AMZA: A Good Fund, But Broader Energy Is Still Outperforming

Summary

- InfraCap MLP ETF is an actively managed fund that invests in midstream energy MLPs, generating stable cash flows from long-term contracts.

- The fund employs modest leverage and options strategies to generate additional income sources.

- AMZA's performance is subject to market volatility and carries a higher degree of risk due to its use of leverage and options strategies.

zhengzaishuru

Formula for success: rise early, work hard, strike oil. - J. Paul Getty

Before we get into the investment case for the InfraCap MLP ETF (NYSEARCA:AMZA), it's essential to understand the nature of Master Limited Partnerships (MLPs). In the energy sector, MLPs are business ventures that play a critical role in the oil and gas industry. They often operate in the midstream segment, which involves the transportation, storage, and processing of these commodities. This places MLPs in a unique position in the energy value chain, where they can generate stable cash flows from long-term contracts, irrespective of the volatility in commodity prices.

Overview of InfraCap MLP ETF

AMZA is an actively managed Exchange Traded Fund (ETF) that primarily invests in such midstream energy MLPs with an emphasis on high current income. The fund employs modest leverage, typically ranging between 20-30%, and also uses options strategies to generate additional income sources.

Unlike passive funds that seek to replicate a specified index's performance, AMZA is actively managed. This means that the fund's security selection and weightings are based on a careful analysis of each security's fundamental and technical factors, instead of merely following market capitalization. This active management approach allows the fund to adapt to changing market conditions and capitalize on potential investment opportunities.

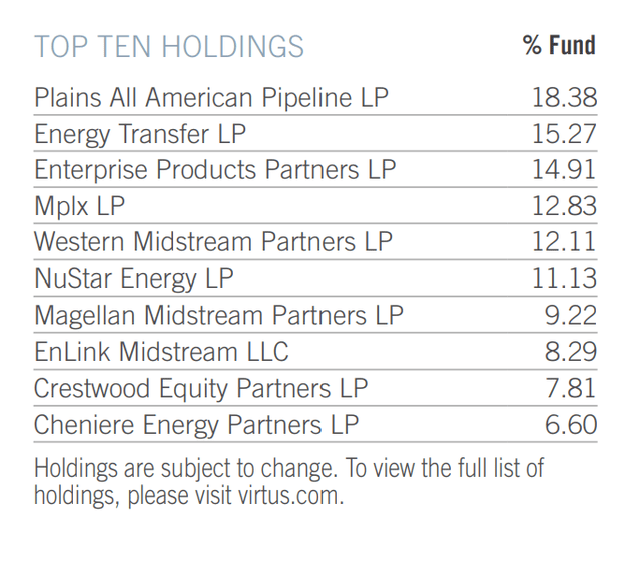

As of 6/30/23, holdings include well-known companies in the space, with some large weightings at the top of the fund.

Options Strategies for Income Generation

Alongside leverage, AMZA also employs options strategies as a means to generate additional income. This involves writing call and put options on various MLPs. While these options strategies can provide an extra source of income, they also come with their own set of risks. For instance, selling call options could limit the fund's potential profits if the price of the underlying asset increases, while selling put options could result in losses if the option is exercised while the asset's price is rising.

Understanding Dividend Yield and Expense Ratio

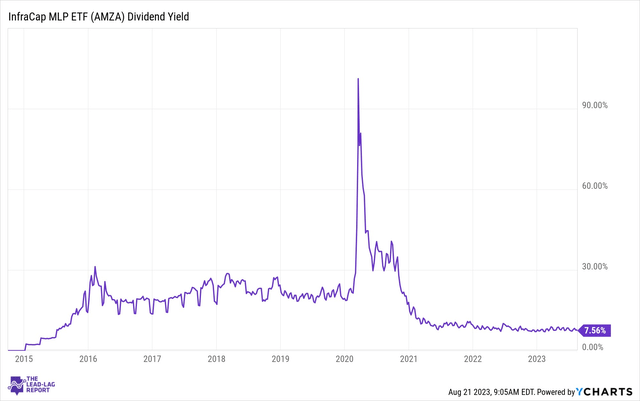

AMZA is attractive to many investors due to its high dividend yield. However, it's important to note that the fund's dividends have been shrinking along with its share price. If you bought AMZA for its high dividend yield a decade ago, your yield on the original investment would be significantly lower today due to the reduction in dividends.

