Fortis: 8-9% Yielding Preferred Shares Offer A Lower Risk Prospect Vs. Common Shares

Summary

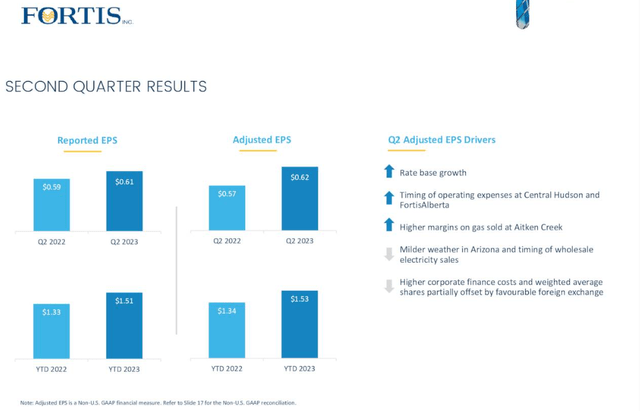

- Fortis delivered strong Q2/23 results, with adjusted earnings per share slightly above consensus and a 14% increase year to date.

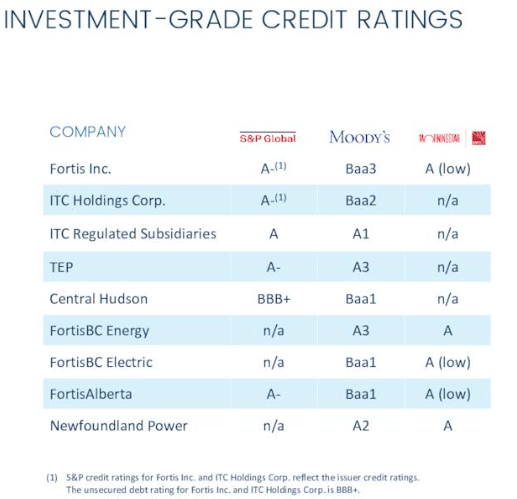

- The company has big capital expenditure plans for the next five years, supported by investment grade ratings and predictable cash flow.

- We examine the valuation and make a case for the preferred shares over the common.

- I do much more than just articles at Conservative Income Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

JamesBrey

Note: All amounts discussed are in Canadian Dollars

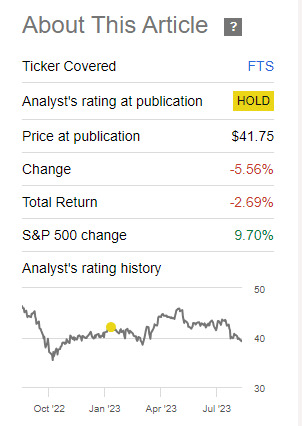

On our last coverage of Fortis Inc. (NYSE:FTS) (TSX:FTS:CA), we gave it a pass while acknowledging it was very close to a failing grade on raw valuation. Specifically, we said:

Nonetheless, if you add the 20.3X earnings multiple and the 6X debt to EBITDA, we have to conclude the shares are not cheap by any stretch of the imagination. Fortis is an excellent company to keep on your watch list. We suspect you will get a chance to pick this up under 17X earnings at some point in the near future. At the current valuations, we can salute the performance, but cannot jump in. We rate the stock a Hold/Neutral while acknowledging that it is dangerously close to a Sell rating.

Source: A Dividend King In The Making

The stock has pretty much gone sideways since then, but we certainly did not miss out on any upside.

Seeking Alpha

We examine the fundamentals once again and tell you where we started nibbling.

Q2-2023

Fortis delivered a strong and steady Q2/23 with adjusted earnings per share of $0.62, which was slightly above consensus. The growth rate year over year was not too shabby and year-to-date numbers were up 14% versus 2022.

