Energy Holds The 100% Line

Summary

- Yesterday, percentage of stocks trading above their 50-DMAs fell down to 33% for the S&P 500. Last Thursday saw a slightly lower reading and 33% is far from the worst in recent years.

- While just a third of the S&P 500 components are above their 50-days, 100% of stocks in the Energy sector are still above their 50-DMAs.

- In 2006 and again in 2016, Utilities was the sector with 100% of stocks above their 50-DMAs, while around 30% of the S&P 500 was above. In 2014, Communication Services was the sector with strong breadth.

Artur Nichiporenko

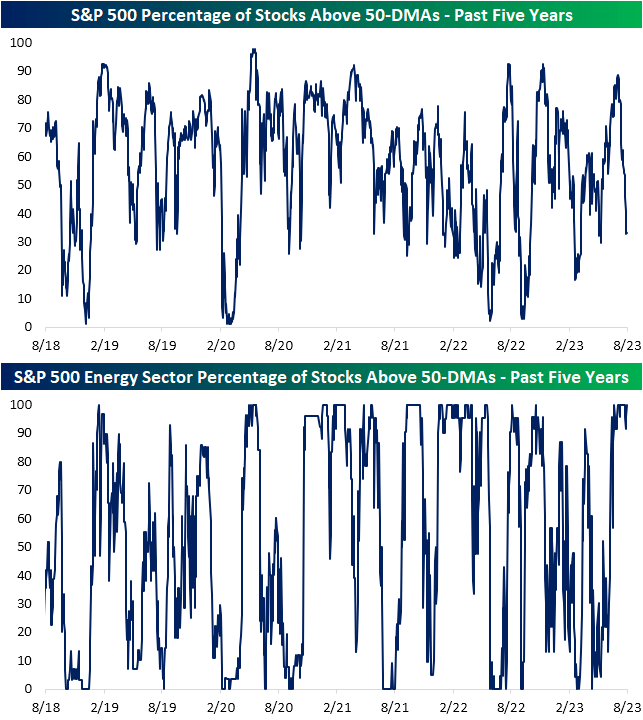

Each day in our Sector Snapshot, among a number of sector-level internal metrics, we show the percentage of stocks trading above their 50-DMAs. Yesterday, that reading fell down to 33% for the S&P 500. While last Thursday saw a slightly lower reading and 33% is far from the worst in recent years (as shown in the first chart below), this month has seen a material decline in the percentage of stocks trading above their respective 50-DMAs. One sector has proved to be an exception, though; while just a third of the S&P 500 components are above their 50-days, 100% of stocks in the Energy sector are still above their 50-DMAs.

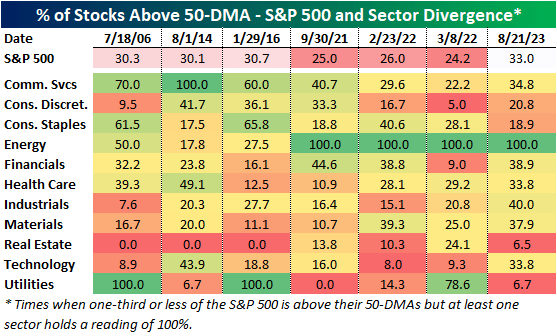

Going back to 1990, it has been rare to see such a small share of the broader market above their 50-DMA while all the components of an entire sector are above their respective 50-DMAs. In fact, it’s only happened six other times. In the table below, we show each of those previous periods, as well as the S&P 500 and each sector's reading on the percentage of stocks above their 50-DMAs. As shown, since 2021 there have been multiple similar instances in which every stock in the Energy sector has bucked the general trend of the broader market. One notable difference this time around is some of the most heavily weighted sectors like Tech and Health Care have far stronger breadth readings. In other words, breadth is healthier (relatively speaking) for those more impactful groups.

Prior to the pandemic, 2006, 2014, and 2016 were the only other periods. In 2006 and again in 2016, Utilities was the sector with 100% of stocks above their 50-DMAs, while around 30% of the S&P 500 was above. Then in 2014, Communication Services (when it was much smaller – about ten stocks- and before it was reconfigured to include stocks like Alphabet, Meta, etc.) was the sector with strong breadth.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by