Oshkosh Corporation: Robust Quarterly Results Lead To Guidance Raise

Summary

- Oshkosh Corporation's guidance for 2023 has been raised, indicating an improved outlook and a decrease in margin struggles.

- The company's order backlog has reached $15 billion, more than twice its market cap, suggesting high demand and potential for growth.

- Despite setbacks in the defense segment, the company's operating income continues to increase, and management appears optimistic about future programs and revenue growth.

shaunl

Investment Rundown

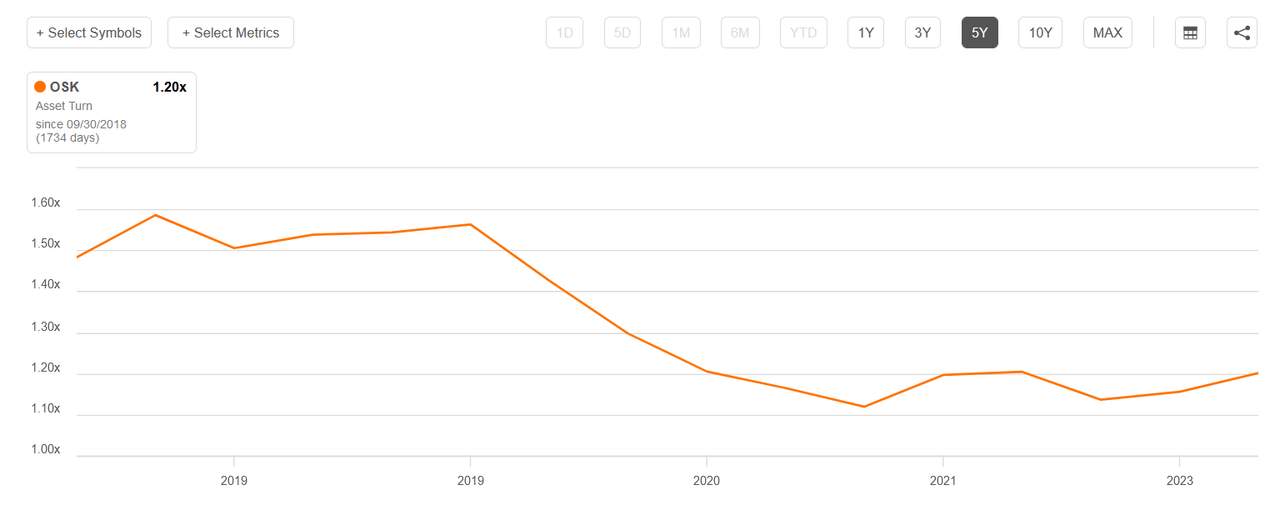

Margin struggles seem to be a thing of the past for Oshkosh Corporation (NYSE:OSK) as guidance for 2023 was raised and its outlook seems better than ever. Robust performance across the segments of the business was a lead reason for this as supply chain issues are disappearing and a seamless transport chain is available.

Order backlogs now amount to over twice the market cap, reaching $15 billion in the latest quarter. OSK will have a lot of demand still and the valuation is at a point where investors are getting a great discount and access to immediate upside potential should OSK continue posting results like these, which I think they will. My rating for OSK is a buy.

