Patria Investments' Q2: Revenue Beats, Growth Concerns Remain

Summary

- Patria Investments' Q2 2023 earnings fell slightly short of expectations, but revenue exceeded analysts' estimates by $14.63M.

- The company is performing well in fee-related earnings and has the potential for strong growth in the future.

- Patria's collaboration with Banco Colombia and its focus on diversifying asset classes are positive indicators for investors.

Dekdoyjaidee

Thesis

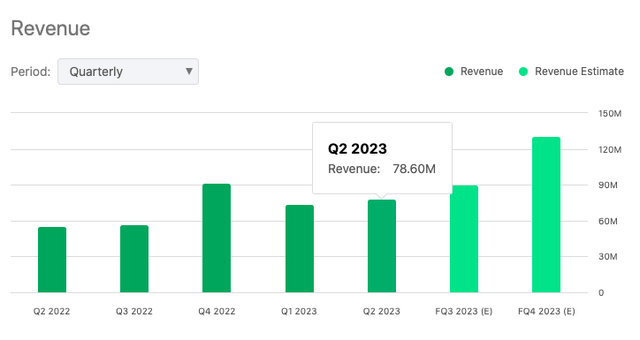

Looking at Patria Investments' (NASDAQ:PAX) Q2 2023 earnings, their non-GAAP EPS of $0.30 came up a penny short of the mark, but on the brighter side, their revenue of $78.6M went beyond what analysts were expecting by about $14.63M.

Breaking it down, the company is standing on some solid ground when we talk about fee-related earnings. That said, there's chatter about possible hitches in growth and a few operational bumps along the way. If we dig a bit deeper into their overall performance and numbers, it seems like a good call might be for investors to just hold tight and see how things shape up in the next few quarters.

Company Profile

Patria Investments Limited, founded in 1994 and based in Grand Cayman, specializes in private market investments in Latin America. The firm provides asset management services spanning private equity, infrastructure, real estate, credit, and various other funds.

Patria Investments' Q2 2023 Earnings Highlights

Taking a closer look at Patria's recent numbers, the Q2 stats initially show some solid groundwork with distributable earnings clocking in at $43.6 million. A big chunk of this is thanks to the consistent fee-related earnings coming through along with a hefty boost from performance fees tied to Infrastructure Fund III.

For a bit more color, so far this year, fee-related earnings are at a cool $65 million. Given this pace, hitting that $150 million goal the company has set for itself doesn't seem too far-fetched, especially if the growth we're seeing keeps up. On the topic of performance fees, there's something interesting brewing. Q2 saw these fees reach $11 million, and if we take a step back, they've hit $40 million over the last few quarters which might indicate that we're on the cusp of a promising wave of performance fee roll-ins.

By the end of Q2, they managed to pull in $1.9 billion, and that number jumped to $2.2 billion by Q3. Add to this the expected AUM from their upcoming collab with Banco Colombia, and we're looking at a year-to-date total nearing $3.4 billion. That's putting them on a solid path towards their big picture aim of hitting $20 billion by 2025.

Digging into operations, with over 30 products in their arsenal, they look well-equipped to lean into areas that look promising, even if the fundraising scene gets a bit choppy. They've got their hands in the usual suspects like private equity and infrastructure, but they're also branching out into areas like growth equity and private credit. Their regional game is on point too. Patria's localized fundraising moves in Brazil, and the aforementioned joint venture with Banco Colombia, that's expected to close in Q3, shows they're not afraid to tweak their strategy based on where they are. Adding some color to this, CEO Alex Saigh noted:

80% of Colombians do have a bank account with Banco Colombia and they have a 60% market share on all transactions including distribution private banking and whatever. And we are now very happy with this JV that can really speed up our fundraising for local Colombian pesos products for local Colombian investors as we did in Chile very successfully.

On the growth front, Patria’s been making strides with a 15% bump in AUM over the last year – a clear nod to their focus on diversifying those asset classes. Plus, with their recent addition to the Russell 2000 and 3000 indices, they might just catch a few more eyes in the investment world.

Zooming out to a regional scope, according to management, Latin America emerges as a relatively stable investment platform, especially when contrasted against the backdrop of global uncertainties. The proactive monetary and fiscal measures, combined with the region's inherent geographical advantages and abundant natural resources, offer a compelling proposition. A discernible trend towards fiscal prudence and an inclination towards private investments could further stimulate economic progression in the region.

Performance

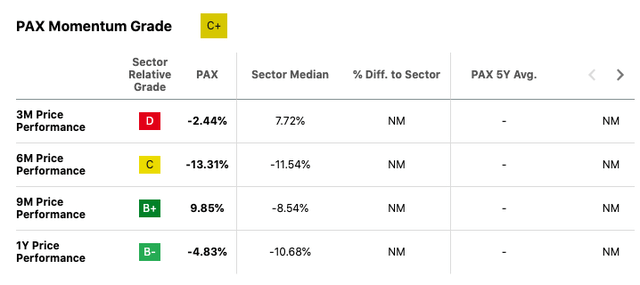

The Momentum Grade for Patria Investments stands at C+, which, while not dismal, does not necessarily paint an overly optimistic picture. Diving deeper, the 3-month (3M) price performance grade of D and a price drop of 2.44% strikes as concerning. Especially when juxtaposed with the broader Financials sector's median 3M performance, which seems to be a rise of 7.72%.

The half-year (6M) picture isn't too rosy either, with a grade of C and a performance of -13.31%. Though this is somewhat in line with the sector median, which isn't a saving grace by any stretch.

