KBC Group: Remain Neutral After Q2

Summary

- KBC Group Q2 earnings exceeded consensus estimates and announced a €1.3 billion share repurchase program.

- Despite that, the company's total yield (dividend plus buyback) is lower than EU average peers. This is also combined with an expensive valuation.

- KBC Group's 2023 outlook shows lower net interest income and might potentially impact the company's future performance. Equal-weight valuation confirmed.

noel bennett

Here at the Lab, we closely follow the EU banking earnings season, and KBC Group NV (OTCPK:KBCSF, OTCPK:KBCSY) has always been on our list. Our readers know that we had buy-rated the company after the COVID-19 outbreak and selected the bank as our best Belgian Pick; however, since the Q4 results, we decided to provide a neutral rating. According to our analysis, KBC's "Valuation Looks Full" with "Impressive Results but Expensive." Looking back, it was a good call. Indeed, KBC's stock price declined, and including the dividend payment, the company's total return was down by 2.64% (Fig 1), while the Europe 600 Banks Index is up by an aggregate performance of 2.6% (Fig 2).

Mare Past Analysis Europe 600 Banks Index Performance

Q2 results

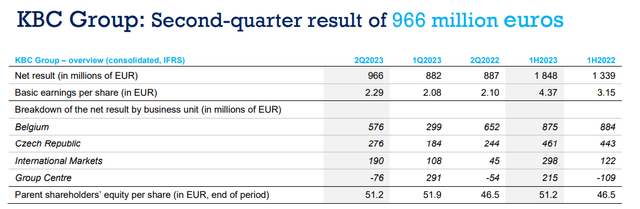

The bank reported a pre-tax profit of €1.2 billion, with Q2 earnings better than Wall Street consensus estimates. While top-line sales were also a tiny beat, KBC's operating expenses were 0.8% higher. Here at the Lab, we like regional players with bank insurance upside. In detail, the insurance sales were up 6% and 10% vs. Q1 and last year's quarter, respectively. Looking at the main bank's index, we should report the cost/income ratio results now at 40%, excluding insurance and bank taxes. In Q2, on the asset management side, net inflows and mutual funds more than offset the net outflows. Cross-checking Benelux peers, we see similarity trend in revenue segments: weaker net interest income (-0.3%), totally offset by more robust non-interest income with a fee up by plus 2.3% and higher insurance income generation, again up by 4.7%. Looking at the EU coverage, we already reported our comment on Intesa San Paolo and BNP Paribas. The leading Italian player generated a clean net income up by 80% compared to last year's results at €4.22 billion. The French bank leader also reported a plus 16.6% net income quarter on quarter. Overall, KBC reported a good set of numbers, but one that we believe is unlikely to be a significant catalyst for the stock price. Important to note also after the CS's AT1 bond development is a good liquidity ratio. In numbers, KBC reported an LCR and NSFR of 152% and 145%, respectively.

KBC Group Q2 Financials in a Snap

Why are we still neutral:

After having analyzed the Q2 results and including the key takeaways from the analyst call, these are the main reasons why we reiterate our equal weight valuation:

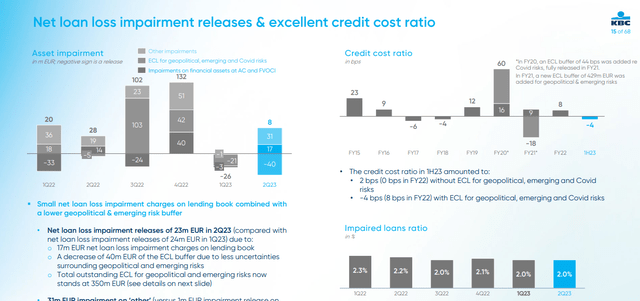

- While the company reported lower loan losses, this was driven by positive one-off effects, and we anticipated a five basis points reversal;

