Cherry Hill Mortgage Investment: Compellingly Cheap, Still Not A Great Investment

Summary

- Cherry Hill Mortgage Investment Corporation is a mortgage REIT company that manages MSRs and agency RMBS to generate income for investors.

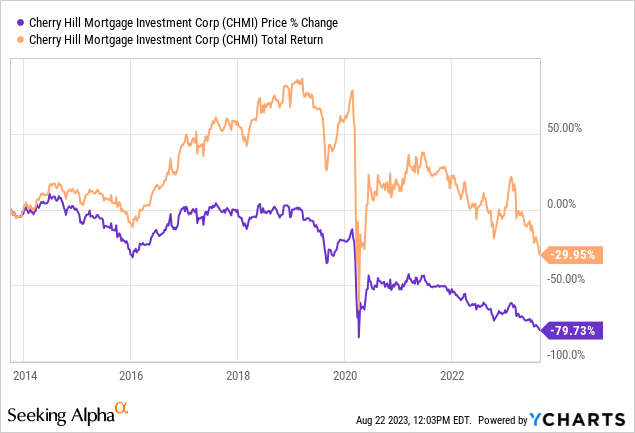

- CHMI has a history of underperformance and poor returns, with a significant drop in share price and total return.

- The stock is super cheap from a fundamental standpoint, but it may be for a good reason.

- The company's high leverage and potential for losses, as well as uncertainties in the economy and mortgage markets, make it a risky investment.

DNY59

Cherry Hill Mortgage Investment Corporation (NYSE:CHMI) is a mortgage REIT company that manages a portfolio of MSRs (mortgage servicing rights) and agency RMBS (residential mortgage backed securities) in a leveraged manner in order to generate income for investors. While the company currently has an attractive valuation and double-digit yield but its past is full of underperformance and poor returns which makes me reluctant about investing in it. The company's share price dropped almost -80% while its total return was -30% during this time including reinvestment of its double-digit dividends.

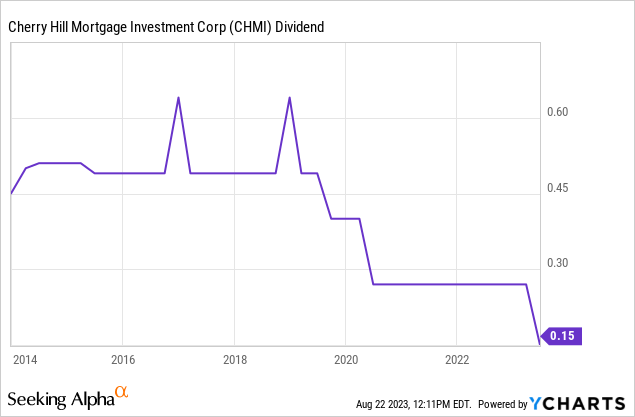

To make the matters worse, the fund cut its quarterly dividend by 44% earlier this summer from 27 cents per share to 15 cents per share. This is not the first (or likely the last) time the company cut its dividends either. Since 2018, the company's quarterly dividends shrank from about 50 cents per share to 15 cents per share. Many times those investors who are seeking high yield stocks say that they don't care for share price of their assets because "they are only in it for the dividend" but when a company's earnings (and share price) start declining, sooner or later dividends get a cut (or multiple cuts) and those investors suddenly pay the price for not paying attention to a company's fundamentals.

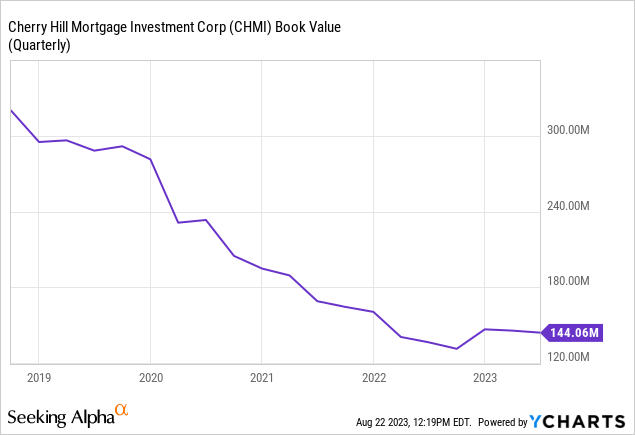

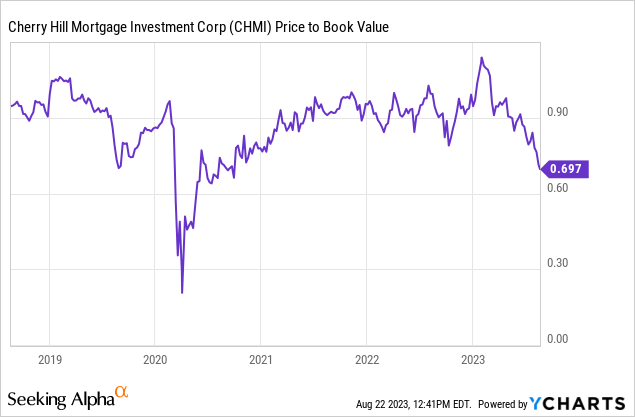

One of the biggest issues with CHMI as well as many mortgage REIT companies is that they are overleveraged and when something goes wrong, their losses multiply and it takes forever to recuperate their losses. For example if you have a portfolio that's down 25%, you have to gain 33% to make your money back. If your portfolio drops 35%, you have to gain 53% to reach back to breakeven. If your portfolio drops 50%, you have to gain 100% to get your money back. Now these calculations are before any leverage comes in. Many mortgage REITs are highly leveraged so a 50% drop in their net assets can even wipe them out completely. When we look at CHMI's book value trend in the last 5 years, we notice that it never actually recovered from the sharp drop in 2020 and it never may.

