AGQ: Big Winner Over The Last Year, And Perhaps The Next Also

Summary

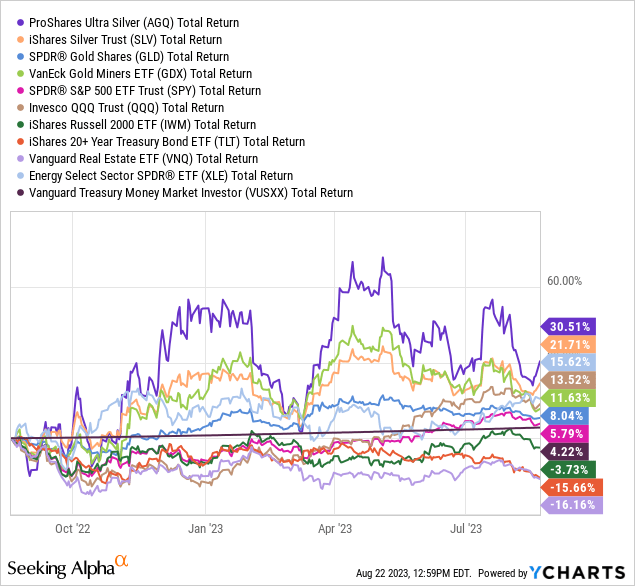

- ProShares Ultra Silver has outperformed most asset classes, including silver/gold bullion, mining stocks, bonds, money markets, U.S. equity averages, real estate, and oil/gas picks over the past 52 weeks.

- The Ultra Silver product could continue to experience significant gains, with silver's fair value reaching above $40 an ounce currently to potentially as high as $100 by 2025.

- Market sentiment for silver remains uncommitted to bearish, with few Wall Street firms recommending it and retail investors in the futures market showing limited interest. Plenty of room to grow.

- Tight physical supply, as highlighted by excessive premiums on short-term futures contracts, is a huge positive for silver's forward price direction.

RyanJLane

I mentioned the ProShares Ultra Silver ETF (NYSEARCA:AGQ) last year here as an excellent place to park some money, with silver's relative price to other asset classes being incredibly cheap. Not so amazingly, AGQ was able to beat silver's decent +21.7% advance with a +30.5% total return gain since my story. What's fascinating is silver was able to climb at all with a rising stock market, growing economy, improving financial optimism, still tightening Federal Reserve, and a 12-month period lacking many serious black swan events.

Believe it or not, AGQ bested most every other investment asset class with its return... better than silver and gold bullion, better than gold/silver mining stocks, better than general U.S. equity averages, better than bonds and money markets, better than other hard asset hedges like commercial real estate and oil/gas plays!

YCharts - ProShares Ultra Silver vs. Asset Classes, 12 Month Total Returns

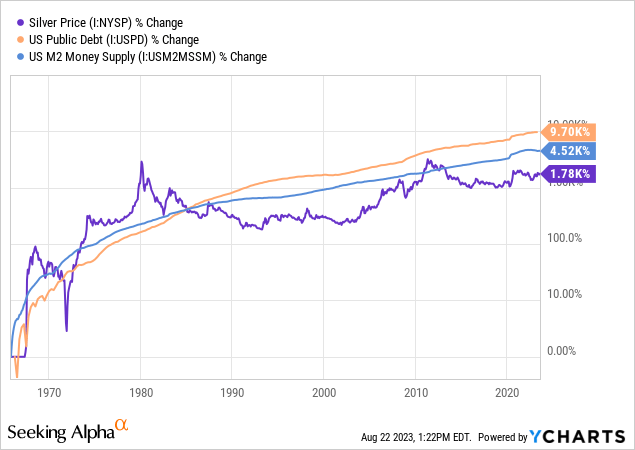

The good news for investors is the Ultra Silver product (aiming for 2x the gains of silver bullion prices) could be in the early innings of a monster move higher into 2024-25. Silver's fair value, using my 60 years of "relative" asset class valuation technique, could be above US$40 an ounce. And, if you include valuations compared to M2 money supply and Treasury debt increases over the decades, $50 to even $100 ounce targets by 2025 are not out of the question.

YCharts - Spot Silver Price vs. Treasury Debt & M2 Money Stock, Since 1965

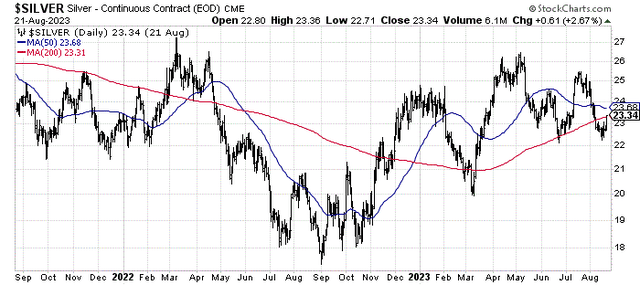

For AGQ investors, a double from $23 an ounce in underlying silver value today closer to $50 translates into a projected gain of +150% to +250% over less than 24 months (depending on changing futures market pricing structure and interest rates on cash for this 2x daily-rebalance design).