Company Structure

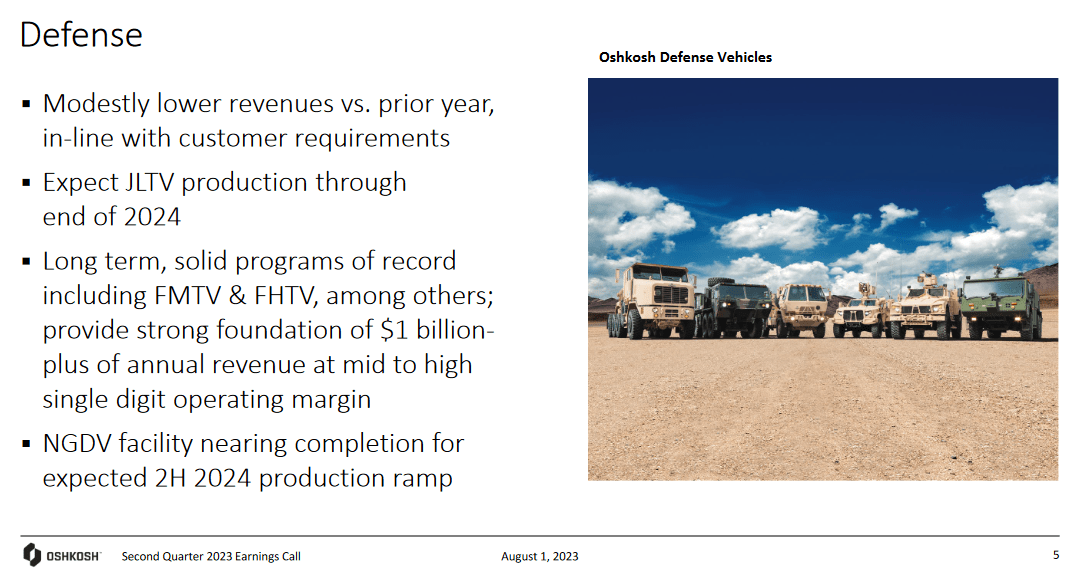

One of the largest setbacks in 2023 for OSK was the miss on getting a renewal to their contract with the US Army for their JLTV. In terms of the effects of the news on the share price it sent it plummeting but seeing as OSK has been able to exceed expectations in deliveries and growing both the top and bottom line, the share price has since rebounded.

The company has divided its operations into three various segments, which are Access, Defense, and lastly Vocational.

Segment Overview (Investor Presentation)

Despite the setback for the defense segment, the operating income continued to increase every year. The coming year should remain rather decent I think seeing as JLTV is set to be in production for the full year at least. How this will affect the operating incomes though shouldn't be too bad. The defense segment only made up 2.6% of the total amount last quarter. The vast majority still comes from the Access segment.

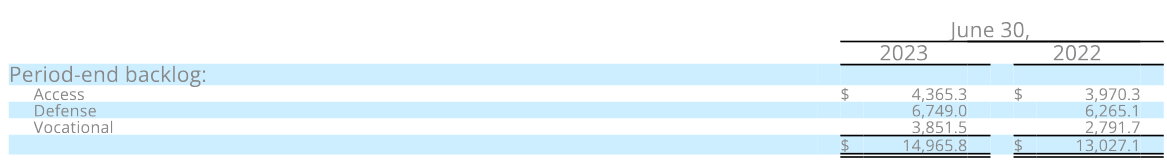

Segment Backlogs (Earnings Report)

However, the amount of backlog that the company has is mostly sitting in the Defense segment at $6.7 billion. I think as the contract with the US Army ceased there will be a poor development here for OSK going forward, which means that further priority will need to be placed on growing backlogs of orders in the other two segments. A failure to do so will likely result in a dropping share price in my view.

Management Views

Listening in to the last earnings call by the company, there are some comments worthwhile highlighting in my opinion. John Pfeifer, the CEO said the following:

“we are still building JLTVs and will continue to do so through the end of 2024 under the current contract. Beyond 2024, we will continue to build JLTVs for international customers as well as JLTV specialty applications. These, of course, are smaller quantities. From 2025 onward, we will continue to deliver on many solid programs of record in the Defense segment, including FMTV, FHTV, Stryker MCWS and multiple trailer programs as well as international contracts that extend well into the future. Long term, we expect that these programs will provide $1 billion-plus revenue base at mid- to high single-digit operating margin”.

This comment very well highlights the ongoing efforts by the company to still grow its Defense segment despite the ongoing challenges and setbacks. With anticipations of $1 billion more in revenues because of additional programs in the Defense segment, this will be a very nice addition. These shouldn't be visible though until after 2025 at the very least. This is why 2025 is such an important year in my opinion, the contract ends by then and it leaves a slight void that OSK needs to fill efficiently. I am however confident in the company's abilities to swiftly find demand though.