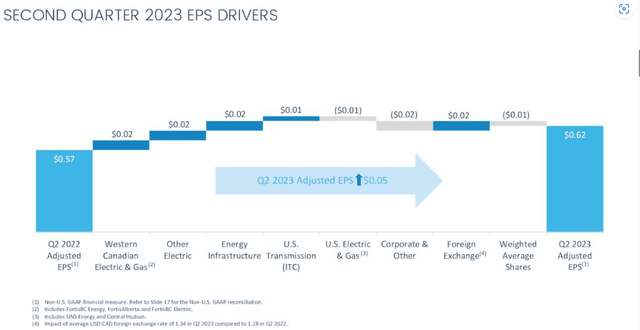

The company broke down its EPS drivers as follows:

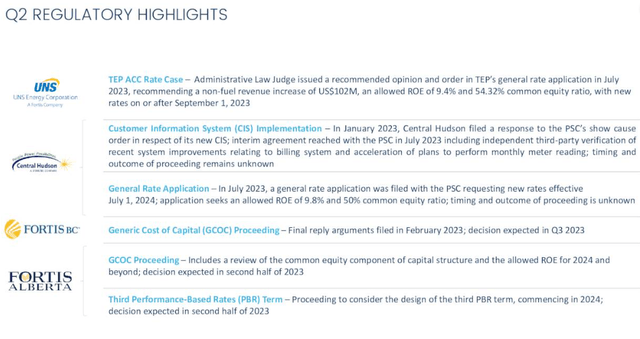

Some of the increase was a timing issue and will detract from Q3 and Q4 numbers in 2023. Overall, expectations are for earnings to come in close to $3.00 per share for 2023, which would be an approximate 8% growth over last year. That is an impressive performance in what has so far been a challenging year for many utilities. The update on the regulatory side was also smooth, with rate increases allowed pretty much in line with expectations.

Outlook

Fortis has some big capital expenditure plans lined up for the next five years.

Fortis Q2-2023 Presentation

The company's investment grade ratings support this and complement the cash flow it continues to generate today.

Fortis Q2-2023 Presentation

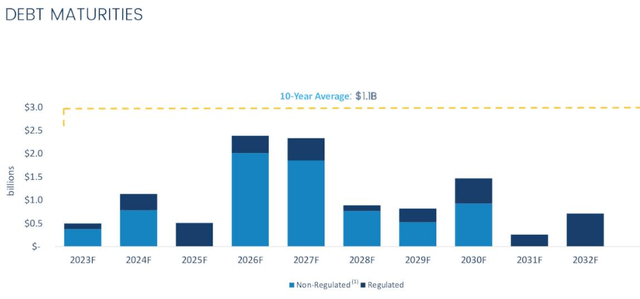

The debt maturities are also well spaced out, and material refinancing needs to come into play in the middle of this decade.

The company is also shedding some of its last remaining non-regulated assets, and that makes the cash flow even more predictable. This will culminate with Aitken Creek asset moving out by the end of this year.

Ben Pham

I guess that's kind of what you've been doing the last few years, shedding Oneita and then the storage business become Pure Play. We saw a pipeline company last week also look at a restructuring. Can you maybe just comment high level, just thoughts on really your observations there? And do you think that Fortis is well positioned now from just the overall corporate structure?

David Hutchens

Yes, for sure, Ben. I would say that even before we did any of those transactions, we were at most a couple of percent that was not regulated utility investments, and now basically post Aitken Creek will be essentially rounding 100% regulated. So, that was some things that we were working on over time. And it was it was more opportunistic finding value where we could at the times that we could. Aitken Creek specifically, as I mentioned on the last call, it's a great opportunity because we found someone who can squeeze more value out of that asset than we can, and that ends up being good for everyone. But yes, I mean as we sit here today and as we hopefully wrap up Aitken Creek by the end of this year, that's about as pure play as you can possibly get.

Source: Fortis Q2-2023 Transcript

Fortis remains a compelling utility growth story, and the only key question here is the valuation. At $54.00 per share, the company is trading near 18X earnings for 2023. This is a good discount to the last 10 years' average, but still a premium considering risk-free rates are about 5%. The big risk for investors is that Fortis does manage to grow at about 5% rates for the next five years, and we see a valuation compression to near 14X earnings. In that scenario, you have a flat price over five years and all you make is a dividend yield of about 4% annually. Some might argue that is enough, but if you don't beat risk-free rates, you have a problem.