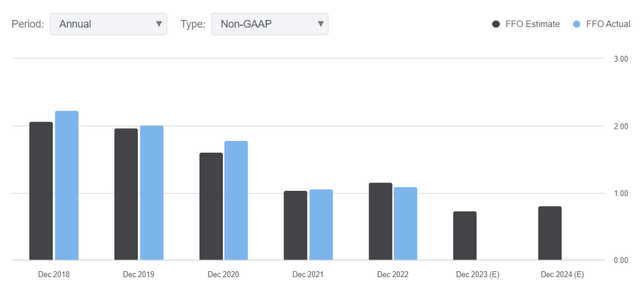

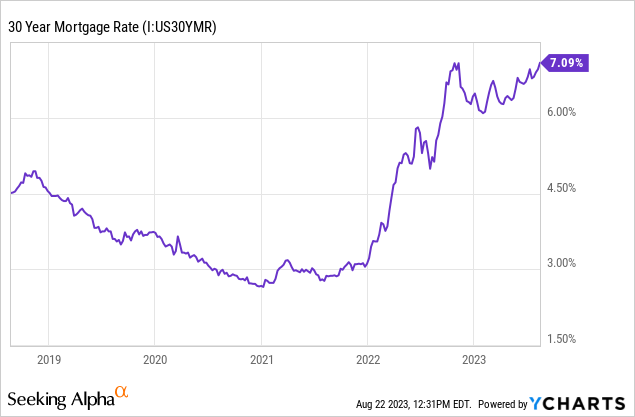

The company's income (as measured by Funds From Operations) shrank significantly in the last 5 years by almost half. This year it's expected to drop significantly below $1 after being above $2 just a few years ago. Analysts expect the company's income to stabilize or perhaps rise a bit after 2024 but this is assuming that the economy can avoid a recession and mortgage markets will perform well which is not a given considering all the uncertainties in the economy today, not to mention how mortgage rates are at the highest level they've been since 2006.

CMHI funds from operations (Seeking Alpha)

People usually say that agency backed mortgages are virtually "risk free" and should be treated almost as government bonds because the government guarantees to pay them if the borrowers fail to pay their mortgage but this is the wrong way to look at agency mortgages and will cause investors to lose a lot of money. Why? While agency backed mortgages might be protected against a possible default, they are not protected against a significant drop in value. Heck, even government's on treasury bonds aren't protected from a drop in value and if a fund is overleveraged in them they can lose significant amount of money as we've seen with several regional banks who found out that you can actually go bankrupt by owning "risk free" government bonds if you are overleveraged and their price drops significantly.

When mortgage rates rise you would expect mortgage servicing companies to earn more money but a rise in rates will cause asset prices to drop significantly which will hurt their book value as well as earning power. This is why mREITs have been struggling so much lately when they should have been making a bank.

CHMI has a leverage ratio of 4.4x which is about average for an mREIT but then again you could say that most mREITs are highly (and dangerously) overleveraged and are only one black swan event away from going bust.

CHMI's portfolio leverage (CHMI)

Having said all that, I will admit that the fund actually trades at a compellingly cheap valuation right now. It currently trades at a price-to-book value of 0.70 which means investors are now able to buy this stock at a 30% discount to its book value. This is the second deepest discount offered by this stock in the last 5 years. As you can already guess, the deepest discount was during the COVID crash in 2020 when the stock traded at a discount of 70% (in other words price to book value of 0.30) but that discount didn't last long just as most discounts from COVID crash and unlikely to repeat again barring a black swan event. Historically this stock traded at an average price-to-book value of 0.9 so it's trading at a discount as compared to its historical average as well.

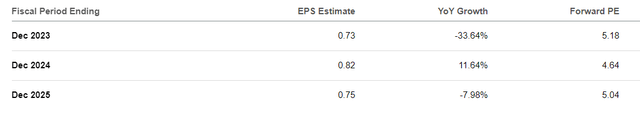

It also trades at a forward P/E (technically P/FFO since this is a REIT) of 5 for this year's estimates and 4.6 for next year's estimates. This is what I would consider compellingly cheap even considering the expected 34% drop in profits this year.

CMHI earnings estimates and forward P/E (Seeking Alpha)

But many could also argue that this stock is cheap for a good reason considering its historical underperformance, high leverage, dividend shrinkage over the years and all risks involved. I consider this stock a speculation play which may surprise some readers because people often associate speculative plays with companies that have super high P/Es or no P/Es at all (due to lack of earnings). Many investors wouldn't consider a low P/E stock trading at a 30% discount to its book value a speculation but it kind of is because stocks like this are only one black swan event away from losing it all and when you invest in a stock like this you assume that there won't be a black swan event anytime soon which can be considered a speculation.

At the end of the day, why should investors put their money in an asset that has a bad track record and continues to shrink when there are so many other stocks and funds that have much better track records?

By the way, this company also offers preferred stocks (CHMI.PR.A)(CHMI.PR.B) which also come with high yield but relatively low risk. Mind you that preferred stocks are not bonds and shouldn't be treated as such. If a company goes bankrupt, its preferred stocks would most likely get wiped out just as its regular stocks are but at least preferred stock owners get priority over regular stock holders in dividends and they are less likely (though still possible) to receive big dividend cuts. Preferred stocks' share prices tend to be more stable and less volatile as compared to their regular counterparts but not always. Some investors might find more value in preferred stocks of this company as compared to its regular stocks if they are tempted by the high yields offered by the company.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.