target weights include almost 20% exposure to gold and silver alone.

Comprehensive, Diversified Commodity Exposure

Source: VanEck, Bloomberg. Data as of 6/30/2023.

Mitigate the Perils of Roll Yield

"Roll yield" is generated when a futures contract approaching expiration is replaced by a contract that expires further into the future, or "rolling" of futures positions. Roll yield can be positive, or accretive, when near-term contracts trade at prices above longer-term contracts. In other words, an investor can establish a longer-dated futures position at a lower price than they can close out their near-term position, rendering the difference a positive roll yield. Commodities in this scenario are considered in "backwardation."

On the flip side, a negative roll yield can deteriorate an investor's return in a scenario when prices for longer-term contracts are higher than they are for expiring contracts. Commodities in this scenario are considered in "backwardation." Many commodities often trade in a state of backwardation, which can detract from overall investor return, particularly in strategies, index-based or active, that regularly roll expiring contracts to the next available contract at the front of the futures curve.

The UBS Constant Maturity Commodity Index targets commodity futures positions along the maturity curve for each commodity component and repositions exposure daily in order to maintain a constant exposure to a target maturity over time. This has allowed the Index to mitigate the long-term effects of negative roll yield on its return profile historically.

Mitigated Negative Roll Yield

Source: VanEck, Bloomberg. Data as of 6/30/2023. Past performance is no guarantee of future results. Index performance is not representative of fund performance. It is not possible to invest directly in an index. Fund performance current to the most recent month end is available by visiting vaneck.com or by calling 800.826.2333.

Proven Strategy Now Available as an ETF

The recently listed VanEck CMCI Commodity Strategy ETF (CMCI) joins the long-standing VanEck CM Commodity Index Fund (CMCAX) to provide investors with exposure to this intelligently designed commodity strategy. Both funds seek to track, before fees and expenses, the performance of the UBS Constant Maturity Commodity Total Return Index. Though the VanEck CM Commodity Index Fund was launched in 2010, the Index dates to 2007, providing investors with over 15 years of live track record that speaks for itself.

Powerful Long-Term Track Record of Excess Returns in Commodities

The Index has long provided well-diversified exposure to commodities while addressing the roll yield dilemma. This has resulted in an impressive track record highlighted by strong relative returns, impressive volatility statistics, and an attractive participation rate in both up and down markets.

Consistent Outperformance

1/2007 - 7/2023

Source: Morningstar. Past performance is no guarantee of future results. Index performance is not representative of fund performance. It is not possible to invest directly in an index. Fund performance current to the most recent month end is available by visiting vaneck.com or by calling 800.826.2333.

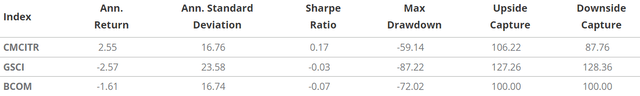

Risk and volatility are equally as important to many commodity investors as total returns, and CMCITR has managed to post impressive excess returns with an attractive volatility profile. The Index's risk-adjusted returns, as measured by Sharpe ratio, have also been consistently greater than other common commodity indexes. CMCITR's participation in broad commodity upside has been stronger than the Bloomberg Commodity Index, and it has also participated less on the downside - the holy grail of investing, greater upside and less downside.

Higher Risk-Adjusted Returns

1/2007 - 7/2023

Source: Morningstar. Past performance is no guarantee of future results. Index performance is not representative of fund performance. It is not possible to invest directly in an index. Fund performance current to the most recent month end is available by visiting vaneck.com or by calling 800.826.2333.

Impressive Up and Down Capture

1/2007 - 7/2023

Source: Morningstar. Calculated using monthly returns. Past performance is no guarantee of future results. Index performance is not representative of fund performance. It is not possible to invest directly in an index. Fund performance current to the most recent month end is available by visiting vaneck.com or by calling 800.826.2333.

VanEck CMCI Commodity Strategy ETF seeks to track, before fees and expenses, the performance of the UBS Constant Maturity Commodity Total Return Index (CMCITR). CMCITR is a next-generation commodity index diversified across maturities, minimizing its exposure to the front end of the futures curves.

- Seeks to minimize exposure to front end of the futures curve and mitigate the impacts of negative roll yield

- Diversified across five commodity sectors and 29 commodity components

- No K-1s - Access to commodities without burdensome K-1 tax reporting

Disclosures

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third-party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index's performance is not illustrative of the Fund's performance. Indices are not securities in which investments can be made. Past performance is no guarantee of future results.

