The Key Selling Point Of The 8.1% Yielding DIAX

Summary

- Selling calls on long positions provides downside protection and shelters investors from stock volatility.

- The Nuveen Dow 30 Dynamic Overwrite Fund writes covered calls on a portion of its equity portfolio to reduce volatility.

- We examine whether this 8% yielding fund meets our buying criteria.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, Conservative Income Portfolio. Learn More »

remco86

The strategy of selling calls on long positions provides downside protection to the extent of the premium received. It also shelters the investor from the brute volatility of outright ownership of the stock. If the stock price closes lower than the strike at expiration, the seller pockets the entire premium as earnings and gets to rinse and hopefully repeat this accretive exercise. While seasoned investors can make this strategy work (to some extent) in all market conditions, it shines in a sideways or flat market. The strike chosen, whether in the money (strike below current stock price), out of the money (strike above current stock price) or at the money (strike = current stock price), depends on the investors outlook for the stock. If the investor is bullish, strikes over the current stock price are chosen to participate further in the price appreciation, but with the margin of safety. A bearish outlook often results in strikes under the current stock price. The premium received shaves off a few dollars from the cost basis, providing an enhanced downside protection. The fund we will talk about today generally writes call options very close to the current stock price and hence is designed to do best in a flat market.

The Fund

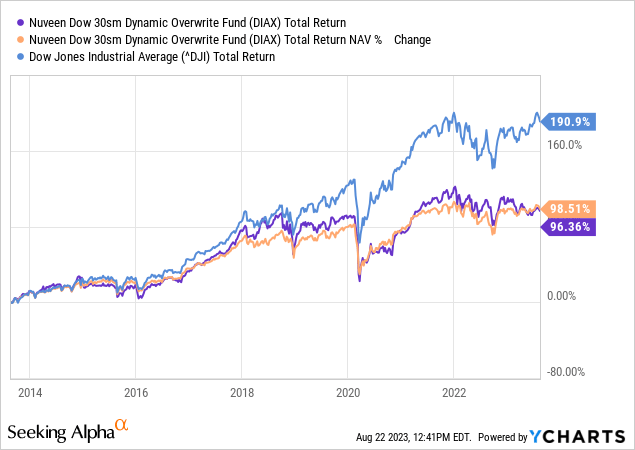

Nuveen Dow 30 Dynamic Overwrite Fund (NYSE:DIAX) invests in a portfolio of equities that enable it to reproduce the price movements of the Dow Jones Industrial Average (DJI). This closed end fund then writes covered calls on anywhere from 35%-75% of the notional value of the equity portfolio to "enhance the Fund's risk-adjusted returns". This risk management reduces the portfolio volatility and provides a buffer for the stock price decline. The offset is that it could also limit the capital gains potential, depending on the closing equity price at option expiration. The overall strategy did as expected. DIAX had a good decade, but the equity index did more than a tad better.

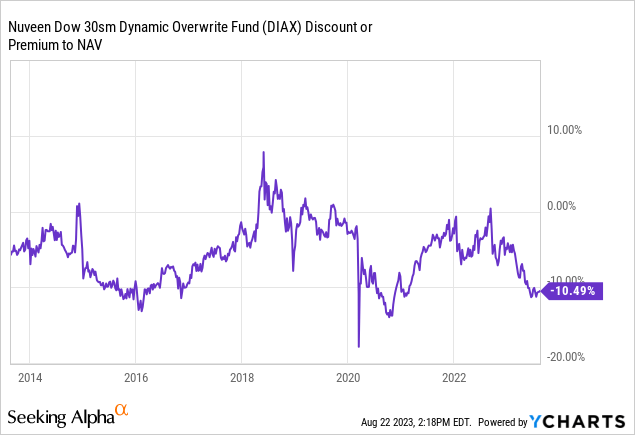

DIAX currently trades at a discount to its NAV and this is one of the wider discounts to NAV that we have seen over the last decade.

