AXIS Capital: Trading At A Discount As The Bottom Line Remains Inconsistent, Sell

Summary

- AXIS Capital Holdings has seen steady top-line growth but inconsistent bottom-line performance, resulting in a discounted share price.

- The company operates in various segments, including insurance and reinsurance, and faces challenges in managing risks.

- The CEO highlighted favorable market conditions and growth in certain areas, but the company needs to demonstrate consistent performance to be considered a buy.

Gary Yeowell/DigitalVision via Getty Images

Introduction

Providing various specialty insurances and reinsurance products worldwide, WXIS Capital Holdings Limited (NYSE:AXS) has grown the top line at a steady rate over the last 10 years averaging around 2.88% annually. The bottom line has been anything but consistent and instead of the last couple of years posting the highest net income for the company, it was back in 2014 that AXS posted a net income of over $800 which has come to be their most profitable year.

This lack of consistent growth has resulted in the share price trading at a discount of over 30% to the secrets based on earrings. This seems justified and I think the lack of consistency brings more risk than reward right now to investors. The dividends paid out over the last 12 months nearly amounts to $160 million which means that AXS has a TTM payout ratio of around 50%. For financial companies that aren't necessarily too high, but it wasn't long ago that the bottom line was negative. Funding the dividend would be very difficult and present ample risk, risks enough to warrant a sell case where actually.

Company Structure

As an insurance company, AXS needs to handle risks very well to ensure they maintain solid margins. This hasn't been the case for the company, as during the last couple of years the bottom line has been inconsistent. Some level of this could be expected given that operations span worldwide, but this might result in AXS being overleveraged. Natural disasters and other weather-related events could result in significant losses in some quarters and years which seems plausible as to what has happened with AXS.

Within the business, there are two various segments, those being Insurance and reinsurance. The first segment focuses on providing property insurance products for commercial buildings, residential premises, and construction projects as well.

Company Overview (Investor Presentation)

Operating as a global insurance company comes with a lot of challenges and properly managing risks is one of them. Seeing as the operations of AXS are so broad I think a lower multiple will continue to be applied to the share price. But though a broad set of operations has also come with some positives, like important and developing relationships that could lead to AXS being a first mover in some markets.

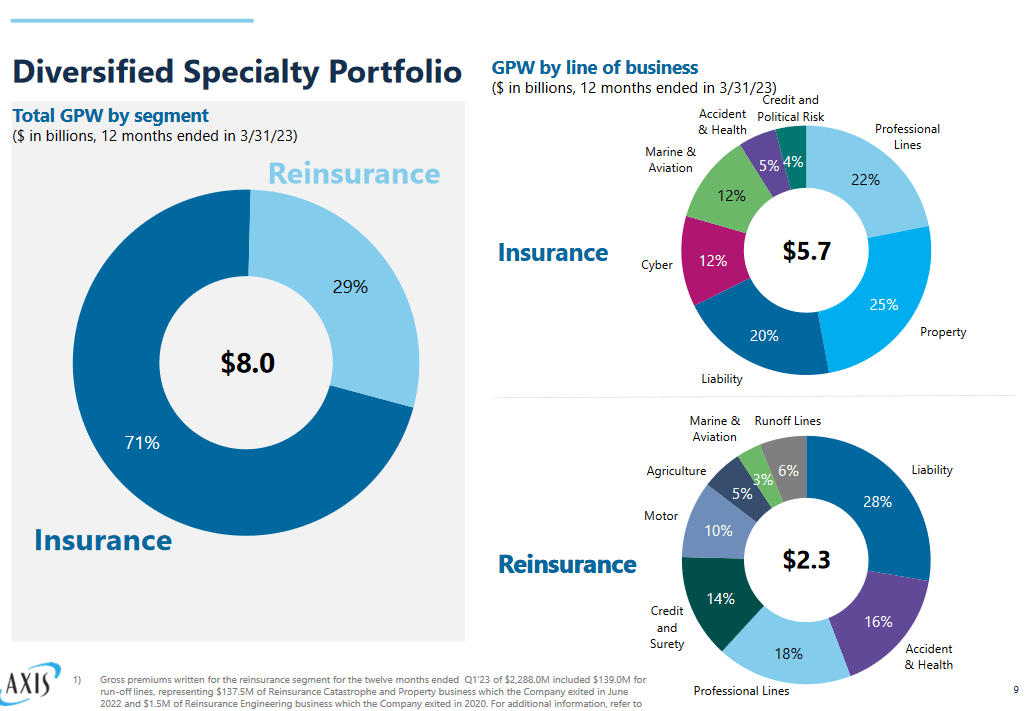

Portfolio Overview (Investor Presentation)

Looking at the specialty portfolio that the company has it mostly consists of insurance and reinsurance only makes up about 29% of the total value. The largest portion of insurance is for properties and these are often some of the most costly ones to issue payments on when disasters and destruction happen. But a 25% portion set for this seems adequately safe and I wouldn't consider AXS to be overleveraged having it at these levels. In the reinsurance segment though, the largest portion is the liability part at 28%, and secondly comes the professional lines. As reinsurance is about proper risk management to drive returns. Comparing the segment to last year it seems that there have been fewer catastrophes and weather-related losses but rather a rise in accident losses instead. Fluctuations like these are common and I don’t necessarily tell the story that AXS does a poor job in this segment of the business.