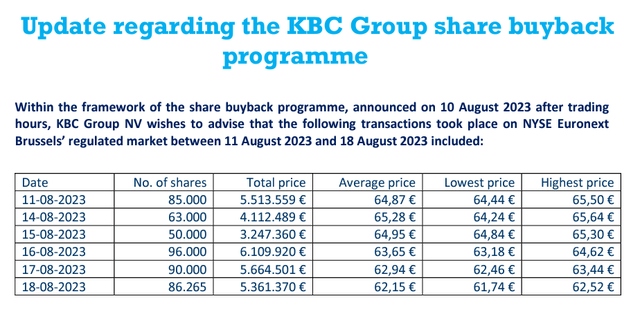

- The bank has finally received the ECB approval for its €1.3 billion share repurchase program and will start the buyback execution imminently. According to our estimates, the buyback is equivalent to a capital return of 4.6%, which, combined with the interim dividend of €1 per share, results in a 6.1% return. This is much lower than the EU average peers in our coverage. If we also projected ISP expected yield in 2024, we derive a dividend yield return higher than 11%. These days, the company is already advancing with its share repurchase plan, and in the fig below, there is full disclosure on the share transactions that took place between 11 and 18 August;

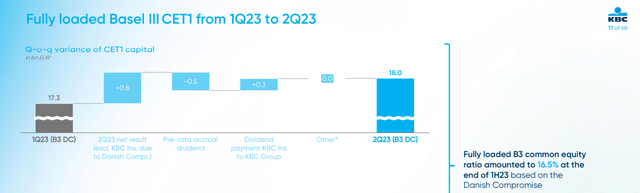

- Here at the Lab, we believe that the Wall Street consensus forecast had deducted the buyback in Q2 into the bank CET 1 capital ratio. This explains why the bank reported a 16.5% CET1 ratio compared to expectations of 15.2%. According to our analysis and including €4.5 billion of risk-weighted assets (as reported by the company), KBC Group has a proforma CET1 ratio of 14.7%. We believe that the bank might optimize its capital structure by issuing AT1 bonds, but timing is not playing the company any favor, given Credit Suisse's recent development;

- Not included in our analysis are the Group Center development and tax considerations. Regarding the division net result, in Q1, the bank recorded a positive of €370 million for the KBC Bank Ireland sales. Therefore, we are back to forecast a run-rate Group Results of minus €80 million per quarter. Regarding taxation, the bank usually pays tax in Q1. Therefore, profit before and after tax is very similar in Q2 and should not be considered as a benchmark to forecast net earnings trends for H2;

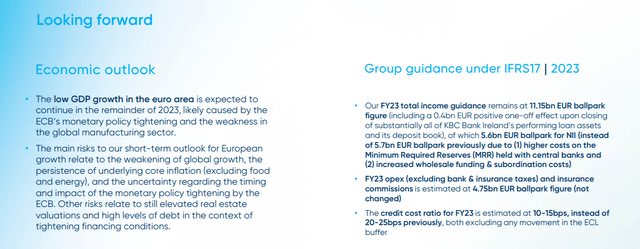

The bank's 2023 outlook flags lower NII evolution (net interest income). All the rest is unchanged, and the company now forecasts an NII of approximately €5.6 billion from previous estimates of €5.7 billion. In addition, LLPs moved to 10-15 from 20-25 basis points. Therefore, updating the latest company's guidance, we arrived at a 2023 top-line sales of €10.8 billion with net earnings of €3.8 billion. In addition, we also believe that increasing funding costs predominantly drive these changes, and our question will be if this impact is also a headwind for the following year.

KBC Group cost of risk evolution KBC Group CET1 ration evolution KBC Group lower 2023 guidance

Conclusion and valuation

In our last analysis, we decided to increase our 2023 EPS estimates by 20% and arrived at €7.2. Today, we maintained our 12-month visible period forecast, confirming a neutral valuation based on a P/E of 9.2x, driving a stock price of €67 ($36.5 in ADR). This is based on a lower NII evolution with a question mark on increasing funding costs. KBC is currently trading above peers on 2024 estimates EPS and at 1.5x 2023 tangible book value compared to peers at <1x. KBC implied return on tangible equity is higher than 16%, and we believe this premium is unjustified. We recognize the company's above-average profitability but believe it makes stocks vulnerable to disappointments. In addition, the 2023 lower outlook was not optimal, and there might be a capital and NII headwind in H2. Therefore, we are again neutral.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.