Moreover, AMZA comes with a relatively high expense ratio of 1.64%. This is the cost of running the fund, and it's deducted from the fund's assets. This high expense ratio can eat into your returns, especially when the fund's performance is lagging.

Performance Analysis

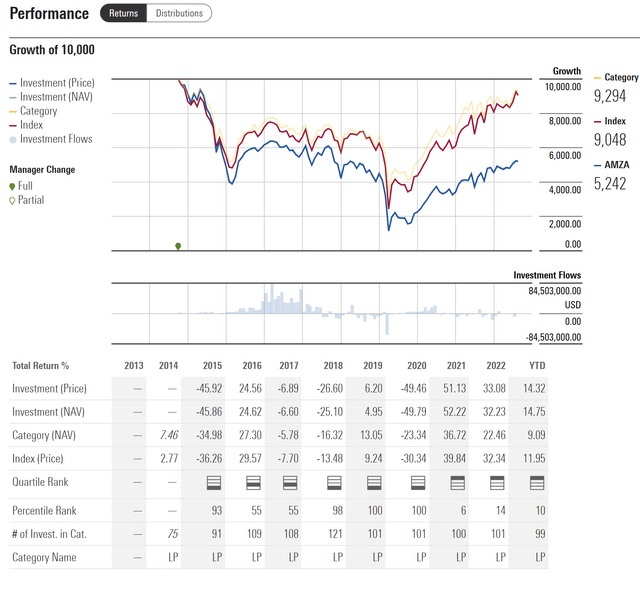

Like all investments, AMZA's performance is subject to market volatility. Since its inception, the fund has shown a mix of periods with positive returns and periods with negative returns. It's important to note that an investment in AMZA involves a higher degree of risk due to the fund's use of leverage and options strategies. Therefore, potential investors should carefully consider these risks before investing in the fund.

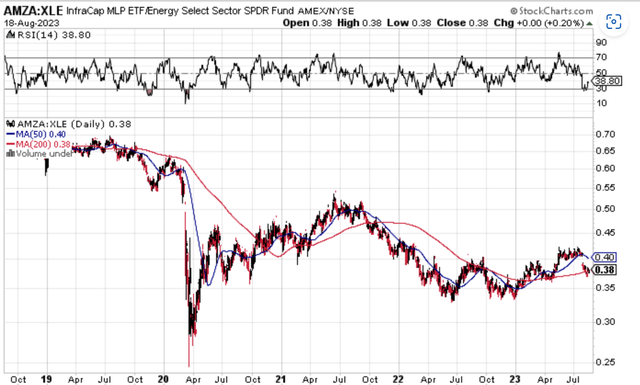

I'd note it's hard to identify what has caused some of the broader underperformance here relative to Energy since late July. Regardless, this is a good reminder that yield is one thing and total return another.

Conclusion

Investing in the InfraCap MLP ETF can be a potentially profitable venture for those seeking exposure to the midstream energy sector and high-income potential. However, the fund's use of leverage and options strategies introduces a higher level of risk, making it crucial for investors to thoroughly understand these aspects before investing. The Fund's performance has been mixed, and relative to the Energy sector (XLE) more broadly, it has underperformed.

While the fund has shown periods of strong performance more recently, its outlook is heavily dependent on broader economic conditions and market trends. With all that said, the InfraCap MLP ETF offers a unique approach to investing in the midstream energy sector, combining active management, leverage, and options strategies to generate high current income. I think it's a good fund, but there are better ways of betting on Energy for now.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.