Valuation

The valuation of OSK right now is rather appealing in my opinion. The company trades at a p/e of 12.5 on an FWD basis, which represents a discount to the sector of 29.8%. As for my preferences with a margin of safety, I do look for at least a 10 - 15% discount to capture “immediate” upside potential. The 29% discount makes OSK fit well within my area of comfort.

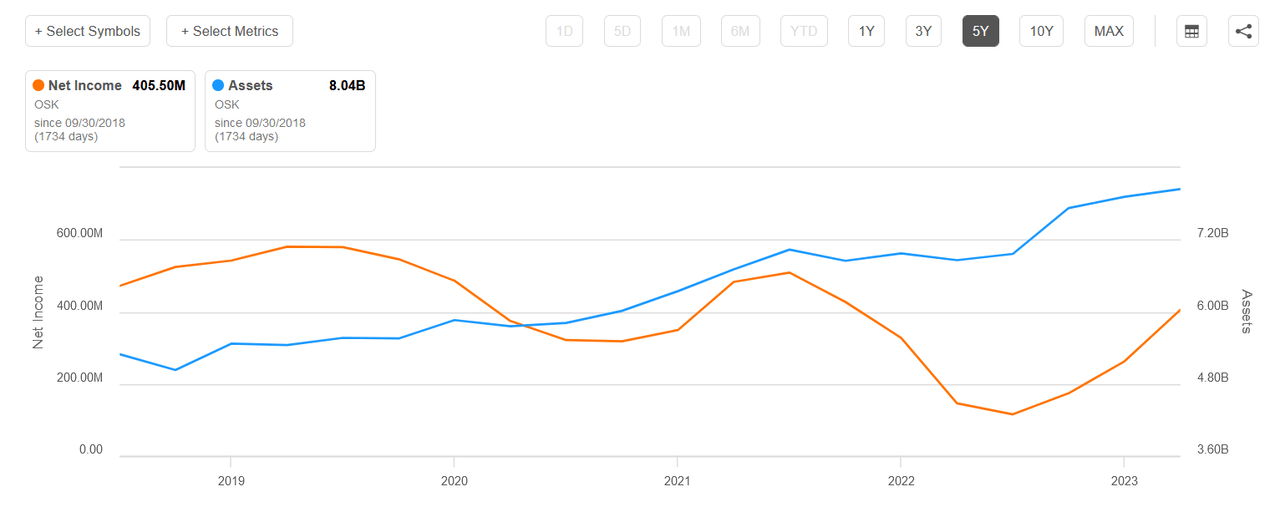

OSK Asset Turnover (Seeking Alpha)

I think that the company does have some work to do regarding its asset turnover, which has historically fallen. I would like to see a recovery of this to justify the valuation increase. If OSK can grow sales further because of assets then being given a sector p/s of 1.3 seems reasonable. In terms of upside potential from here, that would result in OSK having a price target of $176 per share, leaving an upside potential of 76% from today's price levels. I think that even if we aren't reaching half of that potential return, the fact of the matter remains that OSK is undervalued based on the potential that seems likely to come true as the management directs efforts to grow backlog orders and the struggling Defense segment.

Worth Watching

For coming quarters, I think a key area to be looking at will be backlog growth. If we can see a further buildup in the Defense segment then it would be proof that OSK can find opportunities outside their contract with the US Army, which would be a very bullish sign for me.