StockCharts.com - Nearby Silver Futures, 2 Years of Daily Price Changes

Still Positive Silver Backdrop

What I like about silver in particular is the market sentiment setup remains in a bullish position, as few Wall Street firms recommend owning this important dual-purpose industrial and precious metal, at the same time as hedge funds and retail investors in the futures market are missing-in-action to bearish on the metal.

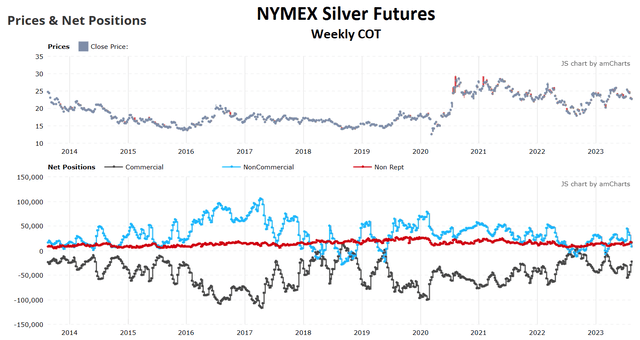

Futures Contract Positioning

The weekly Commitments of Traders [COT] data has reported a rather substantial drop in trader bullishness (price trend followers) vs. a rise in optimism by commercial users (smart money) in August. The level of retail bearishness over the past 12 months in the silver futures market is actually quite similar to the 2018-19 bottoming period. In addition, futures traders remain more bearish today (just like a year ago) than the sub-$15 silver panic liquidation low reached during the early days of the 2020 pandemic.

Tradingster.com - Silver Futures COT, 10 Years of Weekly Data, August 15th, 2023

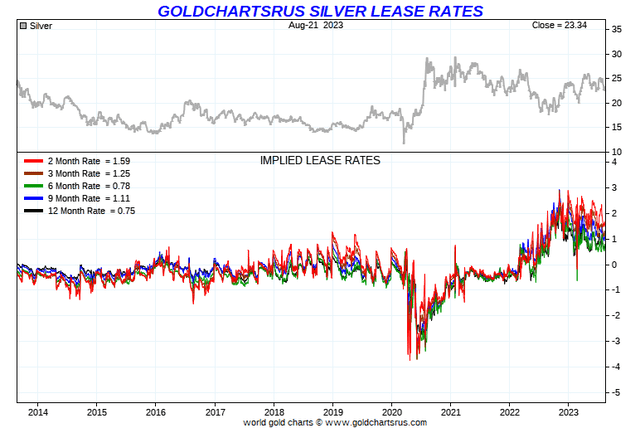

Lease Rate Inversion

Another bullish data point is futures pricing has indicated something of a shortage in physical bullion vs. demand trends. This is visible in the high prices for not-too-distant 2-month and 3-month premiums for the metal vs. either spot quotes or longer-term futures contracts. "Implied" lease rate inversions like today have been rare over the last 40 years, with late-2022 to August 2023 representing the longest ever stretch of consistently tight supply in New York trading. Pictures of this tight silver market idea are drawn below.

GoldChartsRUS.com - Silver Lease Rates, 1 Year

GoldChartsRUS.com - Silver Lease Rates, 10 Years

As I have written in past silver articles over the years, the inverted lease-rate situation is one of the most bullish setups for predicting a rise in silver over the next 6-12 months. All told, the inversion picture today remains decidedly bullish.

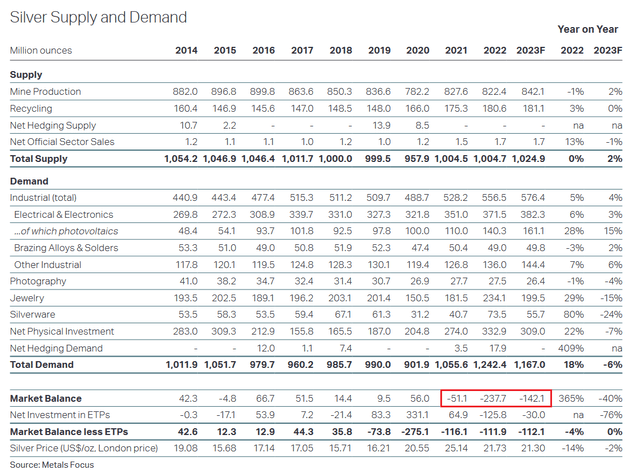

Physical Market Imbalances

Not only are small investors hoarding coins and bullion since the pandemic started (over the latest 24 months, silver coin premiums vs. contained bullion quotes are the highest since the early 1980s boom), but silver demand for green energy applications, specifically solar panel production, has been on a steady incline for years. The industry forecast is silver shortages of mined supply, recycling efforts, and government sales vs. total investment/industrial demand will continue at even greater rates going forward.