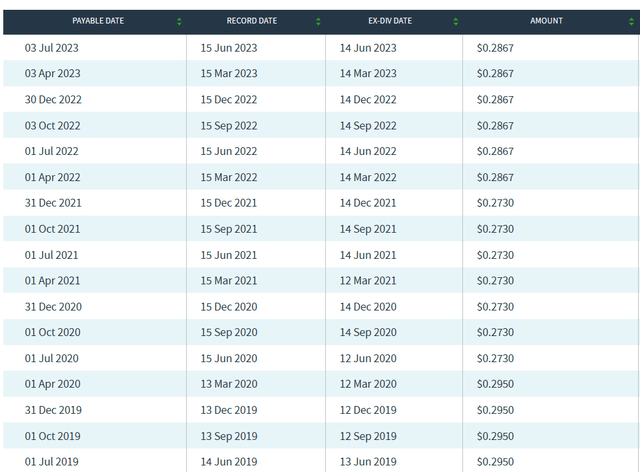

The fund distributes $0.2867 every quarter and yields over 8% based on the last price of $14.22. DIAX has managed distributions, which means that the rate is set based on the advisor's total return expectations over a period of time. The payout remains the same over that time period which caters to investors seeking regular inflows. We can see that reflected in the payments for the last few years.

DIAX started with a NAV of $19.10 in 2005 and the last published NAV was $15.83. The managed distributions while great in terms of steady payouts, can be deplete NAV when the return expectations do not pan out. The DIAX distributions include a component of return of capital, hemorrhaging the NAV over time. Nevertheless, the current yield and discount to NAV brought this fund on our radar. That, combined with our macro outlook, made us dig into the details to see if this could make a good buy for investors seeking exposure to options via funds.

Holdings

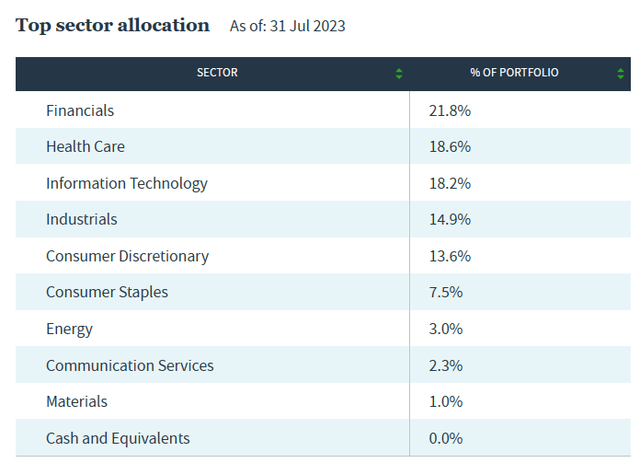

For DIAX, financials, health care and information technology sectors rule the roost.

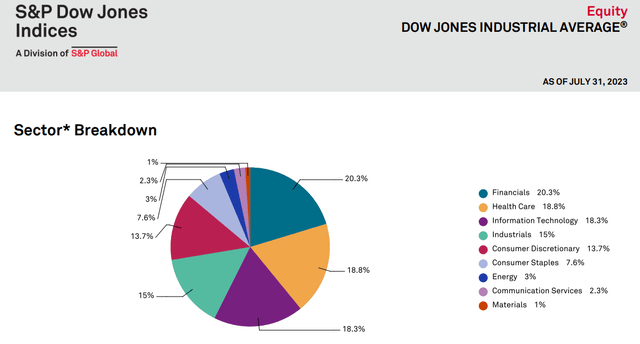

This is unsurprisingly, more or less the same as the sector allocation of the index at the same time point.

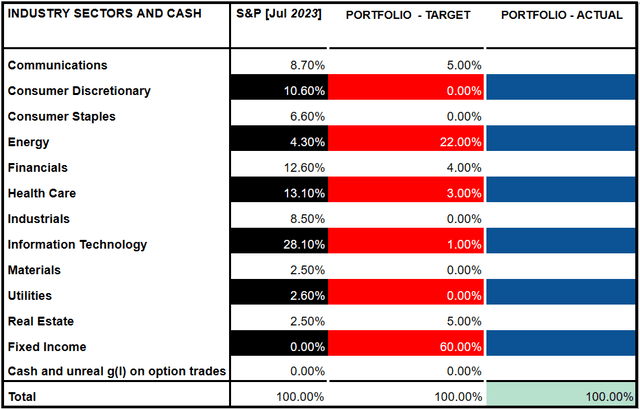

Our current outlook is overwhelmingly partial to high quality, fixed income securities and the energy sector to some extent. The sectors that DJI and by extension DIAX are concentrated have little to no allocation in the portfolio we manage in our marketplace service.