Preferred Shares

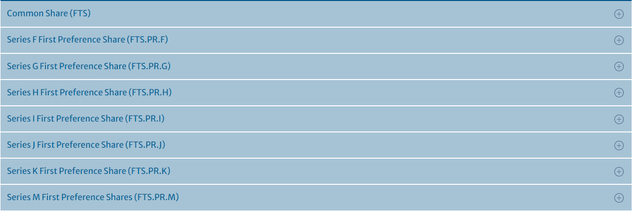

While the common shares have become slightly more attractive as we roll in 2024 estimates alongside a lower price point, the preferred shares for Fortis are incredibly good deals today. The company has quite a few of these as seen below, and we will only cover the ones that we think are attractive today.

Fortis Inc. CUM RD 5Y SR G (FTS.PR.G:CA)

These are the safe choices for those looking for a high yield with a guaranteed payout over the next five years. The yield on par was reset to 6.123%:

Fortis Inc. (the "Corporation") has calculated the annual fixed dividend rate (the "Annual Fixed Dividend Rate") for the five-year period from, and including, September 1, 2023 to, but excluding, September 1, 2028 (the "Subsequent Fixed Rate Period") for the Corporation's Cumulative Redeemable Five-Year Fixed Rate Reset First Preference Shares, Series G (the "Series G First Preference Shares") in accordance with the terms of the Series G First Preference Shares incorporated in the provisions of its articles.

The Annual Fixed Dividend Rate for the Subsequent Fixed Rate Period shall be equal to 6.123% per annum, being equal to the 3.993% yield to maturity of a Canadian dollar denominated non-callable Government of Canada bond with a term to maturity of five years as quoted as of 10:00 a.m. (Toronto time) on August 2, 2023 on the display designated as page "GCAN5YR Index" on the Bloomberg Financial L.P. service, plus 2.13%.

Source: Fortis

That 6.123% on par works out to 8.2% on the current price of $18.70. 8.2% from a quality utility preferred share for the next five years is about as good as it gets. Further out, the repricing will depend on where 5-year Government of Canada (GOC-5) bond yields fall. The shares were set at a spread of 2.13%. Ideally, we would want a longer-term pricing of at least a 3% premium over the GOC-5. But since you are buying this at $18.70, you are locking in a higher effective spread. If we assume rates reset with GOC-5 at 3%, your reset will be 5.13% on par or 6.86% on the current price. Note that you are getting a 3.86% spread even with these reset conditions.

Fortis Inc. CUM RD 5Y SR K (FTS.PR.K:CA)

While the FTS.PR.G preferred shares are great for a guaranteed payout, we like the FTS.PR.K a little more. These are priced as GOC-5 plus 2.04% and currently trade at $16.40. At current GOC-5 yields of 4.14% your reset will be about 6.18% on par and 9.4% on the current price from March 1, 2024. The actual reset date will be in early February. Of course, interest rates could be lowered but these present enough of a premium over FTS.PR.G for us to wait rather than locking in what FTS.PR.G offers.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility?

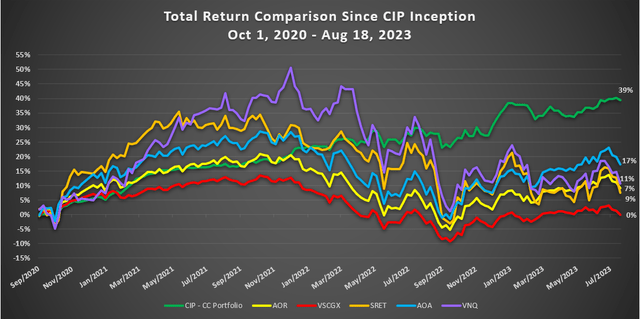

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FTS.PR.K:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.