Below we can review the Silver Institute's 2023 analysis of market balance trends over the last decade. You will notice the skewed structural setup for demand outstripping supply, with a focus on the 2021-23 situation (boxed in red), where a new level of industrial appetite seems to be kicking in.

Silver Institute. 2023 World Silver Survey, Author Reference Point

The saving grace for silver prices in 2022-23 (preventing a major advance) has been large liquidations of silver trading vehicles by brokerages and banks on behalf of frustrated investors not getting enough immediate return, in contrast to the later 2020 price spike. On the flip side, if brokerage investors decide they want to rush back into silver (for whatever reason), such may take the physical shortage condition to a whole new level and again allow price to rise 50% to 100%. Without a material price rise in silver, no new mines will be built, and the shortage gap will only widen in size each year.

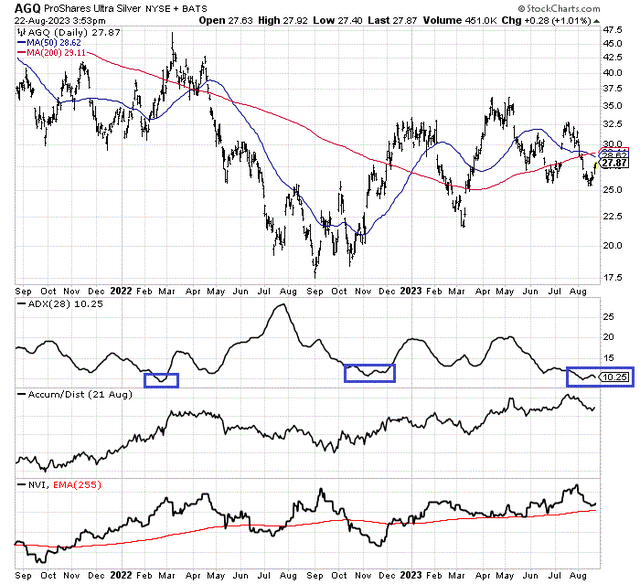

AGQ Trading Pattern

AGQ's trading "momentum" has been quite constructive over the last 12 months vs. the universe of thousands of companies/ETFs I computer sort daily. One statistic that I especially like today is the low 28-day (roughly 1.5 months of trading days) Average Directional Index reading of 10. I have boxed in blue the last two instances of this ADX score nearing 10. A lower-volatility balance of buyers and sellers is the readout. Each proved a great time to buy for quick profits months later.

The Accumulation/Distribution Line and Negative Volume Index have also been in bullish trends over the last several years, in direct contrast to price not doing much over the whole period. If silver bullion is set to jump, AGQ is well prepared to rise at an even faster clip.

StockCharts.com - ProShares Ultra Silver, 2 Years of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

ProShares Ultra Silver has a rather high 0.95% annual management fee to create its daily rebalancing of futures contracts and swap agreements, as the fund recalibrates investment inflows/outflows with its 2x price change goal. The rebalancing feature tends to exaggerate up and down moves over extended periods. Another bummer, the trust does not pay a dividend.

On a cautionary note, the main negative issue over the last six months, dragging returns closer to a 1x bullion investment for gains, is the excessive premiums paid on short-term contracts (discussed in the lease rate inversion paragraphs). When contracts around spot pricing are rolled over to new futures expirations with a higher price, AGQ is kind of swimming against the stream to generate a profit. So, any large downmove in silver will cause a disproportionate hit to AGQ (larger than 2x) at the current time.

Nevertheless, I expect even a slow advance in silver will support AGQ, in a fashion to at least replicate the performance of bullion. If we get oversized silver gains soon, I do believe AGQ will be able to rise strongly in price on its daily rebalance (compounding) feature.

The overriding bullish argument to buy the leverage generated by AGQ is you are not beholden to a mining firm's success (think operating risks) to outline excess returns based on physical silver price gains. I also own a number of gold/silver miners for financial leverage to rising silver, but AGQ is unique in this regard. Proven out by its performance over the last 12 months, AGQ may continue to beat individual miners and mining industry ETFs for profits in your brokerage account over the next 12-24 months.

Remember, if you want a reduced-volatility ETF product based on silver bullion, you can always purchase the zero-leverage iShares Silver Trust (SLV), Sprott Physical Silver (PSLV), or abrdn Physical Silver Shares (SIVR). I personally own large positions in both SLV and SIVR.

I am looking to reenter AGQ in the near future as added leverage to my physical silver and related bullion ETF investments. I rate AGQ a Buy.

Note: AGQ does deliver a yearly K-1 (Form 1065) tax statement for the trust, which is something to consider in taxable accounts, before trading this ETF.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLV, SIVR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may initiate a beneficial Long position in AGQ over the next 72 hours. This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.