However, it's not all gloom. The 9-month (9M) performance paints a more encouraging scene. Grading at B+ and a performance uptick of 9.85% is noteworthy, especially when the sector median over the same period saw a decline of 8.54%. It hints at a period of recovery or outperformance, which might suggest a short-lived event or strategy change that propelled Patria forward. This momentum, however, seems to have somewhat slowed down by the time we reach the 1-year mark, with a B- grade and a -4.83% performance.

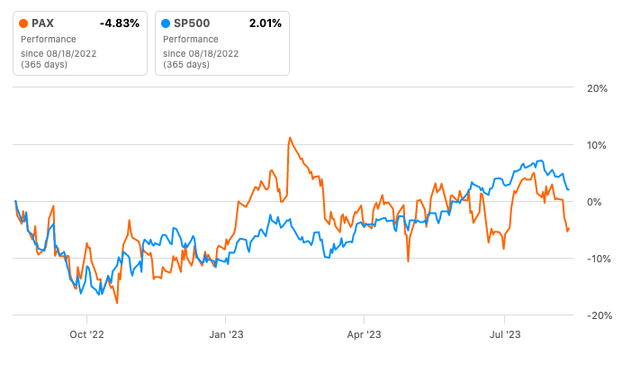

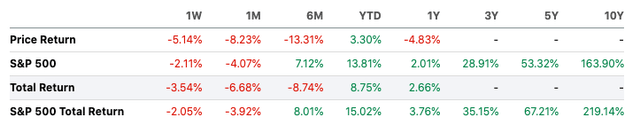

In the wider context, the S&P 500's 1-year price return sits at 2.01%, while Patria lags behind with a -4.83% return.

This underperformance becomes even starker when investors look at the S&P 500's Total Return, which outpaces Patria across the board.

Valuation

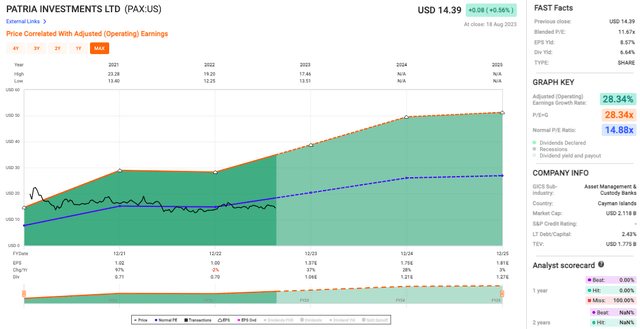

The blended P/E of 11.67x (see chart below) is below the stock's normal P/E ratio of 14.88x which might indicate that Patria can be seen as undervalued given its earnings profile.

On the earnings side, Patria appears to be performing well: The Adjusted (Operating) Earnings Growth Rate is 28.34% indicating that the company has been expanding its earnings at a healthy pace. Also, with a blended P/E less than the normal P/E ratio might suggest that the market hasn't fully recognized the growth potential of Patria and the stock could possibly be trading at a discount.

And turning our attention to dividends, Patria offers a dividend yield of 6.64% which might be an enticing option for both growth and income investors.

Risks & Headwinds

I've noticed Patria's Fund VI is hitting a few bumps, especially when it comes to North America. The US, in particular, seems a bit wary about getting onboard with their fundraising as indicated by management revealing that only one in three funds is being successfully raised.

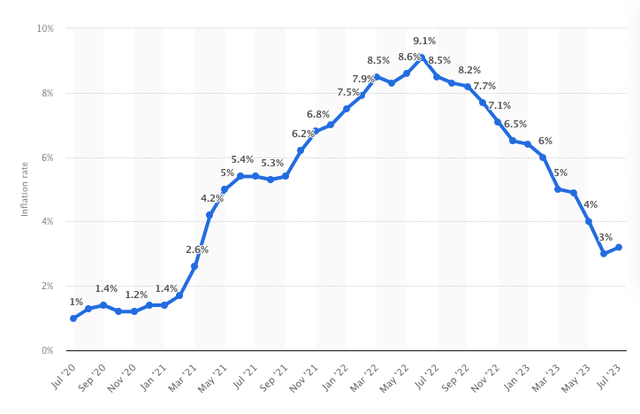

Also, there hasn't been much change in personnel expenses for Patria in Q2 2023 compared to the previous quarter. But when you stack it up against last year's numbers, there's a 7% rise. The admin costs have also jumped by 9% compared to Q2 2022. So, it seems like the company's spending more, and inflation's playing a part in it.

While the management fees have been steady, given how inflation's been behaving (hovering around 3- 4% lately), there's a chance it might mess with those numbers.

12-month inflation rate in the United States from July 2020 to July 2023 (Statista)

Just to give you a snapshot: the Fee Related Earnings (FRE) margin was 56% for Q2 2023, which matches what it was last year. But to hit their yearly target of $150 million in FRE, they'll need to pick up the pace.

Finally, while Patria's assets have grown by 7% compared to last year, $2.1 billion of outflows were observed, with $1.7 billion coming from divestments in their drop-down funds that investors should keep in mind.

Recommendation: HOLD

Diving into Patria Investments, I see they've got a solid foundation with good earnings, a range of assets, and a promising collab with Banco Colombia on the horizon. They're mixing things up and getting more local with their fundraising game, which could give their growth a little nudge. The numbers show a decent earnings growth and a dividend that might catch some eyes. However, their recent momentum isn't exactly keeping up with the rest of the market. Plus, things like rising costs, potential hiccups from inflation on their fees, and a noticeable cash outflow mainly from selling off funds add layers to the puzzle. So, piecing it all together, it might make sense to just sit tight and "hold" while we see how the situation evolves.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)