The UBS Bloomberg Constant Maturity Commodity Index (CMCI) is a Total Return rules-based composite benchmark index diversified across 29 commodity components from within five sectors, specifically energy, precious metals, industrial metals, agricultural and livestock.

Bloomberg Commodity Index (BCOM) provides broad-based exposure to commodities, and no single commodity or commodity sector dominates the index. Rather than being driven by micro-economic events affecting one commodity market or sector, the diversified commodity exposure of BCOM potentially reduces volatility in comparison with non-diversified commodity investments.

S&P GSCI (GSCI) is designed to be investable by including the most liquid commodity futures, and provide diversification with low correlations to other asset classes and weighting commodities based on global production levels.

Definitions: Standard Deviation is a historical measure of the variability of returns relative to the average annual return. A higher number indicates higher overall volatility. Sharpe Ratio is a risk-adjusted measure that is calculated using standard deviation and excess return to determine reward per unit of risk. The higher the sharpe ratio, the better the fund's historical risk-adjusted performance. Max Drawdown measures the largest loss from peak to trough in a certain time period. Upside Capture measures whether an index outperformed a calculation benchmark index in periods of market strength. A ratio over 100 indicates an index has generally outperformed the calculation benchmark index during periods of positive returns for the calculation benchmark index. Downside Capture measures whether an index outperformed a calculation benchmark index in periods of market weakness. A ratio of less than 100 indicates that an index has lost less than its calculation benchmark index in periods of negative returns for the calculation benchmark index.

VanEck CMCI Commodity Strategy ETF: An investment in the Fund may be subject to risks which include, among others, risks related to investing in the agricultural commodity sector, commodities and commodity-linked instruments, commodities and commodity-linked instruments tax, derivatives counterparty, energy commodity sector, metals commodity sector, U.S. treasury bills, Subsidiary investment, commodity regulatory and tax risks with respect to investments in the Subsidiary, gap, cash transactions, credit, debt securities, interest rate, derivatives, commodity index tracking, repurchase agreements, regulatory, market, operational, authorized participant concentration, new fund, no guarantee of active trading market, trading issues, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and commodity index-related concentration risks, all of which may adversely affect the Fund. The use of commodity-linked derivatives such as swaps, commodity-linked structured notes and futures entails substantial risks, including risk of loss of a significant portion of their principal value, lack of a secondary market, increased volatility, correlation, liquidity, interest-rate, valuation and tax risks. Investment in commodity markets may not be suitable for all investors. The Fund's investment in commodity-linked derivative instruments may subject the Fund to greater volatility than investment in traditional securities. The level of derivatives counterparty risk may be heightened due to the Fund currently only having a single counterparty available with which to enter into swap contracts on the Index.

VanEck CM Commodity Index Fund: You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program, not a complete program. Commodities and commodity-linked derivatives may be affected by overall market movements and other factors that affect the value of a particular industry or commodity, such as weather, disease, embargoes or political or regulatory developments. Derivatives use leverage, which may exaggerate a loss. An investment in the Fund may be subject to risks which include, but are not limited to, risks related to commodities and commodity-linked derivatives, credit, derivatives, government-related bond, index tracking, industry concentration, investments in money market funds, interest rate, LIBOR replacement, market, operational, and subsidiary investment risk, all of which may adversely affect the Fund. The use of commodity-linked derivatives such as swaps, commodity-linked structured notes and futures entails substantial risks, including risk of loss of a significant portion of their principal value, lack of a secondary market, increased volatility, correlation, liquidity, interest-rate, valuation and tax risks. Gains and losses from speculative positions in derivatives may be much greater than the derivative's cost. Investment in commodity markets may not be suitable for all investors. The Fund's investment in commodity-linked derivative instruments may subject the Fund to greater volatility than investment in traditional securities.

In no way does UBS sponsor or endorse, nor is it otherwise involved in the issuance and offering of the Fund, nor does it make any representation or warranty, express or implied, to the holders of the Fund or any member of the public regarding the advisability of investing in the Fund or commodities generally or in futures particularly, or as to results to be obtained from the use of the Index or from the Fund.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© 2023 Van Eck Securities Corporation, Distributor, a wholly-owned subsidiary of Van Eck Securities Corporation.

© 2023 VanEck. VanEck®, VanEck Access the opportunities®, and the stylized VanEck design® are trademarks of Van Eck Associates Corporation.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by