Etsy: Reiterating My Sell Rating

Summary

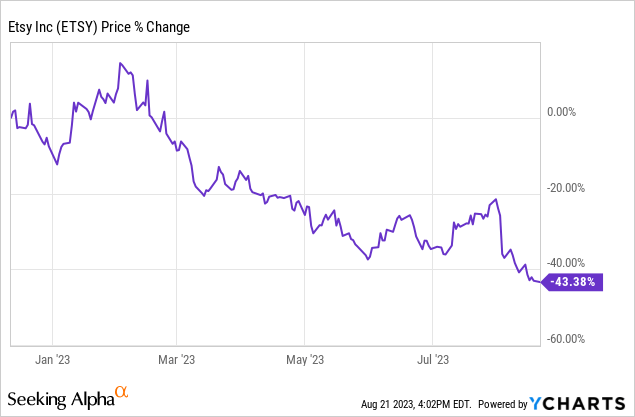

- Etsy's stock has declined by over 40% since my previous Sell rating due to stalled growth and declining profitability.

- Etsy has made significant improvements to the customer experience, which could play out well over the long term.

- I love the company for what it does, but its financials and immediate outlook still do not give me enough confidence to be an investor in this company.

- I am reiterating my Sell Rating.

Puissan Tri Mustika Lubis/iStock via Getty Images

Recap

My first coverage with Etsy (NASDAQ:ETSY) was in mid-December 2022 and it was a Sell rating. This was just after I had used the website to buy handmade gifts for the holidays for my friends. My whole experience was great and I have always loved the site for what it offers. But as a stock, it was not an investable business, which was precisely my point. Many times what we love and what qualifies as an investment are two different things.

In my analysis, I pointed out three of the company's main problems and provided a pessimistic view of the company's future.

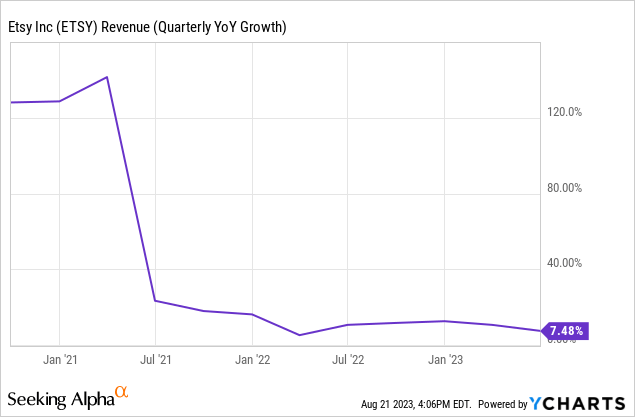

1. Stalled growth but priced like a growth stock

2. Low barriers to entry which can attract competition

3. Deep in debt (negative shareholders equity)

This was a time when many analysts were bullish about the company's prospects. Fast forward to now, the stock is down more than 40% since my rating. In this write-up, we shall see if anything has improved from that time and why I reiterate my Sell rating.

The last few quarters

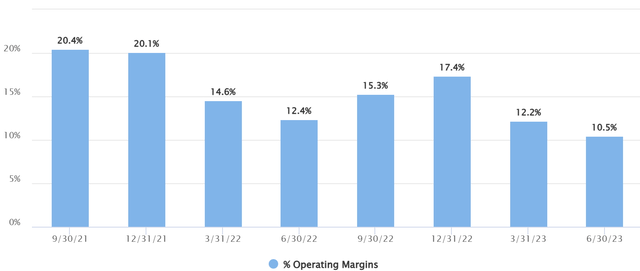

The last three quarters have seen growth in the 7 - 12%, not a big improvement from when I first reviewed the company. Profitability also has not seen much of an improvement either. In fact, diluted EPS has declined by 10 - 30% in the last three quarters and one of the primary underlying reasons could be due to declining operating margins.

My next concern was their negative equity. There has been some improvement here as the company is slowly digging itself out of a hole. Total equity has moved from -$600M last year to -$460M this year, which is good news.

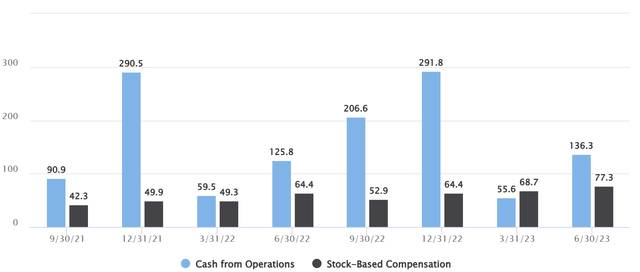

On the surface, it looks like the Cash from operations have remained flat or slightly increasing but I believe this has been possible due to the increase of SBC. Again not a big fan of what's happening here.