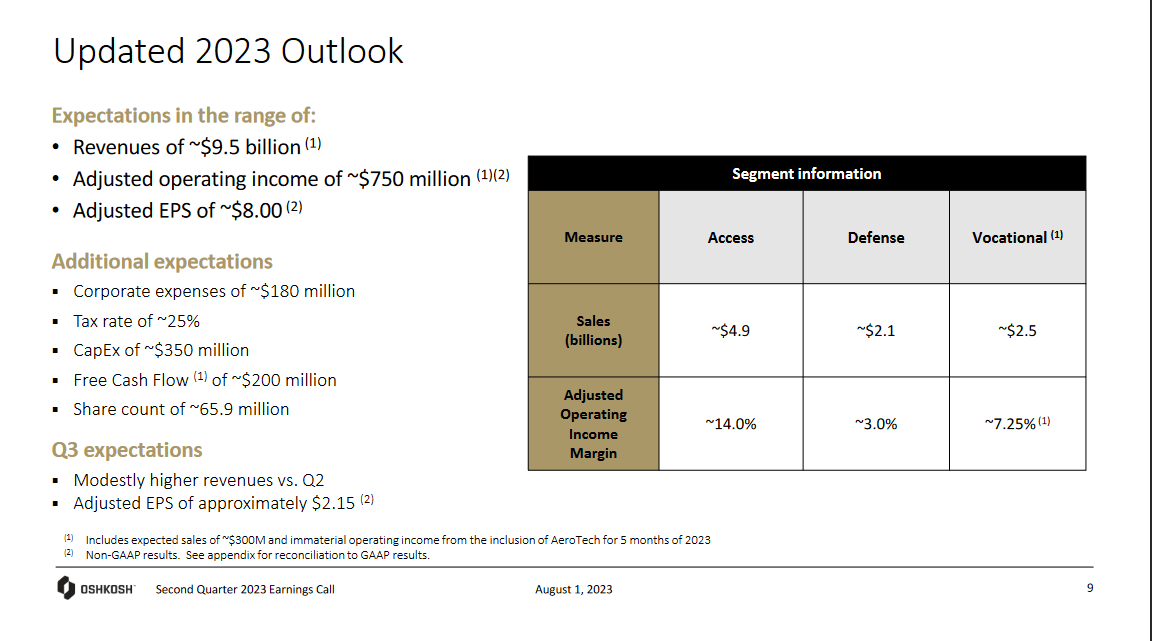

2023 Outlook (Investor Presentation)

The 2023 outlook has been revised upwards quite a fair bit and the EPS now sits at $8 in terms of projections. That is largely supported by strong operating income margins in the Access segment. If we see a plateauing of margins here or a contraction, I would be viewing that as a rather bearish sign that EPS estimates might not be achievable. This would lead to the current valuation being rather fair as growth expectations aren't able to be met. As for investor value, I think if the shares outstanding continue to decline then that would be another supporting factor for the buy case. Outside impacts like raised interest rates seem unlikely to make a significant impact. OSK doesn't hold that much in debt, just under $600 million, so around 10% of the total market cap. A raised interest rate won't bring that much more expenses, only perhaps slightly muting operating margins for the short term.

Risks

Earlier this year, OSK unveiled a fully integrated refuse and recycling collection vehicle under its subsidiary McNeilus. Republic (RSG) and Waste Management (WM) have both confirmed their intent to place orders for this innovative solution.

Segment Overview (Investor Presentation)

The management of OSK appears very optimistic about the prospects of this segment and for it to be a driving force of growth going forward. But I think the capacity needed to make a significant difference in fleet lineups for companies like RSG and WM is immense, and perhaps once they realize the impact is not what they hoped for, demand will reside. The most sales are to be made in California too where there already are a lot of companies competing and despite OSK being a large player, will face risks of having to be cost-competitive with their offerings. This could result in disappointing margins for the segment, as opposed to what was previously hoped for.

On a broader scale, the need to adjust facilities and areas for electric vehicles is still lacking. This creates some short-term headwinds or potentially medium-term headwinds, depending on how quickly the government can roll out upgrades or incentives for EV chargers further.

Final Words

I believe the price of OSK is undervalued based on sector metrics and management's dedication to growing the backlog, while also finding new revenue streams for their Defense segment which is making an investment appealing. The immediate upside potential is solid and with a solid balance sheet where cash/debt is 0.59, above my preferred threshold of at least 0.3. The case for OSK is clear in that growth is continuing and short-term headwinds have unjustifiably discounted the company in my view. The discounted valuation that OSK is receiving also opens up the possibility of an investment case as growth continues for the company.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)