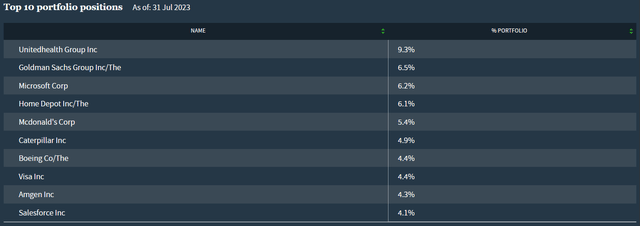

All the DIAX holdings are from large cap companies and the top 10 includes names known to most.

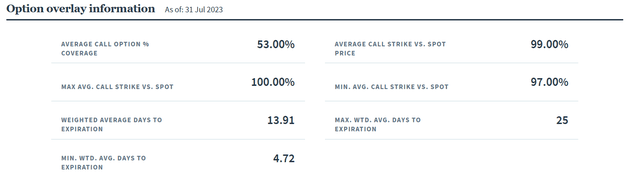

In terms of the options sold, the data as of July 31 provides some interesting insights.

Calls were sold on 53% of the underlying equity portfolio, with all of the options between either at the money or slightly in the money. DIAX writes weekly and monthly options as reflected in the 13.91 weighted average days to expiration and the 4.72 minimum weighted average days to expiration.

Verdict

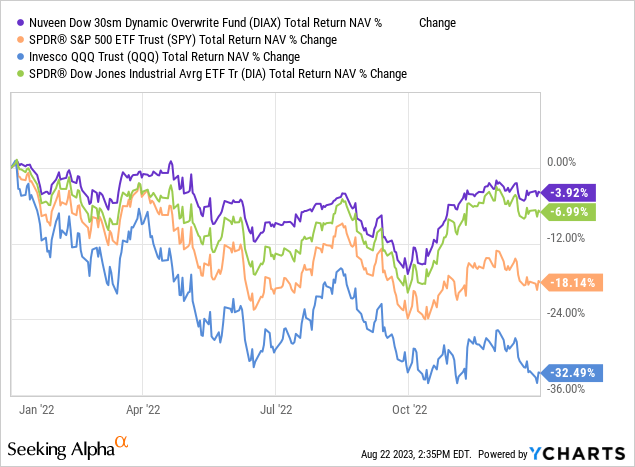

DIAX has annual expenses of around 0.93%. This is in line with some of the other covered call funds we have covered in the recent past, like Voya Global Equity Dividend and Premium Opportunity Fund (IGD), Eaton Vance Tax-Managed Buy-Write Income Fund (ETB) and Virtus AllianzGI Dividend, Interest & Premium Strategy Fund (NFJ). Similar to the three funds, DIAX too does not have any leverage, so no pesky and exorbitant interest expenses eating up the bottom line. The fund did outperform DJIA ETF (DIA), S&P 500 ETF (SPY) and Invesco QQQ Trust (QQQ) during 2022.

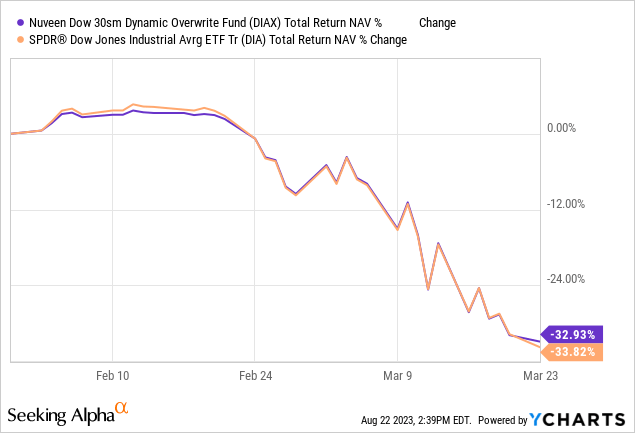

But of course its biggest advantage was that it was tethered to the most defensive index out of the three, and DJIA itself held up quite well when the SPAC and revenue-free NASDAQ bubbles were being blown to smithereens. The outperformance during this turbulent time was quite weak. Going back to COVID-19, DIAX again did a drop for drop with DIA. Note this is on a NAV basis.

This is a true problem with covered call funds today. Almost none are able to show serious outperformance in down markets. But, if you are looking for a relatively better valued index (Dow Jones fits that), with a nice managed distribution and possible some excess alpha from a return to NAV, DIAX fits the bill. We rate the fund a 4 on our potential pain scale, primarily due to the wide discount.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)