Earnings Transcript

Getting some comments on the markets by the management I think is important when covering insurance companies. From the last earnings call the CEO Vince Tizzio had the following to share.

“Let me now provide more color on the insurance segment. We continue to see generally favorable market conditions across our specialty lines with rates holding at 9%, putting us ahead of loss cost trends. Our wholesale business grew 35% and produced strong growth particularly in property and excess casualty while producing an average rate increase of 17%. Our international business, including our Lloyd's syndicate, grew premiums by 23% with strong momentum evidenced in marine, aviation, and renewable energy, all the while yielding an overall rate increase of 7%”.

Seeing that the company can get ahead of market trends is reassuring but we need to see a consistent performance like this if we are to consider the company a buy by any standards. The momentum the company expected in the international business isn't necessarily from the largest markets they serve but seems to have still been sufficient to offset some poor momentum otherwise.

Risk Associated

The data suggests that pricing for AXIS is not experiencing a substantial improvement beyond the confines of underlying loss trends, which management aptly characterized as "mid-single-digits". This development raises a notable concern about the current state of the Property and Casualty market. Challenges will come and go and if we continue to see more natural disasters and weather-related destructions then I think AXS will need to heavily consider the way they do business. These events cost a lot of money and dig deep into the margins of the business. If AXS is too exposed to areas prone to these events then I think we might see disappointing earnings reports if worst comes to worst.

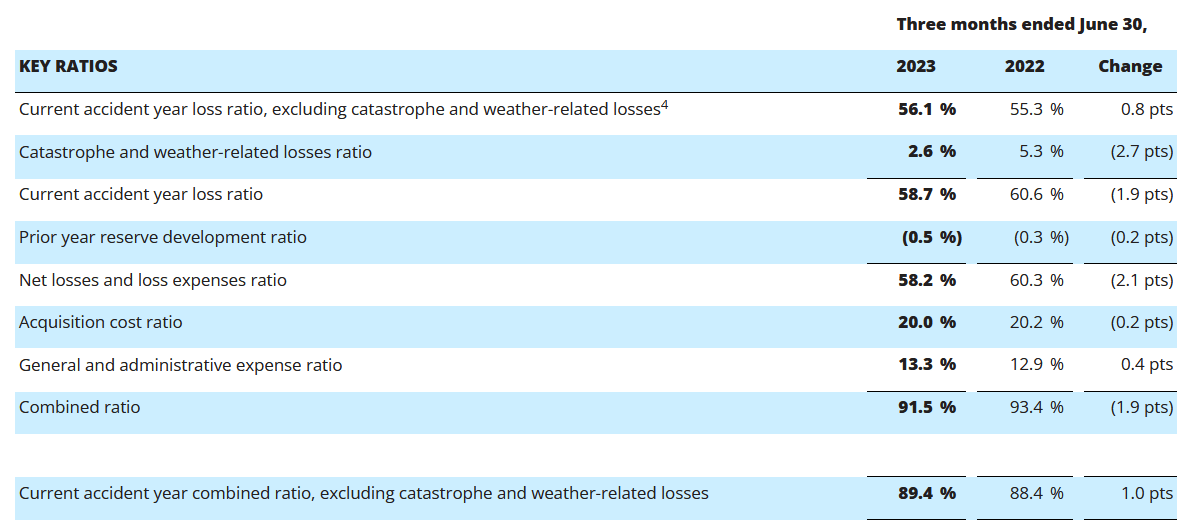

Key Ratios (Earnings Report)

A significant factor underpinning the current market dynamics is the pronounced influence of loss trends on pricing. While this alignment bodes well for insurers with superior underwriting practices, it doesn't carry the same level of potency for insurers operating at an average or less favorable level of underwriting performance.

This unique market condition underscores the ongoing challenge that AXIS and other insurers face in an environment where pricing dynamics are inextricably tied to loss trends. While better-than-average underwriters can capitalize on this alignment to bolster their profitability, companies with more modest underwriting track records may find their ability to drive substantial pricing improvements constrained. If AXS can set itself apart further by being a reliable option here then I think a higher premium could be applied to the share price as well.

Investor Takeaway

The insurance industry is difficult to invest in as margins are often very inconsistent for some companies so finding the way with the most steady trajectory upwards will often be the one you ultimately go with. Unfortunately that doesn't seem to be AXS right now and I think some upcoming issues will negatively affect investors, one of them being dividend payments.

The yield currently is around the 3% mark but with inconsistent bottom line margins, we are not far from AXS not being able to pay out the same dividend as previously. Share dilution has also over the years been coming and this is harming an investment ever so slightly. But practices like these are poor and ultimately lend me to rate AXS as a sell right now rather than a hold. Lacking conviction of dividend growth is what keeps me from a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.