Comparison of CFO and SBC (TIKR)

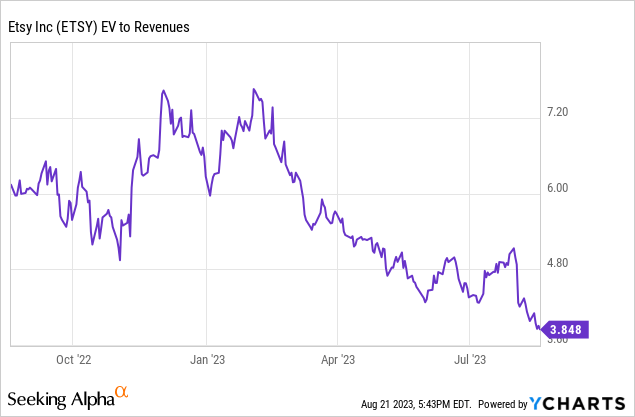

The biggest difference from last time when I analyzed the stock is its stock price which directly affects valuation. The market has slowly woken up to its metrics and consequently priced it lower.

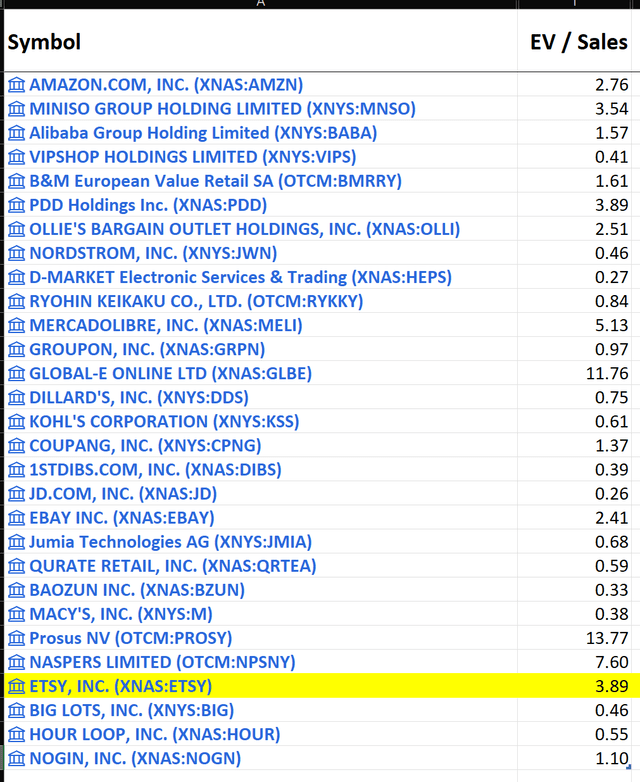

While this is a marked improvement from what we saw last year, this is still quite overvalued when compared to other names in the industry. Since Etsy operates in such a niche segment, it is hard to find too many direct competitors. But in a general sense, we can say this is internet retail and a comparison against some of the popular names in this space would come close to what we are looking for. Also, many metrics are unreliable in valuing a company like Etsy. Cashflow multiples are affected by SBC, earnings multiple is affected by lack of profitability, and comparing just its market cap to sales would not be accurate since it has so much debt. So in the end our metric of choice would be EV to Sales.

What to expect for the future?

The company has been making significant improvements to the user experience, which is a step in the right direction.

- Improved search relevance which drove lifts in sitewide conversion rate and average buyer spend

- Improving buyer experience by the type of information that is presented to the buyer

- Prioritizing "great deals" available from Etsy sellers which would help price-conscious customers

Updates to the site which would improve customer experience (Etsy Investor Presentation)

Obsessing over customers is the right approach, especially in the Internet retail space. In fact, any company that does not do that would concern me. As pointed out by the former CEO and the pioneer of the most famous internet retail company Amazon -

If there’s one reason we have done better than of our peers in the Internet space over the last six years, it is because we have focused like a laser on customer experience

- Jeff Bezos

These steps could pay off over the long term. Improving buyer experience will lead to a lot of word-of-mouth awareness spread especially in such a niche space operated by Etsy. But over the short term to medium term, I am still not confident enough in their financials to buy their stock. As we saw there is not much improvement in their top or bottom line (In fact their profitability has declined)

The company also expects only marginal growth in their revenues of $610 - $645M for the next quarter. At its midpoint, it is around 6% growth in revenues which again does not give me enough confidence to be an investor. So at present, I would reiterate my Sell rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.